Elevated Stock Market Valuations: Why Investors Shouldn't Be Alarmed (BofA)

Table of Contents

Recent market performance has led to concerns about elevated stock market valuations. Many investors are questioning whether the current levels are sustainable, leading to understandable anxiety. However, Bank of America (BofA), a financial giant with significant market insights, offers a nuanced perspective, suggesting that a cautious, rather than panicked, approach is warranted. This article will delve into BofA's rationale, examining key factors contributing to high valuations and outlining reasons why investors shouldn't be unduly alarmed.

Understanding Current Market Valuations

Current market indices reflect a picture of growth alongside elevated valuations. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all show significant gains, but their valuation metrics tell a more complex story. Key valuation metrics like the Price-to-Earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE) are currently above historical averages for some indices.

Several factors are driving these valuations:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies, fueling investment and boosting corporate earnings, thus supporting higher stock prices. Lower interest rates also make bonds less attractive, pushing investors towards higher-yielding equities.

-

Strong Corporate Earnings: Many sectors have reported robust earnings, particularly in technology, healthcare, and consumer staples. While some sectors experience fluctuations, overall corporate profitability has remained strong, supporting higher valuations. BofA's reports often highlight these sector-specific performances. (Specific examples of BofA reports and their findings should be included here, referencing specific sectors and data if possible).

-

Technological Advancements and Innovation: Continued innovation and technological breakthroughs are driving growth in numerous sectors, fueling investor optimism and higher stock prices. The rapid adoption of new technologies and their transformative potential are key drivers of valuation increases.

-

Government Stimulus and Policy: Government stimulus packages and supportive monetary policies have played a role in supporting market growth and influencing valuations. (Specific policies and their impact should be detailed here, referencing reliable sources).

Let's put current valuations in perspective:

- Example: "The current P/E ratio of the S&P 500 is X, compared to the historical average of Y. While higher than the average, it's not unprecedented within specific economic contexts, such as periods of low interest rates and strong economic growth." (Replace X and Y with actual data). Further context needs to be provided about the periods in which these high valuations were seen in the past to put it into proper context.

BofA's Perspective on Elevated Valuations

BofA's official stance on current market valuations generally acknowledges the elevated levels but cautions against immediate alarm. (Cite specific BofA reports or articles supporting this stance here). Their reasoning centers on several key arguments:

-

Long-Term Growth Projections: BofA's analysts often project continued long-term economic growth, suggesting that current valuations may be justified by future earnings potential. (Include specific projections and timeframes from BofA reports).

-

Strength in Specific Sectors: BofA's analysis often highlights specific sectors poised for continued growth, which are expected to offset potential weakness in other areas. (Mention these sectors and explain their growth drivers, again referencing BofA’s analysis).

-

Inflation and Interest Rate Hikes: While acknowledging the impact of inflation and potential interest rate hikes, BofA's perspective often incorporates an assessment of the likely magnitude and effects of these factors on valuations. (Details about BofA's projections regarding inflation and interest rate hikes should be added).

Key takeaways from BofA's analysis:

- BofA emphasizes the importance of considering long-term growth prospects rather than focusing solely on short-term market fluctuations.

- They highlight the resilience of certain sectors and their continued potential for growth.

- They recommend a measured approach to investment strategies rather than panic selling.

Addressing Investor Concerns about Market Corrections

Market corrections and periods of volatility are a normal part of the market cycle. While BofA doesn't predict the future, they acknowledge this possibility. To mitigate risk, they likely recommend strategies like:

- Diversification: Spreading investments across different asset classes and sectors reduces the impact of any single market downturn.

- Long-Term Investment Horizons: Focusing on long-term goals helps to weather short-term market fluctuations.

- Risk Management Techniques: Employing stop-loss orders or other risk management strategies can help limit potential losses during market corrections.

Opportunities within an Elevated Valuation Market

Despite high overall valuations, BofA's analysis likely identifies sectors or asset classes that are undervalued or poised for growth. (Specific sectors or asset classes should be detailed here, referencing BofA's recommendations). Investors can capitalize on these opportunities by:

- Focusing on fundamental analysis: Identifying companies with strong fundamentals, regardless of current market sentiment.

- Employing value investing strategies: Looking for companies trading below their intrinsic value.

- Considering alternative asset classes: Exploring investments beyond traditional equities, such as real estate or bonds, to diversify portfolios.

Conclusion

While elevated stock market valuations are a legitimate concern, BofA's analysis suggests that a panicked reaction is unwarranted. Factors such as low interest rates, robust corporate earnings in specific sectors, and continued technological innovation contribute to the current market landscape. By understanding these factors and employing a balanced investment strategy, investors can navigate the market effectively.

