Deutsche Bank To Serve As Depositary Bank For Epiroc's Level 1 ADR Programs

Table of Contents

Understanding Epiroc's Level 1 ADR Program

Epiroc's Level 1 ADR program offers a streamlined path for US investors to participate in the company's success. Level 1 ADRs are traded over-the-counter (OTC), meaning they aren't listed on a major US exchange like the NYSE or NASDAQ. This offers several key advantages:

- Simplified Access: US investors can access Epiroc stock through their brokerage accounts without the complexities often associated with trading on foreign exchanges.

- OTC Market Trading: Trading occurs on the OTC market, a decentralized market for securities not listed on a formal exchange.

- Lower Regulatory Burden: Level 1 ADRs have less stringent regulatory requirements than higher-level ADRs (Level 2 and Level 3).

- Increased Liquidity Potential: The wider availability via the ADR program has the potential to significantly increase trading volume and liquidity for Epiroc shares. This can lead to more efficient price discovery and better investment opportunities.

The Role of Deutsche Bank as Depositary Bank

Deutsche Bank's role as the depositary bank is pivotal to the success of Epiroc's ADR program. As a custodian bank, they bear significant responsibilities, including:

- Share Custody and Management: Deutsche Bank will hold and manage the underlying Epiroc shares representing the ADRs.

- ADR Conversion Facilitation: They will facilitate the conversion of ADRs into the underlying Epiroc shares, should investors desire.

- Regulatory Compliance: Deutsche Bank will ensure compliance with all relevant US securities regulations.

- Administrative Services: They will provide essential administrative services for ADR holders, streamlining the investment process.

Deutsche Bank's extensive experience and established reputation in providing ADR services makes them an ideal partner for Epiroc, ensuring a smooth and efficient process for investors.

Benefits for Epiroc and Investors

This partnership offers compelling advantages for both Epiroc and its investors:

For Epiroc:

- Enhanced US Market Access: The ADR program significantly increases Epiroc's visibility and access to the lucrative US capital markets.

- Expanded Shareholder Base: Attracting US investors broadens Epiroc's shareholder base, strengthening its financial foundation.

- Increased Stock Liquidity: Improved liquidity facilitates easier trading of Epiroc shares, benefitting both existing and potential shareholders.

For Investors:

- Simplified Access to Epiroc Stock: Investing in a globally recognized leader in mining and infrastructure technology becomes significantly easier.

- Potential for Higher Returns: Exposure to Epiroc's growth potential offers investors opportunities for attractive returns on investment.

- Streamlined Trading Procedures: The ADR program simplifies the trading process, making it more accessible to a wider range of investors.

Increased Trading Volume and Liquidity

By making Epiroc stock readily accessible to the large US investor base, the ADR program, facilitated by Deutsche Bank, is expected to substantially increase trading volume and liquidity. This increased liquidity translates to more efficient price discovery, tighter bid-ask spreads, and potentially lower transaction costs for investors. The expansion of Epiroc's market capitalization is also a likely consequence.

Future Implications and Outlook

The partnership between Epiroc and Deutsche Bank lays a solid foundation for Epiroc's continued growth and expansion in the global market. The success of this Level 1 ADR program could pave the way for future expansion, potentially including higher-level ADR listings. The increased market visibility and access to capital provided by this program strengthens Epiroc's position for long-term success and further international growth within the mining and infrastructure sectors. This strategic move positions Epiroc for significant future growth and highlights the importance of accessing international capital markets.

Conclusion

Deutsche Bank's role as the depositary bank for Epiroc's Level 1 ADR program is a game-changer, offering simplified access to Epiroc stock for US investors. This partnership promises significant benefits for both Epiroc and its investors, including increased liquidity, broader market access, and potentially higher returns. The increased trading volume and enhanced market visibility contribute to a stronger financial position for Epiroc and increased investment opportunities for all. Invest in Epiroc's future through their Level 1 ADR program. Learn more about Deutsche Bank's ADR services for Epiroc and explore the opportunities available to you. [Link to Epiroc Investor Relations] [Link to Deutsche Bank ADR Services]

Featured Posts

-

Man Uniteds Player Name Rejected Fortune To Stay At Old Trafford

May 30, 2025

Man Uniteds Player Name Rejected Fortune To Stay At Old Trafford

May 30, 2025 -

Globalna Ekstremna Zhega 2024 Zasegnati Sa Nad Polovinata Ot Khorata Na Planetata

May 30, 2025

Globalna Ekstremna Zhega 2024 Zasegnati Sa Nad Polovinata Ot Khorata Na Planetata

