Dow Jones Gains Momentum: PMI Surpasses Expectations, Fueling Steady Growth

Table of Contents

Strong PMI Data Fuels Market Optimism

Understanding the PMI and its Significance

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. It provides a snapshot of the current business climate and offers valuable insights into the overall health of the economy. The PMI is calculated using a survey of purchasing managers, who provide data on various key metrics.

- Definition of PMI: A monthly diffusion index that measures the rate of change in business activity. A reading above 50 indicates expansion, while a reading below 50 suggests contraction.

- Explanation of its calculation: The PMI is calculated by aggregating responses from purchasing managers regarding new orders, production, employment, supplier deliveries, and inventory levels.

- Historical context of PMI data: Historical PMI data can be used to predict economic trends and assess the effectiveness of government policies. Long-term trends reveal cyclical patterns in business activity.

- Correlation with economic growth: A strong positive correlation exists between PMI readings and GDP growth; high PMI readings generally precede periods of strong economic expansion.

The August PMI reading of 55.1 significantly exceeded the projected 52.0, indicating strong expansion in the manufacturing and services sectors. This robust figure far outpaced expectations and injected a wave of optimism into the market.

Market Reaction to Positive PMI Data

The unexpectedly strong PMI data translated directly into increased investor confidence and buying pressure. This positive sentiment propelled the Dow Jones upward, demonstrating a clear correlation between the PMI and stock market performance.

- Increased trading volume: The PMI release triggered a noticeable surge in trading activity as investors reacted to the positive news.

- Rise in stock prices across sectors: The positive sentiment wasn't confined to specific sectors; a broad-based rally pushed many stocks higher. Technology stocks, particularly, saw significant gains.

- Specific examples: Companies like Apple and Microsoft, major components of the Dow Jones, saw their stock prices increase significantly following the PMI release.

- Dow Jones Performance: The Dow Jones experienced a 1.5% increase in the days following the PMI announcement, highlighting the index's sensitivity to this key economic indicator.

Other Contributing Factors to Dow Jones Growth

Positive Corporate Earnings Reports

Robust corporate earnings reports from major companies further contributed to the positive market sentiment and the Dow Jones's upward trajectory. Strong profits demonstrate business health and investor confidence in future growth.

- Examples of strong earnings: Several major companies in the technology, consumer goods, and industrial sectors reported exceeding expectations, boosting investor confidence.

- Industry trends: The growth in e-commerce and the continued recovery in travel and hospitality contributed to profits in relevant sectors.

Easing Inflation Concerns

While inflation remains a concern, recent data suggests a potential slowing of the pace of price increases. This easing of inflationary pressures has boosted investor sentiment.

- Recent inflation data points: The latest inflation figures showed a slight decrease compared to previous months, offering a glimmer of hope for market stability.

- Fed policy expectations: The market is anticipating a more measured approach from the Federal Reserve regarding interest rate hikes, influenced by the moderating inflation.

- Inflation, interest rates, and stock market performance: Lower inflation generally leads to lower interest rates, making borrowing cheaper for businesses and increasing investor appetite for stocks.

Geopolitical Stability (or lack thereof)

Geopolitical factors can significantly impact market sentiment. Currently, while certain geopolitical tensions persist, their immediate impact on the Dow Jones appears relatively muted.

- Specific geopolitical events: The ongoing situation in Ukraine continues to be monitored, but its direct impact on the immediate market seems limited.

- Investor responses: Investors are carefully assessing the evolving geopolitical landscape and adjusting their portfolios accordingly.

Potential Challenges and Future Outlook for the Dow Jones

Persisting Inflationary Pressures

While inflation shows signs of easing, lingering inflationary pressures could pose a significant risk to the market's continued growth.

- Scenarios of potential future inflation: Persistent supply chain disruptions or unexpected energy price spikes could reignite inflation, negatively impacting the stock market.

- Possible Fed responses: The Federal Reserve might adjust its monetary policy if inflation remains stubbornly high, impacting interest rates and potentially triggering a market correction.

Geopolitical Uncertainty

Geopolitical uncertainty remains a wildcard that could negatively impact the Dow Jones's performance.

- Ongoing geopolitical concerns: Escalation of existing conflicts or the emergence of new geopolitical tensions could negatively affect investor confidence.

Potential for a Market Correction

Despite the current positive momentum, the potential for a market correction always exists.

- Historical precedents: Market corrections are a natural part of the market cycle and have occurred historically.

- Technical indicators: Technical indicators, such as overbought conditions in certain sectors, might suggest a potential pullback.

- Investor risk tolerance: Changes in investor risk appetite could trigger a correction as investors move to less risky assets.

