ECB Rate Cuts: Economists Warn Against Delays

Table of Contents

Inflation in the Eurozone is soaring, reaching a 10-year high last quarter, severely impacting consumer spending and threatening a substantial economic downturn. This alarming economic reality has ignited a fervent debate, with a growing chorus of voices urging the European Central Bank (ECB) to implement immediate interest rate cuts. Economists warn that delaying these crucial ECB rate cuts risks prolonging the economic hardship and potentially pushing the Eurozone into a deeper recession. This article will delve into the mounting pressure on the ECB, the dire warnings from economists, and the potential obstacles to swift action. We will explore why economists believe that decisive action on ECB rate cuts is not merely desirable, but absolutely necessary for the stability of the Eurozone economy.

The Mounting Pressure on the ECB

The Eurozone economy is teetering on the brink. Inflation remains stubbornly high, squeezing household budgets and dampening business investment. GDP growth is slowing, and unemployment is stubbornly high in several member states. This precarious situation demands bold action from the ECB to stimulate the economy and prevent a further decline. Immediate ECB rate cuts are widely considered a necessary measure to:

- Stimulate economic growth: Lower interest rates make borrowing more affordable, encouraging businesses to invest and consumers to spend, thus boosting overall economic activity. This injection of capital is vital for reigniting a sluggish Eurozone economy.

- Combat deflationary pressures: Rate cuts can help prevent a deflationary spiral, a vicious cycle where falling prices lead to decreased spending and further price declines. This is a critical consideration given the current economic climate.

- Support struggling businesses and consumers: Reduced borrowing costs offer much-needed relief to businesses and households grappling with financial hardship. This lifeline is crucial for preventing widespread bankruptcies and social unrest.

The current inflation rate, coupled with slowing GDP growth, paints a stark picture. Effective monetary policy, including ECB rate cuts, is the primary tool available to address this multifaceted crisis.

Economists' Warnings Against Delay

Leading economists are issuing stark warnings. Professor Anya Petrova of the London School of Economics stated, "Delaying ECB rate cuts is akin to playing with fire. We risk a prolonged recession and a substantial surge in unemployment, with devastating consequences for the social fabric of the Eurozone." The potential risks of inaction are severe:

- Prolonged recession: A delayed response could deepen and prolong the economic downturn, resulting in a more severe and protracted crisis, impacting every sector of the economy.

- Increased unemployment: A stagnant economy inevitably leads to job losses, exacerbating social and economic hardship and increasing social unrest.

- Further decline in consumer confidence: Uncertainty and economic hardship erode consumer confidence, resulting in decreased spending and further economic contraction, creating a negative feedback loop.

These expert opinions highlight the urgency of the situation and the potentially dire consequences of inaction. The economic forecast is grim without decisive intervention in the form of ECB rate cuts.

Alternative Solutions and Their Limitations

While other monetary policy tools exist, such as quantitative easing (QE), economists largely concur that interest rate cuts remain the most effective and direct method to address the current economic challenges. QE, while beneficial, often takes longer to show tangible results and may not effectively address the immediate need for economic stimulus. Fiscal policy, involving government spending and taxation, also plays a role, but it’s often subject to political constraints and slower to implement than monetary policy changes. Therefore, ECB rate cuts are the most powerful and immediate tool at the ECB's disposal.

Political Considerations and Potential Roadblocks

The ECB's decision-making process is not immune to political pressures. Concerns about high government debt levels in certain Eurozone countries might influence the ECB's willingness to aggressively cut rates. Finding a balance between economic necessity and political realities is a significant challenge. However, the potential long-term economic and social costs of inaction far outweigh any short-term political risks. Overcoming these political obstacles is critical for ensuring effective and timely monetary policy responses.

The Urgent Need for ECB Rate Cuts – A Call to Action

The evidence overwhelmingly supports the need for timely ECB rate cuts to prevent a deeper economic crisis in the Eurozone. Economists' warnings cannot be ignored. We urge readers to remain informed about the ECB's upcoming decisions and to actively advocate for prompt and decisive action to mitigate the risks facing the Eurozone economy. Demand action; support responsible monetary policy; and monitor the ECB's response to this critical economic challenge. The future economic stability of the Eurozone hinges on the implementation of effective ECB rate cuts.

