ECB Rate Cuts: Simkus Signals Two More Possible Reductions Due To Trade Slowdown

Table of Contents

Simkus's Prediction and its Rationale

[Simkus's name and title] has publicly indicated the likelihood of two further ECB rate cuts in the coming months. This bold prediction isn't made lightly; it's grounded in a sober assessment of the current economic climate. The reasoning behind this forecast centers on several key weakening economic indicators:

-

Weakening Eurozone GDP Growth: Recent GDP figures for the Eurozone have fallen short of expectations, signaling a slowdown in economic activity. This sluggish growth directly fuels the need for stimulative measures.

-

Declining Inflation Figures (or Persistent Low Inflation): Inflation remains stubbornly low (or has declined) across the Eurozone. This persistent low inflation signifies weak demand and justifies the ECB's consideration of further rate cuts to encourage spending and investment. [Insert specific data points mentioned by Simkus, if available, e.g., "Simkus highlighted the fact that inflation is currently at X%, significantly below the ECB's target of Y%."]

-

Concerns about Global Trade Wars and Their Impact on the Eurozone: The ongoing trade disputes between major global economies are casting a long shadow over the Eurozone's export-oriented industries. Uncertainty surrounding trade policies discourages investment and dampens overall economic growth. [Mention any specific trade tensions highlighted by Simkus].

-

[Mention any other specific data points or indicators cited by Simkus in support of his prediction].

Impact of Trade Slowdown on the Eurozone Economy

The global trade slowdown poses a significant threat to the Eurozone's economic health. Reduced international trade has a cascading effect, impacting various sectors:

-

Decreased Export Revenues: Many Eurozone countries heavily rely on exports. A slowdown in global trade directly translates to lower export revenues for businesses, impacting their profitability and investment capacity.

-

Reduced Business Investment: Uncertainty about the future economic climate prompts businesses to postpone or cancel investment plans, leading to a further dampening of economic activity.

-

Potential Job Losses: As businesses struggle with reduced revenues and demand, job cuts become a worrying possibility, increasing unemployment and further weakening consumer confidence.

-

Impact on Consumer Confidence: News of economic slowdown and potential job losses negatively impacts consumer confidence, leading to decreased spending and a further slowdown in economic growth. This creates a vicious cycle that needs to be addressed through policies such as ECB rate cuts.

ECB's Monetary Policy Tools and Their Effectiveness

The ECB has a range of monetary policy tools at its disposal to stimulate economic growth, including:

-

Interest Rate Cuts: Lowering interest rates makes borrowing cheaper for businesses and consumers, encouraging investment and spending.

-

Quantitative Easing (QE): This involves the ECB purchasing assets, injecting liquidity into the market, and lowering long-term interest rates.

The effectiveness of these tools during a trade slowdown is a subject of ongoing debate:

-

Transmission Mechanism of Rate Cuts: While rate cuts aim to stimulate borrowing, their effectiveness can be limited if banks are reluctant to lend or if businesses are hesitant to invest due to broader economic uncertainty.

-

Potential Limitations of Monetary Policy: Monetary policy alone may not be sufficient to address structural issues or external shocks like a global trade war. Fiscal policy (government spending) often plays a crucial role.

-

Debate around the Effectiveness of QE in the Current Context: The effectiveness of QE in stimulating growth during a trade slowdown is debated. Some argue that it has limited impact when businesses lack confidence or face external constraints.

-

Risks Associated with Further Rate Cuts: Pushing interest rates too low carries risks, such as potentially fueling inflation or creating asset bubbles in certain sectors.

Market Reactions and Investor Sentiment

Simkus's prediction and the broader concerns about the trade slowdown have already influenced market reactions and investor sentiment:

-

Changes in Bond Yields: Bond yields have generally fallen, reflecting investors' preference for safer assets amid economic uncertainty.

-

Stock Market Fluctuations: Stock markets have experienced volatility, with some sectors more affected than others depending on their exposure to global trade.

