Dow Jones, S&P 500, And Nasdaq: Live Stock Market Updates For May 5th

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 5th

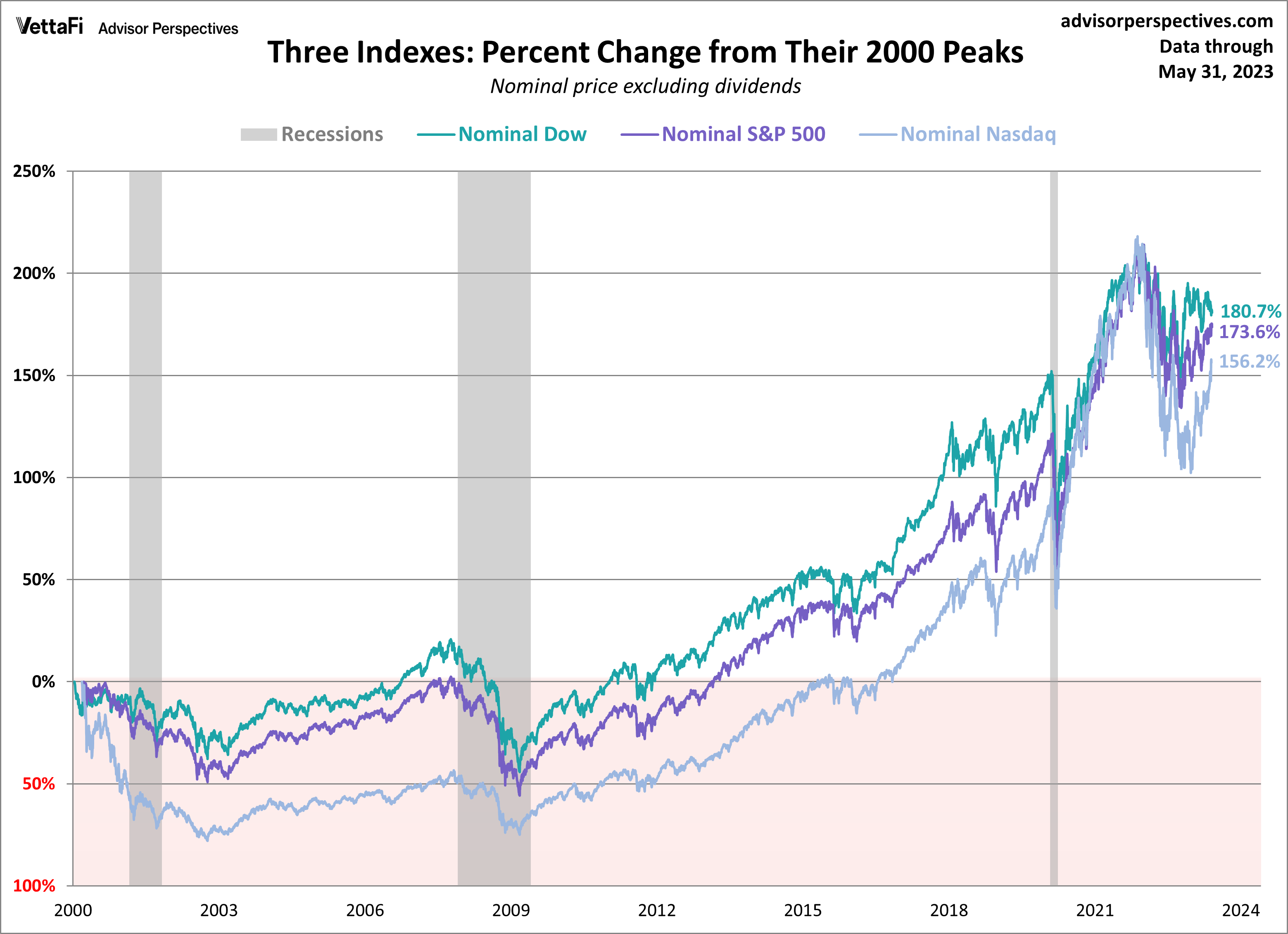

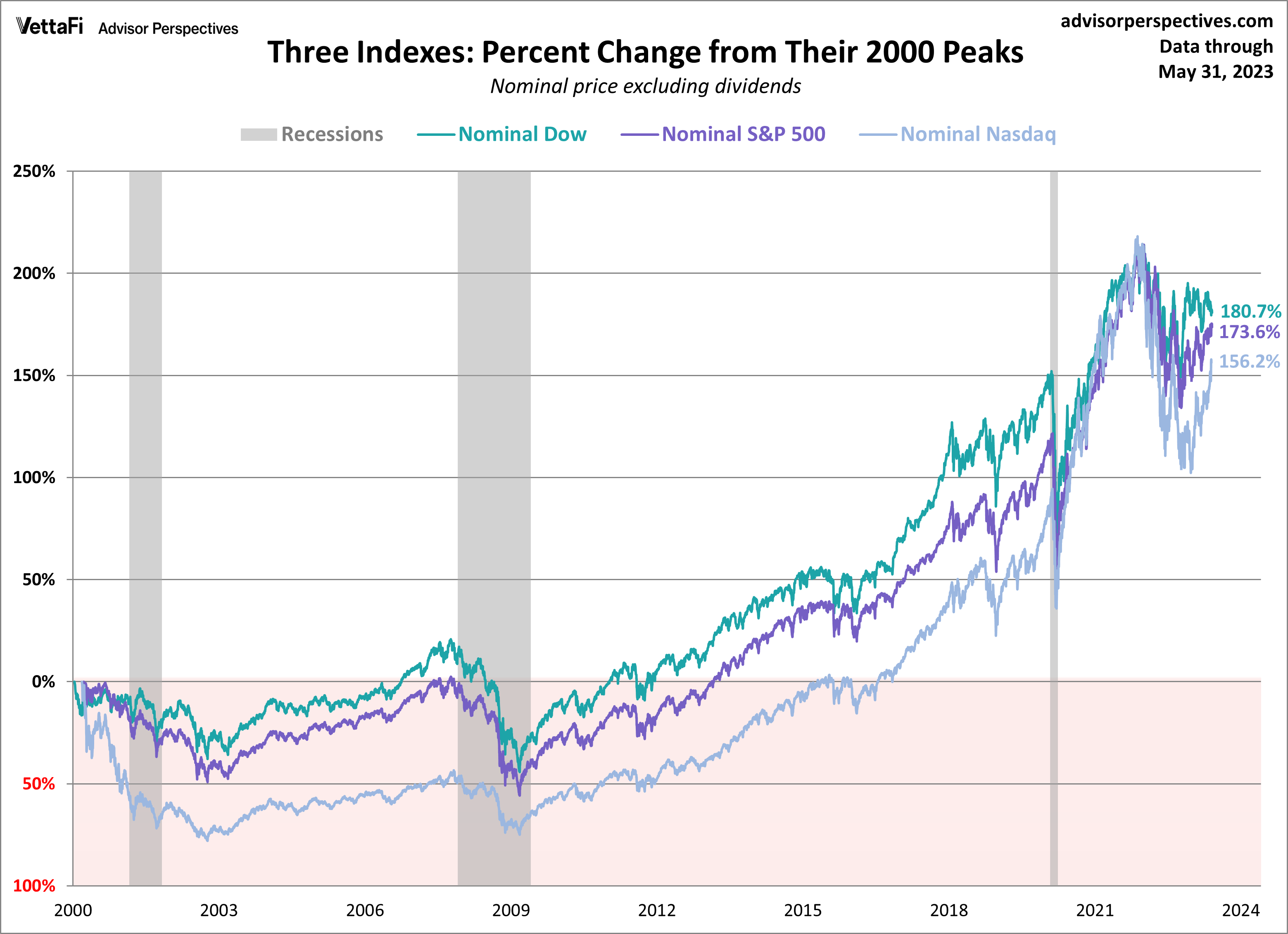

The Dow Jones Industrial Average (DJIA) experienced a moderate decline on May 5th, closing at 33,890. This represents a 0.7% decrease from the previous day's closing value. This downward trend, while not dramatic, underscores the ongoing volatility in the market.

Key Factors Influencing the DJIA

Several factors contributed to the DJIA's movement on May 5th:

- Interest Rate Hike Concerns: Ongoing speculation about further interest rate hikes by the Federal Reserve created uncertainty among investors, leading to profit-taking and a cautious approach to equity investments. This impacted the Dow Jones trading activity significantly.

- Inflation Report Release: The release of the latest inflation report, showing a slight increase in core inflation, further fueled concerns about the Fed's monetary policy and its potential impact on Dow Jones index performance.

- Tech Sector Weakness: A decline in the performance of several major technology companies listed in the DJIA contributed to the overall negative movement, influencing Dow Jones movements.

