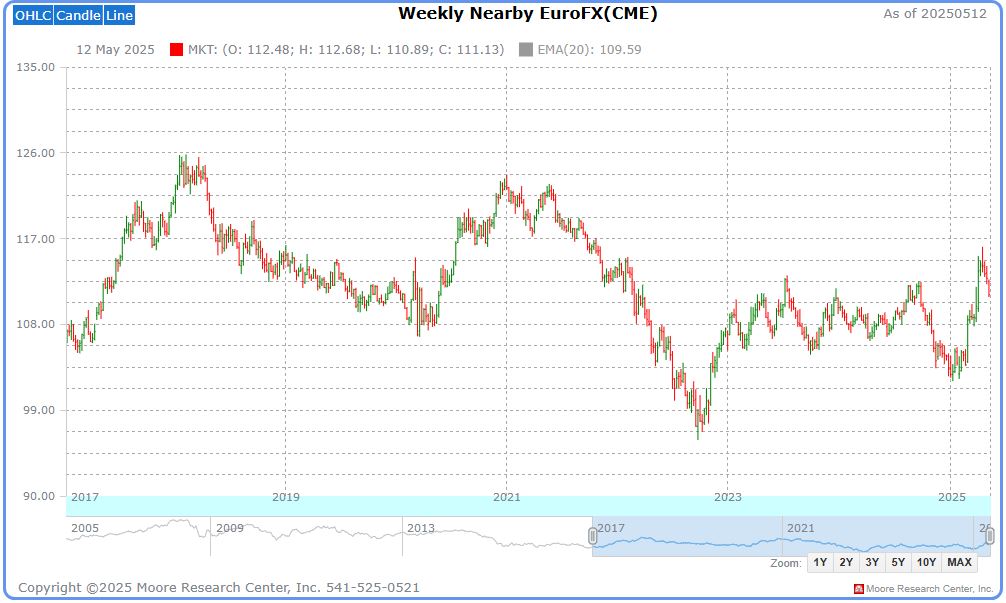

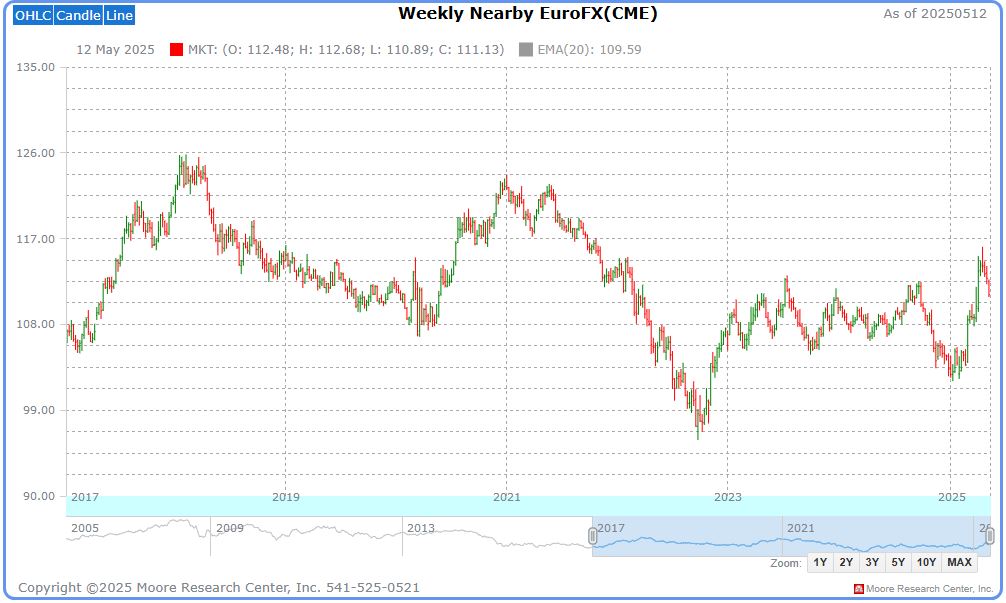

European Market Update: Euro, Futures Rise On Swissquote Bank

Table of Contents

Euro Strengthens Amidst Positive Economic Indicators

The Euro's recent strengthening is largely attributed to several positive economic indicators, boosting investor confidence and driving up demand for the currency.

Improved Economic Sentiment

Positive economic data releases have significantly contributed to the Euro's rise. This improved sentiment is reflected in:

- Strong PMI Data: Purchasing Managers' Index (PMI) readings across several Eurozone countries have exceeded expectations, indicating robust manufacturing and service sector activity.

- Positive GDP Growth Forecasts: Analysts predict sustained GDP growth for the Eurozone in the coming quarters, further fueling positive sentiment.

- Reduced Unemployment Figures: Falling unemployment rates in key Eurozone economies suggest a strengthening labor market and increased consumer spending.

These indicators collectively paint a picture of a healthy and growing Eurozone economy, making the Euro a more attractive investment. Investor confidence is directly proportional to the strength of the underlying economy; positive data translates to increased demand for the Euro, thereby pushing its value higher.

