Dubai's Khazna Targets Saudi Market Following Silver Lake Partnership

Table of Contents

Khazna's Strategic Partnership with Silver Lake

Khazna's expansion into Saudi Arabia is significantly fueled by its strategic partnership with Silver Lake. This investment represents a substantial injection of capital and expertise, providing the foundation for Khazna's ambitious growth strategy. While the exact investment amount remains undisclosed, sources suggest a significant figure that will allow Khazna to accelerate its product development, expand its team, and implement robust market entry strategies within the Kingdom.

- Amount of investment secured: While the specific figure is confidential, it's understood to be substantial enough to significantly impact Khazna's operational capabilities and expansion plans.

- Silver Lake's expertise and network: Silver Lake's extensive experience in investing in and scaling technology companies globally brings invaluable expertise and a powerful network of connections to Khazna. This network provides access to potential partnerships and strategic collaborations within the Saudi Arabian market.

- How the investment will be utilized: The investment will primarily be used for technological upgrades, bolstering Khazna's existing infrastructure and developing new, cutting-edge fintech solutions tailored to the Saudi market. Furthermore, it will facilitate significant team expansion, hiring local talent and experienced professionals to lead the Saudi operation.

- Synergies between Khazna and Silver Lake's portfolio companies: Silver Lake's vast portfolio includes companies operating within the financial technology sector. These synergies can lead to collaborative opportunities, leveraging existing technologies and expertise to accelerate Khazna's growth within Saudi Arabia.

The Allure of the Saudi Arabian Market

Khazna's focus on Saudi Arabia is driven by the country's remarkable economic growth and its ambitious Vision 2030 plan. This initiative aims to diversify the Saudi economy and significantly accelerate digital transformation across all sectors. The expanding fintech landscape in Saudi Arabia presents a massive opportunity for Khazna to leverage its innovative financial technology solutions.

- Saudi Arabia's Vision 2030 and its impact on the fintech sector: Vision 2030 actively promotes the development of the fintech sector, creating a supportive regulatory environment and fostering innovation. This creates a fertile ground for companies like Khazna to flourish.

- Size and growth potential of the Saudi Arabian fintech market: The Saudi Arabian fintech market is experiencing exponential growth, driven by a young, tech-savvy population and increasing smartphone penetration. This presents a vast untapped market for Khazna's services.

- Specific market opportunities Khazna aims to address: Khazna plans to focus on various segments, including digital payment solutions, mobile banking services, and potentially even innovative lending products tailored to the specific needs of Saudi consumers and businesses.

- Regulatory environment and its impact on Khazna's strategy: The Saudi Arabian Monetary Authority (SAMA) is actively working to create a supportive regulatory framework for fintech companies. Khazna is aligning its strategy with these regulations to ensure a smooth and compliant market entry.

Khazna's Value Proposition for the Saudi Market

Khazna brings a suite of innovative fintech solutions designed to meet the evolving needs of the Saudi market. Its value proposition hinges on providing user-friendly, secure, and reliable financial services that are culturally relevant and seamlessly integrated into the daily lives of Saudi consumers and businesses.

- Key features of Khazna's products/services: Khazna’s services will include secure mobile payment solutions, personalized financial management tools, and potentially access to investment platforms – all designed with the Saudi user experience in mind.

- Target customer segments in Saudi Arabia: Khazna aims to cater to a broad spectrum of customers, from individual consumers to small and medium-sized enterprises (SMEs), focusing on the underserved segments of the market.

- Differentiation from competitors in the Saudi market: Khazna's competitive advantage lies in its cutting-edge technology, its commitment to user experience, and its ability to adapt to the specific cultural nuances of the Saudi market.

- Localization strategy for the Saudi market (language, cultural nuances): Khazna's success relies heavily on localization. The company plans to offer its services in Arabic and ensure its products and marketing resonate with Saudi culture and values.

Challenges and Opportunities for Khazna's Saudi Expansion

While the Saudi market presents significant opportunities, Khazna also needs to navigate certain challenges. Competition is fierce, and regulatory hurdles, though increasingly supportive, still need careful attention.

- Major competitors in the Saudi fintech market: The Saudi fintech market is competitive, with both established players and emerging startups vying for market share. Khazna needs to differentiate itself effectively.

