Earnings Preview: Gibraltar Industries' Financial Performance And Future Outlook

Table of Contents

Gibraltar Industries' upcoming earnings announcement is highly anticipated by investors. This earnings preview will delve into the company's recent financial performance, key growth drivers, and a projection of its future outlook. We'll analyze key metrics to understand Gibraltar Industries' position in the market and assess potential investment opportunities. Understanding Gibraltar Industries earnings is crucial for informed investment decisions.

H2: Q2 2024 Financial Performance Review:

H3: Revenue Analysis: Gibraltar Industries' Q2 2024 revenue will be a key indicator of its overall performance. Analyzing year-over-year and quarter-over-quarter growth is essential. We expect a detailed breakdown of revenue streams from its core segments: renewable energy solutions and building products. Understanding the contribution of each segment to overall Gibraltar Industries revenue will provide a clearer picture of the company's strengths.

- Year-over-year revenue change: A significant increase would signal strong market demand and successful execution of the company's strategies. A decrease, however, may require further investigation into underlying causes.

- Key revenue drivers: Identifying the primary factors contributing to revenue growth, whether it’s increased sales volume, higher pricing, or new product launches, is crucial.

- Impact of macroeconomic factors (inflation, interest rates): The current economic climate significantly influences consumer spending and construction activity. Understanding how inflation and interest rates impact Gibraltar Industries revenue is vital.

- Segment-wise revenue breakdown: A detailed analysis of revenue contribution from renewable energy (solar, wind) and building products segments is needed to pinpoint areas of strength and weakness. This will allow investors to assess the performance of Gibraltar Industries revenue within different sectors.

H3: Profitability and Margins: Profitability is another critical aspect of Gibraltar Industries' Q2 2024 performance. Examining gross profit margins, operating margins, and net income will offer insights into the company’s efficiency and cost management.

- Gross profit margin analysis: Analyzing gross profit margins helps determine the efficiency of the company's production and sales processes. Changes in gross profit margin may reflect shifts in raw material costs or pricing strategies.

- Operating income trends: Tracking operating income trends reveals the company's ability to manage operating expenses effectively. Year-over-year comparisons will highlight any significant changes.

- Net income growth: Net income growth is a crucial indicator of overall profitability and financial health. Analyzing net income growth in comparison to revenue growth provides valuable insights into operational efficiency.

- Impact of cost pressures (raw materials, labor): Rising raw material costs and labor expenses can significantly impact profitability. Assessing the company's ability to mitigate these pressures is vital.

H3: Key Financial Metrics: Analyzing key financial ratios provides a comprehensive overview of Gibraltar Industries' financial health and stability.

- Debt levels: High debt levels can indicate financial risk. Analyzing debt-to-equity ratios will provide an indication of the company's financial leverage.

- Liquidity: Assessing the company's liquidity position through the current ratio indicates its ability to meet short-term obligations. Strong liquidity suggests financial stability.

- Return on investment (ROE): ROE measures the profitability of the company's investments. A high ROE indicates efficient capital utilization.

- Financial health assessment: Overall, these metrics will provide a comprehensive assessment of Gibraltar Industries' financial stability and future prospects.

H2: Growth Drivers and Future Outlook:

H3: Renewable Energy Sector Growth: Gibraltar Industries' involvement in the renewable energy sector presents a significant growth opportunity. Analyzing its market share and growth projections in solar and wind energy solutions is crucial.

- Market share in renewable energy: Evaluating Gibraltar Industries' market share in the renewable energy sector will show its competitiveness.

- Growth projections for the sector: The renewable energy sector is experiencing rapid growth; understanding Gibraltar Industries’ ability to capture this growth is essential.

- Competitive landscape: Analyzing the competitive landscape, including key competitors and their strategies, is important for assessing Gibraltar Industries’ position.

H3: Building Products Market Trends: The building products market is closely tied to overall economic conditions. Assessing the demand for Gibraltar Industries' products and their resilience to market fluctuations is crucial.

- Housing market trends: The housing market significantly impacts demand for building products. Understanding housing market trends is crucial for forecasting demand.

- Impact of construction activity: Overall construction activity levels directly affect demand for building products. Analyzing this impact is crucial.

- Pricing strategies: The company's pricing strategies and their effectiveness in a fluctuating market will significantly impact profitability.

- Material costs: Fluctuations in material costs directly impact the company's profitability.

H3: Strategic Initiatives and Acquisitions: Strategic initiatives and acquisitions can significantly impact Gibraltar Industries' future performance.

- New product launches: New product launches can drive revenue growth and enhance market competitiveness.

- Expansion plans: Expansion plans into new markets or product categories can significantly impact future performance.

- M&A activity: Mergers and acquisitions can provide access to new technologies, markets, or customer bases.

H2: Risks and Challenges:

H3: Supply Chain Disruptions: Supply chain disruptions can significantly impact operations and profitability. Analyzing the potential impact on Gibraltar Industries is important.

- Raw material availability: Secure access to raw materials is essential for continuous production. Any shortages can hinder production.

