Dow Futures Drop: Live Stock Market Updates And Analysis

Table of Contents

Factors Contributing to the Dow Futures Drop

Several interconnected economic and geopolitical factors are driving the recent decline in Dow futures. Understanding these underlying causes is crucial for informed investment decisions.

-

Rising Inflation and its Impact: Persistent inflation continues to erode consumer purchasing power. Higher prices for essential goods and services reduce disposable income, potentially leading to decreased consumer spending and impacting corporate profits. This reduced spending directly affects businesses' bottom lines, impacting stock prices. The Federal Reserve's actions to combat inflation are a key element in this equation.

-

Federal Reserve's Monetary Policy and Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes aim to curb inflation. While necessary to stabilize the economy, these increases impact borrowing costs for businesses and consumers, slowing economic growth and potentially triggering a recession. Higher interest rates also make bonds more attractive compared to stocks, potentially shifting investor capital away from equities.

-

Geopolitical Instability and its Global Ripple Effects: Geopolitical events, such as international conflicts and trade tensions, create uncertainty in the global market. These unpredictable events can lead to disruptions in supply chains, impacting production and inflation, and causing investors to seek safer havens for their investments.

-

Corporate Earnings Reports and Investor Sentiment: Disappointing corporate earnings reports can significantly influence investor sentiment. When companies underperform expectations, it can trigger sell-offs, contributing to a broader market decline. Analyzing the performance of key companies within the Dow Jones Industrial Average is crucial for understanding these shifts.

-

Technical Indicators and Potential Downturn Signals: Technical analysts use various indicators (e.g., moving averages, RSI) to predict market trends. Negative signals from these indicators often precede market corrections, providing additional insight into the potential for further decline in Dow futures. It’s important to consider these alongside fundamental analysis.

-

Global Supply Chain Disruptions: Lingering effects of global supply chain disruptions continue to impact businesses' ability to produce and deliver goods. These disruptions contribute to inflation and uncertainty in corporate profitability, negatively influencing investor confidence and market sentiment.