- Geopolitical Uncertainty: Ongoing geopolitical tensions in Eastern Europe added to the general market uncertainty, impacting Dow Jones trading and market volatility.

These factors highlight the interconnectedness of global events and their influence on Dow Jones performance. Understanding these nuances is key to navigating market volatility.

Sector-Specific Analysis of DJIA Movement

The energy sector experienced a slight gain, largely driven by rising oil prices. Conversely, the technology and financial sectors underperformed, contributing significantly to the overall DJIA decline. This sector performance underscores the need for a diversified investment strategy, especially during periods of market instability. Analyzing DJIA sector analysis is crucial for investors seeking sector-specific insights.

S&P 500 Index Performance on May 5th

The S&P 500 index mirrored the Dow Jones's trend on May 5th, closing slightly lower than the previous day. The index finished down 0.6%, reflecting a broad market correction.

Key Drivers of S&P 500 Movement

The S&P 500 movement was influenced by similar factors impacting the DJIA:

- Interest Rate Expectations: Similar to the Dow Jones, concerns over future interest rate hikes significantly impacted S&P 500 trading and overall market sentiment.

- Inflationary Pressures: Persistent inflationary pressures weighed on investor confidence, leading to a sell-off in certain sectors within the S&P 500 index. Understanding S&P 500 performance requires close monitoring of macroeconomic indicators.

- Earnings Season Impact: The ongoing earnings season created some volatility, as individual company performances influenced market trends. S&P 500 performance is directly affected by the collective success of its component companies.

These factors show the complex interplay of economic indicators and their influence on S&P 500 performance.

Broad Market Trends Reflected in the S&P 500

The S&P 500's performance on May 5th indicated a broader market trend of caution and risk aversion among investors. The slight downturn reflects a consolidation phase, with investors awaiting further clarity on economic data and the direction of monetary policy. Monitoring market trends is essential for navigating market fluctuations.

Nasdaq Composite Index Performance on May 5th

The Nasdaq Composite, heavily weighted towards technology stocks, experienced a more significant decline on May 5th than the Dow Jones or S&P 500, closing down 1.2%.

Technology Sector Dominance and its Impact on Nasdaq

The technology sector's underperformance played a major role in the Nasdaq's negative movement. Concerns about the future growth prospects of some leading tech companies, coupled with rising interest rates, negatively impacted investor sentiment towards tech stocks and Nasdaq technology stocks. Understanding the Nasdaq Composite index requires a close focus on the performance of its core technology constituents.

Growth Stock Performance and its Correlation to Nasdaq Movement

Growth stocks, which are often heavily represented in the Nasdaq, were particularly affected by the rising interest rate environment. Higher interest rates generally reduce the present value of future earnings, making growth stocks less attractive to investors. The correlation between growth stock performance and Nasdaq movement is consistently high.

Conclusion

May 5th saw a mixed performance across major US indices, with the Dow Jones, S&P 500, and Nasdaq all experiencing declines driven largely by interest rate concerns, inflation worries, and sector-specific weakness. The technology sector's underperformance significantly impacted the Nasdaq, highlighting the importance of diverse investment strategies. Regularly monitoring live stock market updates is crucial for staying informed and making well-informed investment decisions. Return to our site for future live stock market updates and subscribe to receive daily market reports for timely and accurate daily stock market updates and real-time stock market updates.

Featured Posts

-

Trump Meeting Strategies A Guide To Winning And Losing Scenarios

May 06, 2025

Trump Meeting Strategies A Guide To Winning And Losing Scenarios

May 06, 2025 -

Gigabyte Aorus Master 16 Review Powerful Graphics Loud Fans A Deep Dive

May 06, 2025

Gigabyte Aorus Master 16 Review Powerful Graphics Loud Fans A Deep Dive

May 06, 2025 -

Podcast Creation How Ai Processes Scatological Documents For Engaging Audio Content

May 06, 2025

Podcast Creation How Ai Processes Scatological Documents For Engaging Audio Content

May 06, 2025 -

Where To Watch Celtics Vs Knicks Live Stream Tv Broadcast Details

May 06, 2025

Where To Watch Celtics Vs Knicks Live Stream Tv Broadcast Details

May 06, 2025 -

Review Shotgun Cop Man A Unique Platforming Experience

May 06, 2025

Review Shotgun Cop Man A Unique Platforming Experience

May 06, 2025

Latest Posts

-

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025 -

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025 -

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025