EUR/USD Exchange Rate: Lagarde's Commitment To Enhancing The Euro's Global Profile

Table of Contents

Lagarde's Policies and Their Impact on the Eurozone Economy

The ECB's monetary policy under Lagarde's leadership has significantly shaped the EUR/USD exchange rate. Her decisions on interest rates, quantitative easing (QE), and other monetary tools have had far-reaching consequences for the Eurozone economy and its currency.

The impact of interest rate decisions on the EUR/USD is direct: raising interest rates generally strengthens the Euro against the dollar, attracting foreign investment seeking higher returns. Conversely, lowering rates can weaken the Euro.

- Example 1: The ECB's interest rate hikes in 2022, in response to rising inflation, led to an initial strengthening of the EUR/USD.

- Example 2: The prolonged period of near-zero interest rates following the 2008 financial crisis contributed to a period of relative weakness for the Euro.

Quantitative easing, involving the ECB purchasing government bonds and other assets to inject liquidity into the market, has also influenced the EUR/USD. While QE can stimulate economic growth and inflation, its impact on the exchange rate is complex and often depends on market sentiment and global economic conditions.

- The effectiveness of QE in boosting Eurozone growth and inflation has been a subject of ongoing debate amongst economists.

- Increased inflation, while potentially stimulating economic activity, can also weaken a currency in the long term if it surpasses other major economies.

- The impact of QE on employment within the Eurozone is largely positive in that increased liquidity can encourage businesses to expand, thereby creating jobs.

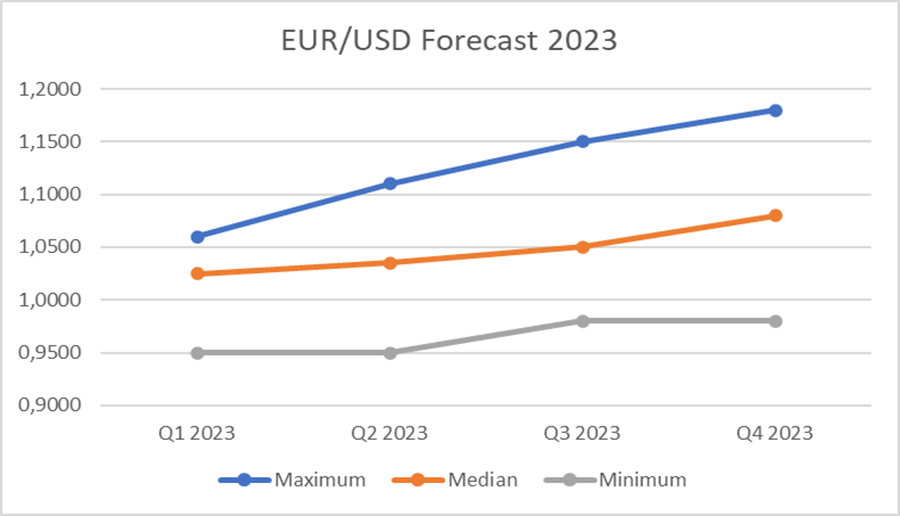

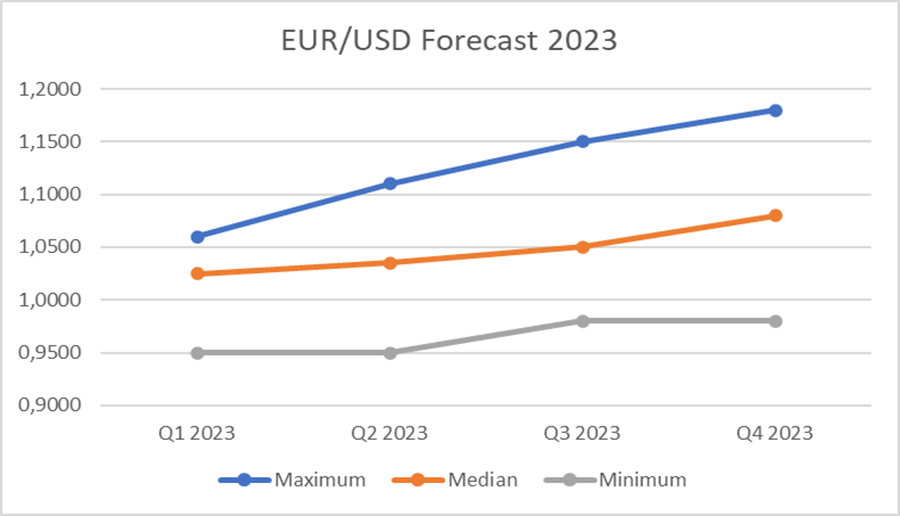

Understanding the interplay between ECB monetary policy, interest rates, quantitative easing, inflation, and the Eurozone economy is crucial for predicting future EUR/USD movements. Analyzing these factors provides valuable insights for EUR/USD forecast models.

