European Shares Rise On Trump Tariff Hint, LVMH Falls

Table of Contents

Surge in European Stock Markets: A Deeper Dive

Positive Market Sentiment Driven by Tariff Hints

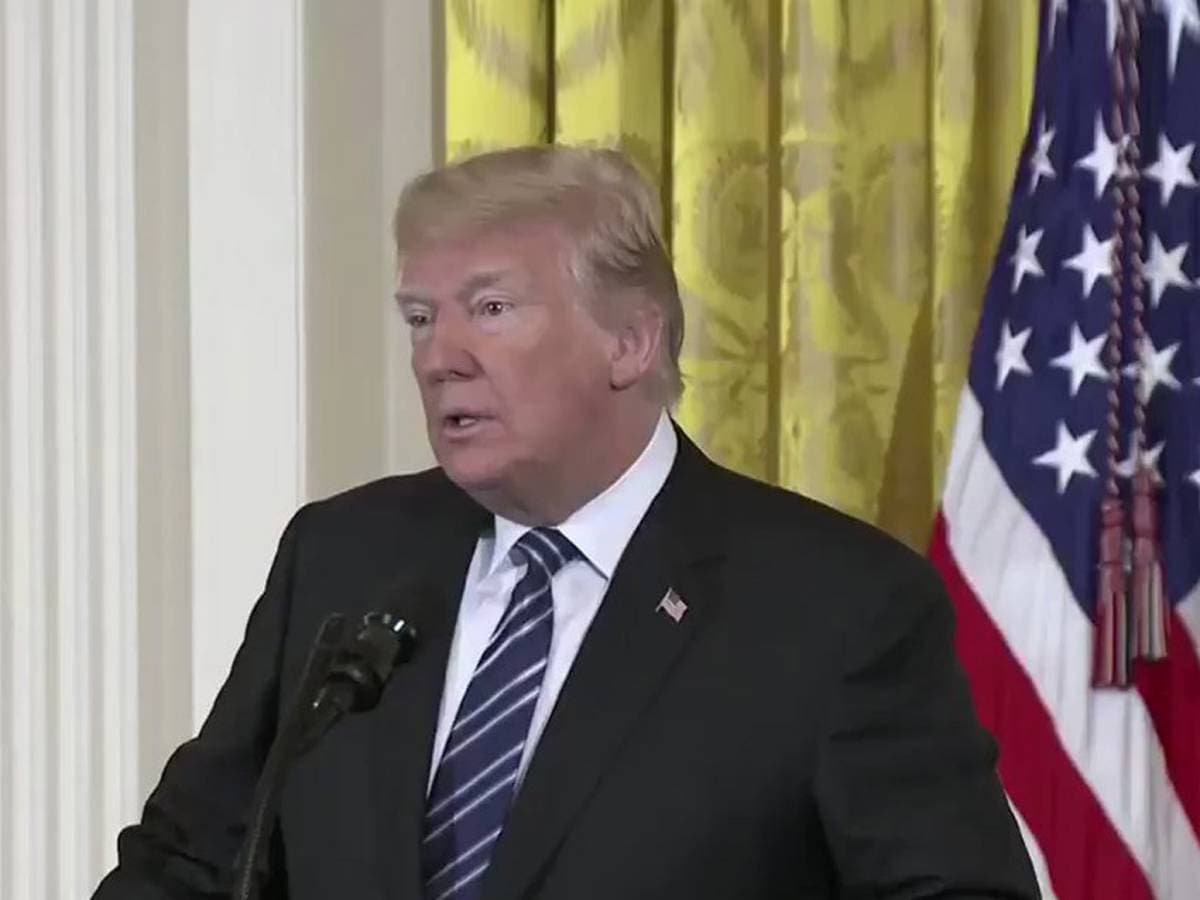

President Trump's recent statements, while vague, suggested a potential softening of his administration's aggressive tariff stance on certain goods. This subtle shift in rhetoric was enough to ignite a wave of positive sentiment among investors, leading to a noticeable increase in European share prices. Sectors like technology and automotive, previously heavily impacted by trade tensions, saw particularly strong gains.

