Dutch Stock Market Slumps: US Trade Tensions Intensify

Table of Contents

H2: The Impact of US Trade Tensions on the Dutch Economy

The Netherlands, a small, open economy heavily reliant on exports, is particularly vulnerable to the escalating US trade tensions and their effects on the Dutch stock market. US tariffs on European goods directly impact Dutch businesses, creating a ripple effect throughout the economy.

H3: Weakening Export Sector

The Netherlands' export-oriented industries are suffering under the weight of increased trade barriers.

- Increased costs for Dutch exporters: Tariffs imposed by the US increase the price of Dutch goods in the American market, reducing their competitiveness.

- Reduced competitiveness in global markets: The trade war creates uncertainty and discourages international trade, impacting the ability of Dutch companies to compete globally.

- Potential job losses in export-oriented industries: As businesses struggle with reduced sales and profitability, job losses in export-oriented sectors become a real threat, further impacting the Dutch stock market.

H3: Decreased Investor Confidence

Uncertainty surrounding future trade policies is a significant factor contributing to the slump in the Dutch stock market. This uncertainty discourages both domestic and foreign investment.

- Foreign direct investment (FDI) inflows decrease: Businesses are hesitant to invest in countries facing trade uncertainty, leading to a decrease in FDI in the Netherlands.

- Domestic investment slows down: Dutch companies postpone expansion plans and reduce investment in new projects due to the unpredictable economic environment.

- Negative impact on business sentiment: The overall mood among businesses is pessimistic, impacting investment decisions and further depressing the Dutch stock market.

H3: Ripple Effect on Related Sectors

The decline in export-oriented sectors has a knock-on effect on related industries, creating a chain reaction throughout the Dutch economy.

- Reduced demand for logistics and transportation services: Fewer exports mean less demand for shipping, trucking, and other logistics services.

- Decline in consumer spending as uncertainty rises: Consumers, feeling less secure about the economic future, tend to reduce spending, further slowing economic growth.

- Potential pressure on the Dutch Guilder: The economic slowdown can put downward pressure on the value of the Dutch currency.

H2: Analyzing the AEX Index and its Recent Performance

The Amsterdam Exchange Index (AEX) provides a clear indication of the impact of US trade tensions on the Dutch stock market. The AEX has experienced a significant drop in recent months, directly correlating with the escalation of trade disputes.

H3: Significant Drop in AEX Values

For example, between [Insert Start Date] and [Insert End Date], the AEX fell by [Insert Percentage]%. This significant drop is largely attributed to the escalating US trade tensions and their impact on Dutch businesses and investor confidence.

- Compare AEX performance to other European stock market indices: The AEX's performance can be compared to other European indices to determine whether the decline is specific to the Netherlands or a broader European trend.

- Analyze the performance of specific sectors within the AEX (e.g., technology, finance): Some sectors within the AEX are more vulnerable to trade tensions than others. Analyzing the performance of individual sectors will offer further insights.

- Discuss the volatility of the AEX in response to trade-related news: The AEX's volatility highlights the market's sensitivity to news related to US trade policy.

H3: Investor Behavior and Market Sentiment

Investor behavior has shifted significantly in response to the increased trade tensions.

- Increased trading volume during periods of heightened uncertainty: Investors are actively trading, trying to adjust their portfolios to mitigate potential losses.

- Shift in investor preference towards safer assets (e.g., government bonds): Investors are moving away from riskier assets, seeking the safety of government bonds.

- Impact of short-selling on AEX values: Short-selling contributes to the downward pressure on the AEX, as investors bet against further declines in the market.

H2: Potential Long-Term Consequences and Mitigation Strategies

The current slump in the Dutch stock market due to US trade tensions has potential long-term economic consequences.

H3: Economic Growth Projections

Revised GDP growth forecasts for the Netherlands are likely to reflect the negative impact of the current market situation.

- Analyze the potential long-term impact on employment: Continued economic slowdown could lead to significant job losses.

- Assess the risk of a recession in the Netherlands: The prolonged impact of trade tensions increases the risk of a recession.

- Consider the potential for government intervention and stimulus packages: Government intervention may be necessary to mitigate the economic downturn.