- Potential regulatory hurdles and how Khazna plans to address them: Navigating the regulatory landscape requires close collaboration with SAMA and a proactive approach to ensure compliance.

- Strategies for navigating cultural differences and building trust with Saudi customers: Understanding and respecting Saudi culture is crucial for building trust and fostering strong customer relationships. Khazna is prioritizing this through careful market research and localized strategies.

- Risk mitigation strategies for market entry: A robust risk assessment and mitigation plan is essential for navigating the complexities of a new market. Khazna's strategy includes thorough due diligence, partnerships with local experts, and careful financial planning.

Conclusion

Khazna's strategic expansion into the Saudi Arabian market, bolstered by its partnership with Silver Lake, represents a significant leap for the Dubai-based fintech company. The vast potential of the Saudi fintech sector, driven by Vision 2030 and a rapidly growing digital economy, presents a compelling opportunity for growth. Khazna's ability to leverage its technological expertise, adapt to the local market, and navigate potential challenges will determine its ultimate success in this dynamic environment.

Stay tuned for updates on Khazna's progress in the Saudi Arabian market. Follow us to learn more about this exciting venture in the world of Dubai-based fintech and its impact on the Saudi financial technology landscape.

Featured Posts

-

Getting Capital Summertime Ball 2025 Tickets Tips And Tricks

Apr 29, 2025

Getting Capital Summertime Ball 2025 Tickets Tips And Tricks

Apr 29, 2025 -

Will Pete Rose Receive A Posthumous Pardon From Trump A Look At The Evidence

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump A Look At The Evidence

Apr 29, 2025 -

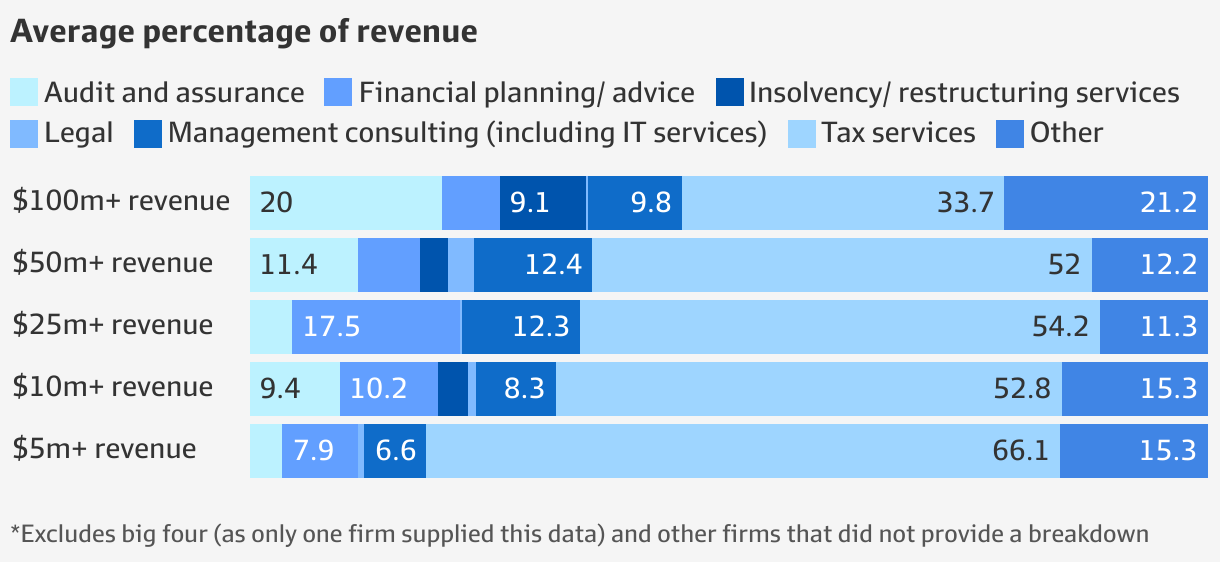

Pw Cs Global Retreat Exiting Countries Amidst Scandal Concerns

Apr 29, 2025

Pw Cs Global Retreat Exiting Countries Amidst Scandal Concerns

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 29, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 29, 2025