- FTSE 100: Increased by 1.5%

- DAX: Rose by 2.0%

- CAC 40: Climbed by 1.8%

The long-term implications of these tariff hints remain uncertain. However, a sustained easing of trade tensions could significantly boost European economic growth by facilitating increased trade and investment.

Analysis of Contributing Factors Beyond Tariff News

While the tariff hints played a significant role, other factors also contributed to the rise in European shares. Positive economic data releases, such as stronger-than-expected GDP growth figures in several key European nations, bolstered investor confidence. Furthermore, several major corporations reported better-than-anticipated earnings, further fueling the positive market sentiment.

- Stronger-than-expected Eurozone PMI figures

- Positive corporate earnings reports from key European companies

- Increased foreign direct investment into the European Union

Geopolitical events, while not directly impacting the market as significantly as the tariff news, played a supporting role in the overall positive sentiment. The absence of major negative geopolitical developments provided a relatively stable backdrop for market growth.

LVMH's Decline: Understanding the Contrasting Performance

Factors Contributing to LVMH's Stock Price Drop

While European shares generally surged, LVMH experienced a notable decline. This contrasting performance highlights the sector-specific nature of market fluctuations. Several factors contributed to LVMH's underperformance:

- Disappointing Earnings Report: LVMH's recent earnings report fell short of analyst expectations, raising concerns about the company's future growth prospects.

- Slowing Luxury Goods Market: A slowdown in the global luxury goods market, particularly in key Asian markets, negatively impacted investor sentiment toward LVMH.

- Geopolitical Uncertainty: Ongoing geopolitical uncertainty, impacting consumer confidence and luxury spending, also weighed on LVMH's stock price.

Key financial indicators, such as a decline in sales growth and reduced profit margins, further contributed to the stock's decrease.

LVMH's Future Outlook and Investor Sentiment

The future trajectory of LVMH's stock price remains uncertain. The company's ability to navigate the slowing luxury goods market and adapt to evolving consumer preferences will be crucial. Investor sentiment toward LVMH is currently cautious, with many adopting a wait-and-see approach. Short-term strategies might involve hedging against further declines, while long-term investors may see this as a potential buying opportunity if the company demonstrates a successful turnaround.

Interconnectedness of Global Markets and the Impact of Geopolitical Events

The rise in European shares, contrasted with LVMH's decline, underscores the intricate interconnectedness of global markets. Events in one region—such as President Trump's tariff hints—can have significant ripple effects across various sectors and geographical areas. Investor behavior is heavily influenced by geopolitical events, impacting global market stability.

- Tariff changes can impact global supply chains and trade flows.

- Geopolitical instability can lead to increased market volatility.

- Investor confidence is highly sensitive to news and events impacting global trade.

Conclusion: Navigating the Volatility in European Shares

This analysis highlighted the contrasting performance of European shares and LVMH, driven by a complex interplay of factors including tariff hints, economic data, and sector-specific challenges. Understanding the interconnectedness of global markets and the impact of geopolitical events is crucial for navigating the volatility inherent in the European stock market. Stay informed about the latest developments in "European Shares" and the global economy. Conduct thorough research into specific companies and sectors to make informed investment decisions. The European market remains volatile, requiring a dynamic and well-informed investment strategy.

Featured Posts

-

Nuovi Dazi Stati Uniti Previsioni Sui Prezzi Del Settore Moda

May 24, 2025

Nuovi Dazi Stati Uniti Previsioni Sui Prezzi Del Settore Moda

May 24, 2025 -

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025 -

10 Fastest Standard Production Ferraris Official Track Performance Data

May 24, 2025

10 Fastest Standard Production Ferraris Official Track Performance Data

May 24, 2025 -

Nasledie Nashego Pokoleniya Chto My Sozdali I Chto Ostavim Potomkam

May 24, 2025

Nasledie Nashego Pokoleniya Chto My Sozdali I Chto Ostavim Potomkam

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025