Dubai Holding's REIT IPO: A $584 Million Offering

Table of Contents

Details of the Dubai Holding REIT IPO

This section provides a detailed overview of the Dubai Holding REIT IPO, covering its size, valuation, and the diverse portfolio of assets under management.

Size and Valuation

The Dubai Holding REIT IPO involved a $584 million offering, representing a significant injection of capital into the Dubai real estate sector. The specific number of shares offered and the price per share were [insert specific details here if available – otherwise, remove this sentence]. The valuation of the REIT reflects the strong underlying value of its diverse portfolio of high-quality assets. This large-scale public offering is a testament to investor confidence in Dubai's robust real estate market.

Assets Under Management (AUM)

The Dubai Holding REIT boasts a diversified portfolio of prime real estate assets, including:

- Luxury Hotels: High-end hotels strategically located in prime areas of Dubai, generating significant revenue streams from accommodation and associated services. These hotels often attract high-spending tourists and corporate clients, contributing to robust occupancy rates and rental income.

- Prime Commercial Properties: A collection of Class A office buildings in central business districts, leased to reputable multinational corporations and local businesses. These properties offer consistent rental income streams and benefit from long-term lease agreements.

- Residential Developments: A range of high-quality residential properties, catering to Dubai's growing population and strong demand for upscale living. These assets benefit from the continuous growth in Dubai's residential real estate market.

- Retail Spaces: Strategically located retail spaces within thriving shopping malls and commercial centers, generating revenue from rental income and potential for future appreciation. These retail assets benefit from high foot traffic and are often anchored by prominent retailers.

This diversified portfolio mitigates risk and provides a stable foundation for generating consistent returns for investors.

Investment Highlights

Several key factors make the Dubai Holding REIT IPO an attractive investment opportunity:

- High Potential for Rental Income: The REIT's diverse portfolio of income-generating properties promises strong and consistent rental income streams.

- Diversified Portfolio Minimizing Risk: The spread of assets across different property types significantly reduces the overall risk associated with the investment.

- Growth Potential of the Dubai Real Estate Market: Dubai's dynamic economy and ongoing infrastructure development create a favorable environment for real estate investment, promising strong capital appreciation.

- Strong Management Team: Dubai Holding's proven track record and experienced management team instill confidence in the REIT's long-term performance.

Impact on the Dubai Real Estate Market

The Dubai Holding REIT IPO has had a significant impact on the Dubai real estate market, fostering increased liquidity, attracting foreign investment, and boosting overall market sentiment.

Increased Market Liquidity

The IPO injects substantial liquidity into the Dubai real estate market, facilitating easier buying and selling of properties. This improved liquidity can help stabilize prices and enhance market efficiency. The increased trading volume resulting from the REIT listing makes it easier for investors to enter and exit the market.

Foreign Investment Attraction

The IPO is expected to attract substantial foreign investment into the Dubai property sector, boosting overall growth and development. The success of this IPO demonstrates the global appeal of Dubai's real estate market and encourages further international investment. This influx of capital can further fuel the development and diversification of the Dubai real estate market.

Market Sentiment and Confidence

The successful completion of the Dubai Holding REIT IPO significantly boosts investor confidence in the Dubai real estate market. It signals the stability and growth prospects of the sector, attracting further investment and stimulating market activity. This positive sentiment reflects positively on the wider economy of Dubai and enhances its international reputation as a premier investment destination.

Investor Considerations for the Dubai Holding REIT IPO

While promising, potential investors should carefully consider the following factors before investing in the Dubai Holding REIT IPO.

Risk Assessment

As with any investment, there are inherent risks associated with the Dubai Holding REIT IPO. Market volatility, fluctuations in property values, and changes in interest rates can all affect the REIT's performance. Investors should carefully evaluate their risk tolerance before investing. Furthermore, understanding the specific risks associated with the individual assets within the REIT's portfolio is crucial.

Financial Performance Projections

[Insert projected returns and dividend payouts, if available, or remove this section if not]. Projected financial performance should be carefully examined, keeping in mind that these are only projections and actual results may vary. It is essential to review the REIT's prospectus and other relevant financial documents thoroughly.

