Emerging Markets Fund Closure: Point72 Traders Withdraw

Table of Contents

Reasons Behind Point72's Emerging Markets Fund Closure

Point72's decision to shutter its emerging markets fund wasn't likely made lightly. Several factors likely contributed to this strategic shift.

Underperformance: A Key Factor in the Fund Closure

One of the most prominent reasons cited for the closure is the fund's underperformance. While precise figures haven't been publicly released, sources suggest the fund's return on investment (ROI) lagged behind established benchmarks and competitor funds specializing in emerging markets. This consistent underperformance, possibly spanning several quarters, would have undoubtedly raised concerns among Point72's leadership, ultimately leading to the decision to close the fund.

- Lack of Alpha Generation: The fund may have struggled to generate alpha (excess returns above the benchmark) in a challenging emerging markets environment.

- Benchmark Comparison: A detailed analysis comparing the fund's performance to relevant indices like the MSCI Emerging Markets Index would reveal the extent of the underperformance.

- Internal Performance Reviews: Point72 likely conducted rigorous internal performance reviews before making the decision to close the fund.

Market Volatility: Navigating Geopolitical and Economic Headwinds

Emerging markets are inherently volatile, subject to significant geopolitical risk and economic uncertainty. Recent global events, such as rising interest rates, the war in Ukraine, and persistent inflation, have created a challenging investment climate. These factors undoubtedly impacted the fund's performance, contributing to the decision to close.

- Geopolitical Instability: The ongoing conflict in Ukraine and escalating tensions in other regions significantly impacted investor sentiment and market stability.

- Economic Uncertainty: Global inflation and rising interest rates increased the risk associated with emerging market investments.

- Currency Fluctuations: Sharp fluctuations in emerging market currencies added another layer of complexity and risk.

Strategic Realignment: A Shift in Investment Focus

Point72 may have decided to strategically realign its investment portfolio, shifting its focus away from emerging markets and towards other asset classes perceived as offering better risk-adjusted returns. This strategic shift reflects a proactive approach to portfolio diversification and risk management.

- Asset Allocation Changes: Point72 may be re-allocating capital to sectors deemed less volatile or offering higher growth potential.

- Diversification Strategies: This move could be part of a broader strategy to diversify the firm's investment portfolio across various asset classes and geographies.

- Internal Resource Allocation: Closing the fund may free up internal resources for other, higher-priority investment initiatives.

Trader Exodus: Loss of Expertise and Management Challenges

Reports suggest a significant number of key traders have left the emerging markets fund. This exodus of experienced personnel could have further exacerbated the challenges facing the fund, ultimately leading to its closure. The loss of institutional knowledge and management expertise would have undeniably impacted the fund's ability to perform optimally.

- Impact on Team Dynamics: The departure of key traders likely affected team morale and the overall effectiveness of the investment team.

- Succession Planning: The firm may have struggled to find suitable replacements for departing traders, leading to a weakening of the team’s capabilities.

- Loss of Market Insight: The departure of experienced traders might have resulted in a loss of valuable market insight and expertise.

Impact of the Closure on the Broader Market

The closure of Point72's emerging markets fund has significant implications for the broader financial landscape.

Investor Confidence: A Test of Sentiment

The closure could negatively impact investor confidence in emerging markets and similar hedge funds. Investors might become more cautious about allocating capital to this asset class, leading to a potential slowdown in foreign investment flows into emerging economies.

- Flight to Safety: Investors might shift their investments toward perceived safer assets, such as US Treasury bonds.

- Reduced Risk Appetite: The closure could signal a broader reassessment of risk in the emerging markets sector.

- Impact on Hedge Fund Reputation: This event might affect the reputation of other hedge funds specializing in emerging markets.

Emerging Market Economies: Potential Economic Consequences

The reduction in foreign investment resulting from the closure could have negative consequences for the economies of the countries where Point72's fund invested. This could lead to decreased economic growth and potentially destabilize some emerging markets.

- Capital Outflow: The withdrawal of investment capital could put pressure on local currencies and financial markets.

- Reduced Economic Growth: Decreased foreign investment could lead to slower economic growth in affected countries.

- Social and Political Implications: Economic hardship resulting from decreased investment could have wider social and political consequences.

Competition in the Hedge Fund Industry: Reshaping the Landscape

The closure might reshape the competitive landscape within the hedge fund industry, potentially leading to consolidation or increased competition among remaining players in the emerging markets sector. Other firms may see an opportunity to acquire assets or attract clients previously invested with Point72.

- Market Share Shifts: Competitors may benefit from the departure of Point72, potentially gaining market share.

