Effortless Dividend Investing: A Simple Path To Maximum Returns

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are a portion of a company's profits distributed to its shareholders. When a company performs well, it can choose to share its success by paying out dividends to those who own its stock. This regular income stream is a key attraction of dividend investing. The amount of the dividend, and how frequently it's paid, varies widely depending on the company and its financial performance.

Types of Dividend Stocks

The world of dividend stocks is diverse. Understanding the different types can help you build a well-rounded portfolio. Here are some key categories:

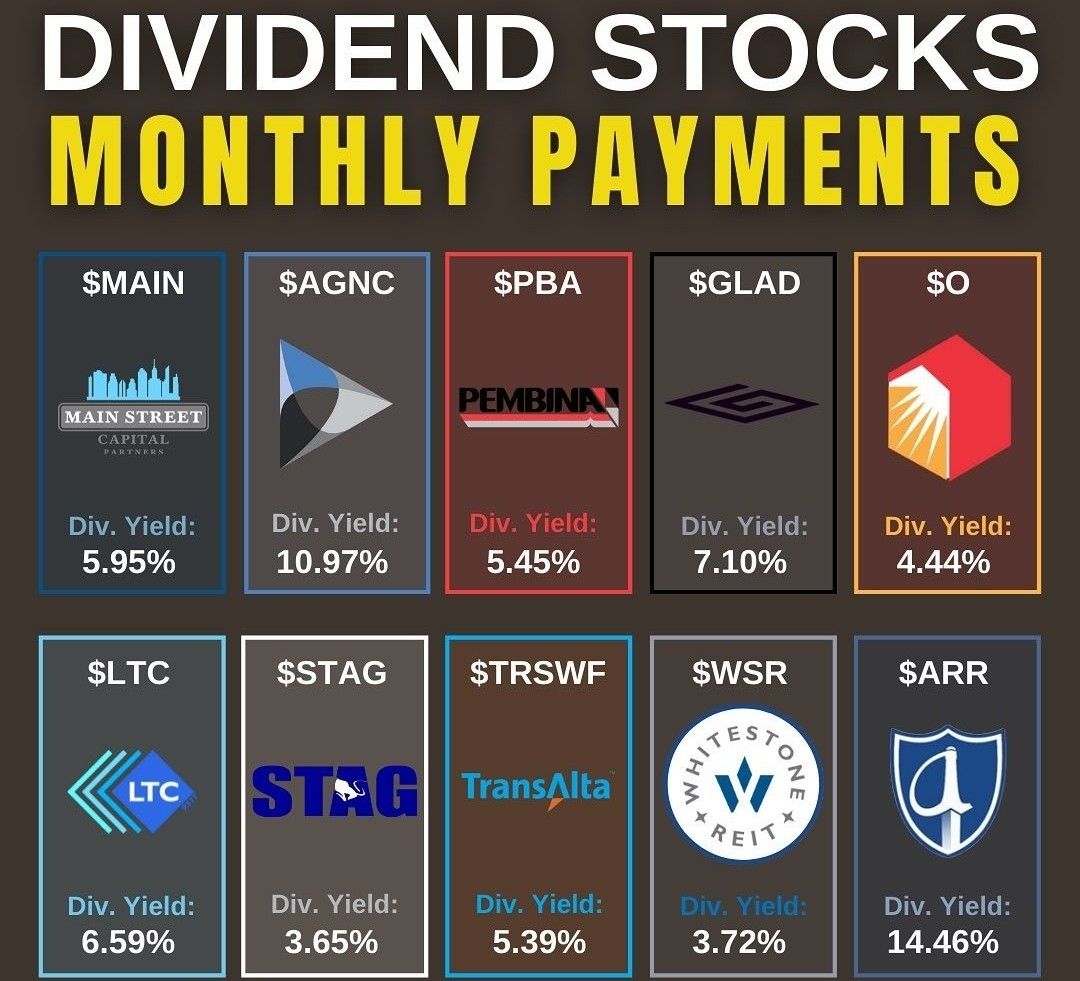

- High-yield dividend stocks: These offer higher dividend payouts compared to their share price. While potentially lucrative, they can also carry more risk. Examples might include certain real estate investment trusts (REITs) or energy companies.

