Dissecting The GOP Tax Cuts: A Deficit Reduction Assessment

Table of Contents

The Provisions of the Tax Cuts and Jobs Act (TCJA): A Deep Dive

The Tax Cuts and Jobs Act (TCJA) significantly altered the US tax code. Let's examine its key components:

Individual Tax Rate Reductions

The TCJA reduced individual income tax rates across several brackets. This resulted in lower tax burdens for many, though the extent of the benefit varied considerably depending on income level.

- Pre-TCJA: Higher tax rates applied to lower income brackets.

- Post-TCJA: Tax brackets were compressed, leading to lower rates across the board, with the highest earners seeing the most significant percentage reduction.

- Impact: The Congressional Budget Office (CBO) projected that the reduction in individual income tax rates would lead to a substantial decrease in federal revenue. [cite CBO report here]

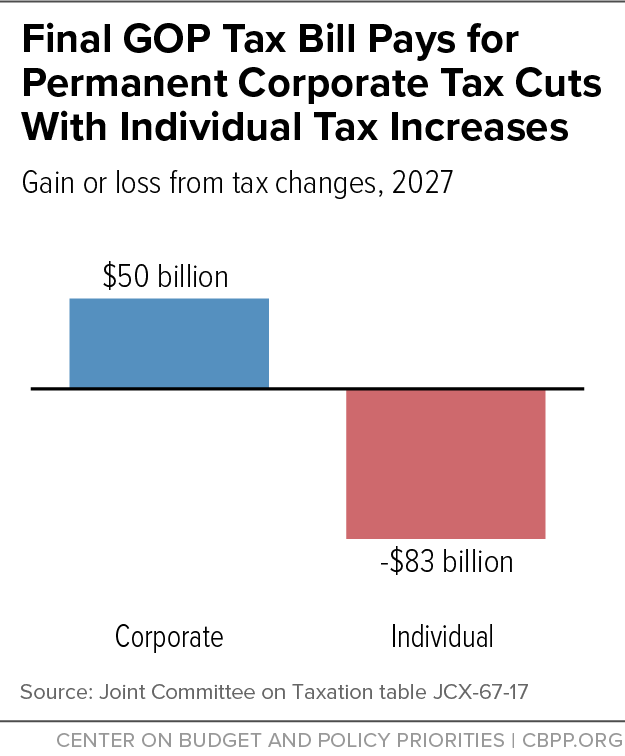

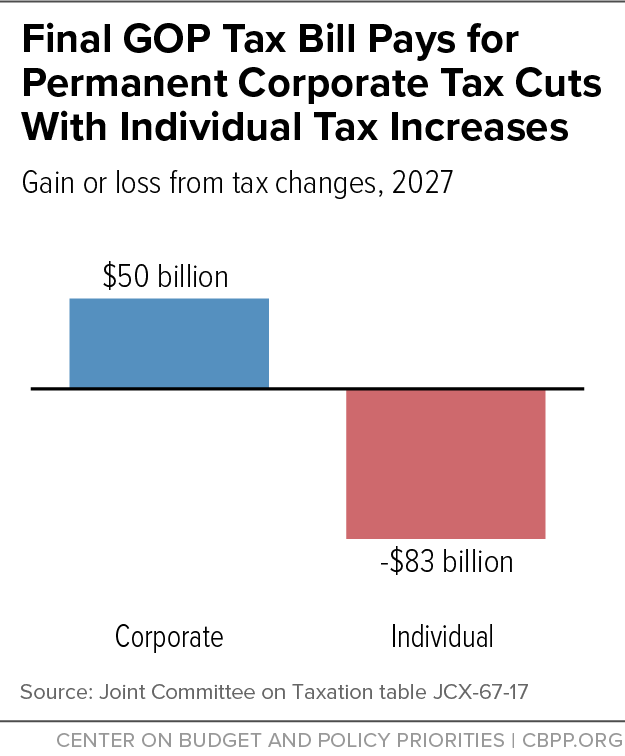

Corporate Tax Rate Reduction

A dramatic reduction in the corporate tax rate was a central feature of the TCJA. The aim was to boost business investment and job creation through improved corporate profitability.

- Pre-TCJA: The top corporate tax rate was 35%.

- Post-TCJA: The top corporate tax rate was reduced to 21%.

