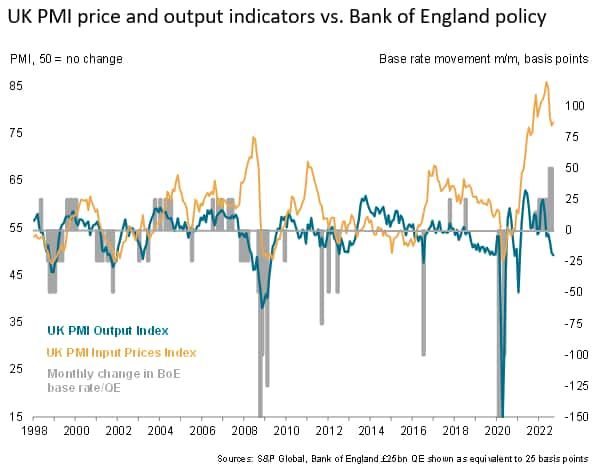

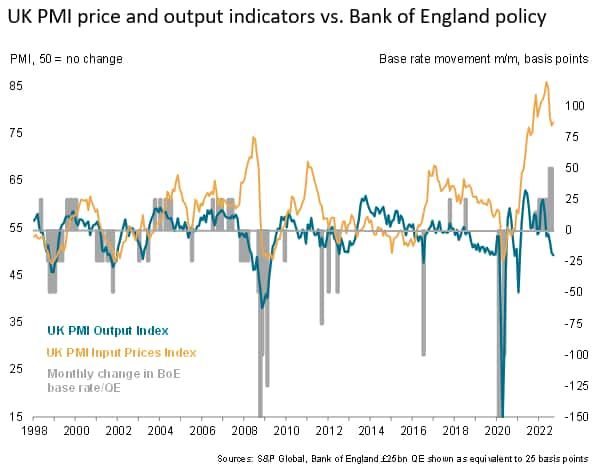

European Midday Market Report: Focus On PMI Data And Stock Performance

Table of Contents

Understanding the PMI Data and its Significance

The Purchasing Managers' Index (PMI) is a crucial economic indicator that provides valuable insights into the health and direction of the European economy. This composite index aggregates data from surveys of purchasing managers in various sectors, offering a snapshot of current business conditions. Understanding its components is key to interpreting its implications for stock performance.

-

Definition and Calculation of PMI: The PMI is calculated based on surveys of purchasing managers across manufacturing, services, and sometimes construction sectors. It reflects changes in business activity, new orders, employment levels, supplier deliveries, and inventory levels. A score above 50 indicates expansion, while a score below 50 suggests contraction.

-

Interpretation of PMI Readings: A PMI reading above 50 signals growth in the sector, indicating increased business activity and optimism. Conversely, a reading below 50 points to contraction, suggesting weakening economic conditions and potential challenges for businesses. A reading of 50 signifies no change from the previous month.

-

Manufacturing PMI vs. Services PMI: The PMI is often broken down into Manufacturing PMI and Services PMI, providing a more granular view of economic activity. A strong Manufacturing PMI might indicate robust industrial production, positively impacting related stocks. Similarly, a high Services PMI might boost shares of companies in sectors like retail or hospitality. The Composite PMI combines both manufacturing and services data to provide a holistic overview.

-

Sources for Accessing Reliable PMI Data: Reliable PMI data is regularly published by organizations like IHS Markit and S&P Global. These reports often include detailed breakdowns by country and sector, allowing for in-depth analysis.

Impact of PMI Data on Stock Performance

The release of PMI data often triggers significant market reactions. The correlation between PMI and stock performance is strong; positive PMI data generally boosts investor confidence, leading to increased buying activity and rising stock prices. Conversely, negative PMI data can trigger sell-offs as investors become more cautious about the economic outlook.

-

How Unexpected PMI Data Can Lead to Market Volatility: The market's reaction is often amplified when PMI data deviates significantly from expectations. Unexpectedly strong or weak data can lead to sharp price swings as investors reassess their positions.

-

Sector-Specific Responses to PMI Changes: Different sectors exhibit varying sensitivities to PMI changes. For instance, a strong Manufacturing PMI will likely positively affect industrial stocks, while a weak Services PMI might negatively impact consumer discretionary stocks.

-

The Role of Investor Sentiment in Amplifying or Dampening PMI's Impact: Investor sentiment plays a crucial role in determining the magnitude of the market reaction. If existing sentiment is already positive, a positive PMI report might only cause a moderate increase. However, if sentiment is negative, the same positive PMI data might have a more substantial impact.