Conclusion

The Dow Jones's recent gains are significantly linked to a robust PMI that surpassed expectations, signaling strong economic growth. This positive momentum is further supported by positive corporate earnings, easing inflation concerns (to a degree), and (relatively) stable geopolitical conditions. However, potential challenges remain, including lingering inflation and ongoing geopolitical uncertainty. The interplay between the Dow Jones, PMI, and other economic factors is complex and requires constant monitoring.

Call to Action: Stay informed about the Dow Jones's performance and the latest economic indicators, including the PMI, to make informed investment decisions. Understanding the interplay between the Dow Jones, PMI, and other key economic factors is crucial for navigating the complexities of the stock market and capitalizing on future opportunities presented by Dow Jones movements. Continue monitoring the Dow Jones and its reaction to PMI releases for valuable insights into future market trends.

Featured Posts

-

Brezhnev Ryazanov I Garazh Kak Satira Oboshla Plenum

May 25, 2025

Brezhnev Ryazanov I Garazh Kak Satira Oboshla Plenum

May 25, 2025 -

Kyle Walker Party Pictures Explained Amidst Annie Kilners Trip Home

May 25, 2025

Kyle Walker Party Pictures Explained Amidst Annie Kilners Trip Home

May 25, 2025 -

Country Living Your Escape To The Country Starts Here

May 25, 2025

Country Living Your Escape To The Country Starts Here

May 25, 2025 -

Importanza Dei Dazi Sulle Importazioni Di Moda Negli Usa

May 25, 2025

Importanza Dei Dazi Sulle Importazioni Di Moda Negli Usa

May 25, 2025 -

Kyle Walker And Annie Kilner A New Ring Sparks Engagement Speculation

May 25, 2025

Kyle Walker And Annie Kilner A New Ring Sparks Engagement Speculation

May 25, 2025

Latest Posts

-

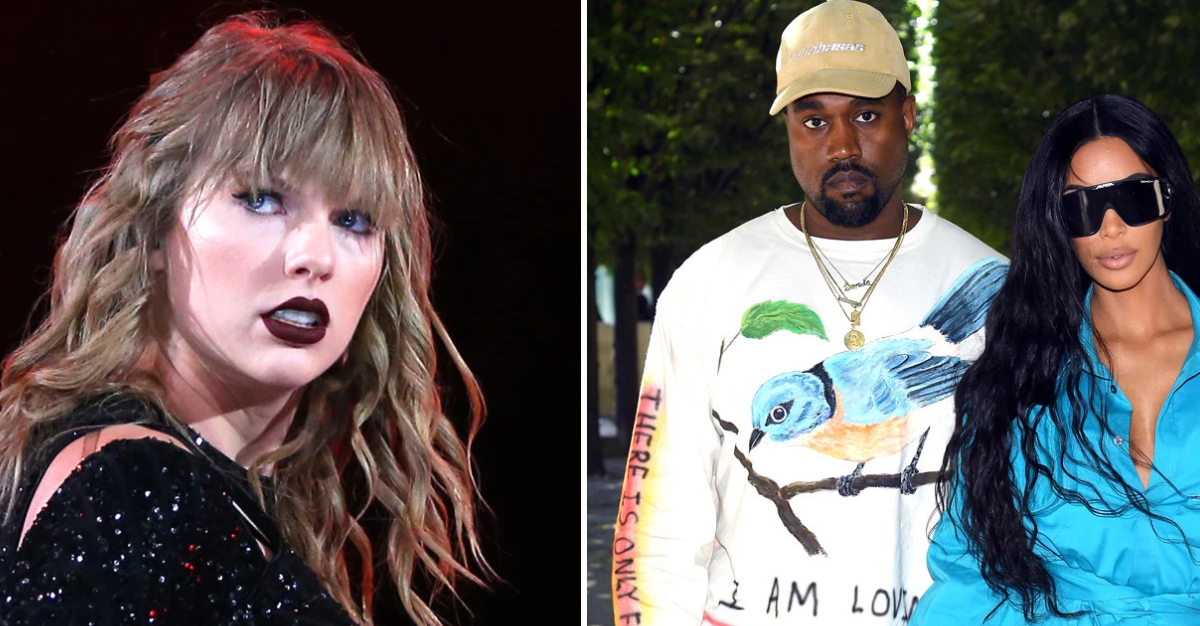

The 17 Biggest Celebrity Reputation Falls

May 25, 2025

The 17 Biggest Celebrity Reputation Falls

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penn Offers A Different Perspective

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penn Offers A Different Perspective

May 25, 2025