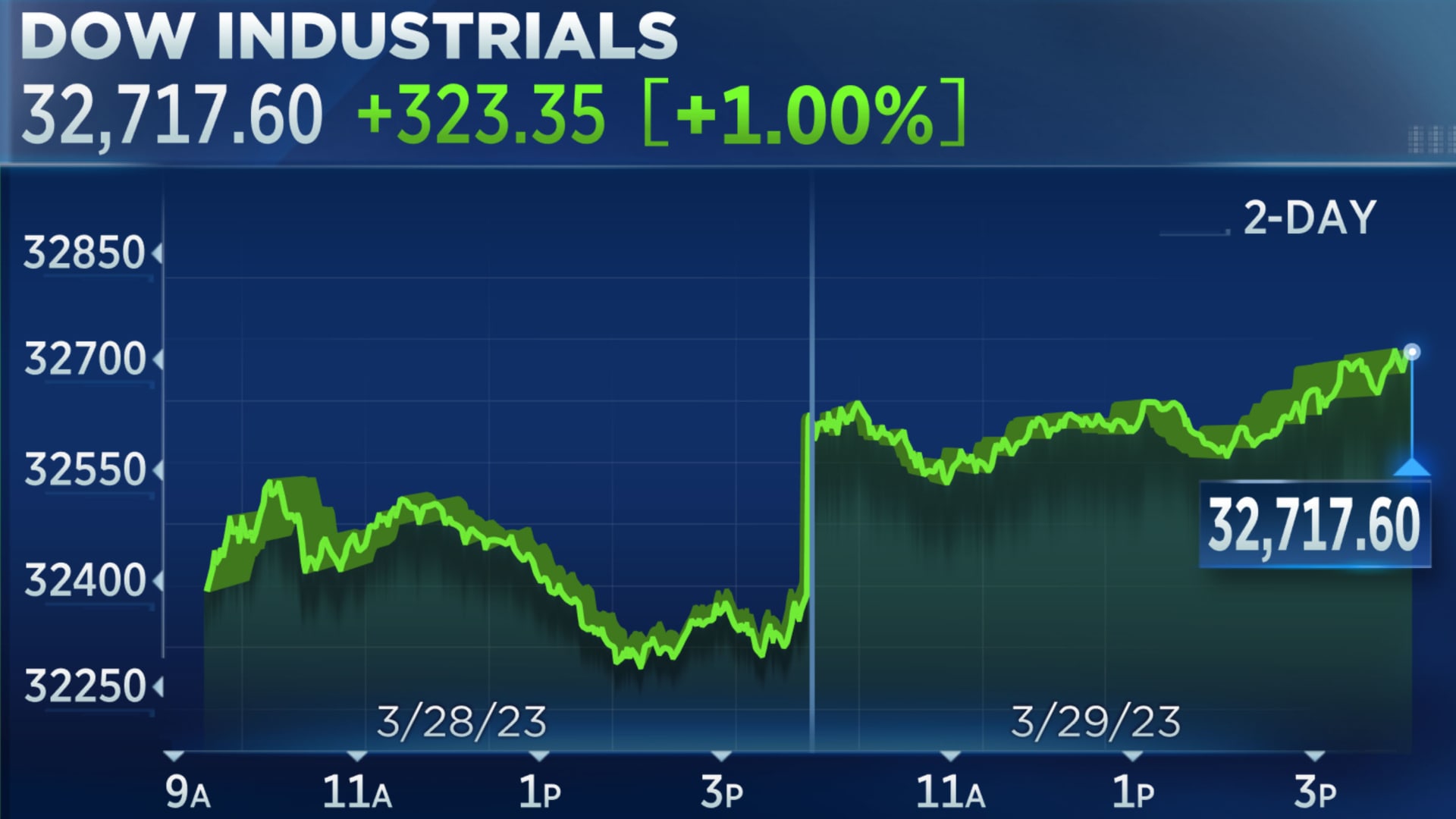

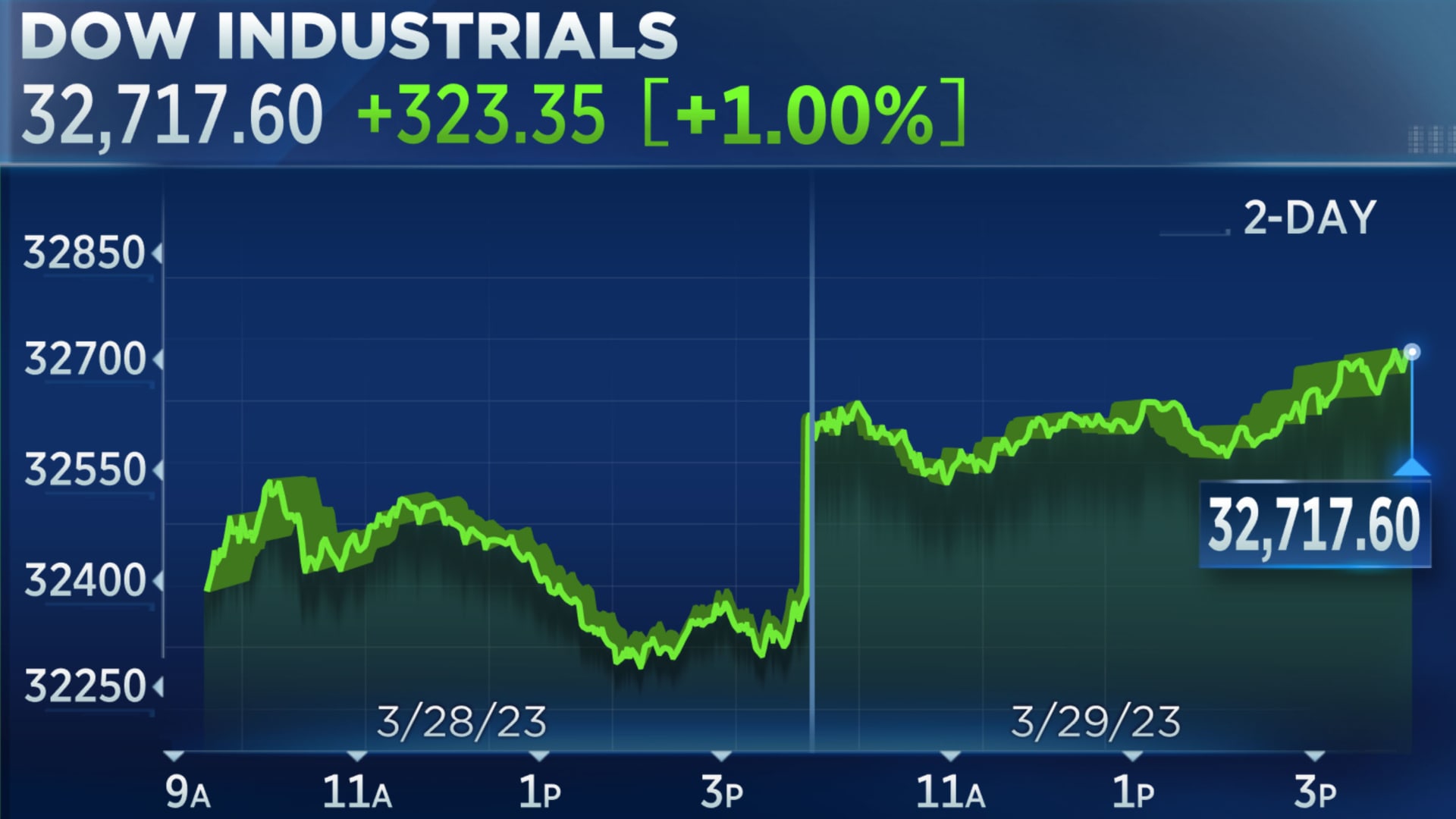

Live Stock Market Updates: Current Dow Futures Performance

(This section would ideally include a live, embeddable chart or ticker displaying real-time Dow futures prices.)