-

Examples of Historical Instances: Analyzing past instances where PMI data significantly impacted European stock markets can offer valuable insights into potential future reactions. For instance, significant drops in PMI during economic downturns have been consistently associated with stock market declines.

Analyzing Key European Stock Indices

Understanding the performance of major European stock indices in relation to PMI releases is crucial. Let's examine how key indices have responded to recent PMI data:

-

Brief Overview of Each Major Index: The Euro Stoxx 50 represents the 50 largest companies in the Eurozone, while the DAX tracks leading German companies. The CAC 40 focuses on France's top companies, and the FTSE 100 represents the UK's 100 largest publicly traded companies.

-

Recent Performance Data: Tracking the recent performance of these indices, alongside the corresponding PMI data, provides valuable insights into their correlation. For example, a period of strong PMI growth should ideally correlate with rising index values.

-

Correlation Between Index Performance and PMI Data: By analyzing historical data, we can identify the relationship between index movements and PMI fluctuations. This allows investors to better predict market reactions to future PMI announcements.

Other Factors Influencing the Midday Market

While PMI data provides valuable insight, it's crucial to remember it's not the sole determinant of market movements. Several other factors play significant roles:

-

The Impact of Geopolitical Instability: Geopolitical events, such as international conflicts or political uncertainty, can significantly impact investor confidence and market sentiment, sometimes overshadowing the effects of PMI data.

-

The Effect of Changes in Currency Exchange Rates: Fluctuations in the Euro against other major currencies can influence the profitability of multinational companies and consequently their stock prices.

-

Influence of Interest Rate Decisions by the European Central Bank: The European Central Bank's monetary policy decisions regarding interest rates directly impact borrowing costs for businesses and consumers, thereby affecting investment and overall market sentiment.

-

Role of Inflation Figures in Market Sentiment: High inflation erodes purchasing power and can lead to increased uncertainty, potentially impacting stock market performance.

Conclusion

This European Midday Market Report highlights the significant role PMI data plays in shaping the European midday market and its influence on stock performance. Understanding how PMI data correlates with stock market movements allows investors to make more informed decisions. However, it's crucial to remember that PMI is just one piece of the puzzle; geopolitical events, currency fluctuations, interest rates, and inflation all contribute to the overall market dynamics.

Stay informed about the European midday market by regularly checking for updates on PMI data and other crucial economic indicators. Use this European Midday Market Report as a valuable tool to enhance your understanding of PMI's impact and improve your investment strategies. Monitor the latest European Midday Market Reports for insightful analysis and stay ahead of the curve in the ever-evolving European stock market.

Featured Posts

-

Understanding The Karate Kid Saga Legend Of Miyagi Dos Place

May 23, 2025

Understanding The Karate Kid Saga Legend Of Miyagi Dos Place

May 23, 2025 -

Metallica To Play Two Nights At Dublins Aviva Stadium In June 2026

May 23, 2025

Metallica To Play Two Nights At Dublins Aviva Stadium In June 2026

May 23, 2025 -

Council Explains Decrease In Mp Referred Send Cases

May 23, 2025

Council Explains Decrease In Mp Referred Send Cases

May 23, 2025 -

Zimbabwe Clinches First Test Victory Over Bangladesh Muzarabanis Star Performance

May 23, 2025

Zimbabwe Clinches First Test Victory Over Bangladesh Muzarabanis Star Performance

May 23, 2025 -

The Origin Of The Whos Name An Unexpected Tale

May 23, 2025

The Origin Of The Whos Name An Unexpected Tale

May 23, 2025

Latest Posts

-

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025 -

Vybz Kartel Announces New York City Barclay Center Concert

May 23, 2025

Vybz Kartel Announces New York City Barclay Center Concert

May 23, 2025 -

No Opposition Vybz Kartel And The Trinidad Governments Regulations

May 23, 2025

No Opposition Vybz Kartel And The Trinidad Governments Regulations

May 23, 2025 -

Vybz Kartels Response To Trinidads Performance Restrictions

May 23, 2025

Vybz Kartels Response To Trinidads Performance Restrictions

May 23, 2025 -

Trinidad And Tobago Restricts Vybz Kartel Official Statement

May 23, 2025

Trinidad And Tobago Restricts Vybz Kartel Official Statement

May 23, 2025