Direct Lender Loans: Guaranteed Approval With No Credit Check

Table of Contents

Understanding "Direct Lender Loans"

When searching for financing, understanding the difference between a direct lender and a loan broker is crucial. A direct lender, such as a bank or credit union, provides loans directly to borrowers without any intermediaries. This can often mean a simpler application process and potentially lower fees, as you're not paying a third party for their services. Loan brokers, on the other hand, act as intermediaries, connecting borrowers with multiple lenders. While this offers a wider range of loan options, brokers typically charge fees, which can impact the overall cost of the loan. Intermediary lenders also exist, often acting as a middleman without the explicit broker role.

- Direct lenders provide loans directly to borrowers without intermediaries. This streamlined process can result in faster processing times.

- Brokers connect borrowers with multiple lenders, often charging fees. These fees can significantly add to the total cost of borrowing.

- Comparing offers from direct lenders and brokers is crucial for cost savings. Shop around to find the best interest rates and terms.

- Direct lenders may offer specialized loan products. Some direct lenders specialize in certain types of loans, like bad credit loans or auto loans.

Choosing between a direct lender and a broker depends on your individual needs and priorities. If you value simplicity and potentially lower fees, a direct lender might be preferable. If you need a wider selection of options, a broker could be a better fit. However, always compare the total cost of the loan, including fees, before making a decision.

The Myth of "Guaranteed Approval"

The promise of "guaranteed loan approval" is a common marketing tactic, but it's crucial to understand that no legitimate lender can guarantee approval to everyone. Loan eligibility depends on several factors:

-

Credit score: Your credit history significantly impacts your chances of approval. A higher credit score generally means better interest rates and more favorable terms.

-

Income verification: Lenders need to ensure you have a stable income to repay the loan. They'll often require proof of income, such as pay stubs or tax returns.

-

Debt-to-income ratio: This ratio compares your monthly debt payments to your monthly income. A high debt-to-income ratio can negatively affect your loan application.

-

Employment history: A stable employment history demonstrates your ability to repay the loan.

-

No legitimate lender guarantees loan approval to everyone. Be wary of lenders who make such claims.

-

Lenders use various criteria to assess risk and eligibility. Understanding these criteria can help you improve your chances of approval.

-

Advertising "guaranteed approval" is often misleading. It's a tactic designed to attract borrowers, regardless of their eligibility.

-

Pre-qualification tools can give a better indication of approval chances. Many lenders offer pre-qualification tools that allow you to check your eligibility without impacting your credit score.

Manage your expectations realistically. Focus on improving your creditworthiness to increase your chances of approval for better loan terms.

"No Credit Check Loans": The Fine Print

The term "no credit check loans" is often used to attract borrowers with poor credit. While it might sound appealing, it's important to understand the implications. While a formal "hard credit check" impacting your credit score might be absent, lenders still assess your creditworthiness. They may use alternative credit scoring methods, or perform a "soft credit check" which doesn't affect your credit score but still provides them with some information.

- "No credit check" usually means alternative credit assessment methods are used. These methods may not always provide a complete picture of your financial situation.

- Interest rates on these loans are typically much higher. This is because lenders perceive a greater risk when they lack comprehensive credit information.

- Borrowers should carefully examine the loan terms and avoid predatory lenders. High interest rates and hidden fees are common characteristics of predatory lending.

- Compare interest rates across different lenders to avoid overpaying. Don't settle for the first offer you see; shop around for the best possible terms.

Be especially cautious of lenders who seem too eager to lend money without asking many questions. These may be predatory lenders attempting to take advantage of your financial situation.

Finding Reputable Direct Lenders

Finding a reputable direct lender is essential to avoid scams and predatory lending practices. Here's how to identify legitimate lenders:

- Check the lender's licensing and registration. Ensure they are legally authorized to operate in your state or country.

- Look for secure websites with encryption (HTTPS). This helps protect your personal and financial information.

- Read online reviews and testimonials. See what other borrowers have to say about their experiences.

- Avoid lenders who ask for upfront fees. Legitimate lenders rarely require upfront payments.

- Report suspicious lenders to relevant authorities. The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are valuable resources.

Remember, if an offer seems too good to be true, it probably is. Prioritize protecting yourself from fraudulent activities.

Alternatives to Direct Lender Loans with No Credit Check

If you're struggling to secure a loan due to credit challenges, consider these alternatives:

- Credit building: Improving your credit score will significantly increase your chances of approval for better loan terms in the future.

- Secured loans: These loans use assets as collateral, reducing the risk for lenders and making approval more likely.

- Co-signer loans: Having a co-signer with good credit can improve your chances of loan approval.

- Debt consolidation loans: Consolidating multiple debts into a single loan can simplify repayments and potentially lower your interest rate.

These options offer paths to financial stability, even if you have a less-than-perfect credit history.

Conclusion

The promise of "guaranteed approval" and "no credit check" loans is often misleading. While direct lender loans can offer convenience and simplicity, it’s vital to understand that lenders assess risk, and approval depends on various factors. "No credit check" loans often come with significantly higher interest rates. Responsible research and comparison shopping are crucial before committing to any loan. Understand your financial situation, compare offers from different direct lenders, and prioritize securing financing from reputable sources. Find a reputable direct lender, compare direct lender loan offers, and explore alternatives to no credit check loans to make informed borrowing decisions.

