Evaluating Uber (UBER) As An Investment Opportunity

Table of Contents

Uber's Financial Performance and Growth Potential

Analyzing Uber's financial health is crucial for any potential Uber (UBER) investment. The company generates revenue from several key streams: rides, Uber Eats (food delivery), and freight services. Examining the growth and profitability of each segment provides a holistic view.

- Revenue Streams: Uber's diverse revenue streams offer resilience against economic downturns. While ride-sharing might be affected by recessions, the food delivery segment often sees increased demand. Freight services represent a growing area with considerable long-term potential.

- Profitability and Key Ratios: While Uber has shown significant revenue growth, achieving consistent profitability remains a challenge. Analyzing key financial ratios like revenue growth, operating margin, and net income margin is crucial. Comparing these metrics to competitors like Lyft provides valuable context.

- External Factors: Fluctuating fuel prices directly impact driver costs and profitability, influencing Uber's bottom line. Driver compensation, another significant expense, needs careful consideration, as it can affect operational efficiency and profitability.

Bullet Points:

- Historical revenue growth analysis: Uber has consistently demonstrated strong revenue growth over the years, but the rate of growth needs careful scrutiny for investment purposes.

- Profit margin comparison to competitors (Lyft, etc.): Benchmarking Uber's profitability against its main competitor, Lyft, helps assess its relative financial strength and competitive position.

- Projected revenue growth based on market expansion: Analyzing future market expansion plans and their potential impact on revenue is vital for predicting future profitability.

The long-term growth potential of the ride-sharing and food delivery markets is significant, driven by increasing urbanization, technological advancements, and changing consumer preferences. This potential fuels the argument for an Uber (UBER) investment, but careful analysis is needed.

Competitive Landscape and Market Share

Understanding Uber's competitive position is paramount for any Uber (UBER) investment strategy. Uber benefits from strong brand recognition and significant network effects, making it difficult for new entrants to compete. However, the competitive landscape is dynamic.

- Competitive Advantages: Uber's substantial market share, brand recognition, and extensive driver network provide a significant competitive advantage. The ease of use of its app is another key strength.

- Competitive Threats: Lyft, Didi Chuxing (in China), and other regional players pose significant competitive threats. These competitors offer similar services and often compete aggressively on price and incentives.

- Market Share Analysis: Uber's market share varies considerably across different geographic regions. Analyzing its dominant markets and areas needing improvement is key to understanding its future growth trajectory.

Bullet Points:

- Comparative analysis of market share with competitors: Tracking Uber's market share relative to competitors reveals its competitive strength and potential vulnerabilities.

- Discussion of strategic partnerships and acquisitions: Uber's strategic partnerships and acquisitions, such as its investment in autonomous vehicle technology, are vital to its long-term competitiveness.

- Analysis of regional market dominance and challenges: Identifying regions where Uber dominates and faces challenges helps understand its overall market strength and growth potential.

Regulatory and Legal Risks

The regulatory landscape for ride-sharing significantly impacts Uber's operations and profitability. Navigating regulations and potential legal challenges represents a significant risk for any Uber (UBER) investment.

- Regulatory Landscape: Ride-sharing regulations vary widely across different jurisdictions. These regulations impact driver licensing, insurance requirements, fare pricing, and other aspects of Uber's operations.

- Future Regulatory Changes: Changes in regulations, such as stricter licensing requirements or increased taxes, could negatively affect Uber's profitability and operational efficiency.

- Legal Challenges: Uber has faced numerous legal challenges and lawsuits relating to driver classification, data privacy, and other issues. These legal battles can result in substantial financial costs.

Bullet Points:

- Examples of regulatory hurdles in different jurisdictions: Highlighting specific regulatory challenges in various regions provides a clearer understanding of the risks involved.

- Potential legal costs and their impact on financials: Analyzing the potential financial impact of legal battles on Uber's financial statements is critical.

- Analysis of the regulatory environment's future impact: Predicting the future impact of regulatory changes and legal challenges is essential for assessing long-term investment risks.

