Evaluating Palantir After A 30% Market Decline

Table of Contents

Analyzing Palantir's Recent Financial Performance

Revenue Growth and Profitability

Palantir's recent quarterly and annual revenue reports paint a complex picture. While the company has demonstrated consistent revenue growth, the rate of expansion has fluctuated. Comparing year-over-year (YoY) and quarter-over-quarter (QoQ) figures is crucial for understanding the underlying trends. Analyzing profitability is equally important. We need to examine gross margins, operating expenses, and key profitability metrics such as net income and EBITDA to gauge the financial health of the business.

- Revenue growth rate comparison (YoY, QoQ): A detailed analysis of these figures is needed to determine the sustainability of Palantir's revenue growth. Are they maintaining a healthy pace, or is growth slowing down?

- Gross margin analysis: Highlighting trends in gross margin helps to understand the company's pricing power and efficiency in delivering its services.

- Operating expense trends: Examining the company's spending on research and development (R&D), sales and marketing, and general administrative expenses is crucial. Are these expenses growing at a sustainable rate?

- Profitability metrics (net income, EBITDA): Ultimately, the bottom line is what matters most. Analyzing net income and EBITDA provides insights into the company’s overall profitability and ability to generate cash flow.

Government vs. Commercial Revenue

Palantir's revenue stream is diversified across government and commercial sectors. Understanding the contribution of each sector and its growth trajectory is crucial. While government contracts historically have been a significant portion of Palantir's revenue, the company is actively pushing into the commercial market. This diversification reduces reliance on a single revenue source but also introduces new challenges and uncertainties.

- Percentage of revenue from government and commercial sectors: Analyzing the split reveals the company's dependence on government contracts.

- Growth rates for each sector: Comparing the growth rates of these sectors indicates the success of Palantir’s commercial expansion efforts.

- Risk associated with government contract reliance: Government contracts are subject to various factors, including budget constraints and political changes.

- Potential for future commercial expansion: The potential for growth in the commercial sector is significant, but success depends on Palantir's ability to compete effectively with established players in the data analytics space.

Assessing Palantir's Future Growth Potential

Product Innovation and Development

Palantir's continued success hinges on its ability to innovate and develop new products and features. The company's R&D investments and the competitive advantages of its technology are crucial factors to consider when evaluating its future growth potential. A strong patent portfolio and a focus on cutting-edge technologies like AI and machine learning are also essential indicators of future success.

- New product features and capabilities: The introduction of new products and features enhances the value proposition for existing and potential clients.

- Investment in AI and machine learning: These investments show Palantir's commitment to leveraging the latest technologies to improve its offerings.

