Evaluating D-Wave Quantum (QBTS): A Quantum Computing Stock Review

Table of Contents

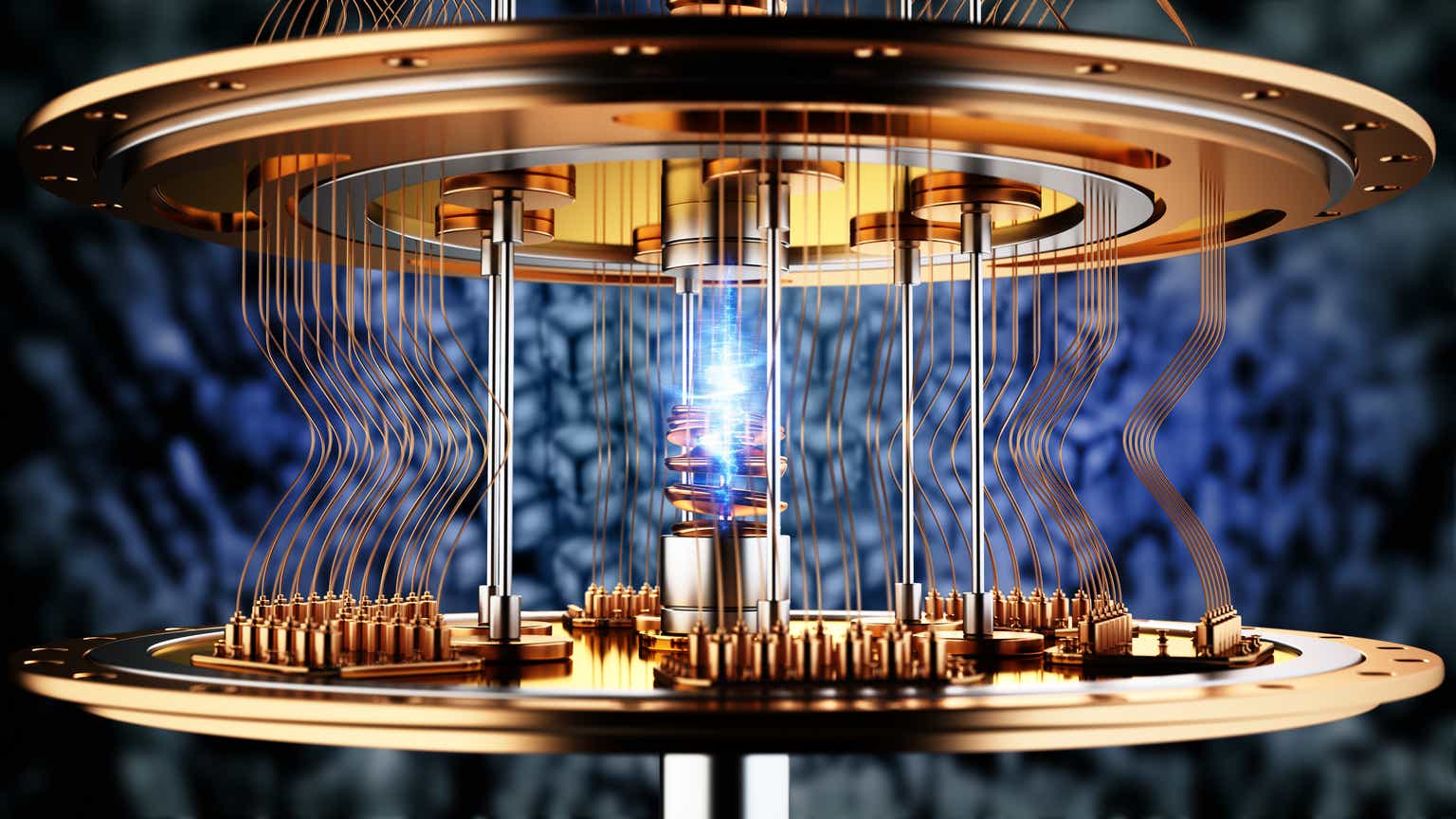

The field of quantum computing is poised for explosive growth, promising to revolutionize industries from medicine and materials science to finance and artificial intelligence. This technological leap presents significant investment opportunities, and D-Wave Quantum (QBTS) stands as a prominent player in this burgeoning market. This article provides a comprehensive review of QBTS as a quantum computing stock, analyzing its strengths, weaknesses, and future prospects to help you assess whether a D-Wave Quantum investment aligns with your investment strategy. We will focus specifically on the investment implications of D-Wave Quantum, examining its potential as a quantum computing stock and the associated risks.

2. D-Wave's Technology and Market Position:

H2: Understanding D-Wave's Quantum Annealing Technology:

D-Wave utilizes quantum annealing, a distinct approach to quantum computing compared to the more widely discussed gate-based model. Quantum annealing excels at solving specific optimization problems by finding the lowest energy state of a quantum system. While not a general-purpose quantum computer like gate-based systems aspire to be, D-Wave's advantage lies in its speed and efficiency for particular types of calculations, offering solutions faster than classical computers for certain complex optimization challenges.

- Advantages: Speed for specific problem types, existing hardware readily available, potential for near-term applications.

- Disadvantages: Limited to specific problem sets, not as versatile as gate-based quantum computers, ongoing development needed for broader applicability.

This specialized approach to quantum computing technology, often termed "quantum annealing," distinguishes D-Wave from competitors employing gate-based quantum computing. Understanding this difference is crucial when evaluating D-Wave's potential as a quantum computing stock.

H2: D-Wave's Current Market Share and Competition:

D-Wave holds a unique position in the quantum computing market. While not the dominant player in terms of overall market share, it is a significant early adopter with established clients and a track record of delivering quantum computing solutions. However, intense competition exists from companies like IBM, Google, and IonQ, all developing gate-based quantum computers with broader potential applications. The quantum computing market is still nascent, but projections indicate substantial growth in the coming years, presenting a significant opportunity for D-Wave and its competitors. The key question for QBTS stock is its ability to maintain and grow its niche, capitalizing on the potential expansion of the quantum computing market size.