Featured Posts

-

Man United Transfer Targets Seven Players On Amorims List

May 28, 2025

Man United Transfer Targets Seven Players On Amorims List

May 28, 2025 -

Baldonis Legal Team Counters Reynolds Claims

May 28, 2025

Baldonis Legal Team Counters Reynolds Claims

May 28, 2025 -

Google Veo 3 Is It A Game Changer For Ai Video Generation

May 28, 2025

Google Veo 3 Is It A Game Changer For Ai Video Generation

May 28, 2025 -

Keeping The Chinese Navy Guessing Americas New Missile Defense

May 28, 2025

Keeping The Chinese Navy Guessing Americas New Missile Defense

May 28, 2025 -

A Deeper Look At Chicagos Recent Crime Reduction

May 28, 2025

A Deeper Look At Chicagos Recent Crime Reduction

May 28, 2025

Latest Posts

-

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025 -

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025 -

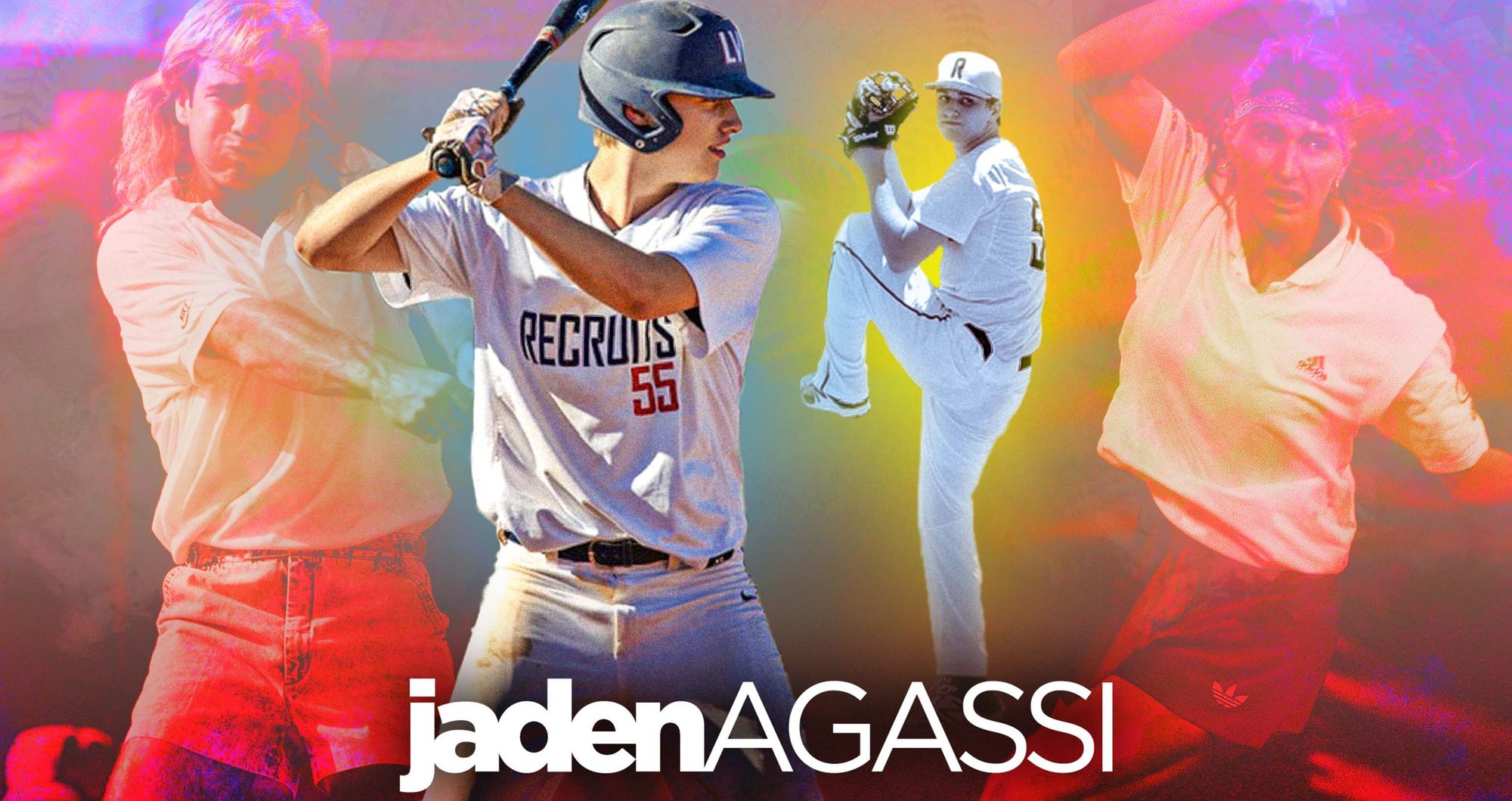

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025 -

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025 -

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025