Dogecoin's Future Uncertain: Musk's Concerns Over Trump's Policies

Table of Contents

Trump's Economic Policies and Their Potential Impact on Cryptocurrency

A potential return of Donald Trump to the presidency introduces significant uncertainty into the cryptocurrency market, particularly for Dogecoin, given Elon Musk's strong association with the coin. Several key policy areas could drastically impact the crypto landscape:

Increased Regulation

A Trump administration might prioritize stricter regulation of the cryptocurrency market. This could manifest in several ways:

- Increased scrutiny of exchanges: More stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations could increase compliance costs for exchanges, potentially driving smaller exchanges out of business.

- Potential tax increases on crypto transactions: Higher capital gains taxes or new taxes specifically targeting cryptocurrency transactions could reduce investor enthusiasm and lower trading volume.

- Limitations on DeFi activities: Increased regulation of decentralized finance (DeFi) protocols could stifle innovation and limit the growth potential of Dogecoin and other cryptocurrencies utilizing DeFi technologies.

These regulatory changes could significantly impact Dogecoin's price and overall adoption, potentially leading to decreased market capitalization and reduced trading activity.

Dollar Strength and Inflation

Trump's economic policies might focus on strengthening the US dollar or combating inflation. This has significant implications for cryptocurrencies:

- Inverse relationship between the dollar and crypto prices: A stronger dollar often leads to decreased demand for cryptocurrencies, as investors may prefer the stability of the dollar.

- Impact of inflation on investor sentiment: High inflation might erode the purchasing power of fiat currencies, potentially pushing investors towards alternative assets like Dogecoin. However, unpredictable inflation could also trigger market uncertainty and negatively affect investor confidence.

Historically, periods of US dollar strength have often coincided with dips in cryptocurrency prices, highlighting the correlation between fiat currency stability and crypto market performance. The impact of inflation on Dogecoin is complex and depends largely on investor perception and market trends.

Trade Wars and Global Economic Uncertainty

A Trump presidency could lead to renewed trade disputes and increased global economic uncertainty. This translates to risks for Dogecoin:

- Risk-averse behavior in investors: During periods of economic uncertainty, investors tend to move towards safer assets, leading to sell-offs in riskier investments like cryptocurrencies.

- Direct impact on Dogecoin's price: A decline in global economic confidence can directly depress the price of Dogecoin, reflecting the overall market sentiment.

The interconnected nature of the global economy means that political instability in one region can quickly ripple outwards, impacting investor confidence and leading to volatility in cryptocurrency markets, including the DOGE price prediction.

Elon Musk's Stance and its Influence on Dogecoin

Elon Musk's pronouncements and actions have historically had a profound impact on Dogecoin's price. Understanding his potential response to Trump's policies is crucial:

Musk's Past Actions and Their Impact on DOGE

Musk's tweets and public statements have repeatedly caused significant price swings in Dogecoin:

- Past tweets and announcements: Musk's past endorsements have sent the Dogecoin price soaring, while negative comments have led to sharp declines.

- Psychological effect on the Dogecoin community: Musk's influence extends beyond price manipulation; it impacts the overall sentiment and confidence within the Dogecoin community.

This demonstrates the power of Musk’s influence and underscores the inherent volatility of Dogecoin.

Musk's Concerns and Their Implications for Dogecoin Investment

Musk has voiced concerns about some of Trump's potential policies. These concerns could significantly impact his relationship with Dogecoin:

- Reduced support for DOGE: If Musk's concerns about the broader economic climate worsen, he might reduce his public support for Dogecoin, potentially causing a price drop.

- Reduction in tweets/mentions: A decrease in Musk's mentions of Dogecoin on social media could signal a shift in his support, impacting investor confidence.

Any change in Musk’s attitude towards Dogecoin, influenced by his views on Trump’s policies, would likely have a dramatic effect on investor sentiment and DOGE’s price.