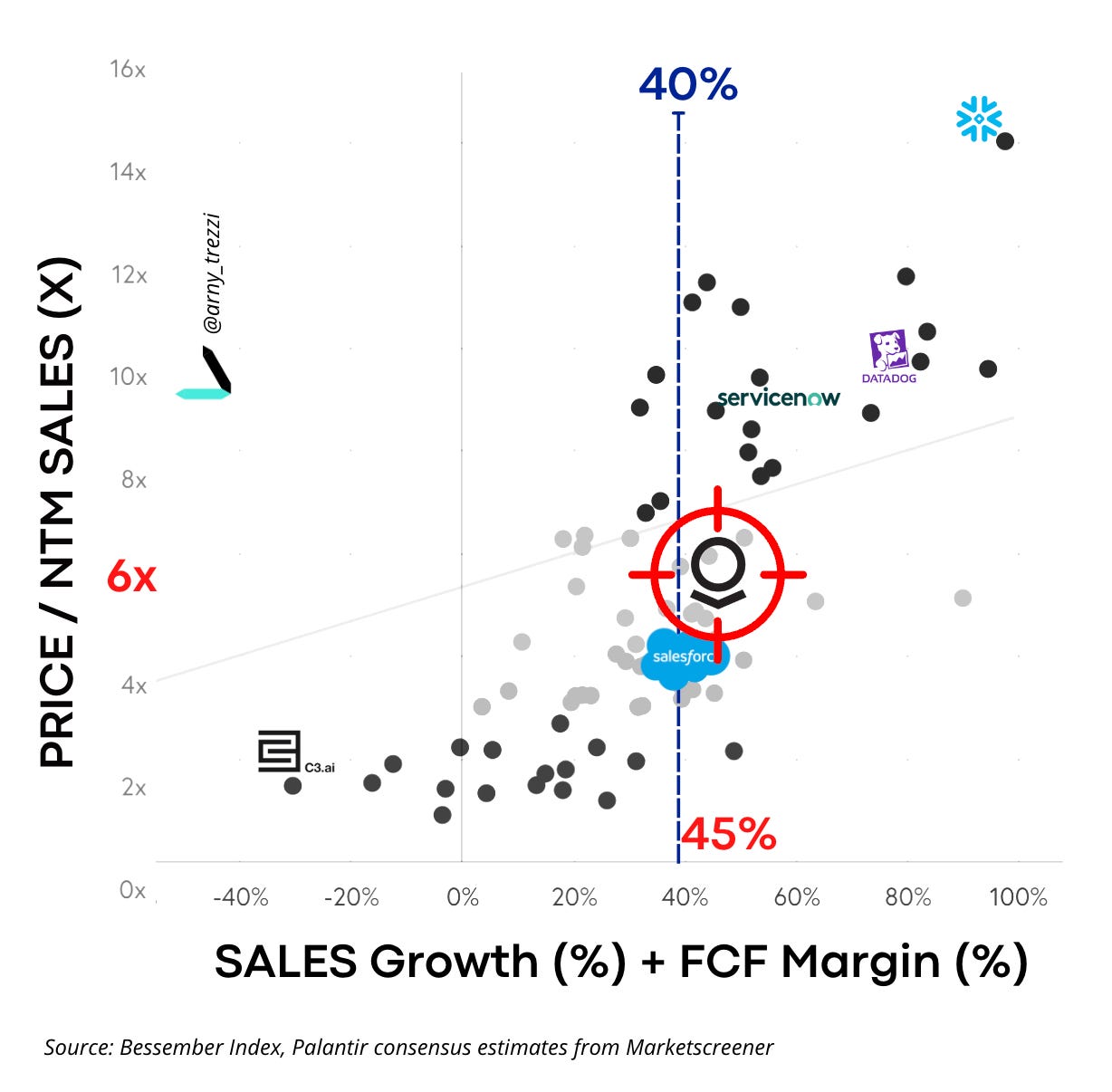

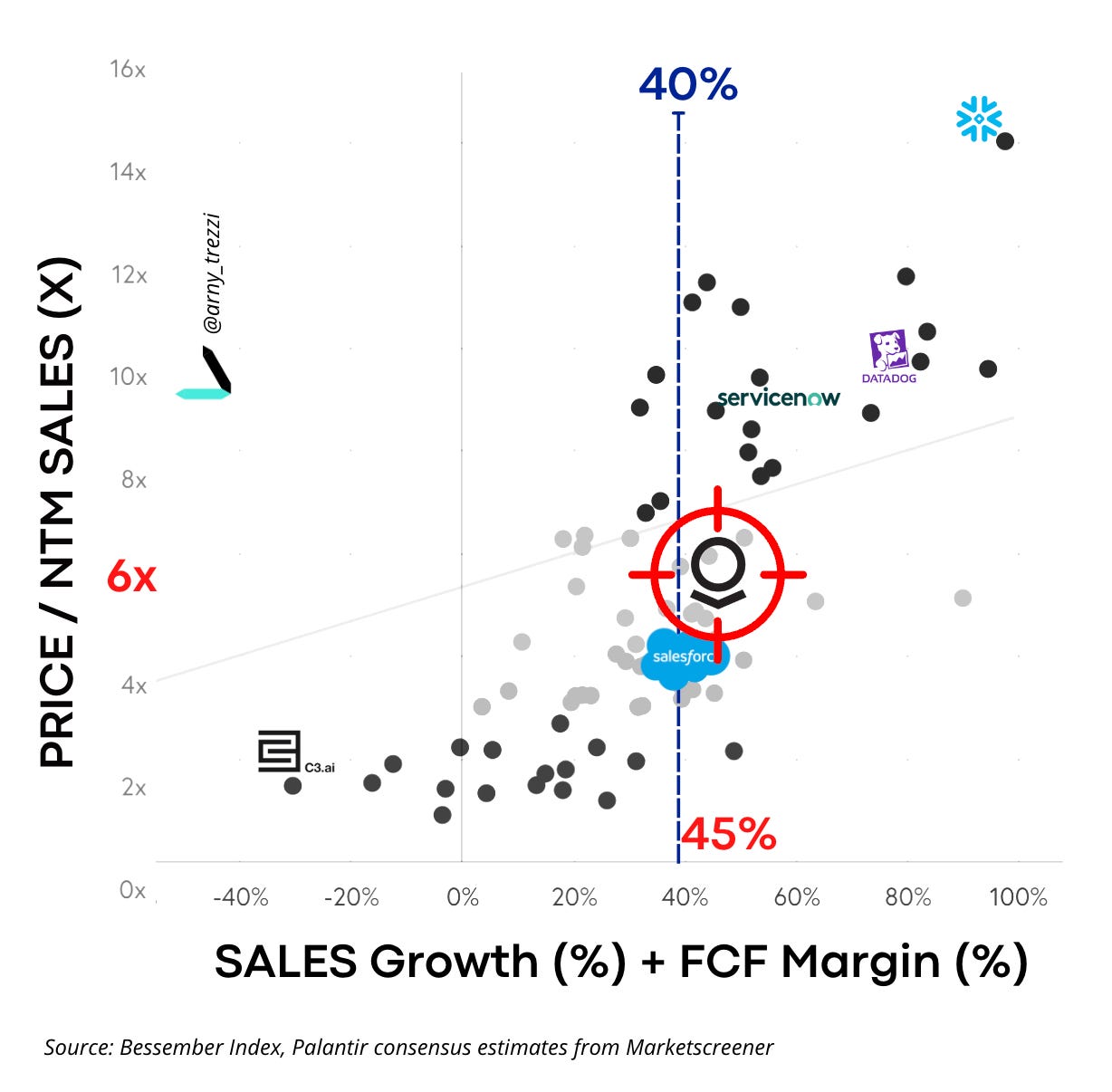

- Competitive landscape analysis: Understanding the competitive landscape is crucial for assessing Palantir's ability to maintain its market position.

- Patent portfolio strength: A strong patent portfolio protects Palantir's intellectual property and provides a competitive edge.

Market Opportunities and Expansion

Palantir operates in a rapidly expanding data analytics market. Identifying key target markets and assessing the potential for expansion into new geographic regions are crucial to forecasting future growth. Analyzing the size and growth potential of the overall market gives an understanding of the total opportunity available to Palantir.

- Market share estimates: Determining Palantir's market share and its potential for growth within existing and new markets is essential.

- Global expansion strategy: A successful global expansion strategy will be critical for achieving significant future growth.

- Addressable market size: Estimating the size of the total market Palantir can address will help investors understand the potential scale of their business.

- Potential partnerships and acquisitions: Strategic partnerships and acquisitions can accelerate Palantir's growth and enhance its product offerings.

Evaluating the Competitive Landscape and Risks

Key Competitors and Market Share

Palantir faces competition from major players in the data analytics space, including established tech giants like AWS and Microsoft Azure. Understanding Palantir's competitive advantages, market share, and the strengths and weaknesses of its competitors is essential for evaluating its long-term prospects.

- List of key competitors (e.g., AWS, Microsoft Azure): Identifying key competitors allows for a thorough comparison of Palantir's offerings.

- Competitive advantages of Palantir: What makes Palantir different from its competitors? Does it possess unique technology, expertise, or market positioning?

- Market share analysis: What percentage of the market does Palantir currently control, and how is that share changing?

