Dragon Den Showdown: Entrepreneur Snubs Two Investors For Risky Deal

Table of Contents

The Entrepreneur and Their Bold Venture

Sarah Chen, a former software engineer with a decade of experience at a leading tech firm, had poured her heart and soul into "Synapse," her revolutionary AI-powered personalized learning platform. Synapse uses advanced algorithms to tailor educational content to individual student needs, promising to disrupt the traditional education market. This innovative startup boasts high-growth potential, targeting the multi-billion dollar EdTech sector.

- Product/Service: Synapse, an AI-driven personalized learning platform providing customized educational content across various subjects.

- Target Market: Students aged 8-18, educators, and homeschooling families. Market size estimated at $340 billion (global).

- Unique Selling Proposition (USP): Hyper-personalized learning paths, real-time progress tracking, and adaptive assessments leading to superior learning outcomes.

- Key Challenges/Opportunities: Securing funding, scaling the platform to handle massive user growth, and navigating competitive market dynamics.

The Dragon Den Offers: A Tale of Two Deals

Two Dragons extended offers to Sarah. Mr. Tanaka, known for his conservative investments, offered $500,000 for a 20% equity stake, with strict milestones and a detailed exit strategy. Ms. Davies, a more aggressive investor, countered with $750,000 for a 30% equity stake, emphasizing rapid scaling and aggressive marketing.

- Investor 1 (Mr. Tanaka): $500,000 for 20% equity, requiring quarterly performance reports and a clear path to acquisition within five years.

- Investor 2 (Ms. Davies): $750,000 for 30% equity, prioritizing rapid user acquisition and market penetration.

- Reasons for Rejection: Sarah felt both offers undervalued Synapse's long-term potential and limited her control over the company's strategic direction. The terms were perceived as overly restrictive.

Why the Entrepreneur Rejected the "Safe" Options

Sarah's rejection wasn't impulsive. She understood the risk, but her long-term vision outweighed the perceived safety of the established investors’ offers. She valued retaining control and maintaining the flexibility to adapt to market changes. Giving up a significant equity stake now might severely limit future growth and potential returns.

- Specific Reasons: Both offers demanded too much equity for the investment amount, restricting future fundraising rounds. The milestones were deemed too stringent, hindering innovation.

- Long-Term Goals: Sarah envisioned Synapse as a global leader in personalized education, requiring significant capital investment and strategic partnerships.

- Drawbacks of Safer Offers: Loss of significant equity, restrictive operational control, and limited potential for exponential growth.

The Risky Deal: A Gamble for Greater Rewards

Instead, Sarah accepted a riskier, high-risk, high-reward deal from a venture capital firm, "NovaCap." NovaCap offered $1 million in seed funding for a 15% equity stake, coupled with valuable mentorship and strategic guidance. This deal carries substantial risk, but it offers the capital and support needed for rapid expansion.

- Details of the Risky Deal: $1 million in seed funding for 15% equity, access to NovaCap's network of mentors and advisors, and strategic partnership opportunities.

- Potential Benefits: Significant funding for platform development, marketing, and team expansion, access to expert guidance, and potential for faster scaling and higher valuations.

- Level of Risk: Higher risk due to the substantial equity stake given away, dependence on NovaCap's support, and the inherent challenges of a fast-growing startup. However, Sarah believes the mitigation strategies in place are sufficient.

Conclusion

This Dragon Den showdown was a masterclass in entrepreneurial risk-taking. Sarah Chen’s bold decision to reject seemingly safe offers in favor of a riskier deal highlights the importance of vision, strategic thinking, and understanding one's risk tolerance. Her gamble may not pay off, but the potential rewards are immense. This Dragon's Den decision underscores that long-term vision and control can be as valuable as immediate funding.

What do you think? Would you have made the same choice in a Dragon Den showdown? Share your thoughts on this risky business decision and let’s discuss entrepreneurial risk-taking in the comments below. Want to learn more about securing funding for your startup? Check out our guide on [link to related article].

