DSP India Fund: Cautious Outlook, Increased Cash Reserves

Cautious Outlook for the Indian Equity Market

The DSP India Fund's cautious outlook stems from a confluence of factors impacting the Indian equity market. Market volatility is at elevated levels, driven by several key concerns:

-

Rising Inflation and Interest Rates: Persistent inflationary pressures are forcing central banks, including the Reserve Bank of India, to raise interest rates. This increases borrowing costs for businesses, potentially hindering economic growth and impacting corporate profitability. Higher interest rates also make bonds a more attractive alternative to equities for some investors.

-

Geopolitical Uncertainties: The ongoing geopolitical landscape, particularly the Russia-Ukraine conflict, presents significant risks to the global economy and, consequently, to India. Supply chain disruptions, energy price volatility, and potential spillover effects on trade relations all contribute to the uncertain outlook.

-

Potential Economic Slowdown: Concerns are growing about a potential slowdown in both global and domestic economic growth. Weakening global demand could impact India's export-oriented sectors, while domestic consumption could also be affected by rising prices and reduced consumer confidence.

-

Valuation Concerns: Certain sectors within the Indian market are perceived to be overvalued relative to their fundamentals. This necessitates a selective approach to investment, favoring companies with strong earnings visibility and robust balance sheets. Analysts are expressing cautious views on certain high-growth tech stocks, for example, citing overvaluation concerns.

Increased Cash Reserves: A Defensive Strategy

The DSP India Fund's decision to increase its cash reserves is a strategic move designed to mitigate risk and enhance downside protection in this volatile market environment. This defensive investment strategy offers several key advantages:

-

Reduced Exposure to Market Downturns: Holding higher cash reserves significantly reduces the fund's exposure to potential market declines. This acts as a buffer against losses during periods of heightened uncertainty.

-

Ability to Capitalize on Buying Opportunities: Increased cash provides the fund with the flexibility to capitalize on potential buying opportunities that may arise as a result of market corrections. This allows the fund manager to strategically deploy capital when valuations become more attractive.

-

Enhanced Portfolio Liquidity: A larger cash position improves the overall liquidity of the portfolio, enabling the fund to meet redemption requests efficiently without compromising its investment strategy.

-

Improved Risk-Adjusted Returns in the Long Term: While short-term returns might be slightly lower due to the higher cash allocation, a more conservative approach can ultimately lead to improved risk-adjusted returns over the long term by limiting potential losses during market downturns. The fund aims to balance risk and reward, focusing on long-term value creation. While the exact percentage increase in cash reserves is proprietary information, the fund manager has publicly stated a significant shift towards a more conservative approach.

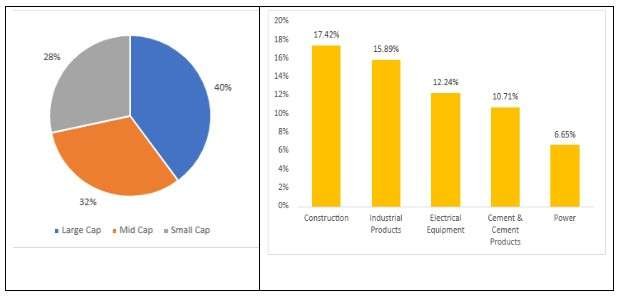

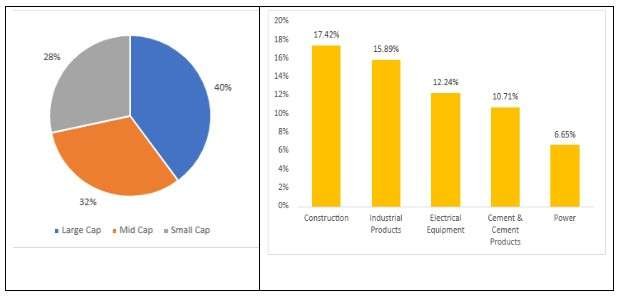

DSP India Fund's Investment Strategy and Portfolio Allocation

The DSP India Fund employs a fundamental, bottom-up investment approach, focusing on identifying high-quality companies with strong long-term growth potential. However, the current market conditions have led to adjustments in the fund's portfolio allocation:

-

Sector Allocation: The fund has increased its weighting in more defensive sectors, such as consumer staples and pharmaceuticals, which are typically less sensitive to economic cycles. This strategic shift aims to reduce overall portfolio volatility.

-

Top Holdings and Performance: While specific details about top holdings are available through official fund disclosures, the overall portfolio strategy reflects a focus on quality companies with a proven track record of delivering consistent earnings.

-

Stock Selection: The fund manager's stock selection process remains rigorous, emphasizing thorough due diligence and a focus on companies with sustainable competitive advantages.

-

Changes in Investment Strategy: Compared to previous periods, the fund's investment strategy reflects a significant shift towards a more cautious approach, prioritizing capital preservation and risk mitigation.

Impact on Investors and Potential Returns

The DSP India Fund's cautious strategy might lead to lower short-term returns compared to a more aggressively positioned fund. However, this approach is designed to protect capital and reduce the potential for significant losses during periods of market volatility. Investors should carefully consider their risk tolerance and investment time horizon before investing in this fund. Long-term investors with a higher risk tolerance might find the reduced volatility appealing, while those seeking short-term gains might find the strategy less attractive.

Conclusion

The DSP India Fund's cautious outlook, coupled with the increase in cash reserves, reflects a prudent response to the current uncertainties in the Indian equity market. This strategic shift prioritizes capital preservation and downside protection while maintaining a long-term focus on value creation. The adjustments to the portfolio allocation and investment strategy demonstrate the fund manager's commitment to adapting to evolving market conditions.

For a deeper understanding of the DSP India Fund's cautious approach and its implications for your investment portfolio, visit [link to fund information]. Considering the cautious outlook on the Indian market, carefully evaluate your risk tolerance before investing in the DSP India Fund. Learn more at [link].

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzioja

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzioja

Nyt Strands Solutions Hints And Answers For March 3 2025

Nyt Strands Solutions Hints And Answers For March 3 2025

Nyt Spelling Bee Answers For February 28 2025

Nyt Spelling Bee Answers For February 28 2025

Hungarys Stance Resisting Us Pressure On China Economic Links

Hungarys Stance Resisting Us Pressure On China Economic Links

Navigating The Chinese Market The Case Of Bmw And Porsche

Navigating The Chinese Market The Case Of Bmw And Porsche