Technological Innovation and Future Strategies

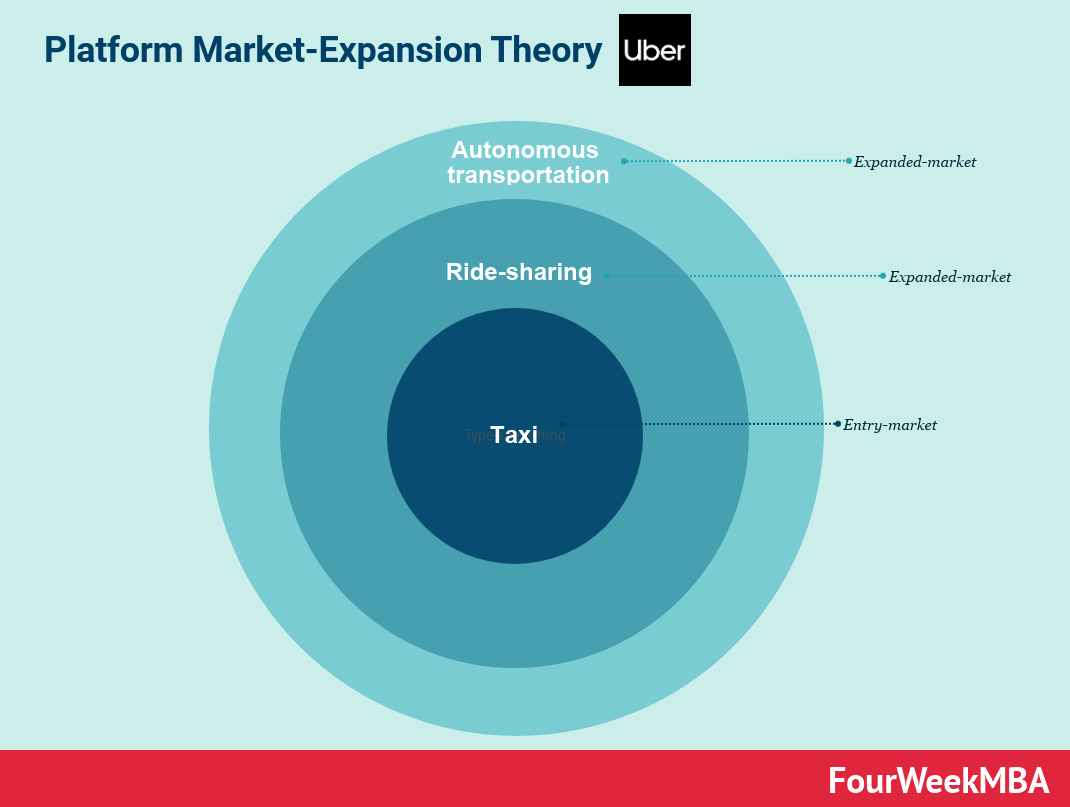

Uber's investment in technological innovation and its expansion strategies are critical elements for evaluating its long-term growth potential as an Uber (UBER) investment.

- Autonomous Vehicles: Uber's investment in autonomous vehicle technology could revolutionize its operations, potentially reducing costs and improving efficiency. However, the development and implementation timelines are uncertain.

- Market Expansion and New Services: Uber's expansion into new markets and services, such as freight transportation and electric scooters, offers opportunities for diversification and growth.

- Maintaining a Competitive Edge: Continuous technological innovation is crucial for Uber to maintain its competitive edge in a rapidly evolving market.

Bullet Points:

- Discussion of self-driving technology development and timelines: Assessing the progress of autonomous vehicle technology and its potential impact on Uber's operations is crucial.

- Analysis of expansion strategies into new geographic markets and service offerings: Analyzing Uber's expansion plans helps understand its future growth prospects.

- Assessment of technological investments and their return on investment (ROI): Evaluating the ROI of Uber's technological investments is important for assessing its long-term financial health.

Conclusion

This analysis of Uber (UBER) as an investment opportunity reveals a complex picture. While Uber demonstrates significant revenue growth and market leadership, it faces challenges related to profitability, competition, and regulatory uncertainty. Technological innovation and expansion into new markets offer potential for future growth, but careful consideration of these risks is crucial.

Call to Action: Before making any investment decisions regarding Uber (UBER) stock, conduct thorough due diligence, considering your personal risk tolerance and financial goals. This analysis provides insights but doesn't constitute financial advice. Further research into the Uber (UBER) investment landscape is recommended to solidify your understanding before considering an Uber (UBER) investment.