- Dividend growth stocks: These stocks focus on increasing their dividend payments over time. Companies like Coca-Cola (KO) and Johnson & Johnson (JNJ) have demonstrated consistent dividend growth over many years, offering both income and capital appreciation potential.

- Blue-chip dividend stocks: These are typically from large, well-established companies with a long history of paying reliable dividends. These stocks are often considered less risky, but their dividend yields might be lower than high-yield options. Examples could include Procter & Gamble (PG) or Walmart (WMT).

The Power of Dividend Reinvestment

One of the most effective strategies for accelerating wealth building through dividend investing is dividend reinvestment. A Dividend Reinvestment Plan (DRIP) automatically uses your dividend payments to purchase additional shares of the same stock. This creates a powerful compounding effect, leading to significant long-term growth.

- Automatic reinvestment of dividends: Simplifies the process and eliminates manual buying of shares.

- Reduced transaction fees: Avoids the costs associated with buying individual shares.

- Accelerated compounding growth: The power of compounding is magnified by reinvesting dividends, leading to exponential growth over time.

Strategies for Effortless Dividend Investing

Diversification for Reduced Risk

Diversification is crucial for mitigating risk in any investment strategy, including effortless dividend investing. Don't put all your eggs in one basket. Spread your investments across various sectors and companies to reduce the impact of any single company's underperformance.

Utilizing Dividend ETFs and Mutual Funds

For effortless diversification, consider investing in dividend-focused exchange-traded funds (ETFs) and mutual funds. These funds hold a diversified portfolio of dividend stocks, making it simple to gain broad exposure to the market. Examples include the Schwab US Dividend Equity ETF (SCHD) or the Vanguard Dividend Appreciation ETF (VIG).

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy reduces the risk associated with lump-sum investing and mitigates the impact of market volatility. By consistently investing, you buy more shares when prices are low and fewer when prices are high.

Selecting High-Yield Dividend Stocks (with due diligence)

Key Metrics to Consider

When selecting dividend stocks, don't solely focus on the dividend yield. Analyze several key metrics:

- Dividend yield: The annual dividend payment relative to the share price (Dividend per share / Share price).

- Payout ratio: The proportion of earnings paid out as dividends (Dividends / Earnings). A sustainable payout ratio is generally below 70%.

- Dividend growth rate: The rate at which the dividend payment has increased over time. A consistent track record of dividend increases is a positive sign.

Analyzing Company Financials

Before investing in any company, research its financial health. Examine its financial statements, including the income statement, balance sheet, and cash flow statement. Look for consistent profitability, strong cash flow, and manageable debt levels.

Identifying Reliable Dividend Payers

Look for companies with a long history of consistent dividend payments and increases. Examine their dividend history, and consider factors such as their industry, competitive landscape, and management's commitment to returning value to shareholders.

Managing Your Dividend Portfolio for Maximum Returns

Regular Portfolio Reviews

Regularly review your portfolio's performance and make adjustments as needed. Rebalance your portfolio to maintain your desired asset allocation and ensure you’re still on track with your investment goals. Consider adjusting your holdings based on changes in market conditions, company performance, and your individual financial circumstances.

Tax Implications of Dividend Income

Dividends are generally taxed as ordinary income. Be aware of the tax implications of your dividend income and consider strategies to minimize your tax burden, such as utilizing tax-advantaged accounts like Roth IRAs or 401(k)s.

Long-Term Perspective

Effortless dividend investing is a long-term strategy. Don't panic-sell during market downturns. Maintain a long-term perspective and focus on the consistent stream of passive income and the power of compounding returns.

Conclusion

Effortless dividend investing offers a simple path to building long-term wealth and generating passive income. By diversifying your portfolio, utilizing ETFs and mutual funds, employing dollar-cost averaging, and selecting reliable dividend payers with due diligence, you can create a sustainable stream of income that grows over time. Remember to regularly review your portfolio and consider the tax implications of your dividend income. Begin your effortless dividend investing strategy now! Discover the simplicity and power of effortless dividend investing and take the first step toward building passive income with effortless dividend investing today! [Link to a brokerage account or investment resource]