- Logistics costs: Increased logistics costs due to supply chain disruptions can squeeze margins.

- Alternative sourcing strategies: The company's ability to implement alternative sourcing strategies to mitigate supply chain risks is essential.

H3: Competition and Market Share: The competitive landscape influences Gibraltar Industries’ ability to maintain or improve its market share.

- Key competitors: Identifying key competitors and their strategies is crucial for evaluating competitive pressure.

- Competitive advantages: Gibraltar Industries’ competitive advantages will determine its ability to maintain or gain market share.

- Market share trends: Monitoring market share trends helps assess the company's performance relative to competitors.

H3: Macroeconomic Factors: Broader macroeconomic factors significantly influence the company’s performance.

- Inflationary pressures: Inflationary pressures impact raw material costs and consumer spending.

- Interest rate hikes: Interest rate hikes affect borrowing costs and investment decisions.

- Economic slowdown: An economic slowdown can reduce demand for building products and renewable energy solutions.

- Impact on demand: The overall impact of these macroeconomic factors on demand for Gibraltar Industries’ products needs to be assessed.

Conclusion:

This earnings preview of Gibraltar Industries provides a comprehensive analysis of its recent financial performance and future outlook. By reviewing key financial metrics, growth drivers, and potential risks, investors can gain valuable insights into the company's prospects. While opportunities exist within renewable energy and building products markets, navigating supply chain challenges and macroeconomic uncertainty remains crucial. Stay tuned for the official Gibraltar Industries earnings release and continue to monitor the company’s performance for informed investment decisions on Gibraltar Industries earnings and future growth.