- Predicted Effects: Proponents argued this would spur investment, leading to increased economic growth and job creation. [cite supporting economic studies here]. Critics countered that this primarily benefited large corporations, with limited "trickle-down" effects on employment. [cite critical economic studies here].

Other Key Provisions

Beyond individual and corporate tax rates, the TCJA included other significant changes:

- Standard Deduction: The standard deduction was significantly increased, benefiting many lower- and middle-income taxpayers.

- Child Tax Credit: The child tax credit was expanded, providing greater financial relief to families with children.

- Estate Tax: The TCJA increased the estate tax exemption, shielding a larger portion of inheritances from taxation.

These changes, while seemingly beneficial in isolation, collectively contributed to a substantial reduction in government revenue.

Economic Impacts and Deficit Projections

Assessing the economic effects of the GOP tax cuts requires analyzing both short-term and long-term impacts.

Short-Term Economic Effects

In the immediate aftermath of the TCJA, some positive economic indicators were observed.

- GDP Growth: A modest increase in GDP growth was recorded in the years following the tax cuts. [cite data source - e.g., BEA]

- Job Creation: While job growth continued, it's challenging to definitively attribute this solely to the tax cuts, as numerous other economic factors are at play. [cite Bureau of Labor Statistics data]

Long-Term Deficit Projections

The CBO and other organizations have produced varying long-term projections for the national debt, all pointing toward a substantial increase due to the reduced tax revenue stemming from the TCJA.

- CBO Projections: The CBO projected significant increases in the national debt over the coming decades, primarily due to the revenue loss caused by the GOP tax cuts. [cite CBO report]

- Impact of Future Interest Rates: Rising interest rates will exacerbate the debt burden, increasing the cost of servicing the national debt.

Revenue Loss vs. Economic Growth

The core debate surrounding the TCJA revolves around whether the stimulated economic growth sufficiently offset the substantial revenue loss.

- Supply-Side Economics Argument: Proponents argue the tax cuts triggered significant economic growth, ultimately outweighing the revenue loss through a larger tax base.

- Counterargument: Critics contend the economic growth stimulated by the tax cuts was not substantial enough to compensate for the massive reduction in government revenue.

Criticisms and Counterarguments

The GOP tax cuts have faced significant criticism, countered by arguments from proponents.

Arguments Against the Tax Cuts

Many critics highlight the following concerns:

- Income Inequality: The tax cuts disproportionately benefited high-income earners, exacerbating income inequality. [cite studies on income inequality after TCJA]

- Increased National Debt: The substantial reduction in government revenue significantly increased the national debt, placing a burden on future generations.

Defenders' Arguments

Arguments in favor of the tax cuts generally center on:

- Economic Stimulus: Proponents argue the tax cuts spurred economic growth, leading to increased job creation and higher wages.

- Investment: The reduced corporate tax rate incentivized business investment, boosting productivity and long-term economic growth.

Conclusion: A Final Assessment of GOP Tax Cuts and Deficit Reduction

The GOP tax cuts, enacted through the TCJA, significantly altered the US tax code, leading to substantial revenue loss and increased national debt. While some positive short-term economic indicators were observed, the long-term fiscal implications remain a major concern. The debate surrounding the effectiveness and fairness of these tax cuts continues, with differing interpretations of their economic impacts. Understanding the long-term effects of the GOP tax cuts is crucial for informed policy discussions. Continue researching the GOP tax cuts and their impact on the national debt to form your own conclusions about this complex and far-reaching tax reform.

Featured Posts

-

Switzerland Challenges China Over Taiwan Strait Drills

May 21, 2025

Switzerland Challenges China Over Taiwan Strait Drills

May 21, 2025 -

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 21, 2025

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 21, 2025 -

Doubt Surrounds Australian Transgender Influencers Record Breaking Success

May 21, 2025

Doubt Surrounds Australian Transgender Influencers Record Breaking Success

May 21, 2025 -

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025 -

Uk Arrest Of American Couple Linked To Bbc Antiques Roadshow Episode

May 21, 2025

Uk Arrest Of American Couple Linked To Bbc Antiques Roadshow Episode

May 21, 2025

Latest Posts

-

Bbai Investors Important Information Regarding Legal Action Contact Gross Law Firm

May 21, 2025

Bbai Investors Important Information Regarding Legal Action Contact Gross Law Firm

