Easy Payday Loans For Bad Credit: Guaranteed Direct Lender Approval

Table of Contents

Understanding Easy Payday Loans and Bad Credit

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help individuals cover unexpected expenses until their next payday. They are typically repaid within a few weeks, offering a convenient solution for immediate financial needs. Applying for these quick cash loans is often easy and accessible through online platforms, allowing you to submit your application and potentially receive funds the same day. However, it's crucial to understand the fees and interest rates associated with these emergency loans before proceeding. These fees can significantly impact the overall cost of the loan, so careful consideration is essential.

How Bad Credit Affects Loan Approval

A low credit score can significantly impact your chances of loan approval. Your credit score is a numerical representation of your creditworthiness, based on your credit history. Factors contributing to a bad credit score include:

- Missed payments: Consistently late or missed payments severely damage your credit.

- High credit utilization: Using a large percentage of your available credit lowers your score.

- Numerous hard inquiries: Multiple loan applications within a short period can negatively affect your score.

- Bankruptcies and collections: These severely impact your creditworthiness.

Lenders use your credit report to assess the risk of lending to you. A poor credit history suggests a higher risk of default, making lenders hesitant to approve your application for a same-day loan or any other type of loan.

Finding Direct Lenders for Easy Payday Loans

Instead of using loan brokers, consider going directly to lenders. Direct lenders often have more flexible approval criteria than brokers and may be more willing to work with applicants who have bad credit. However, it's vital to thoroughly research and verify the legitimacy and reputation of any direct lender before submitting your application. Look for online lender reviews and check if they are licensed and regulated in your state. Using a direct lender streamlines the loan application process and provides transparency.

Strategies for Securing Easy Payday Loans with Bad Credit

Improve Your Chances of Approval

Even with bad credit, you can increase your chances of loan approval. Consider these strategies:

- Secure loan: Offer collateral to secure the loan, reducing the lender's risk.

- Co-signer: Have a person with good credit co-sign the loan, sharing responsibility for repayment.

- Accurate application: Provide completely accurate and truthful information on your loan application. Inaccuracies can lead to immediate rejection.

- Stable income: Demonstrate a consistent and reliable income source to reassure the lender of your ability to repay.

These steps can significantly improve your chances of getting your loan application approved.

Comparing Loan Offers and APRs

Before accepting any loan offer, compare interest rates and fees from multiple lenders. Understand the Annual Percentage Rate (APR), which represents the total cost of borrowing, including interest and fees. Avoid predatory lenders who charge excessively high fees and interest rates. Carefully review all loan terms and conditions before signing any agreement.

Responsible Borrowing and Repayment

Borrow only what you absolutely need and create a realistic repayment plan. Budget carefully to ensure you can afford the loan payments without compromising other essential expenses. Failing to repay a loan on time can have severe consequences, including damage to your credit score and potential legal action. Prioritize responsible borrowing habits to avoid the negative impacts of loan default.

Alternatives to Payday Loans for Bad Credit

If you're struggling with bad credit, consider alternatives to payday loans:

- Credit union loans: Credit unions often offer more favorable loan terms than traditional lenders.

- Personal loans: Personal loans from banks or online lenders may offer lower interest rates than payday loans.

- Debt consolidation loans: Consolidating multiple debts into a single loan can simplify repayment and potentially lower your interest rate.

These options may require a better credit score or additional requirements but offer potentially more manageable repayment terms than a short-term, high-interest payday loan.

Conclusion

Securing easy payday loans for bad credit requires careful planning and research. By understanding your credit situation, choosing a reputable direct lender, comparing loan offers, and practicing responsible borrowing, you can significantly improve your chances of approval. Remember to borrow responsibly and create a realistic repayment plan. Don't let bad credit hinder your access to needed funds. Explore your options for easy payday loans today and find the financial solution that works best for your circumstances. Start your search for easy payday loans now and take control of your finances.

