ECB: Pandemic Fiscal Measures Fueling Persistent Inflation

Table of Contents

The ECB's Pandemic Response and its Impact on Money Supply

The ECB's unprecedented response to the COVID-19 pandemic involved large-scale quantitative easing (QE) programs aimed at injecting liquidity into the Eurozone financial system. These measures, designed to prevent a credit crunch and support economic activity, significantly impacted the money supply. The primary tool was the expansion of the Pandemic Emergency Purchase Programme (PEPP), allowing the ECB to purchase vast quantities of government and corporate bonds. This, coupled with targeted longer-term refinancing operations (TLTROs) designed to encourage bank lending, dramatically increased the monetary base.

- Expansion of the Pandemic Emergency Purchase Programme (PEPP): The PEPP far exceeded previous QE programs in scale and scope, injecting trillions of euros into the financial system.

- Impact of targeted longer-term refinancing operations (TLTROs) on bank lending: TLTROs provided banks with cheap funding, incentivizing lending and boosting overall liquidity.

- Increase in the overall monetary base and its correlation with inflation: The substantial increase in the money supply is strongly correlated with the rise in inflation currently observed across the Eurozone.

- Analysis of the effectiveness of these measures in mitigating the initial economic shock: While effective in preventing a severe economic collapse, the long-term inflationary consequences were not fully anticipated.

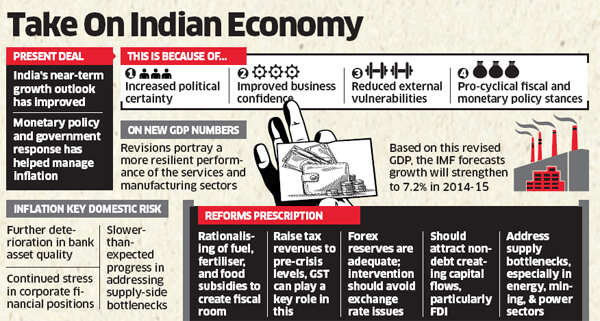

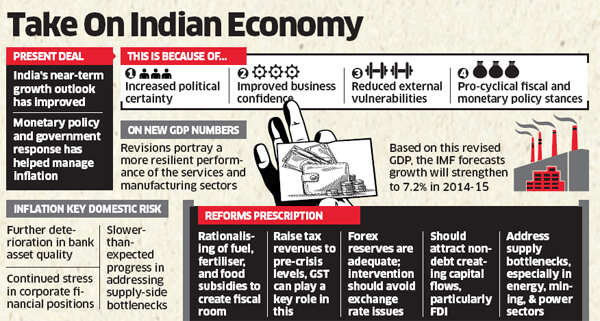

Fiscal Stimulus and its Contribution to Inflationary Pressures

Simultaneously, Eurozone governments implemented substantial fiscal stimulus packages to support their economies. This massive increase in government spending, designed to cushion the blow of lockdowns and support businesses and individuals, significantly boosted aggregate demand. This demand-pull inflation was further exacerbated by global supply chain disruptions caused by the pandemic, leading to shortages and price increases for various goods and services.

- Examples of significant fiscal stimulus packages across Eurozone countries: Many countries implemented large-scale furlough schemes, direct cash payments to citizens, and significant investment in infrastructure projects.

- Analysis of the impact on aggregate demand and consumer spending: The increase in government spending fueled consumer spending and further increased demand.

- Discussion of supply-side bottlenecks and their contribution to inflation: Supply chain issues created shortages, driving up prices independently of demand.

- The interaction between fiscal and monetary policy during the pandemic: The combined effect of expansive monetary and fiscal policies created a potent inflationary cocktail.

The ECB's Current Monetary Policy Response to Inflation

Facing persistent inflation, the ECB has shifted its monetary policy stance towards tightening. This involves a series of interest rate hikes, aimed at reducing borrowing costs and cooling down the economy. Concurrently, the ECB is phasing out its QE programs, gradually reducing its holdings of government and corporate bonds. However, the ECB faces a delicate balancing act: controlling inflation without triggering a sharp economic slowdown or significantly increasing government debt burdens.

- Overview of the ECB's interest rate decisions and their impact on borrowing costs: Interest rate increases impact borrowing costs for businesses and consumers, potentially dampening investment and spending.

- Discussion of the ECB's inflation targets and their credibility: Maintaining credibility around its inflation targets is crucial for the ECB’s effectiveness.

- Analysis of the potential negative consequences of aggressive monetary policy tightening: Aggressive tightening carries the risk of triggering a recession.

- Explanation of the ECB’s communication strategy regarding its approach to inflation: Clear and consistent communication is essential to managing market expectations.

Long-Term Implications and Future Outlook

The long-term implications of the pandemic-related fiscal and monetary policies remain uncertain. The Eurozone faces the potential risk of stagflation – a combination of slow economic growth and high inflation. Moreover, the substantial increase in government debt levels across many Eurozone countries poses a significant challenge for fiscal consolidation. Structural reforms aimed at improving productivity and supply-side capacity will be crucial for addressing persistent inflation in the long term.

- Potential risks of stagflation in the Eurozone: Persistently high inflation combined with slowing economic growth poses a serious threat.

- Challenges of fiscal consolidation in member states: Reducing high levels of government debt will require difficult political decisions.

- Long-term impact on economic growth and productivity: High inflation can erode purchasing power and hinder long-term economic growth.

- The role of structural reforms in addressing inflation: Improving productivity and supply-side capacity are key to tackling inflation in the long run.

Conclusion

The current inflationary environment in the Eurozone is a complex phenomenon significantly influenced by both the ECB's pandemic monetary policies and the expansive fiscal measures implemented by Eurozone governments. The ECB faces the difficult task of managing inflation while supporting economic growth and navigating the long-term consequences of its pandemic response. Understanding the interplay between these factors is crucial. Stay informed about the ECB's ongoing efforts to manage inflation and its impact on the Eurozone economy by following relevant news and analysis on the ECB's monetary policy and its ongoing efforts to combat the effects of pandemic fiscal measures on persistent inflation.

Featured Posts

-

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Historic Flooding Snow And Tornadoes Slam Louisville At The Start Of 2025

Apr 29, 2025

Historic Flooding Snow And Tornadoes Slam Louisville At The Start Of 2025

Apr 29, 2025 -

Get Your Capital Summertime Ball 2025 Tickets Today

Apr 29, 2025

Get Your Capital Summertime Ball 2025 Tickets Today

Apr 29, 2025 -

Goldman Sachs Exclusive Tariff Advice Navigating Trump Era Trade Policy

Apr 29, 2025

Goldman Sachs Exclusive Tariff Advice Navigating Trump Era Trade Policy

Apr 29, 2025 -

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025