Featured Posts

-

Enexis Laadpaal Optimaal Gebruik Buiten Piekuren In Noord Nederland

May 01, 2025

Enexis Laadpaal Optimaal Gebruik Buiten Piekuren In Noord Nederland

May 01, 2025 -

Claudia Sheinbaum Y Julio Cesar Clase Nacional De Boxeo 2025

May 01, 2025

Claudia Sheinbaum Y Julio Cesar Clase Nacional De Boxeo 2025

May 01, 2025 -

Xrp On The Brink Analyzing The Impact Of Etf Applications And Sec Actions

May 01, 2025

Xrp On The Brink Analyzing The Impact Of Etf Applications And Sec Actions

May 01, 2025 -

Baitulmal Sarawak Salurkan Bantuan Rm 36 45 Juta Kepada Asnaf Mac 2025

May 01, 2025

Baitulmal Sarawak Salurkan Bantuan Rm 36 45 Juta Kepada Asnaf Mac 2025

May 01, 2025 -

Dallas Tv Stars Death A Tribute To An 80s Icon

May 01, 2025

Dallas Tv Stars Death A Tribute To An 80s Icon

May 01, 2025

Latest Posts

-

Play Station Network Hesabi Olusturma Ve Giris

May 02, 2025

Play Station Network Hesabi Olusturma Ve Giris

May 02, 2025 -

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025 -

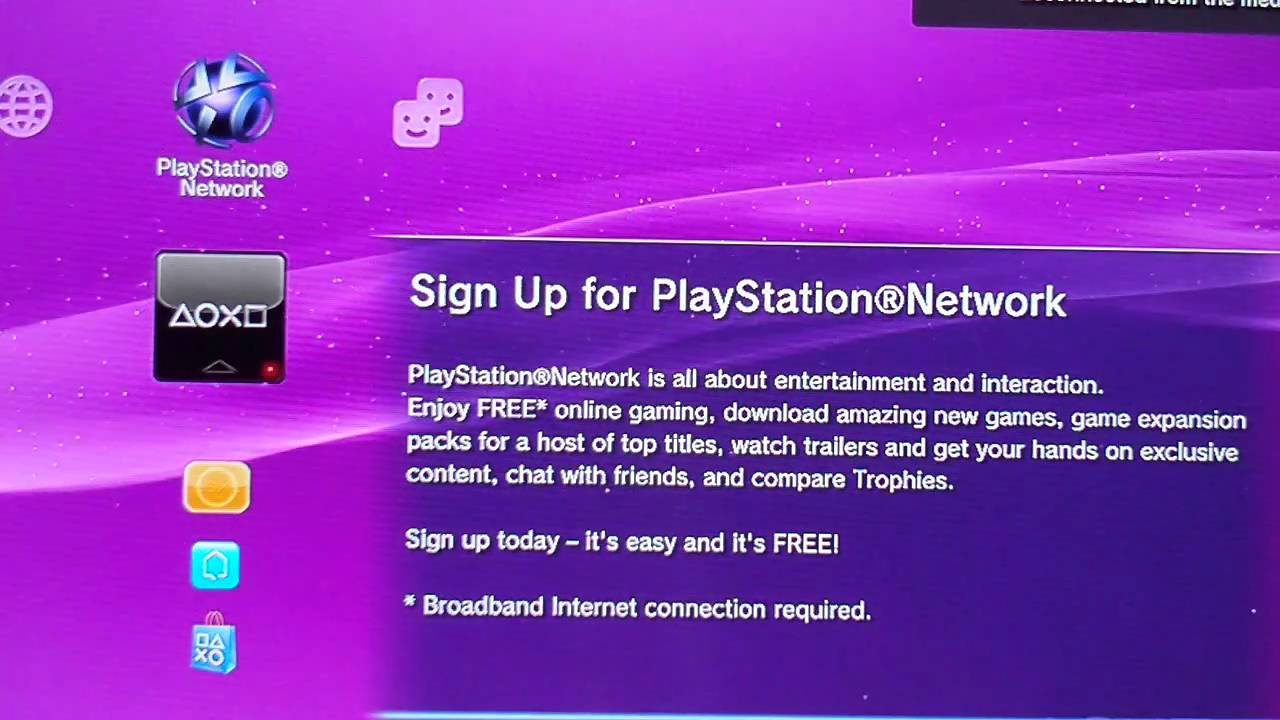

Sonys Ps 5 Update A Blast From The Past With Retro Console Themes

May 02, 2025

Sonys Ps 5 Update A Blast From The Past With Retro Console Themes

May 02, 2025 -

Play Station Network Nedir Ve Nasil Giris Yapilir

May 02, 2025

Play Station Network Nedir Ve Nasil Giris Yapilir

May 02, 2025 -

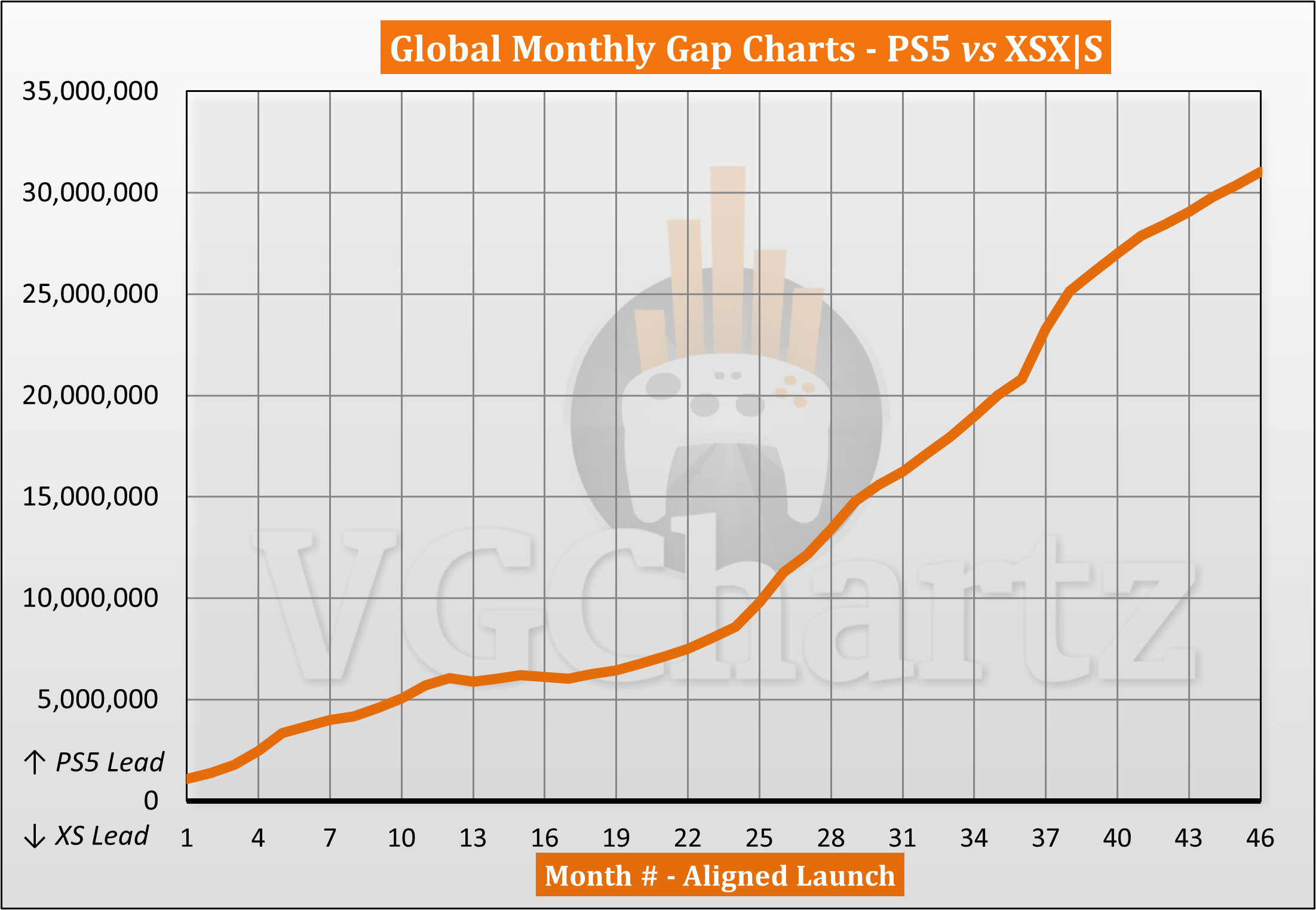

Ps 5 Or Xbox Series X S Examining Us Sales To Find The Winner

May 02, 2025

Ps 5 Or Xbox Series X S Examining Us Sales To Find The Winner

May 02, 2025