- Key Competitors: IBM (with its Qiskit platform), Google (with its Sycamore processor), IonQ (with its trapped-ion technology).

- Market Growth: The global quantum computing market is expected to experience significant growth in the coming decade, creating potential for substantial returns on a QBTS investment.

3. Financial Performance and Investment Analysis:

H2: QBTS Stock Performance and Valuation:

Analyzing QBTS stock price requires careful consideration of D-Wave Quantum's financial performance. While the company is still in a growth phase, investors should assess revenue growth, operating expenses, and overall profitability. Key valuation metrics such as the price-to-sales ratio and market capitalization provide context for its valuation relative to other tech stocks. Direct comparisons to established tech companies can be challenging due to the unique nature of the quantum computing industry and its early stage development. Understanding the QBTS valuation requires considering future potential alongside current financial performance.

- Key Metrics to Monitor: Revenue growth, operating margins, price-to-sales ratio, market capitalization, and debt levels.

- Comparison to Peers: Comparing QBTS to other publicly traded tech companies requires cautious interpretation, as direct comparisons might not accurately reflect the inherent risks and opportunities within the quantum computing sector.

H2: Risks and Opportunities for QBTS Investors:

Investing in QBTS, like any investment in a young technology company, carries significant risks.

- Technological Risks: The success of D-Wave's quantum annealing technology hinges on its ability to address a sufficiently large and lucrative market segment. The technology's limitations compared to gate-based approaches represent a potential challenge.

- Competitive Risks: The intense competition from established players with substantial resources poses a threat.

- Market Volatility: The quantum computing market remains volatile, making the QBTS stock price susceptible to swings based on market sentiment and technological advancements.