- Consolidation Opportunities: Larger hedge funds might seek to acquire assets or teams from Point72.

- Increased Competition: The closure could intensify competition among remaining players specializing in emerging markets.

Future Outlook for Point72 and Emerging Markets

Point72's future investment strategy remains uncertain. While they might re-enter the emerging markets sector in the future, it is likely they will adopt a more cautious and selective approach. The long-term prospects for emerging markets remain mixed, with significant potential for growth but also considerable risk.

- Revised Investment Criteria: Point72 may implement stricter investment criteria for future emerging markets investments.

- Phased Re-entry: A gradual re-entry into the emerging markets sector is possible, focusing on specific countries or sectors.

- Technological Advancements: The use of advanced analytics and AI could enable more informed and efficient investment decisions in emerging markets.

Conclusion: Emerging Markets Fund Closure: Implications and Future Considerations

Point72's decision to close its emerging markets fund highlights the inherent volatility and risk associated with this asset class. The closure's impact extends beyond Point72, affecting investor confidence, emerging market economies, and the competitive landscape of the hedge fund industry. While the long-term prospects for emerging markets remain promising, future investments will require careful consideration of geopolitical risks, economic uncertainty, and rigorous due diligence. Stay tuned for further updates on the evolving situation in emerging markets investment and the future strategies of Point72. Follow [your publication/website] for more insights on emerging market fund performance and significant industry changes.

Featured Posts

-

A Detailed Look At Dave Portnoys Criticism Of Gavin Newsom

Apr 26, 2025

A Detailed Look At Dave Portnoys Criticism Of Gavin Newsom

Apr 26, 2025 -

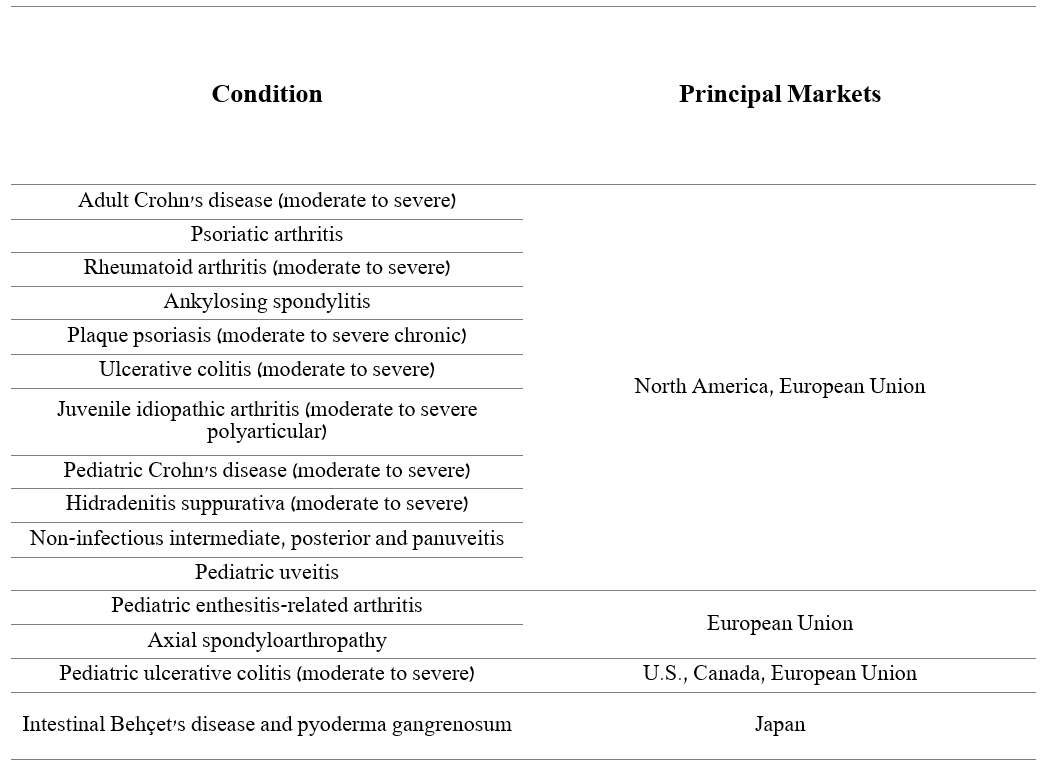

Abb Vies New Drugs Fuel Sales Growth And Increased Profit Forecast

Apr 26, 2025

Abb Vies New Drugs Fuel Sales Growth And Increased Profit Forecast

Apr 26, 2025 -

Uk Wind Auction Reform Vestas Highlights Threat To Factory Investment And Jobs

Apr 26, 2025

Uk Wind Auction Reform Vestas Highlights Threat To Factory Investment And Jobs

Apr 26, 2025 -

Why Invest In Middle Management The Return On Investment For Companies And Employees

