Elon Musk's Net Worth: How US Economic Policies Impact Tesla's CEO Fortune

Table of Contents

Understanding Elon Musk's Net Worth Fluctuations

Elon Musk's immense wealth primarily stems from his substantial stake in Tesla, Inc., and his ownership of SpaceX. Understanding the fluctuations in his net worth requires examining the performance of these ventures.

The Primary Sources of Elon Musk's Wealth

- Tesla Stock: This forms the lion's share of Musk's wealth. Tesla's stock price directly impacts his net worth; a surge in the stock price translates to a significant increase in his personal fortune, and vice-versa.

- SpaceX: Though less publicly valued than Tesla, SpaceX is a significant contributor to Musk's overall net worth. Successful launches, securing lucrative contracts, and future ventures like Starship development influence its valuation and, consequently, Musk's wealth.

- Other Investments and Assets: Musk's portfolio likely includes other investments and personal assets which contribute to his overall net worth, albeit to a lesser extent than his stake in Tesla and SpaceX.

The interconnectedness of these sources is crucial. Tesla's success relies on factors like consumer demand, technological innovation, and favorable economic conditions. SpaceX's performance depends on government contracts, private investment, and the overall state of the aerospace industry. These are all influenced by prevailing economic factors. For example, a recession could negatively impact demand for both Tesla vehicles and SpaceX's services, impacting Musk’s overall net worth.

The Influence of US Economic Policies on Tesla's Performance

US economic policies significantly influence Tesla's performance and, as a result, Elon Musk's net worth. These policies span several key areas:

Impact of Tax Policies

- Corporate Tax Rates: Lower corporate tax rates can boost Tesla's profitability, increasing its stock price and benefiting Musk. Conversely, higher rates can reduce profitability.

- Tax Incentives and Subsidies: Government incentives for electric vehicle (EV) manufacturers, such as tax credits for EV purchases, directly benefit Tesla's sales and overall financial health.

- Potential Changes in Tax Laws: Any significant changes to corporate tax legislation or EV incentives can have a substantial and immediate impact on Tesla's financial performance and, therefore, Elon Musk's net worth.

Impact of Monetary Policies

- Interest Rates: Higher interest rates can increase borrowing costs for consumers, potentially reducing demand for luxury goods like Tesla vehicles. Lower interest rates can stimulate consumer spending.

- Inflation: Rising inflation increases raw material costs and production expenses for Tesla, impacting profitability. Managing inflation effectively is crucial for Tesla's financial health.

- Federal Reserve Actions: The Federal Reserve's monetary policy decisions, such as interest rate adjustments, significantly influence overall market sentiment and directly impact Tesla's stock valuation and Musk's net worth.

Impact of Trade Policies

- Tariffs and Trade Wars: Tariffs on imported goods can affect Tesla's global supply chain and increase production costs. Trade wars can disrupt international sales and distribution networks.

- Government Regulations: Government regulations on EV emissions, safety standards, and charging infrastructure impact Tesla's operational costs and market competitiveness.

- International Trade Agreements: Favorable international trade agreements can ease Tesla's expansion into new markets, boosting sales and revenue.

Specific Examples of US Policies Impacting Elon Musk's Net Worth

Analyzing specific instances helps illustrate the link between US economic policies and Elon Musk's wealth. For example, the introduction of significant tax credits for EV purchases in the US demonstrably boosted Tesla sales and its stock price, positively impacting Musk's net worth. Conversely, periods of heightened trade tensions or increased interest rates have shown a negative correlation with Tesla's stock performance and thus, Musk's fortune. (Note: Specific data points and charts would be included here in a complete article).

Conclusion: Elon Musk's Net Worth and the US Economy: A Complex Relationship

The relationship between Elon Musk's net worth and US economic policies is undeniable and complex. Tesla's success, and therefore Musk's wealth, is intrinsically linked to the overall economic health of the US and the government's approach to taxation, monetary policy, and international trade. Understanding these factors is key to comprehending the fluctuations in Elon Musk's CEO fortune. Key takeaways include the direct impact of tax incentives, interest rate changes, and trade policies on Tesla's performance, and ultimately, on Elon Musk's net worth. To stay informed about the future of Elon Musk's net worth and the financial health of Tesla, continue following developments in US economic policies and their potential impacts on the company. Further research into "Elon Musk's net worth" and related terms like "Tesla stock price" and "US economic outlook" is encouraged.

Featured Posts

-

How The Fentanyl Crisis Influenced Us China Trade Discussions

May 10, 2025

How The Fentanyl Crisis Influenced Us China Trade Discussions

May 10, 2025 -

The Snl Impression That Left Harry Styles Devastated

May 10, 2025

The Snl Impression That Left Harry Styles Devastated

May 10, 2025 -

Edmonton Oilers Draisaitl Injury Update And Playoffs Outlook

May 10, 2025

Edmonton Oilers Draisaitl Injury Update And Playoffs Outlook

May 10, 2025 -

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025 -

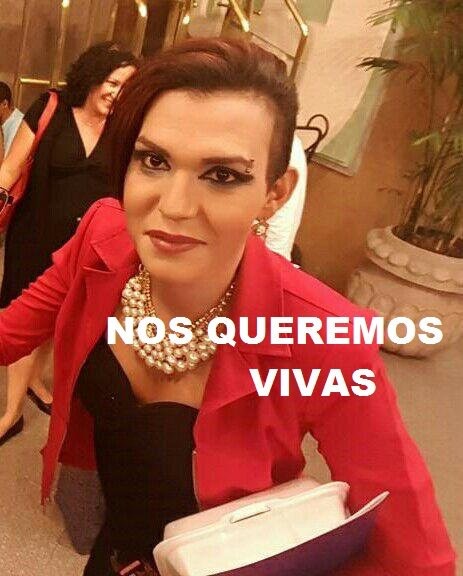

Debate Sobre Derechos Trans Arrestan A Universitaria Por Usar Bano Femenino

May 10, 2025

Debate Sobre Derechos Trans Arrestan A Universitaria Por Usar Bano Femenino

May 10, 2025