Elon Musk's Net Worth: Below $300 Billion After Tesla And Tariff Headwinds

Table of Contents

Tesla Stock Performance and its Impact on Elon Musk's Net Worth

Elon Musk's net worth is heavily tied to Tesla's stock performance. Any significant fluctuation in Tesla's share price directly impacts his overall wealth. Let's examine the key factors contributing to this volatility:

Volatility in the Electric Vehicle Market

The electric vehicle (EV) market, while experiencing explosive growth, is far from stable. Intense competition and evolving market dynamics significantly influence Tesla's stock price.

- Increased competition from established automakers: Traditional auto manufacturers are aggressively entering the EV market, increasing competition for Tesla. This heightened competition impacts Tesla's market share and profitability.

- Concerns about future EV demand: Global economic uncertainty and shifting consumer preferences create concerns about the future demand for electric vehicles, impacting investor confidence in Tesla.

- Impact of global economic uncertainty: Recessions and economic downturns worldwide generally reduce consumer spending, including on luxury goods like electric vehicles, thereby impacting Tesla's sales figures.

Recent Tesla Financial Reports and Investor Sentiment

Tesla's financial reports are closely scrutinized by investors, shaping investor sentiment and stock prices. Recent reports have shown a mixed bag of results.

- Production challenges: Meeting production targets has proven challenging for Tesla at times, impacting the company's ability to meet growing demand and investor expectations.

- Delivery numbers: While Tesla consistently delivers a significant number of vehicles, variations from projected targets can negatively influence investor confidence and stock prices.

- Profit margins: Maintaining healthy profit margins in a competitive market is crucial for Tesla's long-term success and its valuation in the stock market. Any squeeze on profit margins can trigger negative market reactions.

- Analyst ratings: Analyst ratings and predictions for Tesla's future performance significantly impact investor decisions and subsequent stock price movements.

Elon Musk's Twitter Activity and its Effect on Tesla's Stock

Elon Musk's prolific and often controversial Twitter activity has frequently impacted Tesla's stock price. His public pronouncements can significantly influence investor perception and market sentiment.

- Examples of controversial tweets: Musk's tweets, ranging from announcements about potential company strategies to personal opinions, have frequently caused market volatility.

- Investor reactions: Investors react swiftly to Musk's tweets, causing sudden price swings, both positive and negative, depending on the content and interpretation of his messages.

- Regulatory scrutiny: Musk's Twitter activity has drawn regulatory scrutiny on numerous occasions, leading to uncertainty and potential legal ramifications that indirectly affect Tesla's stock price.

The Role of Tariffs and International Trade on Tesla's Profitability

International trade policies and tariffs play a significant role in Tesla's global operations and profitability, impacting Elon Musk's net worth.

Impact of Tariffs on Tesla's Exports and Import Costs

Tariffs imposed by various countries on imported goods, including electric vehicles and components, increase Tesla's costs and affect its competitive positioning in global markets.

- Specific examples of tariffs impacting Tesla: Various countries have implemented tariffs on imported vehicles, increasing the cost of Tesla cars in those markets and reducing profitability.

- Increased costs passed on to consumers: Tesla often absorbs some of the increased costs due to tariffs, but sometimes passes them on to consumers, leading to higher prices and reduced competitiveness.

- Impact on global market share: Tariffs can limit Tesla's ability to penetrate new markets and compete effectively with local or other internationally established manufacturers.

Geopolitical Factors and their Influence on Tesla's International Growth

Geopolitical instability and international trade relations significantly impact Tesla's expansion plans and overall success.

- Trade wars: Trade disputes between countries can disrupt Tesla's supply chains and create uncertainty in its international operations.

- Political instability in key markets: Political instability in key markets can create risks for Tesla's investments and operations in those regions.

- Impact on supply chains: Disruptions to global supply chains due to geopolitical events can negatively affect Tesla's production and delivery timelines.

Other Factors Contributing to the Decline in Elon Musk's Net Worth

Beyond Tesla's performance, other factors have contributed to the decline in Elon Musk's net worth.

Diversification of Investments

Elon Musk's investments extend beyond Tesla and SpaceX. The performance of these other investments plays a role in his overall wealth.

- Investments in other companies: Musk has investments in various other companies, and their performance affects his net worth.

- Cryptocurrency holdings: Musk's public pronouncements and investments in cryptocurrencies have impacted their values and consequently his net worth.

- Their performance: The combined performance of these diverse investments contributes to the overall fluctuation of his wealth.

Philanthropy and Charitable Giving

Elon Musk's philanthropic activities, while commendable, also impact his net worth.

- Significant donations: Musk has made significant donations to various charitable causes.

- Charitable foundations: His involvement in charitable foundations has implications for his personal wealth.

- Their financial implications: These charitable contributions directly reduce his net worth, though they benefit society as a whole.

Conclusion

This article explored the multifaceted factors contributing to the recent decline in Elon Musk's net worth. The primary drivers are the challenges faced by Tesla, including stock market volatility influenced by intense competition in the EV market, production challenges, and Elon Musk's own public statements. Furthermore, international tariffs and geopolitical factors impacting Tesla's global operations have contributed to this decline. Finally, Musk's diverse investments and philanthropic activities also play a role in his overall financial picture.

Call to Action: Stay informed about the latest developments affecting Elon Musk's net worth and the future of Tesla by regularly checking our website for updates on Elon Musk's net worth, Tesla's financial performance, and the evolving dynamics of the electric vehicle industry. Understanding the factors impacting Elon Musk's net worth requires continuous monitoring of the interplay between Tesla's performance, global economic trends, and the broader geopolitical landscape.