-

Currency Exchange Rate Movements: The Euro's exchange rate has been subject to fluctuations based on investor sentiment and expectations regarding ECB rate cuts.

-

Changes in Investor Risk Appetite: Investors are exhibiting a more cautious approach, favoring less risky investments due to the increased economic uncertainty.

Alternative Economic Scenarios and Potential Outcomes

While Simkus's prediction points towards further ECB rate cuts, it's important to consider alternative economic scenarios:

-

Scenario 1: Stronger-than-expected Economic Rebound: A sudden improvement in global trade or stronger-than-anticipated domestic demand could lead to a faster-than-expected economic recovery, potentially reducing the need for further rate cuts.

-

Scenario 2: Prolonged Trade Slowdown and Further Rate Cuts: A prolonged period of slow global trade could necessitate further, more aggressive ECB rate cuts, potentially combined with other stimulative measures.

-

Scenario 3: Escalation of Trade Tensions and Deeper Recession: A significant escalation of trade tensions could trigger a deeper recession in the Eurozone, requiring substantial and coordinated policy responses beyond just ECB rate cuts.

Conclusion: The Future of ECB Rate Cuts and the Trade Outlook

Simkus's prediction of two more ECB rate cuts underscores the seriousness of the current economic situation. The weakening Eurozone GDP growth, persistently low inflation, and the impact of the global trade slowdown all point towards the need for further stimulative measures. However, the effectiveness and potential risks associated with these ECB rate cuts require careful monitoring. It's crucial to closely follow economic indicators and the ECB's policy decisions to understand the evolving economic landscape. To stay updated on further developments regarding ECB rate cuts and the overall trade outlook, follow reputable financial news sources such as [List reputable financial news sources, e.g., Bloomberg, Reuters, Financial Times]. Understanding the implications of these crucial monetary policy decisions is vital for navigating the current economic climate.

Featured Posts

-

Professional Help For A New Look Ariana Grandes Hair And Tattoo Transformation

Apr 27, 2025

Professional Help For A New Look Ariana Grandes Hair And Tattoo Transformation

Apr 27, 2025 -

Anti Vaccine Advocate Review Of Autism Vaccine Link Sparks Outrage Nbc Connecticut Sources

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Link Sparks Outrage Nbc Connecticut Sources