Analyzing the Risk: Investing in Dogecoin Under Uncertainty

Navigating the uncertain future of Dogecoin requires a strategic approach:

Diversification and Risk Management Strategies

In the volatile cryptocurrency market, diversification is key:

- Other investment options: Don't put all your eggs in one basket. Consider diversifying your portfolio across other cryptocurrencies, stocks, bonds, and other asset classes.

- Risk tolerance levels: Understand your own risk tolerance before investing in Dogecoin, considering its inherent volatility.

- Benefits of diversification: A well-diversified portfolio can help mitigate losses from any single asset, including Dogecoin.

Sensible risk management is paramount in the unpredictable world of cryptocurrency investment.

Long-Term vs. Short-Term Outlook for Dogecoin

The long-term and short-term outlook for Dogecoin under Trump's potential policies presents contrasting scenarios:

- Bullish scenarios: A positive economic outlook, coupled with continued support from Elon Musk, could lead to increased adoption and a rise in Dogecoin's price.

- Bearish scenarios: Increased regulations, economic instability, and reduced support from Musk could significantly depress Dogecoin's value.

Predicting the future of Dogecoin remains challenging, highlighting the need for careful consideration of both potential upsides and downsides.

Conclusion

The future of Dogecoin remains uncertain, largely dependent on the interplay between potential economic shifts under a Trump administration and Elon Musk's continued involvement. While Dogecoin’s volatility offers significant opportunities, it also presents substantial risks. Investors should carefully consider the potential implications of Trump’s policies on the cryptocurrency market before making investment decisions. Thorough research and a well-diversified investment strategy are crucial for navigating the unpredictable landscape of Dogecoin and other cryptocurrencies. Understanding the potential impact of political and economic uncertainty on your Dogecoin investment is essential for informed decision-making. Remember to always conduct your own thorough research before investing in Dogecoin or any other cryptocurrency.

Featured Posts

-

The Pitts Rising Star Son Of A Mega Famous Actor

May 29, 2025

The Pitts Rising Star Son Of A Mega Famous Actor

May 29, 2025 -

Formiranje Vlade Kosova Krasnici Postavlja Uslov Kurtiju

May 29, 2025

Formiranje Vlade Kosova Krasnici Postavlja Uslov Kurtiju

May 29, 2025 -

O Elon Mask Kai O Proypologismos Toy Tramp Kritiki Kai Anisyxies Gia To Elleimma

May 29, 2025

O Elon Mask Kai O Proypologismos Toy Tramp Kritiki Kai Anisyxies Gia To Elleimma

May 29, 2025 -

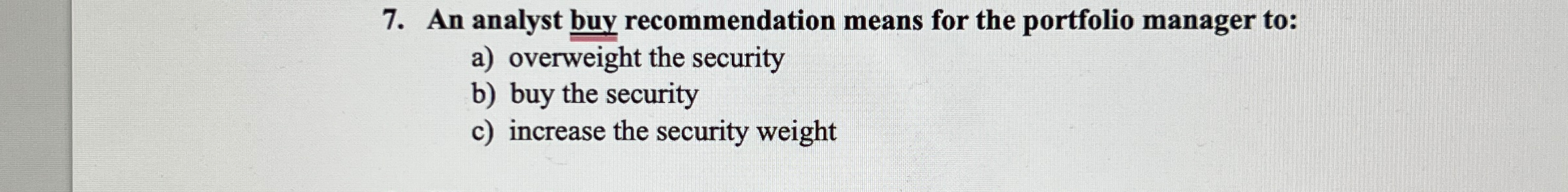

Entertainment Stock Dip Analyst Buy Recommendation

May 29, 2025

Entertainment Stock Dip Analyst Buy Recommendation

May 29, 2025 -

Kontroversi Nft Nike Gugatan Ganti Rugi Rp 84 Miliar

May 29, 2025

Kontroversi Nft Nike Gugatan Ganti Rugi Rp 84 Miliar

May 29, 2025