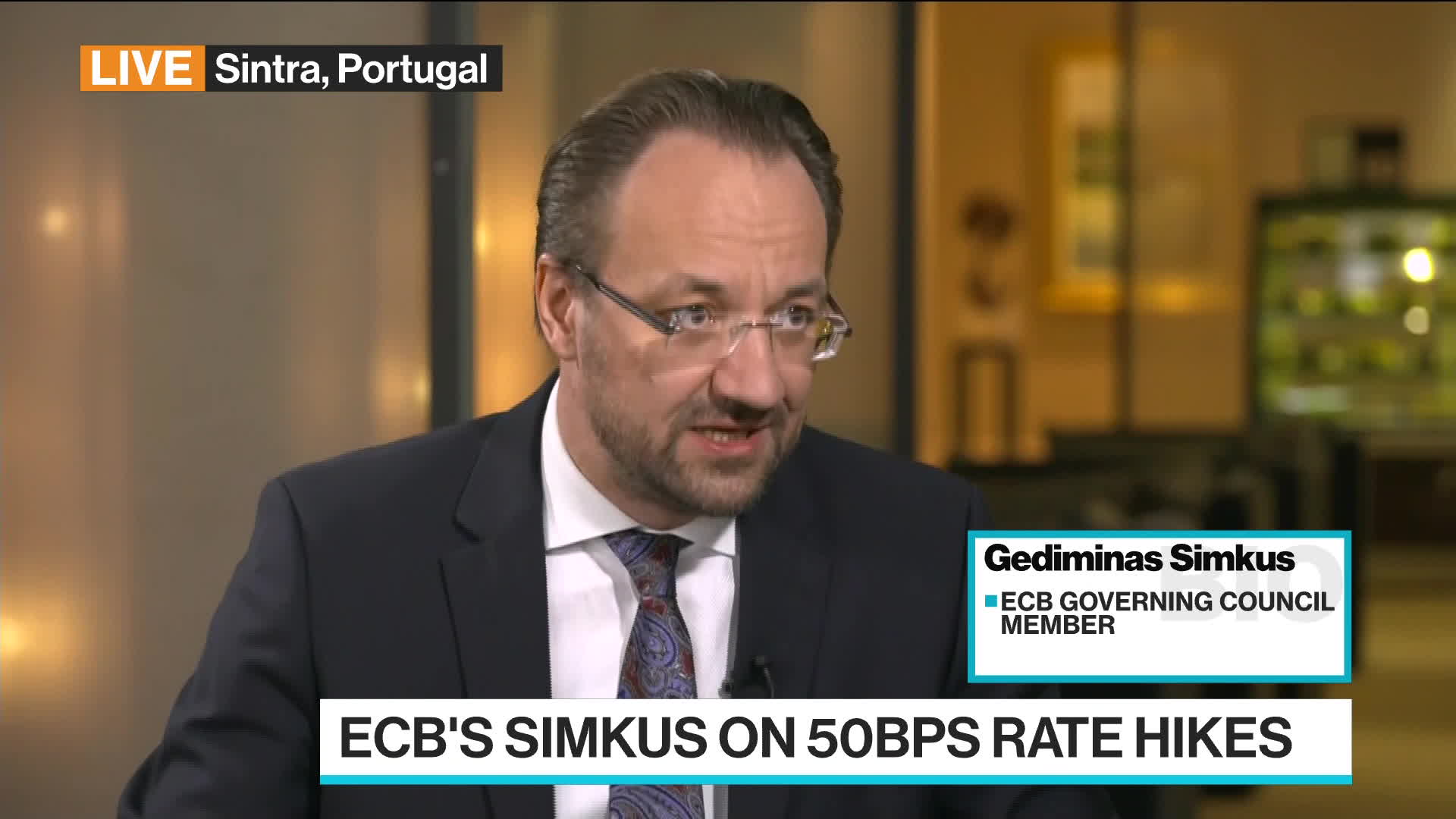

ECB's Simkus Hints At Two More Interest Rate Cuts Amidst Trade War Impact

Table of Contents

Simkus's Statement and its Implications

Šimkus's suggestion, though not a formal announcement of policy, carries considerable weight. While the exact wording may vary depending on the source, the core message points towards a softening of monetary policy. His reasoning likely stems from a confluence of concerning economic indicators within the Eurozone. Inflation remains stubbornly below the ECB's target of "below, but close to, 2 percent," GDP growth is sluggish, and unemployment, while low in some areas, is not universally robust.

The potential impact of two more interest rate cuts is far-reaching:

- Impact on lending rates: Lower ECB interest rates translate to lower borrowing costs for banks, potentially leading to cheaper loans for businesses and consumers.

- Effect on investment and consumer spending: Reduced borrowing costs can stimulate investment and boost consumer spending, potentially invigorating economic activity. This effect, however, can be muted if consumers lack confidence.

- Potential risks associated with further rate cuts: The risk lies in the potential for further diminishing returns and even unintended consequences. Very low interest rates could potentially fuel asset bubbles or encourage excessive risk-taking.