Comparison with other REITs

Comparing the Dubai Holding REIT with other similar REITs in the region and globally is vital. This comparison will highlight its unique selling points, competitive advantages, and potential for future growth compared to similar investment opportunities. Factors such as dividend yields, expense ratios, and portfolio diversification should be considered.

Conclusion

The Dubai Holding REIT IPO, a significant $584 million offering, represents a compelling investment opportunity within the dynamic Dubai real estate market. The REIT's diverse portfolio of high-quality assets, coupled with the growth potential of the Dubai property market, presents a strong case for investment. However, potential investors should conduct thorough due diligence, carefully assess the associated risks, and possibly consult a financial advisor before making any investment decisions related to the Dubai Holding REIT IPO. Understanding the specific details of the offering, including its financial projections and risk assessment, is crucial to determine if it aligns with your investment strategy and risk tolerance. Learn more about the Dubai Holding REIT IPO and make informed investment choices.

Featured Posts

-

His And Hers Hugo Boss Big Savings During Amazons Spring 2025 Sale

May 20, 2025

His And Hers Hugo Boss Big Savings During Amazons Spring 2025 Sale

May 20, 2025 -

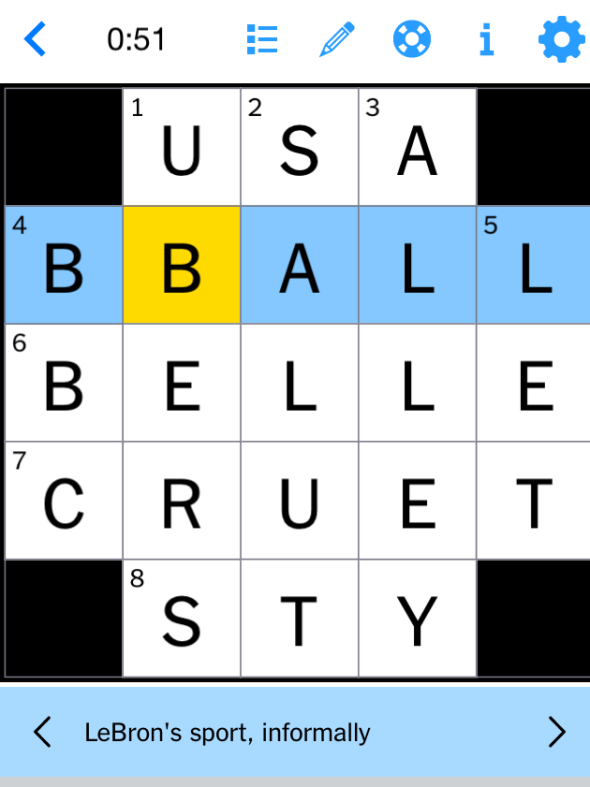

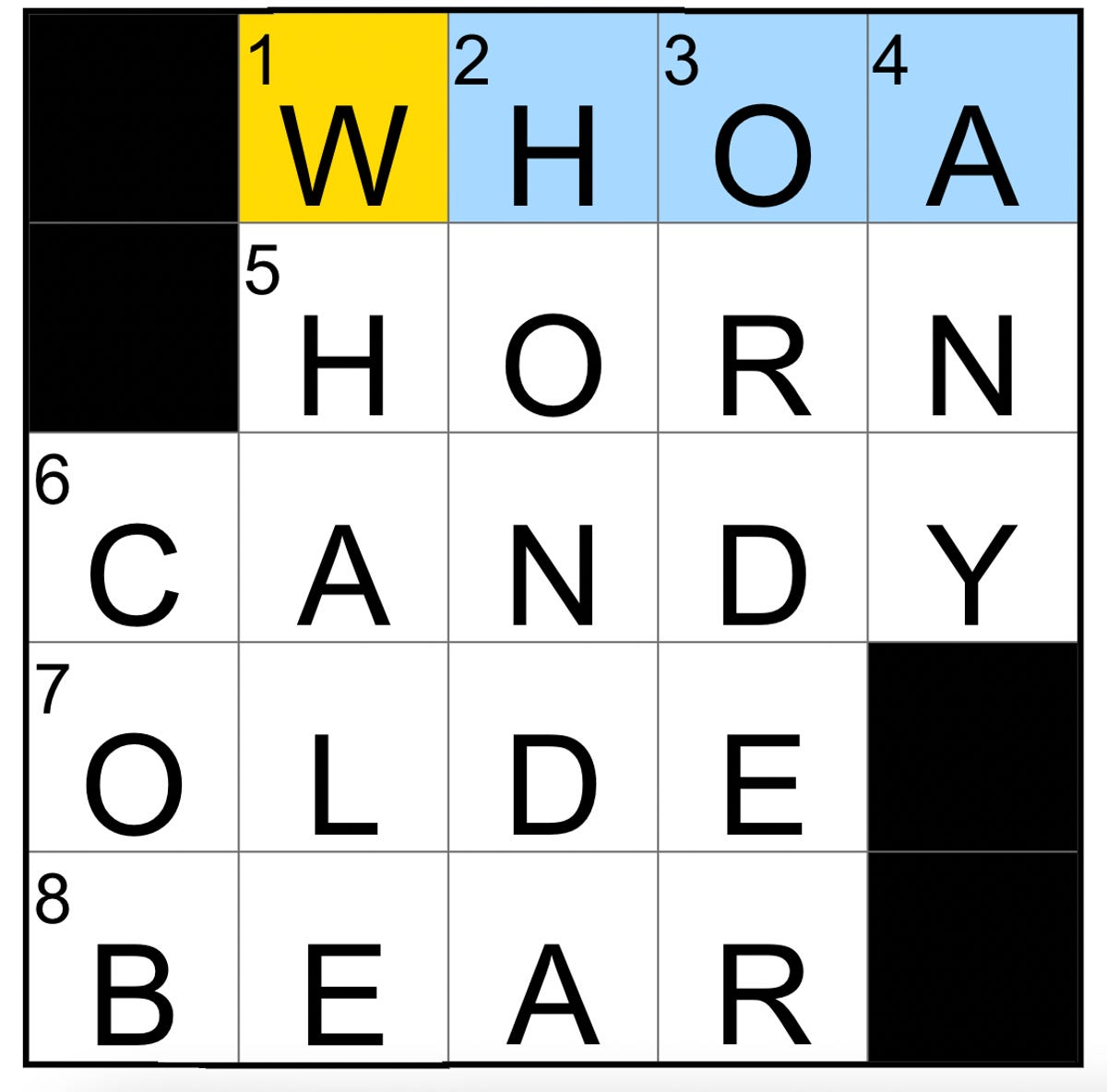

Nyt Mini Crossword Puzzle Hints April 26 2025

May 20, 2025

Nyt Mini Crossword Puzzle Hints April 26 2025

May 20, 2025 -

Acces Limite Aux 2 Et 3 Roues Sur Le Boulevard Fhb Des Le 15 Avril

May 20, 2025

Acces Limite Aux 2 Et 3 Roues Sur Le Boulevard Fhb Des Le 15 Avril

May 20, 2025 -

Uncovering The Designer Behind Suki Waterhouses Fashion Choices

May 20, 2025

Uncovering The Designer Behind Suki Waterhouses Fashion Choices

May 20, 2025 -

Jennifer Lawrence Druhe Dieta Potvrdene

May 20, 2025

Jennifer Lawrence Druhe Dieta Potvrdene

May 20, 2025

Latest Posts

-

50 Years Of Gma A Paley Center Celebration

May 20, 2025

50 Years Of Gma A Paley Center Celebration

May 20, 2025 -

Nyt Mini Crossword Puzzle Hints April 26 2025

May 20, 2025

Nyt Mini Crossword Puzzle Hints April 26 2025

May 20, 2025 -

Unlock The Nyt Mini Crossword Hints For April 26 2025

May 20, 2025

Unlock The Nyt Mini Crossword Hints For April 26 2025

May 20, 2025 -

Paley Center To Honor Gma On Its 50th Anniversary

May 20, 2025

Paley Center To Honor Gma On Its 50th Anniversary

May 20, 2025 -

April 26 2025 Nyt Mini Crossword Hints

May 20, 2025

April 26 2025 Nyt Mini Crossword Hints

May 20, 2025