- Competitive threats and opportunities: What are the potential threats and opportunities arising from competition?

Potential Risks and Challenges

Investing in Palantir involves several risks. These include data security and privacy concerns, geopolitical risks, the impact of economic downturns, and regulatory compliance challenges. A comprehensive understanding of these potential risks is vital for informed decision-making.

- Data security and privacy risks: Handling sensitive data necessitates stringent security measures. Breaches can have significant financial and reputational consequences.

- Geopolitical risks: Palantir's business is subject to geopolitical events that could negatively affect its operations in certain regions.

- Economic downturn impacts: During economic downturns, companies may reduce spending on data analytics services.

- Regulatory compliance challenges: Navigating complex regulatory environments, especially related to data privacy, is a significant challenge.

Conclusion

Palantir's recent market decline has created uncertainty, but a thorough analysis reveals both risks and opportunities. While the challenges are real – competition, economic factors, and regulatory hurdles – Palantir's innovative technology and expanding market opportunities suggest a potentially strong long-term outlook. Investors must carefully weigh these factors, conducting thorough due diligence before investing in Palantir stock. Remember that past performance is not indicative of future results. Is Palantir stock a suitable addition to your portfolio? Further research on Palantir stock and the wider data analytics market is highly recommended before making any investment decisions.

Featured Posts

-

What Williams Said About Doohan As Colapinto Transfer Rumors Intensify

May 09, 2025

What Williams Said About Doohan As Colapinto Transfer Rumors Intensify

May 09, 2025 -

High Down Payments The Canadian Homeownership Hurdle

May 09, 2025

High Down Payments The Canadian Homeownership Hurdle

May 09, 2025 -

Bristol Airport Stalking Case Polish Womans Madeleine Mc Cann Claim

May 09, 2025

Bristol Airport Stalking Case Polish Womans Madeleine Mc Cann Claim

May 09, 2025 -

Brekelmans Inzet Voor Een Sterke Relatie Met India

May 09, 2025

Brekelmans Inzet Voor Een Sterke Relatie Met India

May 09, 2025 -

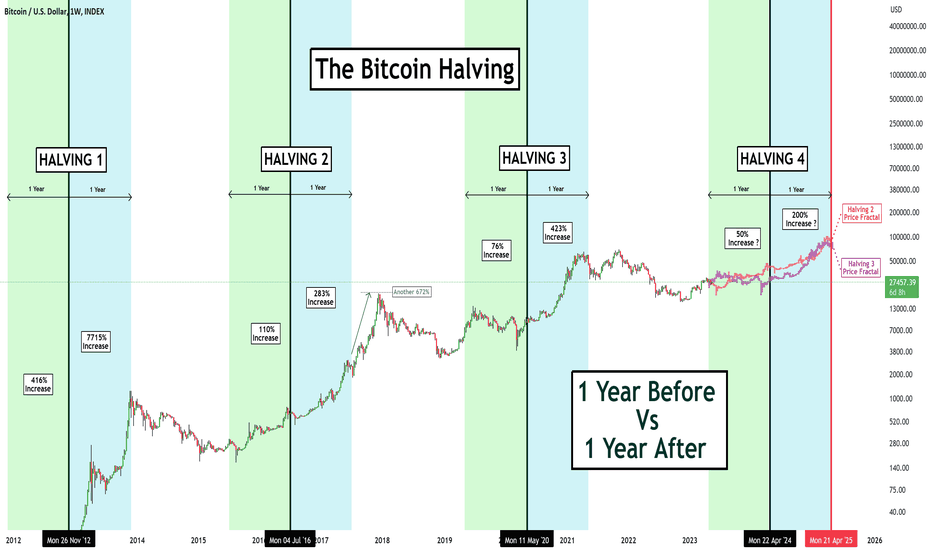

Bitcoin Price Prediction Can Trumps 100 Day Speech Push Btc Past 100 000

May 09, 2025

Bitcoin Price Prediction Can Trumps 100 Day Speech Push Btc Past 100 000

May 09, 2025