Economic Impact Of Trump's Tariffs On Small Businesses: A Case Study

Table of Contents

Increased Input Costs and Reduced Profit Margins

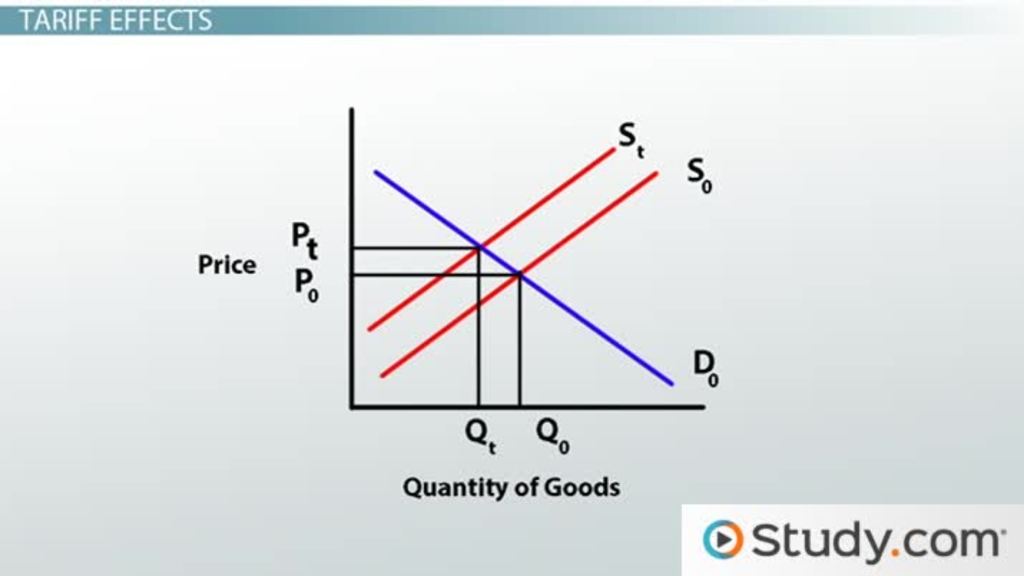

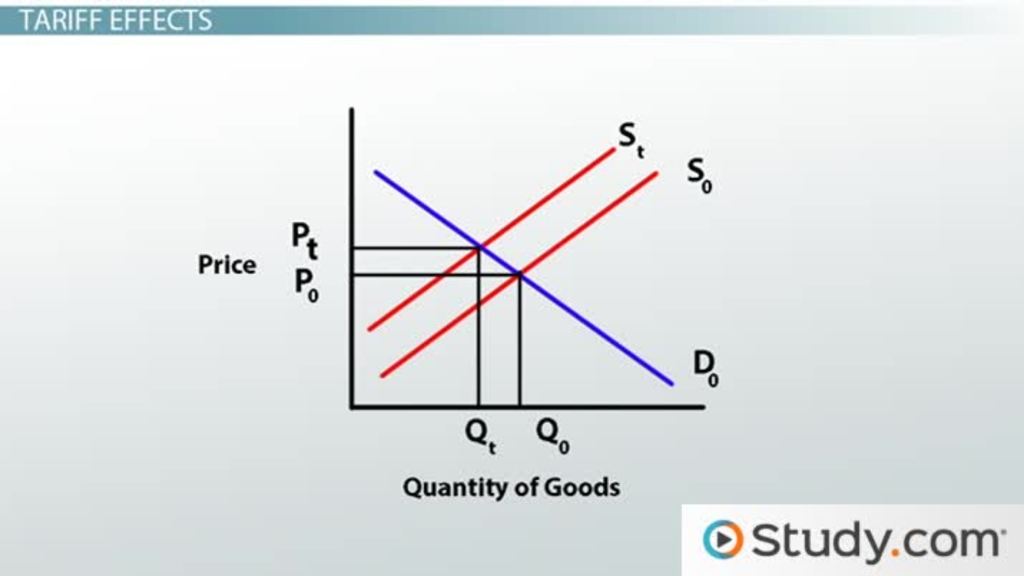

Trump's tariffs, designed to protect domestic industries, significantly increased the cost of imported goods. This directly impacted small businesses reliant on global supply chains for raw materials, components, and finished products. The resulting surge in input costs squeezed profit margins, threatening the viability of many small enterprises. The impact of these "small business tariffs" was widespread and devastating for many.

- Increased cost of steel and aluminum: Manufacturers relying on these materials for production faced dramatic price increases, making their products less competitive and reducing profitability.

- Higher prices for imported components: Technology companies, particularly those assembling electronics or using specialized parts from overseas, experienced significant cost hikes. These increased costs were often difficult to pass on to consumers.

- Rising costs of consumer goods: Retail businesses found themselves dealing with higher prices for imported goods, forcing them to either absorb the increased costs and reduce their profit margins or pass them on to consumers, potentially impacting sales volume.