Apr 26, 2025

Why Invest In Middle Management The Return On Investment For Companies And Employees

Apr 26, 2025 -

Dow Futures And China Economy Stock Market Update

Apr 26, 2025

Dow Futures And China Economy Stock Market Update

Apr 26, 2025

Latest Posts

-

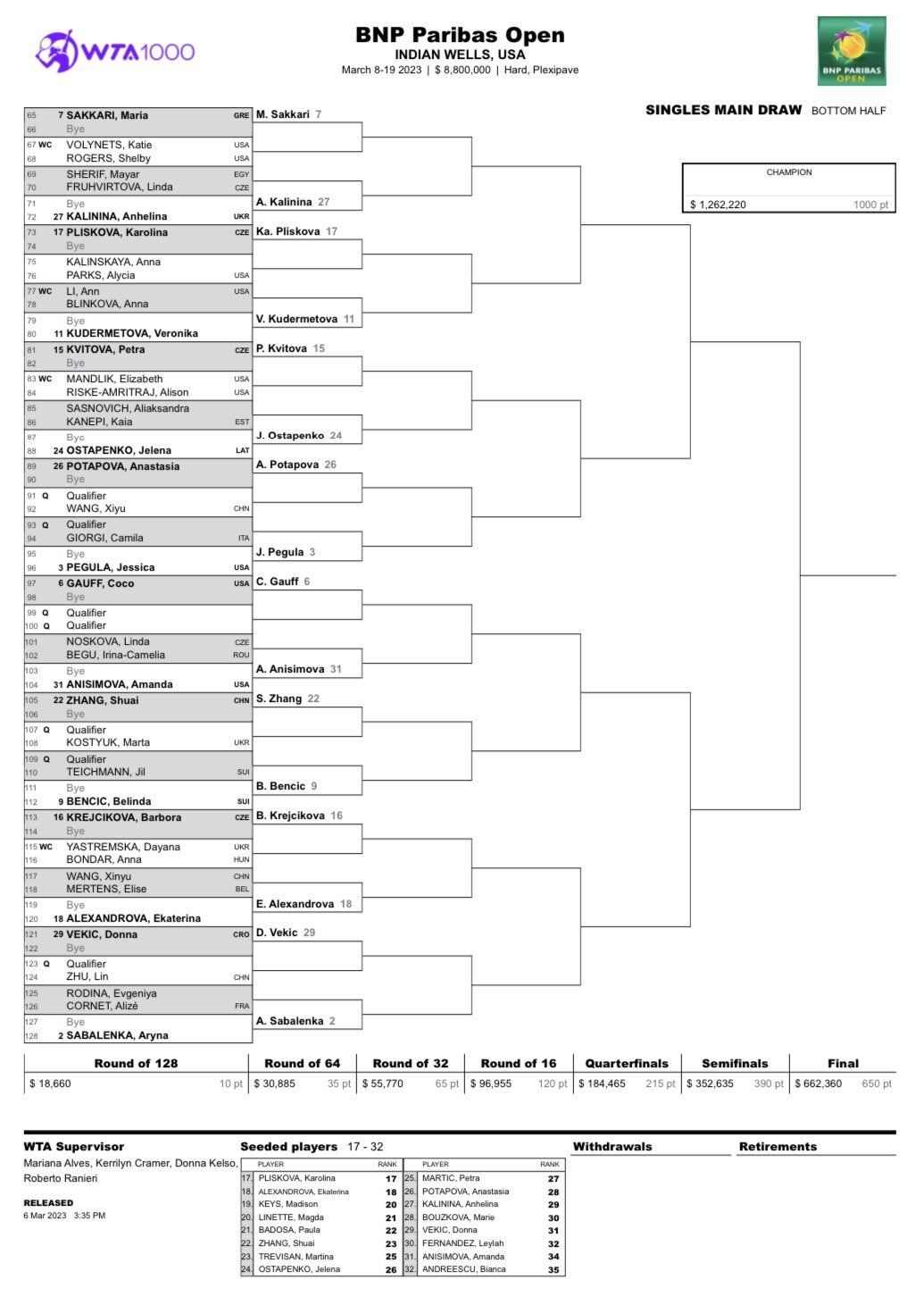

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025 -

Paolini Y Pegula Caen En Dubai Fin Prematuro En El Wta 1000

Apr 27, 2025

Paolini Y Pegula Caen En Dubai Fin Prematuro En El Wta 1000

Apr 27, 2025 -

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025