Featured Posts

-

Dossier On Papal Candidates Cardinals Face Crucial Choice

May 08, 2025

Dossier On Papal Candidates Cardinals Face Crucial Choice

May 08, 2025 -

Azalan Karlilik Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025

Azalan Karlilik Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025 -

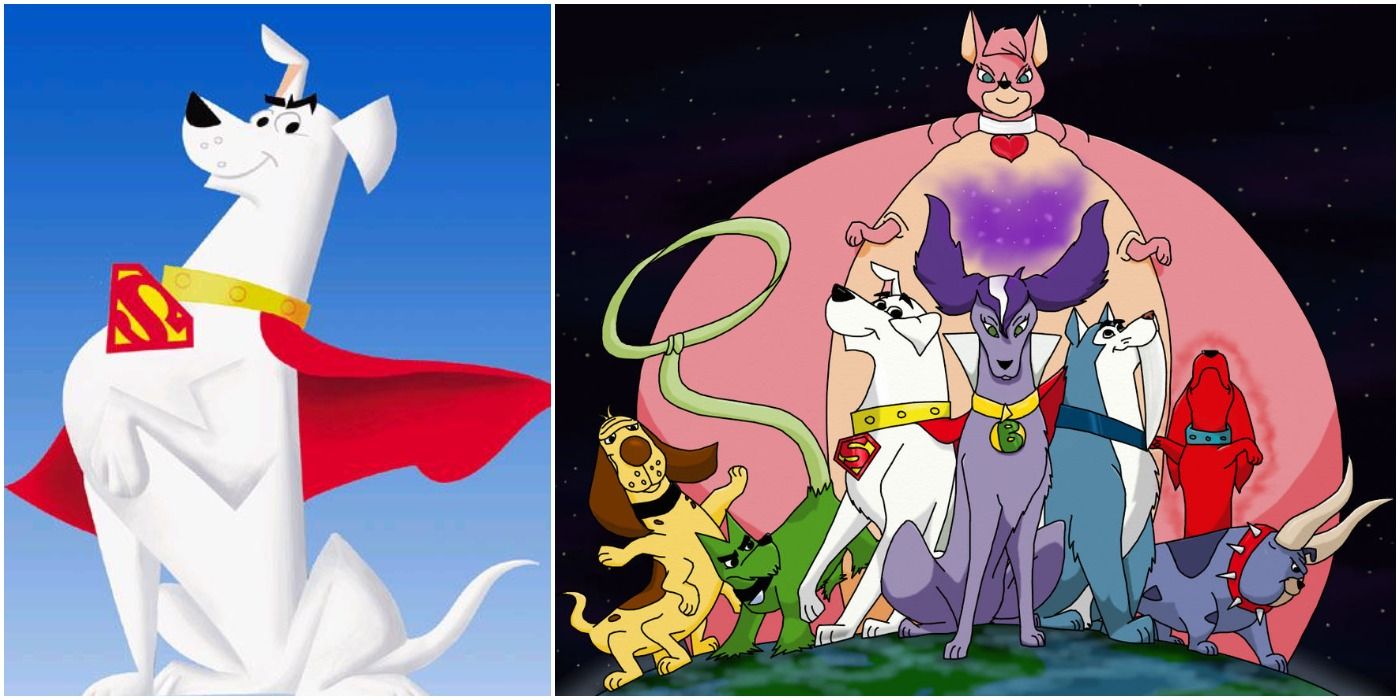

New Superman Footage More Than Just Krypto Analyzing A Key Scenes Impact

May 08, 2025

New Superman Footage More Than Just Krypto Analyzing A Key Scenes Impact

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

Nereden Izleyebilirim Arsenal Psg Maci Canli Yayin Bilgileri

May 08, 2025

Nereden Izleyebilirim Arsenal Psg Maci Canli Yayin Bilgileri

May 08, 2025

Latest Posts

-

Madeleine Mc Cann Imposter Charged Stalking Allegations Surface

May 09, 2025

Madeleine Mc Cann Imposter Charged Stalking Allegations Surface

May 09, 2025 -

Addressing The Rumors Williams Official Comments On Doohan And Colapinto

May 09, 2025

Addressing The Rumors Williams Official Comments On Doohan And Colapinto

May 09, 2025 -

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025 -

Statement From Williams Regarding Doohan In Light Of Colapinto Links

May 09, 2025

Statement From Williams Regarding Doohan In Light Of Colapinto Links

May 09, 2025 -

Woman Claims To Be Madeleine Mc Cann Now Facing Stalking Charges

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Now Facing Stalking Charges

May 09, 2025