Entertainment Stock Price Drop: Should You Buy The Dip?

Table of Contents

Keywords: Entertainment stocks, stock market dip, buy the dip, entertainment industry, investment strategy, stock price drop, entertainment investment, risk assessment, market volatility

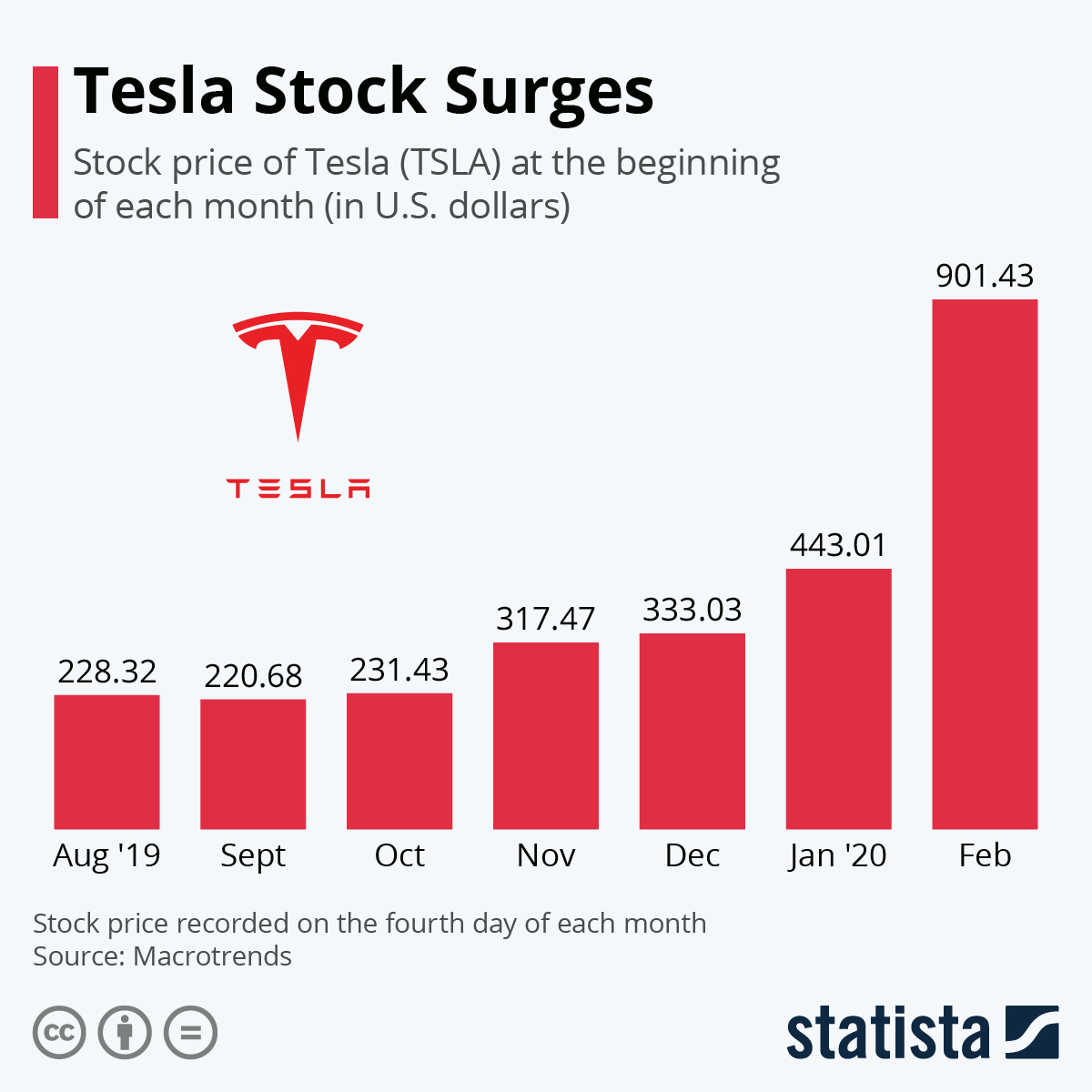

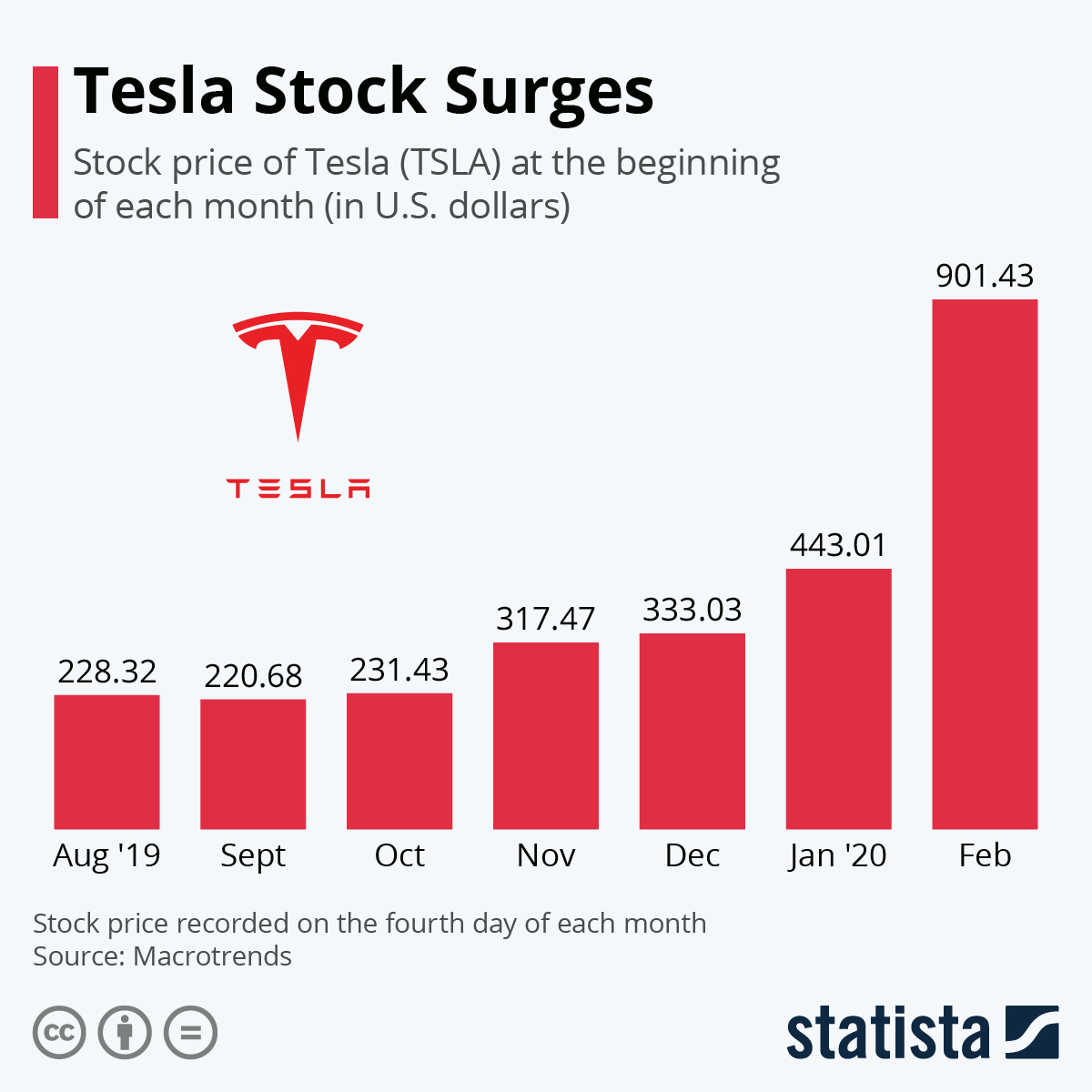

The entertainment industry, once a seemingly recession-proof sector, has seen a significant stock price drop recently. This downturn has left many investors wondering: should they "buy the dip," or is this a sign of more significant trouble to come? This article will delve into the factors contributing to this volatility, analyze the risks and rewards, and offer guidance on navigating this challenging market.

Understanding the Entertainment Stock Price Drop

The recent downturn in entertainment stocks reflects a confluence of factors impacting the industry's profitability and future prospects. Companies like Disney and Netflix, once considered industry giants, have experienced notable price drops, signaling a broader trend.

-

Impact of streaming wars: The intense competition among streaming platforms has led to increased content spending and squeezed profit margins. Netflix's subscriber growth slowdown is a prime example of this challenge. The need for constant new content creation and investment in technology puts pressure on profitability.

-

Changing consumer habits: Consumers are increasingly price-sensitive, leading to "subscription fatigue." The rising cost of living makes entertainment subscriptions, while desirable, a discretionary expense easily cut back on.

-

Economic downturn and its effects on discretionary spending: A weakening global economy directly impacts consumer spending. Entertainment, often considered a non-essential expense, is one of the first areas where consumers cut back during economic uncertainty.

-

Inflation and rising production costs: Increased production costs, from talent fees to equipment and marketing, are compressing profit margins for entertainment companies. This is particularly challenging in an environment of rising interest rates.