Featured Posts

-

Padres Power Ranking Plummet National Outlets Latest Assessment

May 28, 2025

Padres Power Ranking Plummet National Outlets Latest Assessment

May 28, 2025 -

The Housing Permit Dip Understanding The Construction Markets Challenges

May 28, 2025

The Housing Permit Dip Understanding The Construction Markets Challenges

May 28, 2025 -

Kemacetan Di Bali Diprediksi Pada 5 Dan 6 April 2025 Tips Menghadapinya

May 28, 2025

Kemacetan Di Bali Diprediksi Pada 5 Dan 6 April 2025 Tips Menghadapinya

May 28, 2025 -

Marlins And Torpedo Bats A Growing Trend

May 28, 2025

Marlins And Torpedo Bats A Growing Trend

May 28, 2025 -

San Diego Padres Season Preview And 2025 Home Opener Expectations

May 28, 2025

San Diego Padres Season Preview And 2025 Home Opener Expectations

May 28, 2025

Latest Posts

-

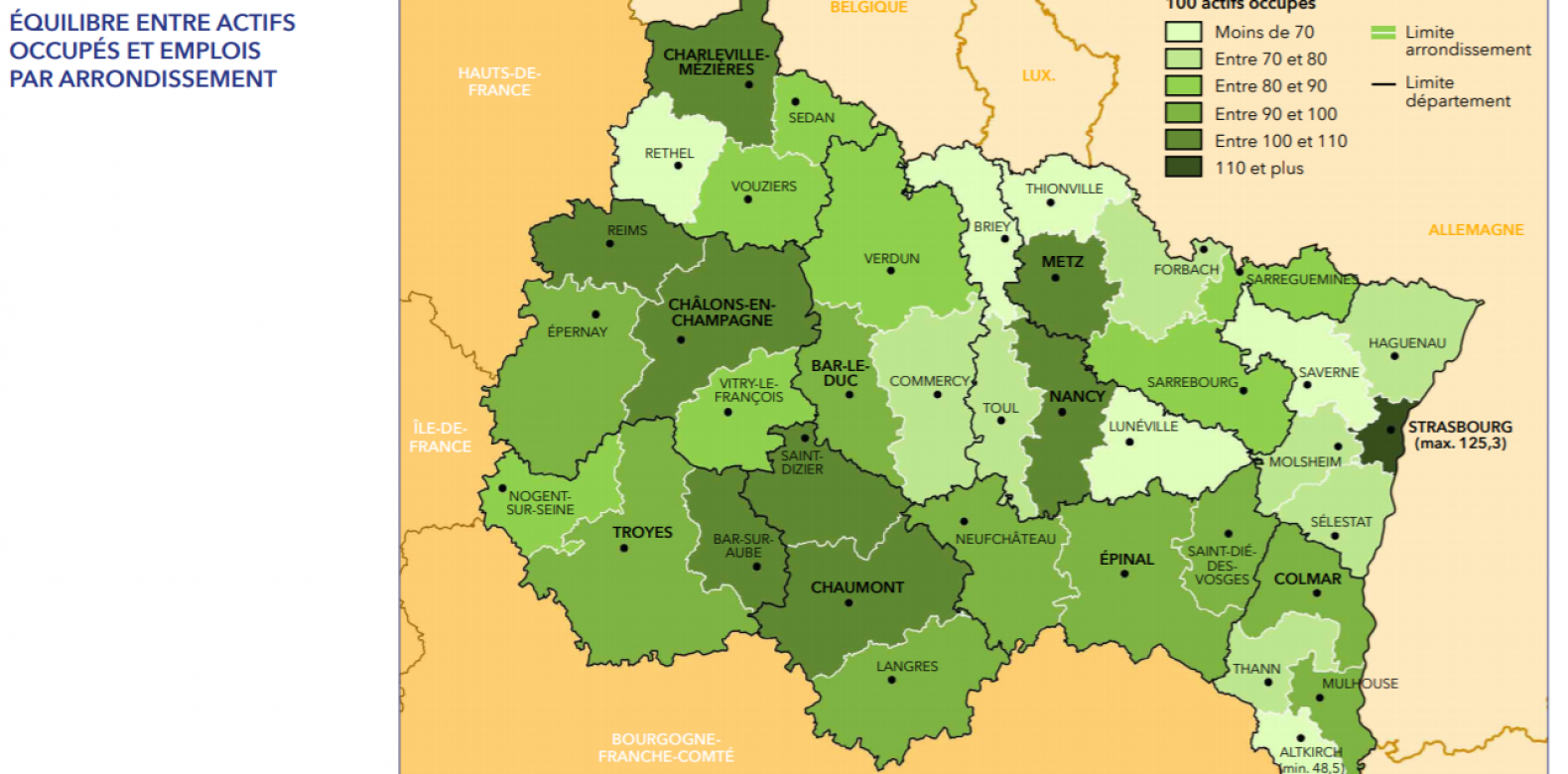

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025 -

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025 -

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025 -

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025