The Impact of the Trade War on the Eurozone Economy

The ongoing trade disputes, particularly the US-China trade war, are significantly impacting the Eurozone. Reduced exports to key markets, supply chain disruptions, and increased uncertainty are dampening economic growth. Industries heavily reliant on international trade, such as automotive manufacturing and agricultural exports, are particularly vulnerable. The uncertainty surrounding future trade policies discourages long-term investment and weakens business confidence.

- Specific examples of trade war impacts on Eurozone businesses: German car manufacturers, for instance, have been significantly affected by reduced demand from China and the US. Agricultural producers are facing tariff barriers and reduced export opportunities.

- Analysis of reduced consumer confidence: The ongoing trade tensions and economic uncertainty have negatively impacted consumer confidence, leading to decreased spending and further slowing economic growth.

- Potential for a recessionary environment: The continued negative impact of the trade war, coupled with weak economic indicators, raises concerns about the potential for the Eurozone to enter a recessionary environment.

Alternative Monetary Policy Options Considered by the ECB

While interest rate cuts are a primary tool, the ECB has other options at its disposal. Quantitative easing (QE), involving the purchase of government and corporate bonds to inject liquidity into the market, is one possibility. Targeted long-term refinancing operations (TLTROs) provide cheap, long-term loans to banks, encouraging lending to businesses and consumers.

- Explanation of QE and TLTROs: QE aims to lower long-term interest rates and stimulate lending, while TLTROs directly target bank lending.

- Advantages and disadvantages of each tool: While both can stimulate the economy, QE carries risks of asset bubbles, and TLTROs' effectiveness depends on bank willingness to lend.

- Potential effectiveness in the current economic climate: The effectiveness of these tools in the current climate of trade uncertainty and weak confidence remains debatable, and their deployment depends on a careful assessment of the risks and benefits.

Market Reactions and Analyst Opinions on the Predicted ECB Interest Rate Cuts

Simkus's comments have already elicited a response in financial markets. The Euro's exchange rate has shown some volatility, and government bond yields have generally fallen, reflecting expectations of lower interest rates. However, analyst opinions are varied. Some believe further rate cuts are necessary to avert a recession, while others express concern about the potential risks of excessively low rates.

- Changes in the Euro exchange rate: A weaker Euro can boost exports but also increase the cost of imported goods.

- Movement in government bond yields: Lower yields indicate increased demand for government bonds, reflecting investors’ search for safety in a uncertain environment.

- Expert opinions supporting and opposing the cuts: The debate is ongoing, reflecting the complexity of the economic situation and the potential trade-offs involved in further ECB interest rate cuts.

Conclusion: The Future of ECB Interest Rates and the Eurozone Economy

Šimkus's statement highlights the considerable challenges facing the Eurozone economy. The ongoing trade war and weak economic indicators suggest a heightened likelihood of further ECB interest rate cuts. These cuts, while potentially stimulating economic activity in the short term, also carry risks. The ECB must carefully weigh these risks against the potential benefits and explore alternative monetary policy tools to navigate this complex economic environment. Stay informed about the crucial developments regarding ECB interest rate cuts and their impact on the Eurozone economy by subscribing to our newsletter and following us on social media. The future direction of ECB monetary policy will significantly impact businesses and consumers throughout the Eurozone, making staying informed about potential ECB interest rate cuts essential.

Featured Posts

-

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025 -

The Perfect Couple Season 2 Source Material And Casting Announcements

Apr 27, 2025

The Perfect Couple Season 2 Source Material And Casting Announcements

Apr 27, 2025 -

Electric Vehicle Sales Slowdown Canadian Consumer Interest Wanes

Apr 27, 2025

Electric Vehicle Sales Slowdown Canadian Consumer Interest Wanes

Apr 27, 2025 -

Romantic Alaskan Escape Ariana Biermanns Adventure

Apr 27, 2025

Romantic Alaskan Escape Ariana Biermanns Adventure

Apr 27, 2025 -

Microsofts Design Chief On The Intersection Of Ai And Human Design

Apr 27, 2025

Microsofts Design Chief On The Intersection Of Ai And Human Design

Apr 27, 2025

Latest Posts

-

Red Sox Manager Cora Alters Lineup For Doubleheaders First Game

Apr 28, 2025

Red Sox Manager Cora Alters Lineup For Doubleheaders First Game

Apr 28, 2025 -

Coras Strategic Lineup Tweaks For Red Sox Doubleheader

Apr 28, 2025

Coras Strategic Lineup Tweaks For Red Sox Doubleheader

Apr 28, 2025 -

Boston Red Sox Coras Minor Lineup Adjustments For Doubleheader

Apr 28, 2025

Boston Red Sox Coras Minor Lineup Adjustments For Doubleheader

Apr 28, 2025 -

Alex Coras Lineup Modifications Boston Red Sox Game 1

Apr 28, 2025

Alex Coras Lineup Modifications Boston Red Sox Game 1

Apr 28, 2025 -

Red Sox Doubleheader Game 1 Coras Lineup Strategy

Apr 28, 2025

Red Sox Doubleheader Game 1 Coras Lineup Strategy

Apr 28, 2025