Featured Posts

-

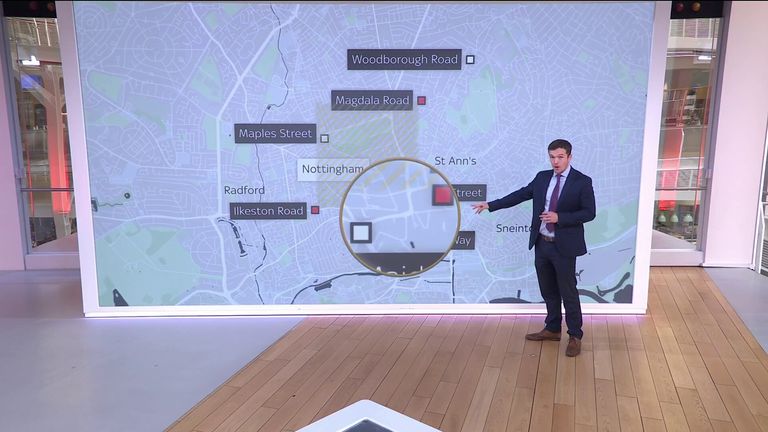

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025 -

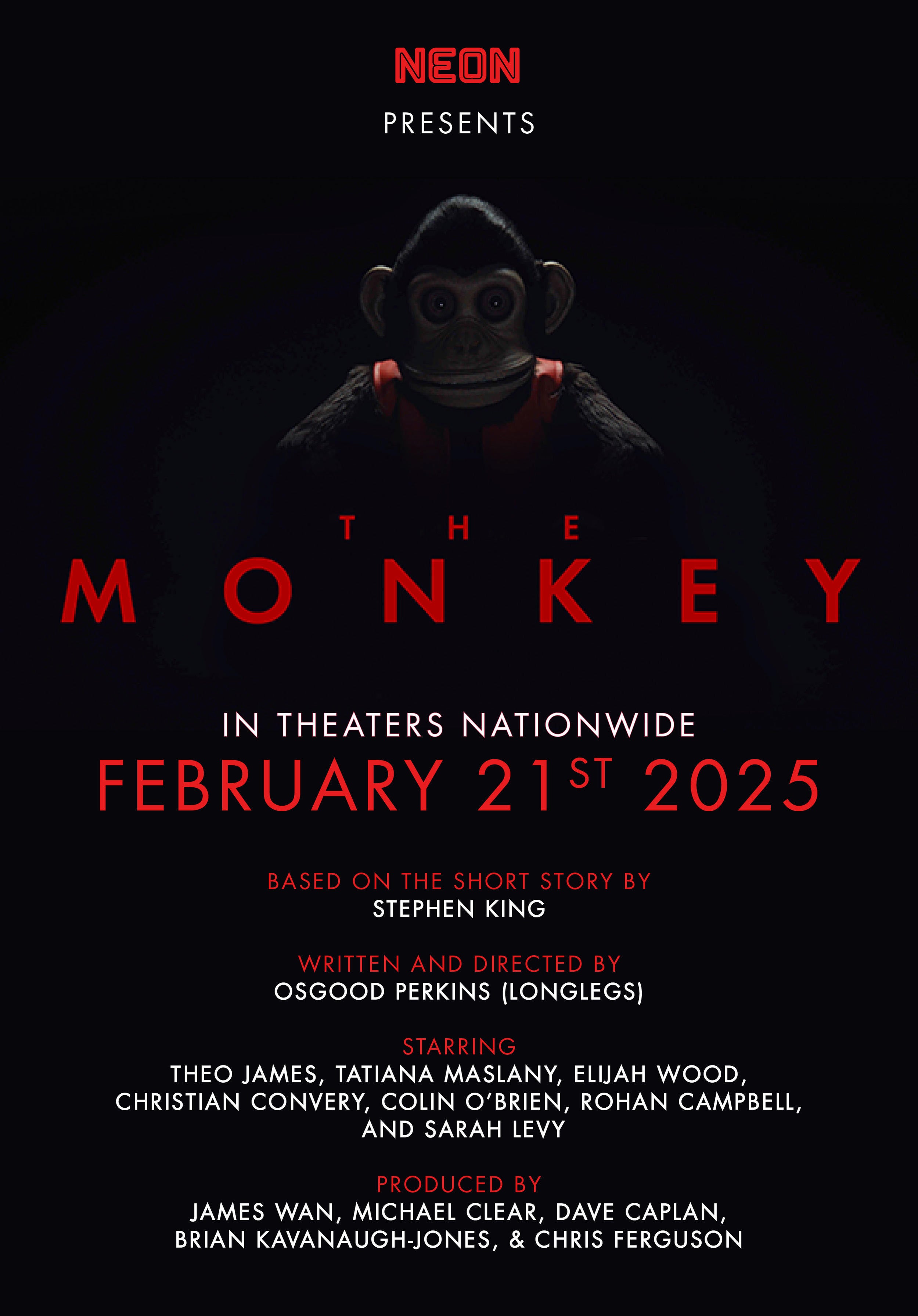

2025 A Good Year For Stephen King Regardless Of The Monkey Films Reception

May 10, 2025

2025 A Good Year For Stephen King Regardless Of The Monkey Films Reception

May 10, 2025 -

Trois Hommes Victimes D Une Agression Violente Au Lac Kir A Dijon

May 10, 2025

Trois Hommes Victimes D Une Agression Violente Au Lac Kir A Dijon

May 10, 2025 -

Putins Victory Day Ceasefire A Strategic Calculation

May 10, 2025

Putins Victory Day Ceasefire A Strategic Calculation

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025