May 30, 2025 -

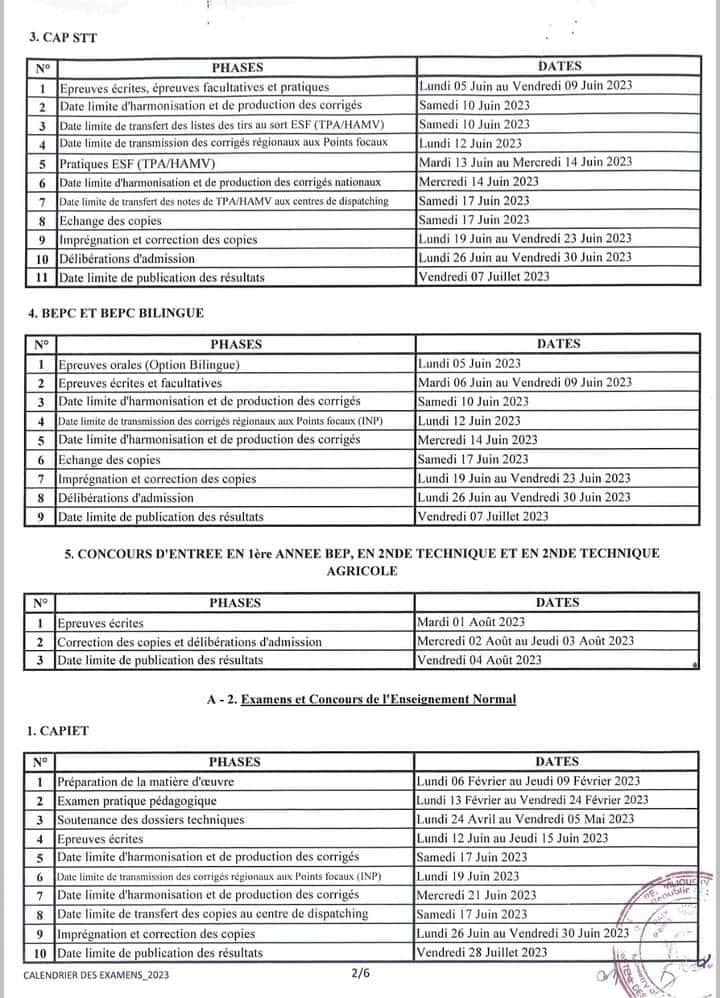

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025 -

Cts Eventim Q1 Adjusted Ebitda And Revenue Growth

May 30, 2025

Cts Eventim Q1 Adjusted Ebitda And Revenue Growth

May 30, 2025 -

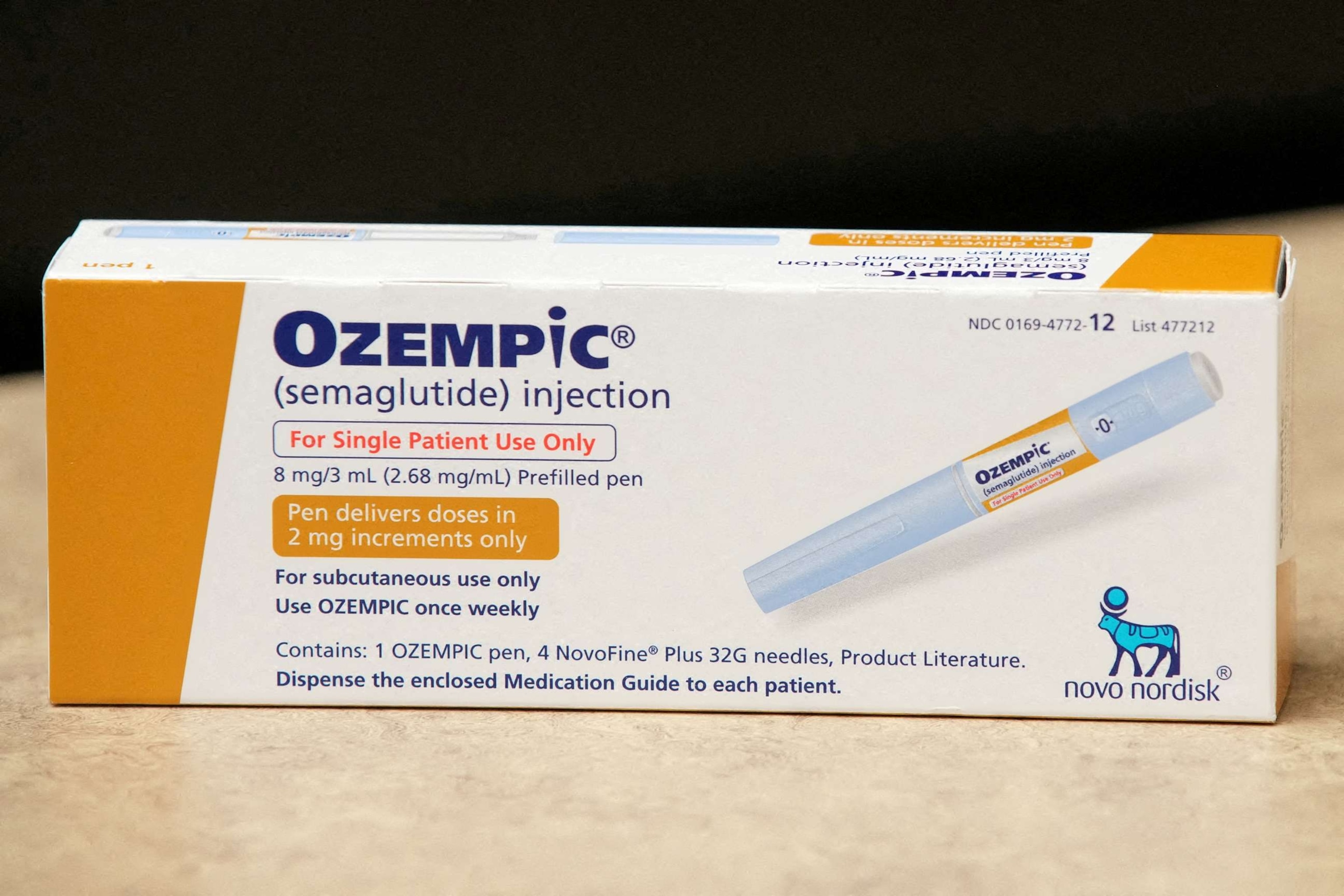

Ozempic And The Weight Loss Market Novo Nordisks Stalled Progress

May 30, 2025

Ozempic And The Weight Loss Market Novo Nordisks Stalled Progress

May 30, 2025