The impact on profit margins was stark. Many small businesses, lacking the economies of scale of larger corporations, found it difficult to absorb these increased costs without significantly impacting their bottom line. Data from the Small Business Administration (Note: Insert actual data or citation if available) indicated a sharp decline in profitability for certain sectors during this period.

Decreased Consumer Demand and Sales

The higher prices resulting from Trump's tariffs weren't confined to businesses; they directly affected consumers. Increased costs for goods and services led to reduced consumer demand, creating a ripple effect that negatively impacted small businesses. This "trade war impact" extended beyond direct importers, affecting the broader economy.

- Reduced sales volumes: Businesses heavily reliant on consumer spending, such as restaurants, retailers, and service providers, experienced a decline in sales as consumers tightened their budgets.

- Increased competition from domestic producers: While some domestic producers benefited from tariff protectionism, this often came at the expense of small businesses competing against suddenly more affordable domestically-produced alternatives.

- Shift in consumer behavior: Consumers adapted by seeking cheaper alternatives, reducing overall consumption, or delaying purchases, further impacting sales for many small businesses.

For instance, (Note: Insert data or example illustrating decreased sales in a specific sector, such as clothing retail or furniture manufacturing). This decline in sales underscored the interconnected nature of the economy and the far-reaching consequences of Trump's trade policy.

Supply Chain Disruptions and Operational Challenges

Trump's tariffs significantly disrupted global supply chains, adding complexity and uncertainty for small businesses. The reliance on international trade for many small businesses made them particularly vulnerable to these disruptions.

- Difficulty sourcing raw materials and components: Businesses found it challenging to source materials from affected countries, leading to delays and potential shortages.

- Increased lead times and transportation costs: Navigating tariffs and trade restrictions increased lead times and transportation costs, further impacting profitability and operational efficiency.

- Uncertainty in forecasting demand and planning production: The fluctuating nature of tariffs made it difficult for small businesses to accurately forecast demand and plan production schedules, creating additional operational challenges.

These disruptions added significant administrative burdens and costs, forcing small businesses to divert resources from core operations to manage the complexities of the new trade environment.

Case Study: The Impact on "XYZ Crafts"

XYZ Crafts, a small family-owned business specializing in handcrafted wooden toys, relied heavily on imported hardwoods from Southeast Asia. Trump's tariffs significantly increased the cost of these materials, forcing XYZ Crafts to absorb a 25% increase in input costs. Owner Sarah Miller stated, "The tariffs made it almost impossible to maintain our profit margins. We had to raise prices, but that led to a drop in sales. We barely survived." XYZ Crafts responded by exploring alternative, more expensive domestic wood sources, a move that further reduced profitability. This illustrates the struggle many small businesses faced in adapting to the sudden and drastic changes implemented by Trump's trade policy.

Conclusion: Key Takeaways and Call to Action

This analysis demonstrates the significant negative economic impact of Trump's tariffs on small businesses. Increased input costs, reduced consumer demand, and supply chain disruptions created a perfect storm that threatened the viability of countless small enterprises. Understanding the long-term consequences of such trade policies is crucial for policymakers and business owners alike.

Understanding the economic impact of Trump's tariffs on small businesses is crucial for shaping future trade policies that protect and promote the growth of these vital economic engines. Further research into the long-term consequences of these policies, and the development of support mechanisms for small businesses facing similar challenges, is essential.

Featured Posts

-

Thlyl Elaqt Twm Krwz Wana Dy Armas Hqyqt Am Ishaet

May 12, 2025

Thlyl Elaqt Twm Krwz Wana Dy Armas Hqyqt Am Ishaet

May 12, 2025 -

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma Agonon

May 12, 2025

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma Agonon

May 12, 2025 -

India Pakistan Conflict Five Indian Soldiers Killed Despite Truce

May 12, 2025

India Pakistan Conflict Five Indian Soldiers Killed Despite Truce

May 12, 2025 -

Analyzing The Effectiveness Of Heightened Border Control Measures Fewer Arrests Increased Detentions

May 12, 2025

Analyzing The Effectiveness Of Heightened Border Control Measures Fewer Arrests Increased Detentions

May 12, 2025 -

Celtics Secure Division Title With Impressive Blowout Win

May 12, 2025

Celtics Secure Division Title With Impressive Blowout Win

May 12, 2025

Latest Posts

-

Top 10 Efl Games That Defined The League

May 13, 2025

Top 10 Efl Games That Defined The League

May 13, 2025 -

Reliving The Efls Most Memorable Games

May 13, 2025

Reliving The Efls Most Memorable Games

May 13, 2025 -

Sezona Na Uspekh Lids I Barnli Vo Premier Ligata

May 13, 2025

Sezona Na Uspekh Lids I Barnli Vo Premier Ligata

May 13, 2025 -

Lids Una Ted I Barnli Nov Zhivot Vo Premier Ligata

May 13, 2025

Lids Una Ted I Barnli Nov Zhivot Vo Premier Ligata

May 13, 2025 -

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025