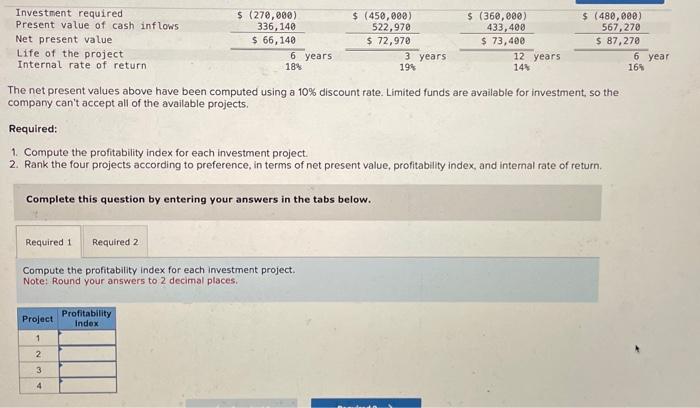

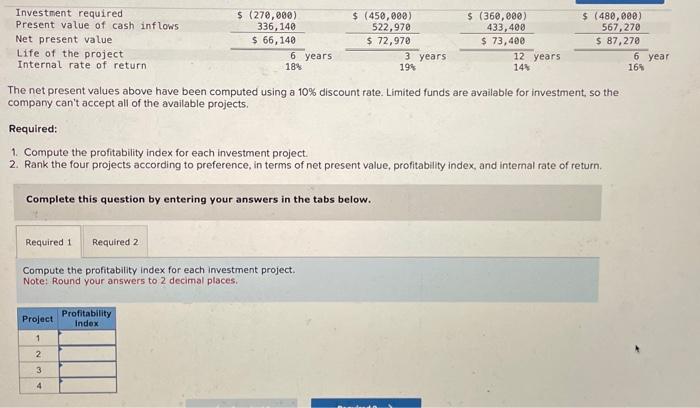

Dragon's Den: Little Coffee's Four Investment Offers

Table of Contents

Investment Offer #1: The Cautious Approach

Investment Amount & Equity Offered:

The first offer proposed a £100,000 investment in exchange for 10% equity in Little Coffee. This represented a relatively small stake for the investors, suggesting a cautious approach to risk.

Strengths & Weaknesses:

- Strengths:

- Lower equity loss for Little Coffee, maintaining greater control.

- Stable funding for immediate needs and manageable growth.

- Reduced risk for both Little Coffee and the investors.

- Weaknesses:

- Slower growth potential compared to other offers.

- Limited expansion opportunities due to lower capital injection.

- May hinder the company's ability to compete aggressively in a rapidly expanding market.

Potential Long-Term Impact:

Accepting this offer would provide Little Coffee with a steady, secure path forward. However, it might prevent them from capitalizing on rapid market growth or outpacing competitors with more ambitious funding. Long-term market share could be impacted.

Investment Offer #2: The Aggressive Expansion

Investment Amount & Equity Offered:

The second offer was significantly larger – a £500,000 investment in exchange for 30% equity. This reflected a much more aggressive investment strategy focused on rapid expansion.

Strengths & Weaknesses:

- Strengths:

- Significant capital injection for rapid expansion into new markets.

- Potential for substantial market share gains through aggressive marketing and distribution.

- Faster growth and increased brand visibility.

- Weaknesses:

- Higher equity loss for Little Coffee, potentially diluting the founders' ownership.

- Increased financial risk due to the significant investment.

- Potential for faster growth to outpace the company's ability to manage efficiently.

Potential Long-Term Impact:

This high-risk, high-reward strategy could propel Little Coffee to market leadership but also carries the risk of significant financial losses if expansion isn't managed effectively. The long-term success hinges on the company's ability to execute its expansion plan flawlessly.

Investment Offer #3: The Strategic Partnership

Investment Amount & Equity Offered:

This offer involved a £250,000 investment for 20% equity, but the key differentiator was the inclusion of a strategic partnership with a major coffee distributor.

Strengths & Weaknesses:

- Strengths:

- Access to established distribution networks and wider market reach.

- Expertise and guidance from a seasoned industry partner.

- Potential for enhanced brand credibility and wider consumer base.

- Weaknesses:

- Potential loss of control over certain aspects of the business.

- Compromise on brand identity or marketing strategies to align with the partner.

- Potential for conflicts of interest between Little Coffee and its partner.

Potential Long-Term Impact:

The strategic partnership offers significant advantages in terms of market access and expertise. However, Little Coffee needs to carefully weigh the potential loss of autonomy and control against the benefits of a strong partnership.

Investment Offer #4: The Wildcard

Investment Amount & Equity Offered:

The fourth offer was unique, proposing a £300,000 investment for 25% equity with a strong focus on innovative marketing and sustainability initiatives.

Strengths & Weaknesses:

- Strengths:

- Innovative approach aligned with Little Coffee's ethos of sustainability.

- High growth potential due to cutting-edge marketing strategies.

- Opportunity to set new industry standards in ethical and sustainable coffee production.

- Weaknesses:

- High risk due to the innovative and untested nature of the proposed marketing campaign.

- Uncertain return on investment, as the success depends on the novel marketing strategy.

- Potential for misalignment with Little Coffee’s long-term goals if the innovative approach fails to deliver.

Potential Long-Term Impact:

This offer presents a significant gamble, but with the potential for exceptional returns if the innovative approach proves successful. It is a high-risk, high-reward option that aligns with Little Coffee's values.

Conclusion:

Little Coffee faced a crucial decision in the Dragon's Den, weighing the pros and cons of four very different investment offers. Each offer presented unique advantages and disadvantages, requiring careful consideration of short-term gains versus long-term growth potential and risk tolerance. While the aggressive expansion offer promised rapid growth, it also entailed considerable equity loss. The strategic partnership offered valuable expertise but could compromise control. The cautious approach provided stability but limited growth. The wildcard presented an innovative yet uncertain path. Ultimately, the "best" choice depends on Little Coffee’s risk appetite and long-term vision. What would you have done in Little Coffee's position on Dragon's Den? Discuss your thoughts on Little Coffee's Dragon's Den investment offers below!

Featured Posts

-

Airbnb Domestic Searches Surge 20 As Canadians Shun Us Travel

May 01, 2025

Airbnb Domestic Searches Surge 20 As Canadians Shun Us Travel

May 01, 2025 -

Il Caso Becciu Riflessioni Sulle Preghiere E Le Speculazioni Sulle Dimissioni

May 01, 2025

Il Caso Becciu Riflessioni Sulle Preghiere E Le Speculazioni Sulle Dimissioni

May 01, 2025 -

Becciu Rinvio Processo 8xmille Per Il Fratello

May 01, 2025

Becciu Rinvio Processo 8xmille Per Il Fratello

May 01, 2025 -

Tweet Controversy Police Leader Under Investigation For Remarks On Chris Rock

May 01, 2025

Tweet Controversy Police Leader Under Investigation For Remarks On Chris Rock

May 01, 2025 -

Did Targets Reduced Dei Efforts Backfire Examining The Boycott And Sales Decline

May 01, 2025

Did Targets Reduced Dei Efforts Backfire Examining The Boycott And Sales Decline

May 01, 2025