DSP Raises Cash, Signals Concern Over Indian Equities

Table of Contents

DSP's Fundraising: A Closer Look

The Amount Raised and its Purpose

DSP Investment Managers recently raised a substantial sum (the exact figure needs to be inserted here, obtained from reliable financial news sources). The stated purpose of this "cash infusion" is to strengthen their position amidst prevailing market uncertainties and to capitalize on potential opportunities that may arise from market corrections.

- Sources of Funding: (Insert details on the sources of funding, e.g., private equity, debt financing, etc., if available).

- Timeline: The fundraising concluded on (Insert date if available).

This strategic move of "DSP Investment Managers fundraising" suggests a proactive approach to managing risk in the current environment, allowing them to deploy capital strategically when attractive investment opportunities emerge. The timing of the fundraising is also noteworthy, suggesting a considered response to the prevailing market dynamics.

Analyst Interpretations of DSP's Move

Financial analysts offer diverse interpretations of DSP's fundraising. While some see it as a sign of caution regarding the immediate future of Indian equities, others view it as a shrewd opportunistic move to take advantage of potential undervaluation in the market.

- Cautious Interpretation: "The fundraising suggests DSP is anticipating further market turbulence," notes Analyst X from Investment Firm Y. (Insert actual quotes from analysts whenever possible, citing the source).

- Opportunistic Interpretation: Analyst Z from Firm A counters, stating, "This is a smart move; it allows DSP to selectively invest in undervalued assets as the market corrects." (Insert actual quotes from analysts whenever possible, citing the source).

These contrasting "market analysis" perspectives underscore the complexity of interpreting DSP's actions and highlight the uncertainty prevalent within the market itself.

Concerns Regarding Indian Equities: Unpacking the Signals

Specific Concerns Highlighted by DSP

While DSP hasn't explicitly detailed all their concerns, their fundraising strongly implies apprehension regarding several factors impacting the "Indian equity market outlook."

- Inflationary Pressures: Rising inflation rates could erode corporate earnings and dampen investor sentiment.

- Interest Rate Hikes: Increased interest rates impact borrowing costs for companies, potentially slowing economic growth.

- Global Economic Slowdown: A global recession could negatively impact Indian exports and foreign investment.

- Geopolitical Risks: Global geopolitical instability can add further uncertainty to the market.

These "market risks" are not unique to India but are amplified by the country's specific economic vulnerabilities.

Comparison with Other Investment Firms' Stances

DSP's stance isn't entirely unique. Several other major investment firms have expressed similar concerns about the "Indian equity market outlook," although the degree of caution varies. Some are adopting a more defensive posture, while others maintain a more optimistic long-term view.

- (Insert names and perspectives of other major investment firms, citing their statements and reports). Comparing these diverse viewpoints gives a broader understanding of the overall "investment sentiment." This "competitive analysis" helps assess the level of consensus or divergence in the market.

Implications for Investors in Indian Equities

Potential Impact on Investment Strategies

DSP's actions and expressed concerns should influence investor strategies, particularly regarding risk management and portfolio diversification.

- Diversification: Investors should ensure adequate diversification across different asset classes to mitigate risk.

- Risk Management: A cautious approach with robust risk management strategies is essential.

- Market Reactions: The market may react negatively to further signs of caution from major investment firms.

This "investment advice" underscores the need for investors to carefully evaluate their portfolios and adjust their investment strategies accordingly.

Long-Term Outlook for Indian Equities

Despite the current uncertainties, the "long-term investment" outlook for Indian equities remains complex. While challenges persist, certain growth sectors continue to offer potential.

- Potential Growth Areas: Specific sectors like technology, renewable energy, and healthcare might offer better long-term growth prospects. (Needs specific examples and data to support this claim).

- Persistent Challenges: Inflation, interest rates, and global economic uncertainties will continue to pose significant challenges.

- Factors Affecting Long-Term Performance: Government policies, regulatory changes, and technological advancements will significantly influence "future market trends."

Understanding these factors is crucial for developing a sound "long-term investment" strategy.

Conclusion: Analyzing DSP's Move and its Impact on Indian Equities

DSP's fundraising and its implied concerns about the Indian equity market represent a significant development for investors. The move highlights prevailing uncertainties, prompting investors to adopt more cautious strategies and carefully evaluate their portfolios. The diverse perspectives among investment firms further underscore the market's complexity. Understanding "DSP raises cash, signals concern over Indian equities" is key for making informed investment decisions.

Stay updated on the latest news regarding DSP Investment Managers and the evolving landscape of Indian equities. Learn more about navigating the complexities of the Indian equity market and develop a robust investment strategy.