Factors Contributing to the Volatility

Beyond the industry-specific challenges, macroeconomic factors significantly contribute to the volatility in entertainment stocks.

-

Interest rate hikes and their effect on valuations: Rising interest rates make borrowing more expensive, impacting companies' ability to invest in growth initiatives. This also affects investor sentiment, leading to lower valuations for growth-oriented companies.

-

Geopolitical instability and its ripple effects: Global events, such as geopolitical tensions and conflicts, impact market sentiment and create uncertainty for investors, leading to broader market sell-offs that affect even relatively stable sectors like entertainment.

-

Competition from other forms of entertainment: The rise of video games, eSports, and other interactive forms of entertainment is diverting consumer attention and spending away from traditional media. This creates a more fragmented and competitive entertainment landscape.

-

Changes in advertising revenue: The shift towards streaming models has also impacted advertising revenue for entertainment companies. Traditional linear television advertising is declining, creating a need for new and innovative monetization strategies.

Analyzing the Risk and Reward

Buying entertainment stocks during a downturn presents both risks and potential rewards. A careful risk assessment is crucial before making any investment decisions.

-

Risk assessment: temporary vs. long-term issues: It's essential to differentiate between temporary market fluctuations and fundamental problems within individual companies. Thorough research is critical to determine whether the price drop reflects a short-term correction or signals deeper, long-term issues.

-

Potential for significant growth in the future: Despite the current challenges, the entertainment industry still holds significant long-term growth potential. Technological advancements, new content formats, and evolving consumer preferences will continue to shape the sector's future.

-

Diversification strategies to mitigate risk: Diversifying your portfolio across different entertainment companies and other asset classes can significantly reduce overall risk. Don't put all your eggs in one basket.

-

Importance of fundamental analysis before investing: Before investing in any entertainment stock, perform a thorough fundamental analysis, evaluating the company's financial health, management team, and competitive landscape.

Due Diligence: Researching Individual Entertainment Stocks

Thorough research is paramount before investing in any individual entertainment stock. Leverage reliable resources like financial news websites (e.g., Yahoo Finance, Bloomberg), SEC filings (EDGAR database), and company investor relations pages.

-

Analyze company financials (revenue, debt, profitability): Scrutinize key financial metrics to understand the company's financial health and stability.

-

Evaluate management teams and their strategies: A strong and experienced management team can significantly impact a company's success.

-

Assess competitive landscape and future growth prospects: Analyze the competitive landscape and the company's ability to adapt to changing market conditions.

Alternative Investment Strategies

Instead of directly buying individual stocks during a dip, consider alternative strategies.

-

Dollar-cost averaging to reduce risk: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. This helps mitigate the risk of investing a lump sum at a potentially high price.

-

Investing in established, dividend-paying entertainment companies: Established companies with a history of paying dividends offer a more stable income stream, especially during market volatility.

-

Considering ETFs focused on the entertainment sector: Exchange-Traded Funds (ETFs) provide diversified exposure to the entertainment sector, reducing the risk associated with investing in individual stocks.

Conclusion

Entertainment stock prices have experienced a notable drop, driven by various macroeconomic and industry-specific factors. Buying the dip presents both risks and rewards. Thorough due diligence, a well-defined investment strategy, and a realistic risk assessment are crucial for navigating this volatile market. Carefully analyze the entertainment stock market before making any investment decisions. Consider your risk tolerance and investment goals before deciding whether to buy the dip in entertainment stocks. Remember to conduct thorough research and consider diversifying your portfolio. Make informed decisions about your entertainment stock investments.

Featured Posts

-

Mai Arrangementer I Moss Fullstendig Oversikt

May 29, 2025

Mai Arrangementer I Moss Fullstendig Oversikt

May 29, 2025 -

Avoid French Traffic Jams This Weekend Best Routes And Alternative Roads

May 29, 2025

Avoid French Traffic Jams This Weekend Best Routes And Alternative Roads

May 29, 2025 -

La Trayectoria De Victor Fernandez

May 29, 2025

La Trayectoria De Victor Fernandez

May 29, 2025 -

Ipa I Apoxorisi Toy Mask Kai Oi Epiptoseis Stin Kyvernisi Tramp

May 29, 2025

Ipa I Apoxorisi Toy Mask Kai Oi Epiptoseis Stin Kyvernisi Tramp

May 29, 2025 -

Czy Flagowa Inwestycja Pcc Zostanie Opozniona I Bedzie Drozsza

May 29, 2025

Czy Flagowa Inwestycja Pcc Zostanie Opozniona I Bedzie Drozsza

May 29, 2025