Analyzing real-time Dow futures data offers crucial insights into the current market dynamics. Key aspects to monitor include:

-

Real-time Dow Futures Price: Constant monitoring of the current price is essential for understanding the immediate market reaction to news and events.

-

Trading Volume Analysis: High trading volume during a price drop often signals stronger selling pressure, indicating a potentially more significant decline. Conversely, low volume may suggest a less impactful price movement.

-

Support and Resistance Levels: Identifying key support and resistance levels helps predict potential price reversals or further declines. These levels represent psychological price barriers where buying or selling pressure tends to be stronger.

-

News Impact on Dow Futures Price: Major news events – whether economic announcements, geopolitical developments, or significant corporate news – often cause immediate and substantial shifts in Dow futures prices.

Analyzing the Impact on Different Investment Sectors

The Dow futures drop's impact isn't uniform across all sectors. Understanding this differentiated effect is vital for effective portfolio management.

-

Technology Stocks: The tech sector is often sensitive to interest rate changes and economic uncertainty. Higher rates increase borrowing costs for growth-oriented tech companies, potentially impacting valuations.

-

Energy and Commodity Sectors: Energy and commodity prices are typically influenced by global events and inflation. These sectors can experience increased volatility during periods of economic uncertainty.

-

Financial and Healthcare Sectors: The financial sector can be impacted by interest rate changes, while the healthcare sector may be more resilient during economic downturns due to its relatively defensive nature.

-

Portfolio Diversification Strategies: Diversifying your portfolio across different sectors helps mitigate the overall risk associated with market volatility. Investing in sectors less correlated to the Dow's performance can help cushion the impact of a downturn.

Strategies for Navigating Market Volatility

Navigating market volatility requires a proactive approach and well-defined strategies.

-

Risk Assessment and Diversification: Conducting a thorough risk assessment and diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) reduces exposure to individual sector downturns.

-

Hedging Strategies: Consider hedging strategies such as options or futures contracts to protect your portfolio against further market declines. Consult with a financial advisor to determine suitable hedging options.

-

Long-Term Investment Perspective: Maintaining a long-term investment horizon helps minimize the impact of short-term market fluctuations. Resist the urge to make impulsive decisions based on short-term price movements.

-

Alternative Investment Options: Explore alternative investment options, such as precious metals or real estate, which may offer a hedge against market volatility.

Conclusion

This article provided live stock market updates and analysis regarding the recent Dow futures drop, examining contributing factors such as rising inflation, interest rate hikes, and geopolitical uncertainty. We also explored the impact on various investment sectors and offered strategies for navigating market volatility. Staying informed about Dow futures movements and other market trends is crucial for making informed investment decisions. Continue to monitor the Dow futures and adapt your investment strategy accordingly to mitigate risk and potentially capitalize on opportunities. Regularly checking for live stock market updates and analysis is key to successful investing.

Featured Posts

-

The Rise Of Disaster Betting Examining The Case Of The Los Angeles Wildfires

Apr 22, 2025

The Rise Of Disaster Betting Examining The Case Of The Los Angeles Wildfires

Apr 22, 2025 -

Fractured Ties Analyzing The Breakdown In U S China Relations And The Risk Of Cold War

Apr 22, 2025

Fractured Ties Analyzing The Breakdown In U S China Relations And The Risk Of Cold War

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Trump Administrations Ire

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Trump Administrations Ire

Apr 22, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 22, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 22, 2025 -

Trumps Obamacare Defense Supreme Court Implications For Rfk Jr

Apr 22, 2025

Trumps Obamacare Defense Supreme Court Implications For Rfk Jr

Apr 22, 2025

Latest Posts

-

Young Thugs New Album Uy Scuti When Can We Expect It

May 10, 2025

Young Thugs New Album Uy Scuti When Can We Expect It

May 10, 2025 -

Elon Musks Space X A 43 Billion Windfall Over Tesla Holdings

May 10, 2025

Elon Musks Space X A 43 Billion Windfall Over Tesla Holdings

May 10, 2025 -

Uy Scuti Young Thug Offers Clues On Upcoming Album Release

May 10, 2025

Uy Scuti Young Thug Offers Clues On Upcoming Album Release

May 10, 2025 -

43 Billion Boost Space X Stake Now Outweighs Elon Musks Tesla Investment

May 10, 2025

43 Billion Boost Space X Stake Now Outweighs Elon Musks Tesla Investment

May 10, 2025 -

Analyzing Mariah The Scientists Burning Blue Sound And Significance

May 10, 2025

Analyzing Mariah The Scientists Burning Blue Sound And Significance

May 10, 2025