Eramet To Gain From China's Curbs On Lithium Technology Exports

Table of Contents

China's Curbs on Lithium Technology Exports: A Game Changer

China's recent export restrictions on crucial lithium technologies represent a major turning point in the global lithium-ion battery market. These curbs target specific technologies vital for battery production, aiming to bolster domestic industries and secure China's position in the burgeoning electric vehicle (EV) and energy storage systems (ESS) sectors.

- Specific technologies affected: The restrictions encompass various refining processes, key materials, and advanced manufacturing technologies directly related to lithium-ion battery production. This includes, but is not limited to, certain types of lithium processing equipment and specialized chemicals.

- Reasons behind China's decision: The move is largely driven by national security concerns and a desire to foster domestic innovation and self-sufficiency in the strategically important lithium-ion battery industry. Competition for global market share is also a key factor.

- Potential short-term and long-term consequences: In the short term, the restrictions could lead to supply chain disruptions and price increases for lithium-ion battery components globally. In the long term, this could accelerate the development of alternative supply chains and foster greater diversification outside of China, benefiting companies like Eramet.

Eramet's Strategic Position and Enhanced Competitiveness

Eramet is a leading global mining and metallurgy group with a significant and growing presence in the lithium market. Its geographically diverse operations and strategic investments position it to capitalize on the opportunities created by China's export controls. Unlike companies heavily reliant on Chinese supply chains, Eramet's global footprint reduces its vulnerability to disruptions.

- Specific locations of Eramet's lithium projects: Eramet's lithium projects are strategically located across multiple continents, including South America (its Whabou project in Brazil). This geographic diversification significantly reduces reliance on any single region and offers protection against geopolitical risks.

- Eramet's investment in research and development of lithium technologies: Eramet is actively investing in research and development, focusing on innovative and sustainable lithium extraction and processing techniques. This commitment to technological advancement strengthens its competitiveness in the evolving lithium landscape.

- Eramet's partnerships and collaborations in the lithium sector: Eramet actively fosters strategic partnerships and collaborations throughout the lithium value chain. This collaborative approach enables access to expertise, technology, and markets, further strengthening its market position.

Increased Demand and Market Share for Eramet

The global demand for lithium is experiencing explosive growth, fueled primarily by the rapid expansion of the electric vehicle (EV) market and the increasing adoption of energy storage systems (ESS) for renewable energy integration. China's export restrictions are likely to exacerbate existing supply chain constraints, creating a significant opportunity for companies like Eramet to expand their market share.

- Projected growth in the EV and ESS markets: The EV and ESS markets are projected to experience substantial growth over the coming decade, driving unprecedented demand for lithium. This surge in demand is expected to further increase lithium prices and enhance the profitability of producers like Eramet.

- Market analysis demonstrating the potential increase in Eramet's market share: With major competitors facing supply chain disruptions, Eramet is well-positioned to capture a larger slice of the market. Analysis shows a clear potential for significant market share growth as a result of China's export restrictions.

- Eramet's pricing strategies and market competitiveness: Eramet's strategic approach to pricing and its commitment to efficient production processes will ensure its competitiveness in the increasingly dynamic lithium market.

Potential Challenges and Mitigation Strategies for Eramet

While Eramet stands to gain substantially from China's export controls, it also faces potential challenges. These could include increased production costs due to inflation or geopolitical instability impacting its operations in various regions. However, Eramet has already implemented strategies to mitigate these risks.

- Specific challenges and their potential impact: Increased energy costs, fluctuations in currency exchange rates, and potential labor disruptions are all potential challenges that could impact Eramet's operations and profitability.

- Eramet's plans to overcome these challenges: Eramet is actively diversifying its supply chains, investing in automation and process optimization to improve efficiency and reduce costs, and actively managing its geopolitical risks.

- Risk management strategies employed by Eramet: The company employs robust risk management strategies to identify, assess, and mitigate potential threats. This includes proactive monitoring of global events and strategic partnerships that enhance resilience.

Conclusion

China's curbs on lithium technology exports present a significant opportunity for Eramet to strengthen its position in the global lithium market. By leveraging its diversified operations, strategic investments in R&D, and robust risk management strategies, Eramet is well-positioned to capture increased market share and benefit from the rising global demand for lithium. Eramet's lithium strategy showcases its adaptability and forward-thinking approach in a rapidly evolving landscape. To learn more about Eramet's investments in lithium and its response to China's export restrictions on lithium technology, explore Eramet's official website and delve deeper into Eramet's benefits from China's lithium export curbs, paving the way for investing in Eramet's lithium future.

Featured Posts

-

Millions Stolen Office365 Hack Targets Executive Inboxes

May 14, 2025

Millions Stolen Office365 Hack Targets Executive Inboxes

May 14, 2025 -

Analyzing Disneys Live Action Remakes Predicting Snow Whites Rotten Tomatoes Score

May 14, 2025

Analyzing Disneys Live Action Remakes Predicting Snow Whites Rotten Tomatoes Score

May 14, 2025 -

Dispute Erupts Jake Pauls Opponent Rejects Joshua Fight Claims Paul Responds

May 14, 2025

Dispute Erupts Jake Pauls Opponent Rejects Joshua Fight Claims Paul Responds

May 14, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Hike Sparks Outrage

May 14, 2025

Broadcoms V Mware Acquisition A 1 050 Price Hike Sparks Outrage

May 14, 2025 -

Introducing The Eurovision Song Contest 2025 Hosts

May 14, 2025

Introducing The Eurovision Song Contest 2025 Hosts

May 14, 2025

Latest Posts

-

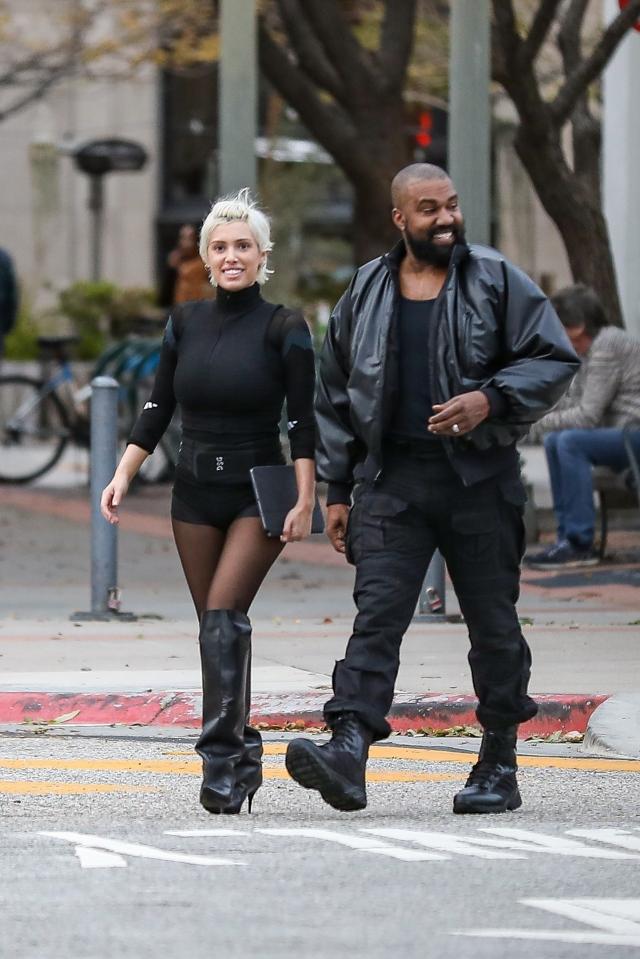

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025 -

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025 -

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025 -

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025 -

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025