Epiroc Aktiebolag Selects Deutsche Bank As Depositary Bank For ADR Programs

Table of Contents

Understanding Epiroc Aktiebolag's ADR Program

An American Depositary Receipt (ADR) is a negotiable certificate representing ownership in the shares of a foreign corporation. These shares are held by a US depositary bank, in this case Deutsche Bank, which facilitates the trading of these shares on US exchanges. For Epiroc Aktiebolag, offering ADRs provides several key advantages:

- Increased Investor Base: Access to the large and liquid US capital markets opens doors to a significantly wider pool of investors, including institutional and retail investors who might not otherwise invest directly on the Stockholm Stock Exchange (SIX).

- Enhanced Liquidity: Increased trading volume due to a broader investor base naturally translates to improved liquidity, making it easier to buy or sell shares. This reduces volatility and improves pricing efficiency.

- Potential for Higher Valuation: Enhanced visibility and increased investor interest can potentially lead to a higher market valuation for Epiroc Aktiebolag.

Trading ADRs differs from trading directly on SIX. Investors can buy and sell Epiroc ADRs through their brokerage accounts in US dollars, eliminating the complexities associated with international currency transactions and dealing directly with the Stockholm Stock Exchange.

- Increased global market access for Epiroc.

- Simplified investment for US and international investors.

- Improved company profile and brand recognition in international markets.

- Potential for higher trading volume and share price.

Deutsche Bank's Role as Depositary Bank

The depositary bank plays a vital role in facilitating ADR programs. It acts as an intermediary between the foreign company (Epiroc Aktiebolag) and US investors. Deutsche Bank's selection reflects its extensive experience and reputation in managing ADR programs for multinational corporations. Their expertise translates into several key benefits for Epiroc:

- Expertise in handling complex financial transactions: Deutsche Bank possesses the infrastructure and experience to manage the complexities of international financial transactions related to ADR issuance, trading, and settlement.

- Extensive network and infrastructure for international settlements: Their global network ensures smooth and efficient cross-border transactions, minimizing delays and costs for both Epiroc and its investors.

- Strong reputation and credibility in the global financial market: Their reputation provides confidence and credibility to both existing and potential investors.

- Streamlined processes for ADR issuance and trading: Deutsche Bank's expertise simplifies the processes involved in issuing and trading ADRs, making it easier for investors to participate.

Implications for Investors

The Epiroc Aktiebolag ADR program presents numerous opportunities for investors. US investors now have convenient access to shares of a leading company in the mining and construction equipment industry, without the complexities of investing directly on the SIX. Key implications include:

- Easier access to Epiroc shares for US investors: Investing in Epiroc becomes significantly easier for US investors as they can now trade in US dollars through familiar brokerage accounts.

- Potential for diversification and exposure to the mining and construction equipment sector: The program offers diversification benefits for investors seeking exposure to this dynamic sector.

- Improved liquidity and trading opportunities: Enhanced trading volume provided by the increased investor base leads to better liquidity and more trading opportunities.

- Increased transparency and reporting standards: Listing on US exchanges often necessitates adherence to higher transparency and reporting standards, benefiting all investors.

Future Outlook for Epiroc Aktiebolag and its ADR Program

The long-term implications of the Epiroc Aktiebolag ADR program are positive. Increased global visibility and accessibility are expected to boost foreign direct investment (FDI), strengthen relationships with international stakeholders, and enhance the company's brand reputation. Potential future developments could include expanding the ADR program to other global markets or introducing other strategic initiatives to capitalize on this enhanced market access. While the program holds significant potential, challenges such as currency fluctuations and global economic conditions need to be monitored.

- Potential for increased foreign direct investment (FDI).

- Strengthened relationships with international investors and stakeholders.

- Enhanced brand recognition and market leadership in the global marketplace.

- Continued innovation and growth within the company.

Conclusion

Epiroc Aktiebolag's partnership with Deutsche Bank for its ADR program represents a strategic move with far-reaching benefits. By offering ADRs, Epiroc gains access to a significantly larger pool of international investors, improves market liquidity, and potentially increases its valuation. For investors, the program provides easier access to a company with a strong position in the mining and construction equipment sector. The increased transparency and reporting standards also benefit all shareholders.

Call to Action: Learn more about the Epiroc Aktiebolag ADR program and how you can invest in this exciting opportunity. Visit the Epiroc Aktiebolag investor relations website [Insert Link Here] or explore Deutsche Bank's ADR services information [Insert Link Here] to understand how you can participate in the Epiroc Aktiebolag ADR offering.