H3: Strategies for Investors

Navigating the current market requires careful consideration of risk management and investment strategies.

- Diversification of investment portfolios: Spreading investments across different asset classes and geographies reduces risk.

- Risk management techniques: Employing stop-loss orders and other risk management techniques helps to limit potential losses.

- Long-term investment strategies: Maintaining a long-term investment horizon can help weather short-term market fluctuations.

3. Conclusion:

The ongoing US trade tensions are having a demonstrably negative impact on the Dutch stock market, leading to a substantial slump in the AEX index and negatively impacting investor confidence and the Netherlands economy. The weakening export sector and decreased investment are causing ripples throughout the Dutch economy. Understanding these trends and adapting investment strategies accordingly is crucial for navigating this challenging period. Stay informed on developments in the Dutch stock market and US trade relations to make informed decisions regarding your investments. Consult with financial professionals for personalized advice tailored to your risk tolerance and investment goals. Remember, carefully monitoring the US trade tensions' impact on the Netherlands economy is key to managing risk in the current market climate.

Featured Posts

-

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Analisi Del Settore Moda

May 25, 2025

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Analisi Del Settore Moda

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025 -

Is An Escape To The Country Right For You A Checklist

May 25, 2025

Is An Escape To The Country Right For You A Checklist

May 25, 2025 -

Demna Gvasalia Reshaping The Identity Of Gucci

May 25, 2025

Demna Gvasalia Reshaping The Identity Of Gucci

May 25, 2025 -

Dramatic Police Chase Texting Pair Refuels Vehicle At 90mph

May 25, 2025

Dramatic Police Chase Texting Pair Refuels Vehicle At 90mph

May 25, 2025

Latest Posts

-

Are Thames Water Executive Bonuses Justified An Examination Of The Facts

May 25, 2025

Are Thames Water Executive Bonuses Justified An Examination Of The Facts

May 25, 2025 -

The Thames Water Executive Bonus Scandal A Detailed Analysis

May 25, 2025

The Thames Water Executive Bonus Scandal A Detailed Analysis

May 25, 2025 -

Thames Waters Executive Pay Scrutiny And Public Outrage

May 25, 2025

Thames Waters Executive Pay Scrutiny And Public Outrage

May 25, 2025 -

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025 -

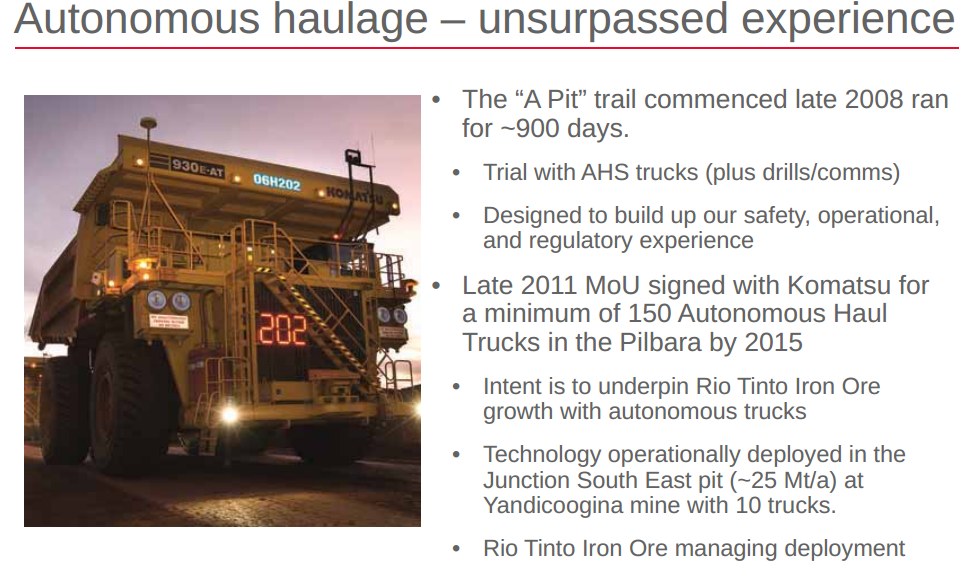

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025