Featured Posts

-

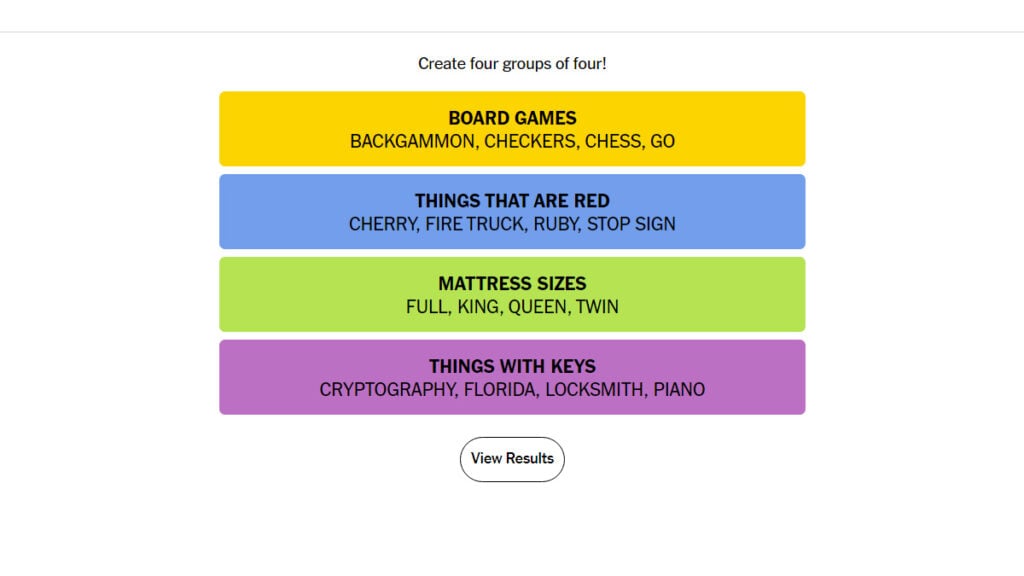

Nyt Strands Hints And Answers Tuesday April 29 Game 422

Apr 29, 2025

Nyt Strands Hints And Answers Tuesday April 29 Game 422

Apr 29, 2025 -

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 29, 2025

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 29, 2025 -

Massive 20 000 Strong March Demands Transgender Rights

Apr 29, 2025

Massive 20 000 Strong March Demands Transgender Rights

Apr 29, 2025 -

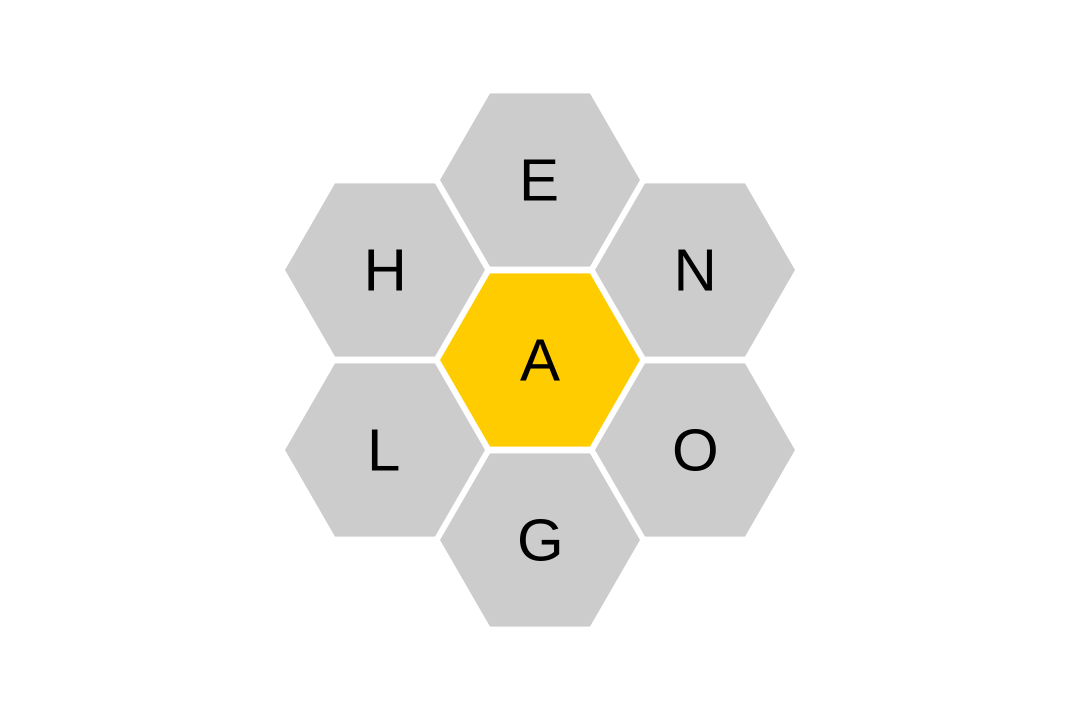

Nyt Spelling Bee February 10 2025 Clues Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee February 10 2025 Clues Answers And Pangram

Apr 29, 2025 -

Abstiegskampf Bundesliga Klagenfurt Und Die Suche Nach Einem Neuen Trainer

Apr 29, 2025

Abstiegskampf Bundesliga Klagenfurt Und Die Suche Nach Einem Neuen Trainer

Apr 29, 2025