ECB Policy Impact

The European Central Bank's (ECB) monetary policy decisions also play a crucial role in shaping the Euro's trajectory. Recent actions include:

- Interest Rate Adjustments: The ECB's recent interest rate decisions, while debated, have contributed to a more stable and predictable market environment, increasing investor confidence.

- Quantitative Easing Measures (if applicable): Any ongoing or recently concluded quantitative easing programs by the ECB influence market liquidity and subsequently impact the Euro's value. (Note: This point should be adjusted based on the actual ECB policy at the time of writing).

- Policy Announcements: The ECB's communication and future policy guidance play a significant role in shaping market expectations and influencing the Euro's exchange rate.

The market's reaction to these ECB policies underscores the interconnectedness of monetary policy and currency value. Clear communication and well-defined strategies from the ECB contribute to market stability and confidence, benefiting the Euro's strength.

Futures Markets Reflect Growing Optimism

The upward trend in futures markets further reinforces the growing optimism surrounding the European economy. Swissquote Bank's data reveals significant gains across various contract types.

Rise in Futures Contracts

Swissquote Bank's platform shows substantial increases in various futures contracts, including:

- Equity Index Futures: Futures contracts tied to major European equity indices have seen significant percentage gains (quantify with actual data if possible, e.g., "the DAX futures contract increased by X%").

- Commodity Futures: Specific commodity futures contracts (e.g., energy, metals) have also experienced price increases, reflecting positive economic forecasts and increased demand.

This broad-based rise in futures contracts indicates a strong positive sentiment across different sectors, suggesting a robust and optimistic outlook for the European economy.

Implications for Investors

The rising futures market presents both opportunities and risks for investors:

- Hedging Strategies: Futures contracts can be utilized as hedging tools to mitigate risks associated with price fluctuations in underlying assets.

- Profit Potential: The upward trend presents opportunities for profit through strategic investments in futures contracts.

- Associated Risks: Investors should be aware of the inherent risks involved in futures trading, including potential for significant losses.

Investors should carefully assess their risk tolerance and investment goals before engaging in futures trading. Professional financial advice is recommended.

Swissquote Bank's Role in Market Reporting

Swissquote Bank plays a vital role in providing reliable and timely market data, crucial for informed investment decisions.

Swissquote Bank's Data Reliability

Swissquote Bank is renowned for its accurate and real-time market data, providing traders with a trusted source of information. Its strengths include:

- Real-time Data Feeds: Access to up-to-the-minute market information is essential for making timely trading decisions.

- Advanced Charting Tools: Sophisticated charting tools help visualize market trends and analyze price patterns.

- Trusted Market Information: Swissquote Bank's established reputation ensures data accuracy and reliability.

Reliable data is paramount for making sound investment choices. The accuracy and timeliness of Swissquote Bank's data contribute significantly to informed trading strategies.

Access to Trading Platforms

Swissquote Bank offers convenient and user-friendly trading platforms, facilitating easy access to the European markets:

- Web-based Platform: A user-friendly web platform allows for trading from any computer with internet access.

- Mobile Trading App: Mobile applications provide convenient access to markets on the go.

- Educational Resources: Swissquote Bank often provides educational resources to support traders of all levels.

The ease of access and user-friendly interfaces offered by Swissquote Bank make it a preferred choice for many traders seeking to participate in the European markets.

Conclusion: European Market Update: Euro, Futures Rise on Swissquote Bank

This European Market Update highlights the significant gains experienced by the Euro and futures contracts, as reported by Swissquote Bank. Positive economic indicators, coupled with the ECB's policy decisions, have fueled a surge in investor optimism, driving up both the Euro and futures prices. Swissquote Bank's reliable data and user-friendly platforms provide investors with essential tools for navigating this dynamic market environment.

Key Takeaways:

- The Euro is strengthening due to positive economic data and ECB policies.

- Futures markets show a significant upward trend, reflecting growing optimism.

- Swissquote Bank provides crucial real-time data and accessible trading platforms.

Stay updated on the latest European Market updates, track the Euro and futures movements, and access reliable market data through Swissquote Bank. Start your analysis today!

Featured Posts

-

Notre Dame De Poitiers Un Appel Aux Dons Pour Sa Restauration

May 19, 2025

Notre Dame De Poitiers Un Appel Aux Dons Pour Sa Restauration

May 19, 2025 -

Mets Spring Training Finale Batys Roster Spot And The Impact Of Injuries

May 19, 2025

Mets Spring Training Finale Batys Roster Spot And The Impact Of Injuries

May 19, 2025 -

Gazze Ye Umut Tasiyan Tirlar Yardim Malzemelerinin Akisi

May 19, 2025

Gazze Ye Umut Tasiyan Tirlar Yardim Malzemelerinin Akisi

May 19, 2025 -

Gazze Nin Kanalizasyon Altyapisi Anadolu Ajansi Na Goere Kritik Durum

May 19, 2025

Gazze Nin Kanalizasyon Altyapisi Anadolu Ajansi Na Goere Kritik Durum

May 19, 2025 -

Gazzeli Cocuklarin Kuran Ezberleme Yoentemi Cadirda Oegrenme

May 19, 2025

Gazzeli Cocuklarin Kuran Ezberleme Yoentemi Cadirda Oegrenme

May 19, 2025