Apr 27, 2025 -

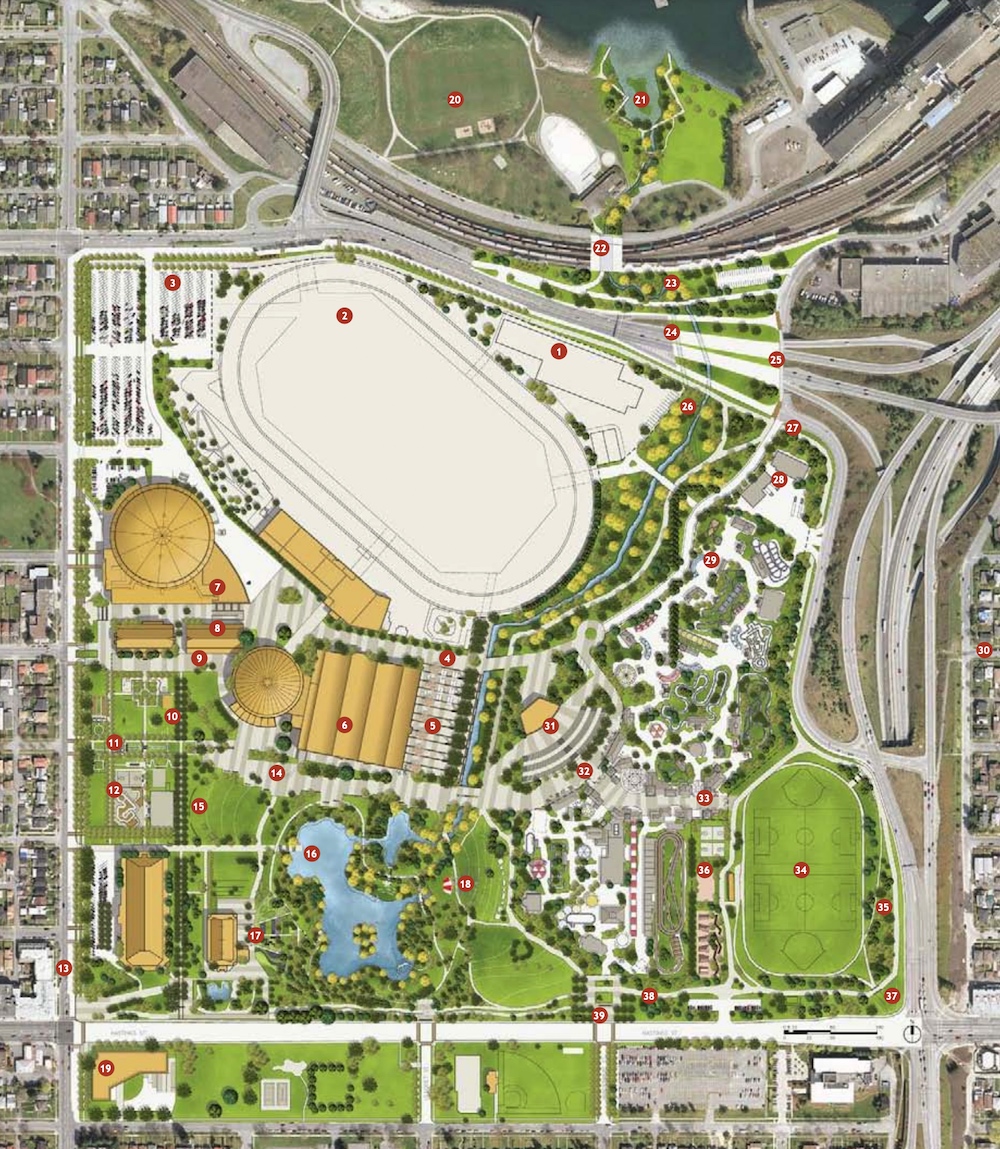

New Whitecaps Stadium Possible Pne Fairgrounds Development Talks

Apr 27, 2025

New Whitecaps Stadium Possible Pne Fairgrounds Development Talks

Apr 27, 2025 -

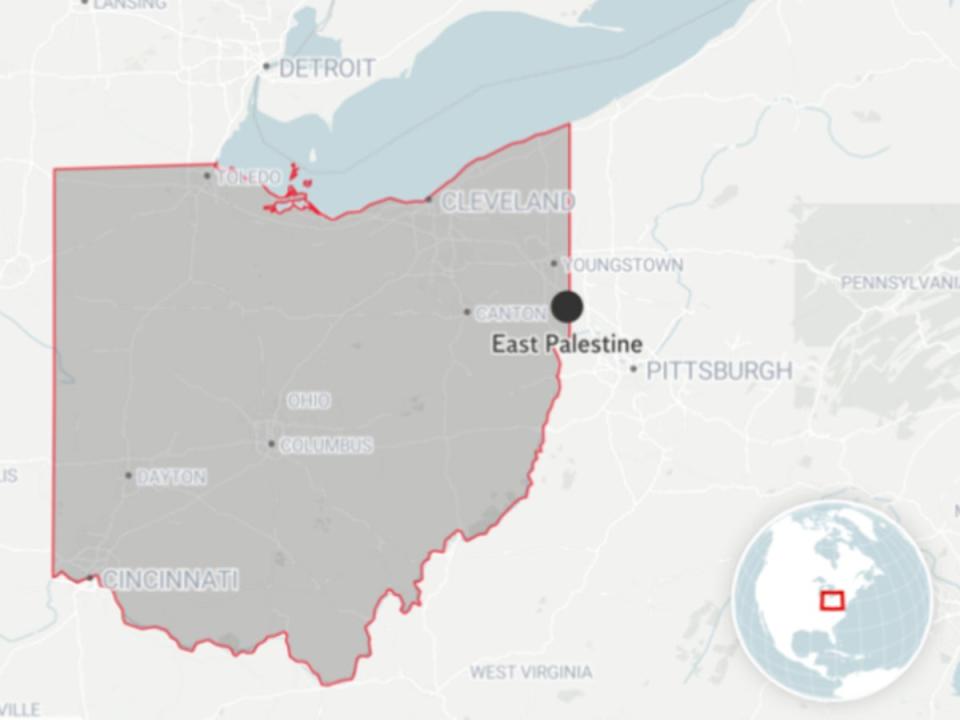

Toxic Chemical Persistence Ohio Train Derailments Lingering Impact On Buildings

Apr 27, 2025

Toxic Chemical Persistence Ohio Train Derailments Lingering Impact On Buildings

Apr 27, 2025 -

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Latest Posts

-

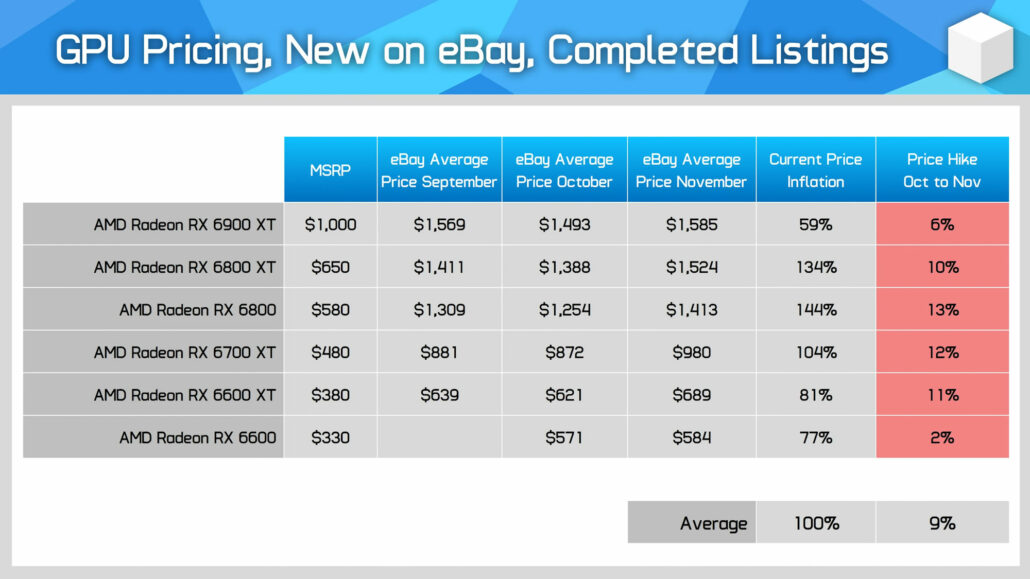

Rising Gpu Prices What To Expect In The Coming Months

Apr 28, 2025

Rising Gpu Prices What To Expect In The Coming Months

Apr 28, 2025 -

Navigating The High Cost Of Gpus In 2024

Apr 28, 2025

Navigating The High Cost Of Gpus In 2024

Apr 28, 2025 -

Gpu Prices Factors Contributing To The Current Market

Apr 28, 2025

Gpu Prices Factors Contributing To The Current Market

Apr 28, 2025 -

Are High End Gpus Unaffordable Again

Apr 28, 2025

Are High End Gpus Unaffordable Again

Apr 28, 2025 -

The Current State Of Gpu Pricing A Detailed Analysis

Apr 28, 2025

The Current State Of Gpu Pricing A Detailed Analysis

Apr 28, 2025