Featured Posts

-

Courtroom Drama Tory Lanezs Heated Confrontation With His Lawyer

May 13, 2025

Courtroom Drama Tory Lanezs Heated Confrontation With His Lawyer

May 13, 2025 -

Why Angus Should Become A Recurring Character In Elsbeths Stories

May 13, 2025

Why Angus Should Become A Recurring Character In Elsbeths Stories

May 13, 2025 -

Sabalenka Defeats Paolini To Reach Porsche Grand Prix Final

May 13, 2025

Sabalenka Defeats Paolini To Reach Porsche Grand Prix Final

May 13, 2025 -

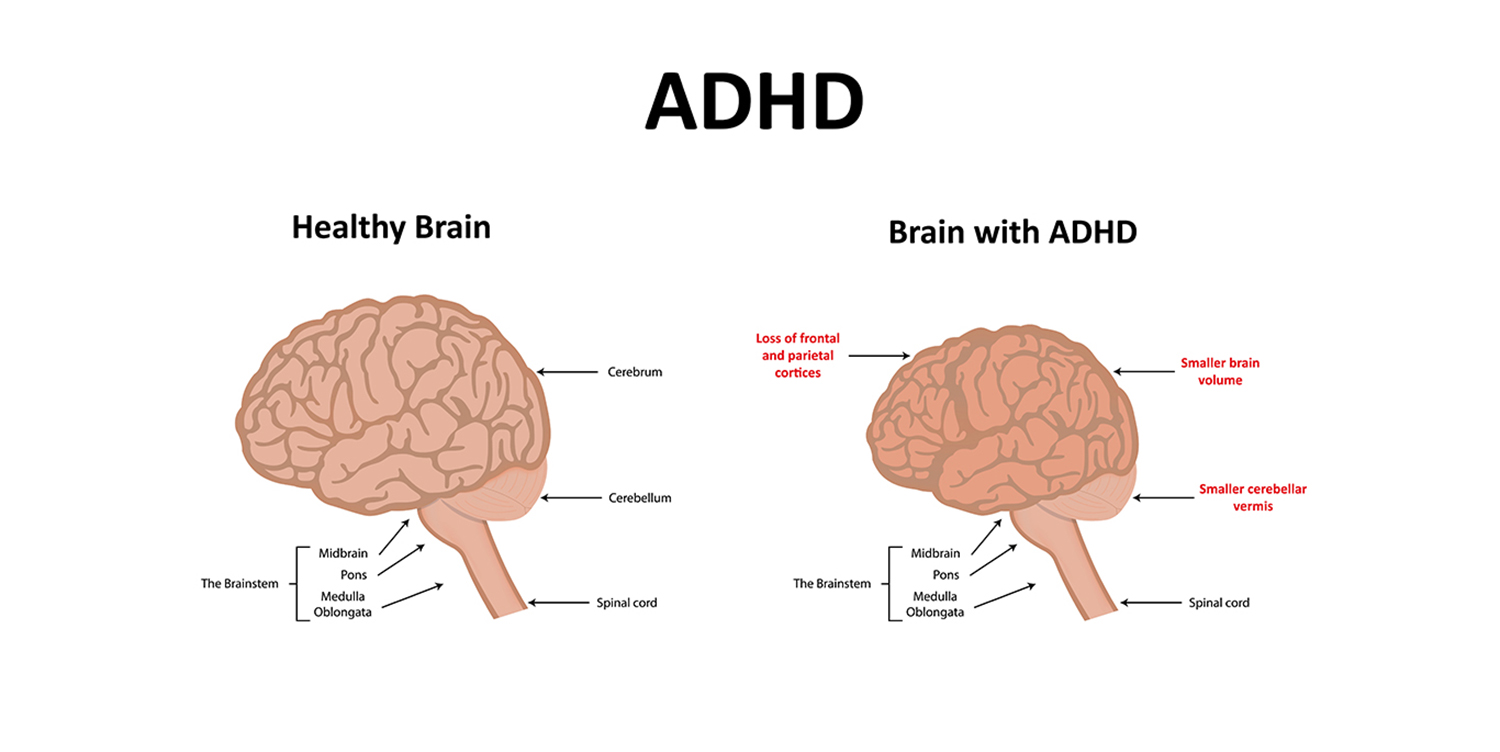

Inside Our Adhd Minds Strategies For Success And Well Being

May 13, 2025

Inside Our Adhd Minds Strategies For Success And Well Being

May 13, 2025 -

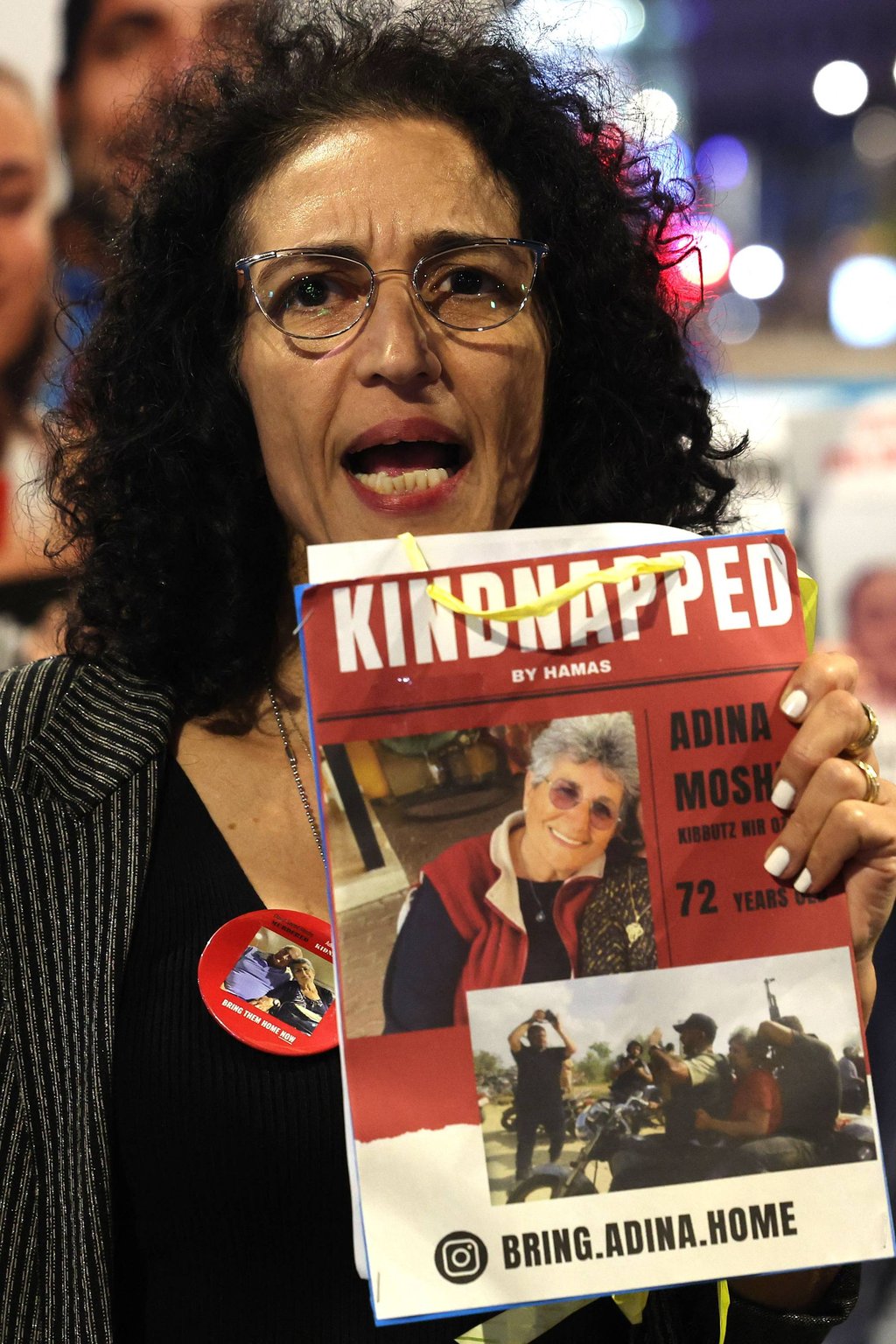

The Enduring Nightmare Gaza Hostages And Their Families

May 13, 2025

The Enduring Nightmare Gaza Hostages And Their Families

May 13, 2025