Featured Posts

-

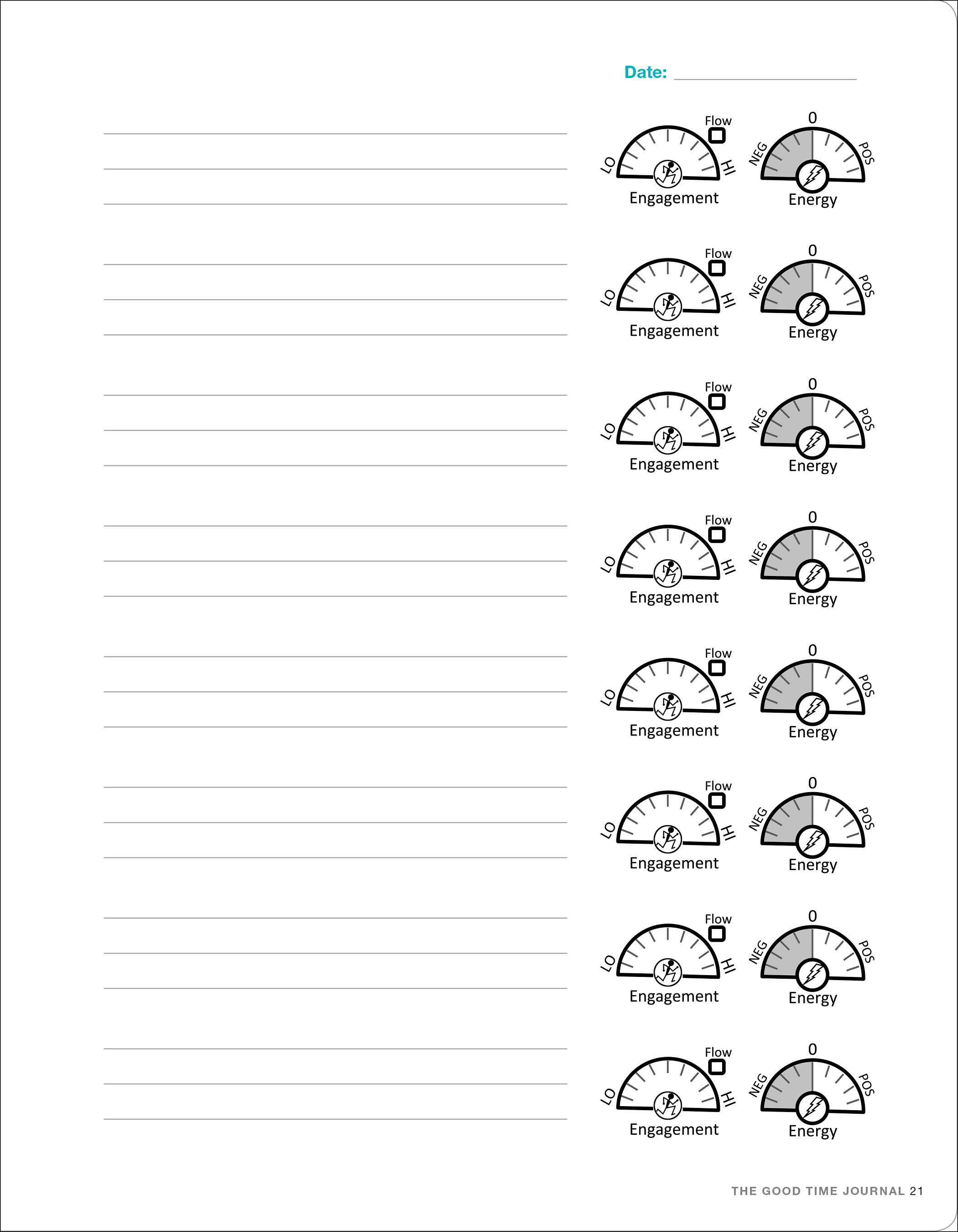

Designing Your Good Life A Practical Guide

May 31, 2025

Designing Your Good Life A Practical Guide

May 31, 2025 -

Rachat D Anticorps Par Sanofi Details De L Accord Avec Dren Bio Mars 2025

May 31, 2025

Rachat D Anticorps Par Sanofi Details De L Accord Avec Dren Bio Mars 2025

May 31, 2025 -

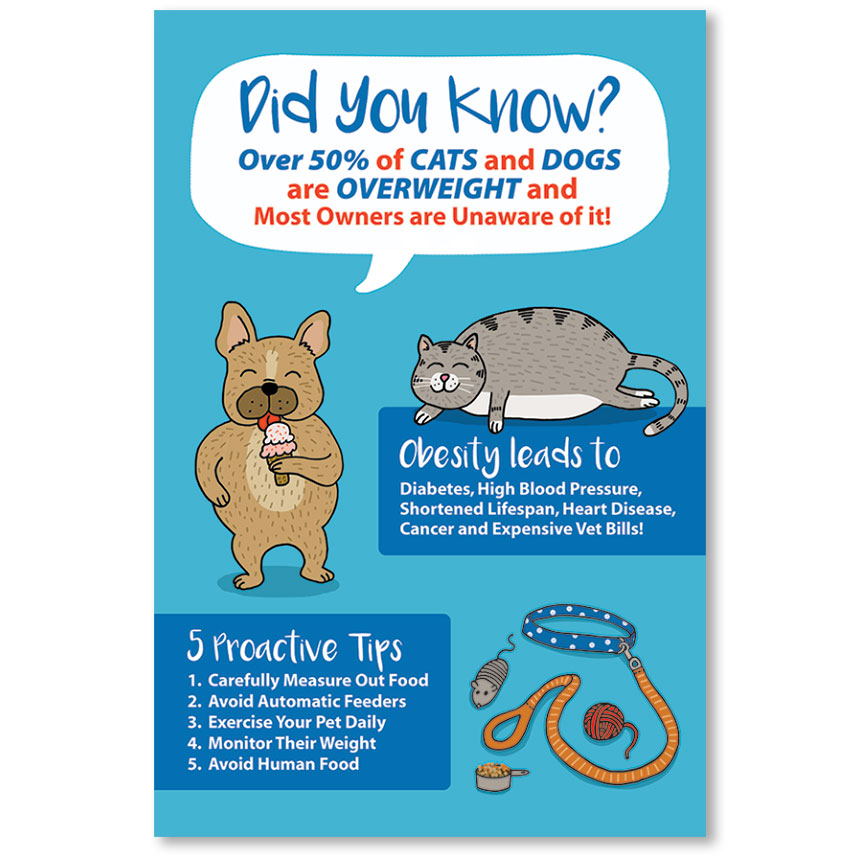

Uk Vets Reveal How Corporate Targets Inflate Pet Bills

May 31, 2025

Uk Vets Reveal How Corporate Targets Inflate Pet Bills

May 31, 2025 -

Como Hacer Un Croque Monsieur Receta Simple Y Deliciosa

May 31, 2025

Como Hacer Un Croque Monsieur Receta Simple Y Deliciosa

May 31, 2025 -

Analysis Elon Musks Departure From The Trump Administration

May 31, 2025

Analysis Elon Musks Departure From The Trump Administration

May 31, 2025