Featured Posts

-

Aviva Stadium To Host Metallica For Two Nights In June 2026

May 30, 2025

Aviva Stadium To Host Metallica For Two Nights In June 2026

May 30, 2025 -

Bruno Fernandes To Real Madrid Examining The Transfer Rumours

May 30, 2025

Bruno Fernandes To Real Madrid Examining The Transfer Rumours

May 30, 2025 -

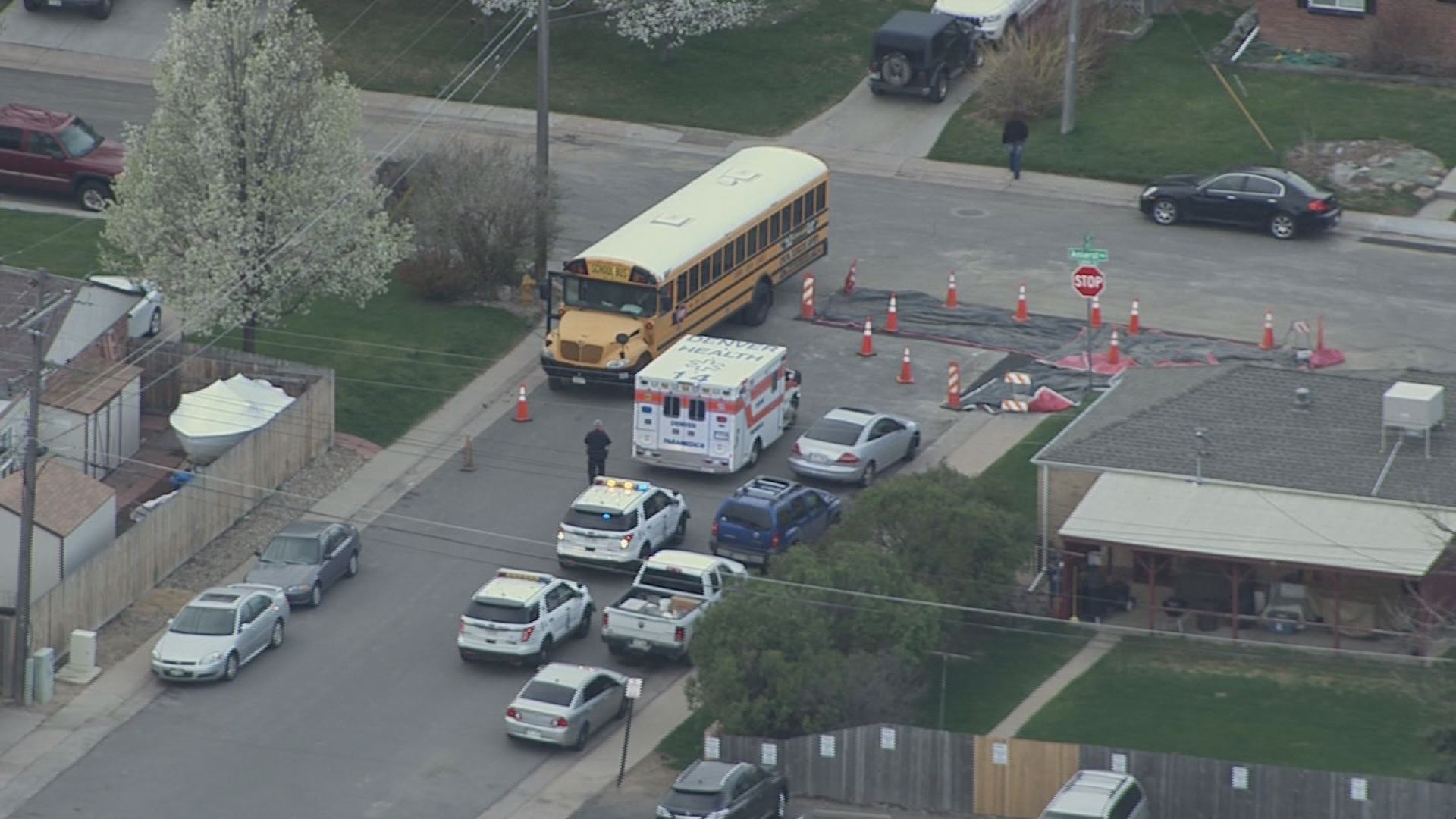

Pella School Bus Accident Leaves Two With Injuries

May 30, 2025

Pella School Bus Accident Leaves Two With Injuries

May 30, 2025 -

Did Elon Musk Father Amber Heards Twins A Look At The Renewed Embryo Controversy

May 30, 2025

Did Elon Musk Father Amber Heards Twins A Look At The Renewed Embryo Controversy

May 30, 2025 -

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Du Sud Ouest

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Du Sud Ouest

May 30, 2025