Featured Posts

-

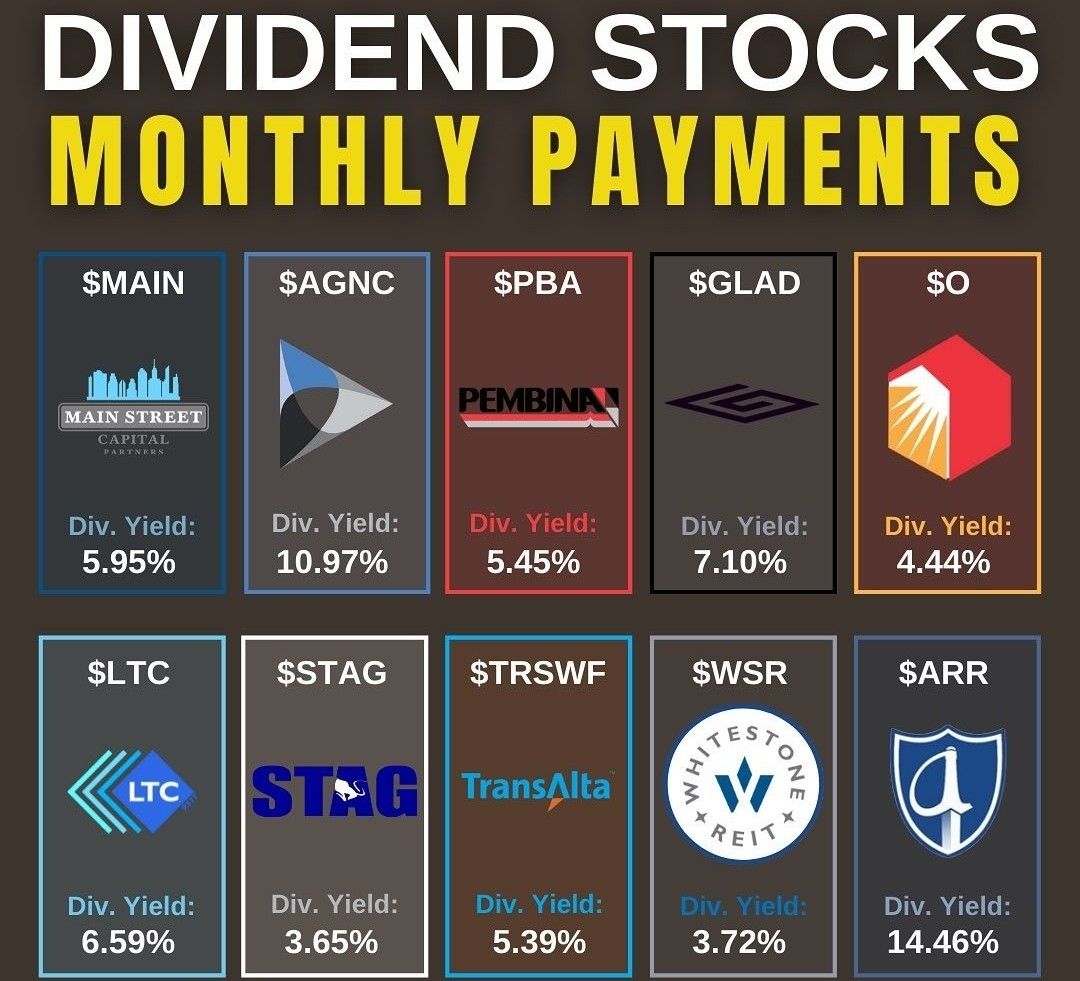

Las Vegas John Wick Experience Channel Your Inner Baba Yaga

May 11, 2025

Las Vegas John Wick Experience Channel Your Inner Baba Yaga

May 11, 2025 -

Woman Accuses Prince Andrew Of Sexual Assault Says She Has 4 Days To Live After Bus Crash

May 11, 2025

Woman Accuses Prince Andrew Of Sexual Assault Says She Has 4 Days To Live After Bus Crash

May 11, 2025 -

Nba Legend Magic Johnson Predicts Knicks Vs Pistons Winner

May 11, 2025

Nba Legend Magic Johnson Predicts Knicks Vs Pistons Winner

May 11, 2025 -

Fin D Une Epoque Thomas Mueller Quitte Le Bayern Munich

May 11, 2025

Fin D Une Epoque Thomas Mueller Quitte Le Bayern Munich

May 11, 2025 -

The Wall Street Rally A Comprehensive Look At The Bear Markets Demise

May 11, 2025

The Wall Street Rally A Comprehensive Look At The Bear Markets Demise

May 11, 2025