Call to Action: Don't let concerns about elevated stock market valuations sideline your investment goals. Learn more about BofA's perspective and develop a sound investment strategy tailored to your risk tolerance. Consult with a financial advisor to discuss your options and how to best navigate this period of elevated stock market valuations. Remember, a long-term perspective and a well-diversified portfolio can help mitigate risks associated with these elevated valuations.

Featured Posts

-

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro Blossoms

May 25, 2025

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro Blossoms

May 25, 2025 -

Kharkovschina Svadebniy Den S Pochti 40 Parami Molodozhenov Foto

May 25, 2025

Kharkovschina Svadebniy Den S Pochti 40 Parami Molodozhenov Foto

May 25, 2025 -

M56 Road Closure Live Updates Following Serious Accident

May 25, 2025

M56 Road Closure Live Updates Following Serious Accident

May 25, 2025 -

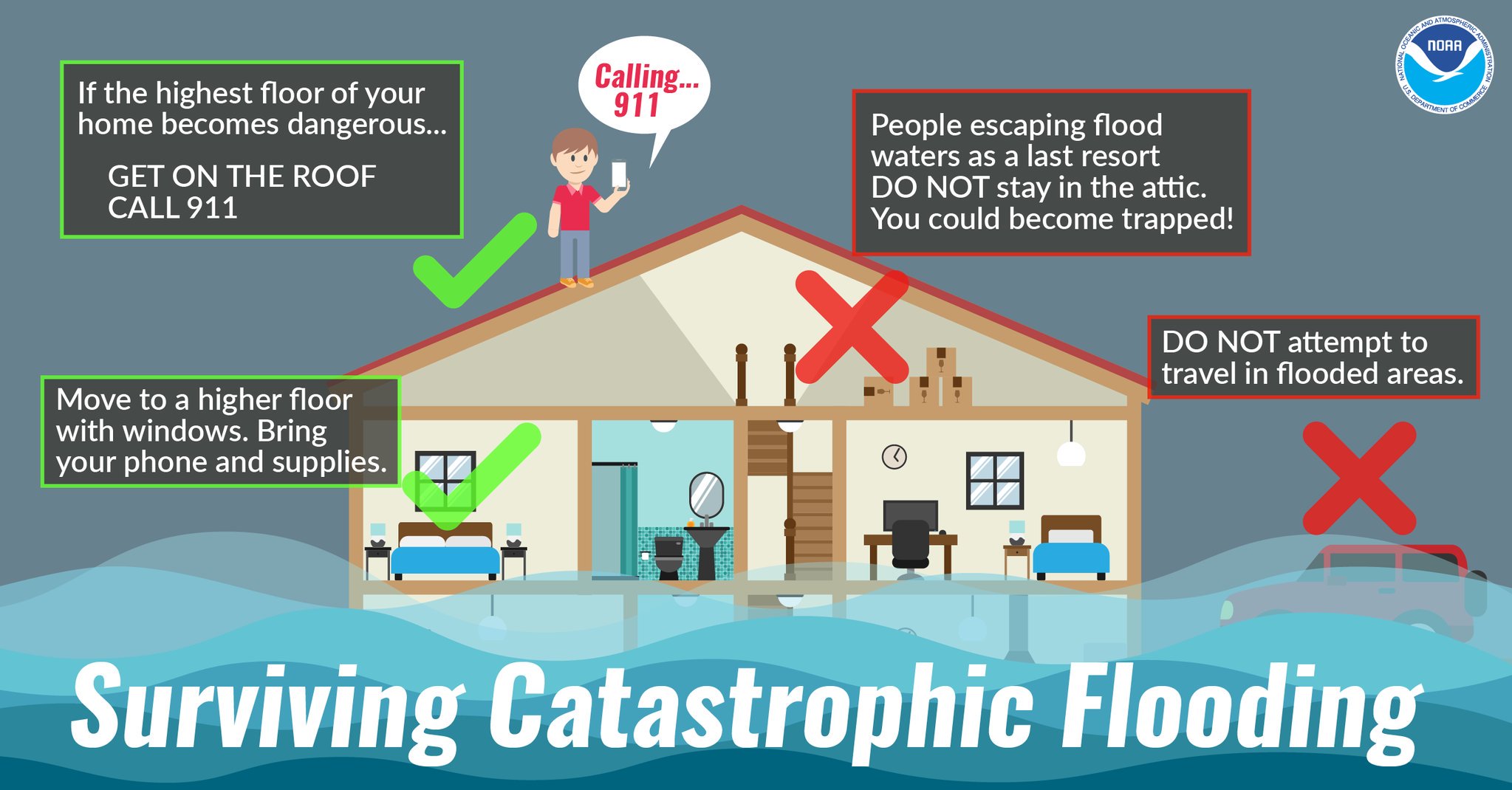

Action Needed Flood Advisories And Severe Weather Updates For Miami Valley

May 25, 2025

Action Needed Flood Advisories And Severe Weather Updates For Miami Valley

May 25, 2025 -

Annie Kilners Solo Outing After Kyle Walkers Evening With Two Brunettes

May 25, 2025

Annie Kilners Solo Outing After Kyle Walkers Evening With Two Brunettes

May 25, 2025

Latest Posts

-

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025 -

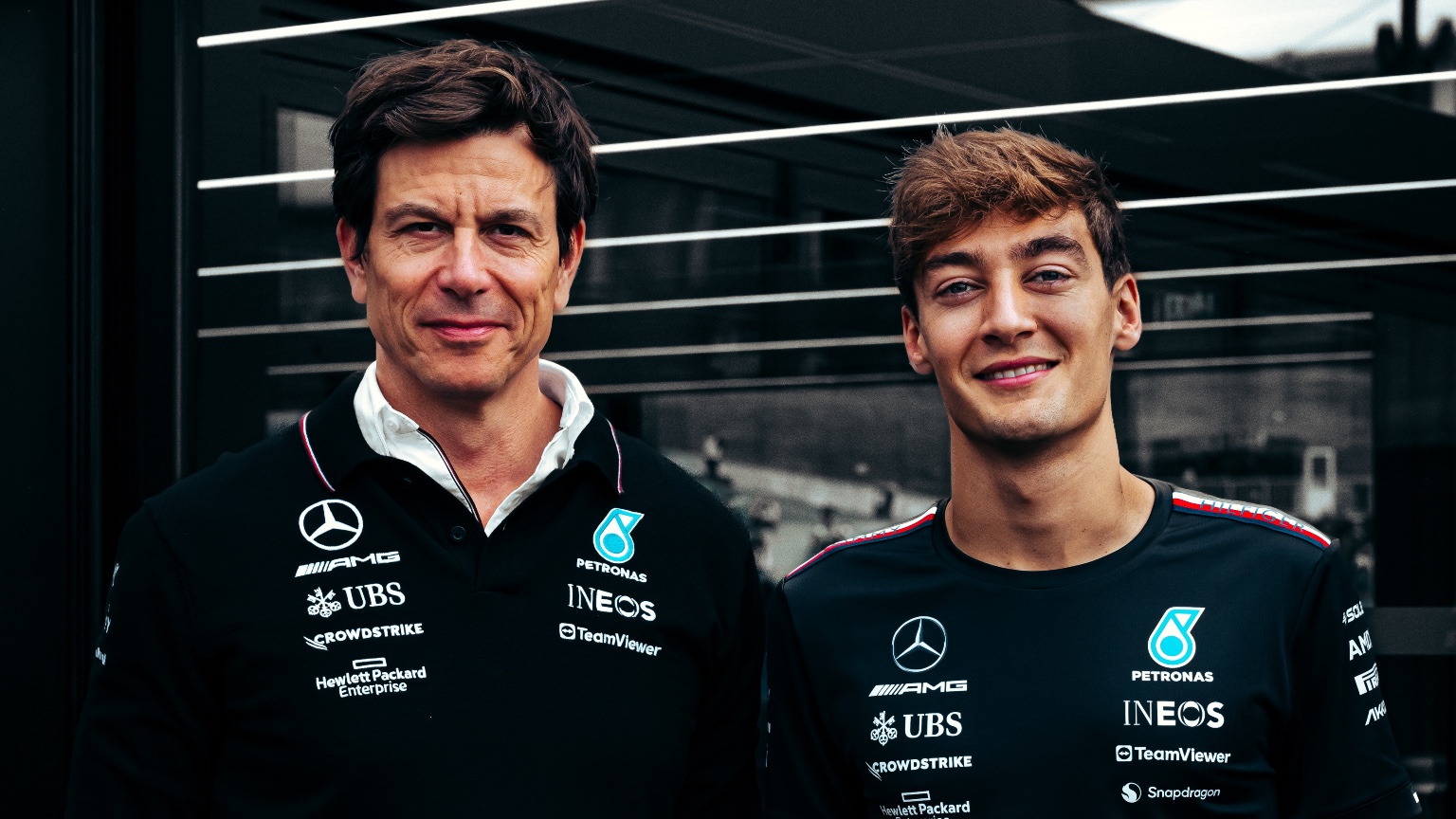

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025 -

The George Russell Contract Why Mercedes Must Act

May 25, 2025

The George Russell Contract Why Mercedes Must Act

May 25, 2025 -

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025