However, significant investment opportunities exist:

- First-Mover Advantage: D-Wave's early market entry provides a potential first-mover advantage.

- Partnerships and Collaborations: Strategic partnerships could accelerate growth and market adoption.

- Technological Breakthroughs: Future advancements in quantum annealing technology could significantly enhance its capabilities and market appeal, potentially boosting the QBTS stock price.

4. Future Outlook and Potential for Growth:

H2: D-Wave's Roadmap and Future Technological Advancements:

D-Wave's roadmap outlines plans for further technological advancements and product development, including improvements to its quantum annealing processors and the development of supporting software and algorithms. These advancements are crucial for expanding the range of problems D-Wave can solve and improving the overall performance of its quantum computing systems. The successful execution of this roadmap is key to the company's future growth and the potential for a positive return on a QBTS investment.

H2: Long-Term Investment Potential of QBTS:

The long-term investment potential of QBTS depends on several key factors: the continued development and refinement of its quantum annealing technology, successful expansion into new markets and applications, the overall growth of the quantum computing industry, and the ability to effectively compete with established players. Investing in QBTS requires a long-term perspective, acknowledging the inherent uncertainties and risks associated with early-stage technology companies. A well-diversified portfolio can mitigate some of these risks.

5. Conclusion: Should You Invest in D-Wave Quantum (QBTS)?

D-Wave Quantum presents a compelling, albeit risky, investment opportunity within the rapidly growing quantum computing sector. While D-Wave's quantum annealing technology offers speed advantages for specific problem types and the company holds a notable position in the market, it faces strong competition and technological uncertainties. The long-term success of QBTS hinges on continued technological advancement, market adoption, and the ability to secure profitable partnerships. The financial performance and valuation of QBTS should be carefully examined before making any investment decisions. This review emphasizes the potential of D-Wave Quantum as a quantum computing stock, but ultimately, a thorough due diligence process is crucial before investing in QBTS or any quantum computing stock. Remember to conduct your own comprehensive research and consult with a financial advisor before making any investment decisions. The information provided here should not be construed as investment advice.

Featured Posts

-

Old North State Report May 9 2025 News And Analysis

May 21, 2025

Old North State Report May 9 2025 News And Analysis

May 21, 2025 -

Unprecedented Feat William Goodges Record Breaking Australian Foot Journey

May 21, 2025

Unprecedented Feat William Goodges Record Breaking Australian Foot Journey

May 21, 2025 -

Get To Know Paulina Gretzky Dustin Johnsons Wife Family And Career

May 21, 2025

Get To Know Paulina Gretzky Dustin Johnsons Wife Family And Career

May 21, 2025 -

Gbr Highlights Best Grocery Buys 2000 Quarter Found Doge Poll Update

May 21, 2025

Gbr Highlights Best Grocery Buys 2000 Quarter Found Doge Poll Update

May 21, 2025 -

Navigating Trade Frictions Switzerland And Chinas Push For Dialogue On Tariffs

May 21, 2025

Navigating Trade Frictions Switzerland And Chinas Push For Dialogue On Tariffs

May 21, 2025

Latest Posts

-

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025 -

Echo Valley Images Reveal Tense Atmosphere Of New Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025

Echo Valley Images Reveal Tense Atmosphere Of New Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025 -

New Images From Echo Valley Offer Glimpse Into Sydney Sweeney And Julianne Moore Thriller

May 22, 2025

New Images From Echo Valley Offer Glimpse Into Sydney Sweeney And Julianne Moore Thriller

May 22, 2025 -

Understanding The Bruins Offseason Strategy Espns Expert Take

May 22, 2025

Understanding The Bruins Offseason Strategy Espns Expert Take

May 22, 2025 -

Sydney Sweeney And Julianne Moore In Echo Valley First Look At Thriller Images

May 22, 2025

Sydney Sweeney And Julianne Moore In Echo Valley First Look At Thriller Images

May 22, 2025