May 21, 2025 -

Deadline Approaching Big Bear Ai Bbai Investors Contact Gross Law Firm

May 21, 2025

Deadline Approaching Big Bear Ai Bbai Investors Contact Gross Law Firm

May 21, 2025 -

School District Procedures For Winter Weather Advisories And Delays

May 21, 2025

School District Procedures For Winter Weather Advisories And Delays

May 21, 2025 -

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025 -

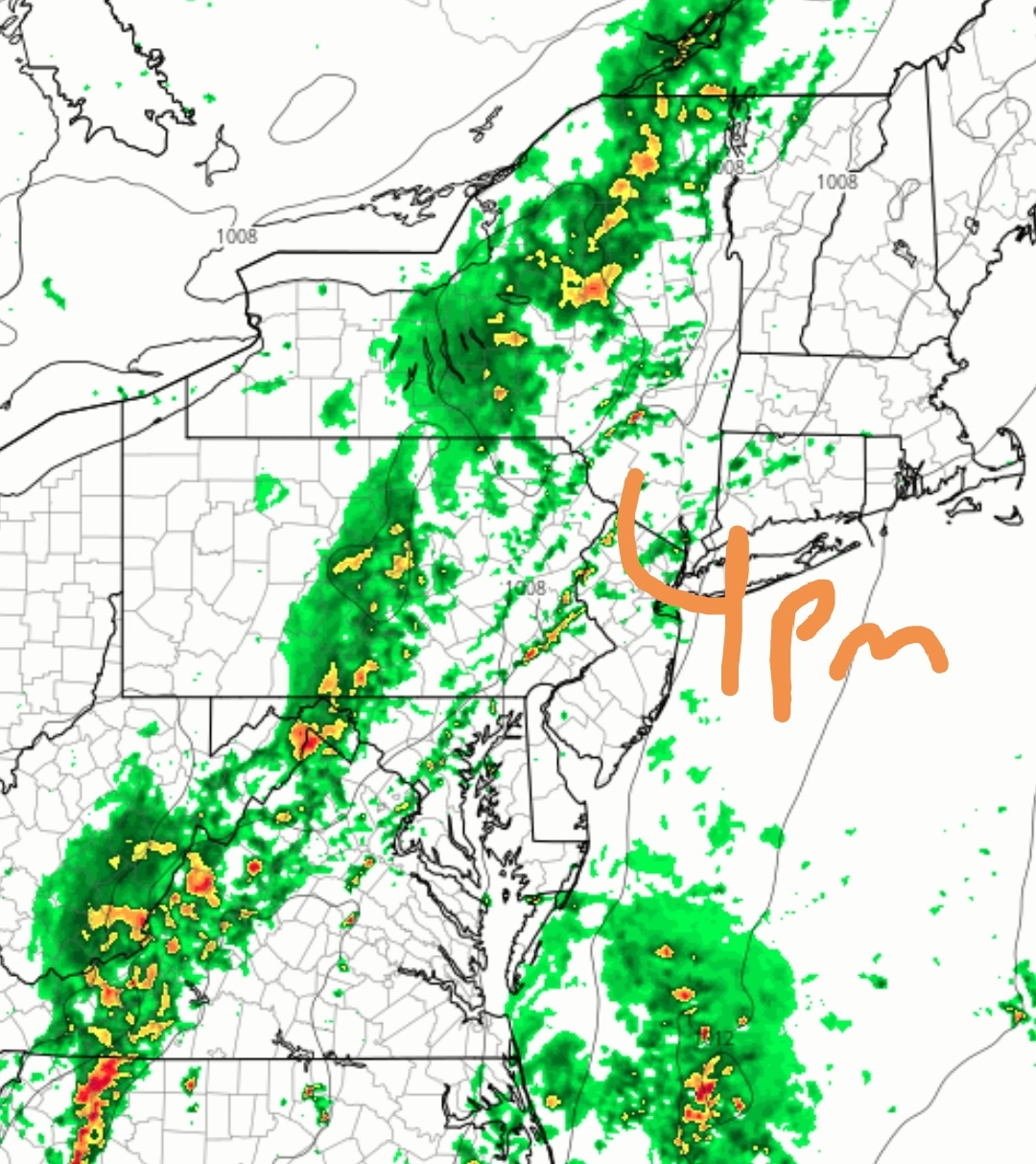

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025