Strengthening the Euro's International Role

Lagarde has actively pursued initiatives to enhance the Euro's global influence, aiming to increase its use in international trade and finance. A key element of this strategy is the development of a digital euro.

The introduction of a digital euro, a central bank digital currency (CBDC), could significantly strengthen the Euro's international role. A digital Euro would offer several potential advantages:

- Increased efficiency and reduced transaction costs for international payments.

- Enhanced financial inclusion for underserved populations.

- Improved cross-border payments for both individuals and businesses.

- Potential for increased use of the Euro in international reserves.

However, challenges remain, including the need for robust cybersecurity measures and the potential impact on the traditional banking system. Lagarde's public statements, focusing on the Euro's international role and the benefits of the digital euro, reflect the ECB's commitment to promoting the currency's global use. A stronger Euro could significantly impact global trade balances, potentially altering the competitive landscape for businesses worldwide.

Geopolitical Factors and their Influence on the EUR/USD

Geopolitical events significantly influence the EUR/USD exchange rate. Global uncertainty, often stemming from geopolitical risks, can lead to increased volatility in the currency markets.

- The war in Ukraine, for example, has had a profound impact on the Eurozone economy and the EUR/USD, causing energy price spikes and supply chain disruptions. This has created uncertainty impacting the Euro's value.

- US-China relations also play a crucial role, with trade tensions and geopolitical competition influencing investor sentiment towards both the dollar and the Euro.

Energy prices and supply chain disruptions, often exacerbated by geopolitical events, directly impact the Eurozone economy and consequently influence the EUR/USD. The Euro's relative strength or weakness during times of global crisis often depends on investor confidence and the perceived resilience of the Eurozone economy compared to other major economies. The ongoing global economic uncertainty therefore contributes significantly to EUR/USD volatility.

Conclusion: The Future of the EUR/USD Exchange Rate under Lagarde's Leadership

Lagarde's policies have had a significant and multifaceted impact on the EUR/USD exchange rate and the Euro's global standing. Her focus on monetary policy, efforts to strengthen the Euro's international role, and navigating the complexities of the geopolitical landscape all contribute to the currency's performance. The future trajectory of the EUR/USD will depend on a complex interplay of factors, including the ongoing economic recovery in the Eurozone, the success of the digital euro initiative, and evolving geopolitical dynamics. Understanding these factors is critical for investors and businesses operating in the global market. Stay informed on the EUR/USD exchange rate and Lagarde's impact by following our updates!

Featured Posts

-

Response To Blake Livelys Motion Justin Baldonis Legal Teams Counterarguments

May 28, 2025

Response To Blake Livelys Motion Justin Baldonis Legal Teams Counterarguments

May 28, 2025 -

Infrastruktur Jalan Raya Bali Kritik Surya Paloh Dan Solusinya

May 28, 2025

Infrastruktur Jalan Raya Bali Kritik Surya Paloh Dan Solusinya

May 28, 2025 -

Postponed Wedding Hailee Steinfeld Reflects On Josh Allens Proposal

May 28, 2025

Postponed Wedding Hailee Steinfeld Reflects On Josh Allens Proposal

May 28, 2025 -

Climate Whiplash A Growing Threat To Cities Worldwide

May 28, 2025

Climate Whiplash A Growing Threat To Cities Worldwide

May 28, 2025 -

Prakiraan Cuaca Semarang Besok 26 Maret Hujan Siang Hari

May 28, 2025

Prakiraan Cuaca Semarang Besok 26 Maret Hujan Siang Hari

May 28, 2025

Latest Posts

-

Public Help Sought In Seattle First Hill Homicide Case

May 29, 2025

Public Help Sought In Seattle First Hill Homicide Case

May 29, 2025 -

Schotwonden Na Schietincident Met Pasen In Venlo Aanhouding

May 29, 2025

Schotwonden Na Schietincident Met Pasen In Venlo Aanhouding

May 29, 2025 -

Seattle Police Investigating First Hill Homicide Public Assistance Needed

May 29, 2025

Seattle Police Investigating First Hill Homicide Public Assistance Needed

May 29, 2025 -

Na Schietincident Met Pasen Aanhouding In Venlo

May 29, 2025

Na Schietincident Met Pasen Aanhouding In Venlo

May 29, 2025 -

Seattle Police Seek Publics Assistance In First Hill Homicide Investigation

May 29, 2025

Seattle Police Seek Publics Assistance In First Hill Homicide Investigation

May 29, 2025