Deutsche Bank And IBM: A Partnership Driving Digital Innovation

Table of Contents

IBM's Technology Solutions for Deutsche Bank's Digital Transformation

IBM plays a crucial role in Deutsche Bank's ambitious digital transformation journey. The partnership leverages IBM's extensive portfolio of advanced technologies to modernize Deutsche Bank's infrastructure, enhance customer experience, and bolster its cybersecurity defenses. This collaboration represents a significant investment in the future of Deutsche Bank, enabling it to compete effectively in the increasingly digital financial landscape.

Cloud Computing and Infrastructure Modernization

IBM's cloud solutions, particularly IBM Cloud, are central to Deutsche Bank's infrastructure modernization efforts. Migrating to the cloud has enabled Deutsche Bank to achieve significant improvements in scalability, efficiency, and security.

- Enhanced Agility: The cloud platform provides Deutsche Bank with the flexibility to rapidly deploy new applications and services, responding quickly to market demands and customer needs.

- Reduced Infrastructure Costs: By leveraging IBM Cloud's pay-as-you-go model, Deutsche Bank has optimized its IT spending, reducing capital expenditure and improving operational efficiency.

- Improved Disaster Recovery Capabilities: IBM Cloud's robust infrastructure ensures business continuity and minimizes downtime in the event of unforeseen circumstances. This is crucial for a financial institution like Deutsche Bank.

AI and Machine Learning for Enhanced Customer Experience

Artificial intelligence (AI) and machine learning (ML) are transforming the customer experience at Deutsche Bank. IBM's AI capabilities are being integrated across various platforms to personalize customer interactions, enhance fraud detection, and optimize risk management.

- Improved Customer Service through Chatbots: AI-powered chatbots provide instant support and answer frequently asked questions, improving customer satisfaction and freeing up human agents to handle more complex issues.

- Personalized Financial Advice: AI algorithms analyze customer data to provide personalized financial advice and recommendations, tailoring services to individual needs and preferences.

- Proactive Risk Identification: Machine learning models identify potential risks and fraudulent activities in real-time, enabling proactive mitigation and minimizing potential losses.

Cybersecurity and Data Protection Solutions

Robust cybersecurity is paramount in the financial sector. Deutsche Bank and IBM are collaborating to fortify Deutsche Bank's security posture against evolving cyber threats. IBM provides advanced security solutions, contributing to a more secure and resilient infrastructure.

- Enhanced Threat Detection: IBM's security solutions provide advanced threat detection capabilities, identifying and neutralizing potential cyberattacks before they can cause damage.

- Data Encryption: Protecting sensitive customer data is a top priority. IBM's encryption technologies safeguard data both in transit and at rest, ensuring compliance with industry regulations.

- Compliance with Industry Regulations: IBM's solutions help Deutsche Bank meet stringent regulatory requirements related to data privacy and security, fostering trust and confidence among customers.

Strategic Goals and Business Outcomes of the Partnership

The partnership between Deutsche Bank and IBM is strategically aligned with Deutsche Bank's broader objectives for digital transformation. The collaboration aims to achieve significant improvements in operational efficiency, customer satisfaction, and overall competitive advantage.

Improved Operational Efficiency

The Deutsche Bank and IBM partnership has resulted in substantial improvements in operational efficiency. Automation and streamlined processes have led to significant cost savings and increased productivity.

- Automation of Tasks: Automation of repetitive tasks through AI and robotic process automation (RPA) frees up human resources for more strategic initiatives.

- Improved Workflow Management: Streamlined workflows improve collaboration and reduce bottlenecks, ensuring faster processing times and enhanced productivity.

- Reduction in Manual Errors: Automation minimizes the risk of human error, leading to improved accuracy and reduced operational costs.

Enhanced Customer Satisfaction

The partnership between Deutsche Bank and IBM is directly contributing to improved customer satisfaction. Faster transaction processing, personalized services, and enhanced customer support are key factors driving customer loyalty.

- Faster Transaction Processing: Modernized infrastructure and streamlined processes result in faster transaction processing, enhancing customer experience.

- Personalized Banking Services: AI-powered personalization ensures customers receive tailored financial products and services, enhancing their overall banking experience.

- Improved Customer Support: Enhanced customer support channels, including AI-powered chatbots, provide faster and more efficient assistance.

Increased Innovation and Competitive Advantage

The collaboration between Deutsche Bank and IBM provides Deutsche Bank with access to cutting-edge technologies and expertise, enabling it to innovate faster and stay ahead of the competition.

- Development of Innovative Fintech Solutions: The partnership fosters the development of innovative fintech solutions, creating new revenue streams and strengthening Deutsche Bank's market position.

- Access to Cutting-Edge Technologies: Deutsche Bank benefits from access to IBM's vast portfolio of advanced technologies, including AI, cloud computing, and blockchain.

- Improved Time-to-Market: Faster development cycles and streamlined deployment processes enable Deutsche Bank to bring new products and services to market quickly.

Case Studies and Success Stories

While specific quantifiable results may be confidential, the success of the Deutsche Bank and IBM partnership is evident in Deutsche Bank’s improved operational efficiency, enhanced customer experience, and strengthened security posture. Success stories highlight the significant impact of integrating IBM's AI and cloud solutions into Deutsche Bank's operations. These improvements speak volumes about the strategic value of the collaboration. The partnership has demonstrably helped Deutsche Bank navigate the complex challenges of digital transformation successfully.

Conclusion: The Future of Deutsche Bank and IBM's Digital Innovation Partnership

The partnership between Deutsche Bank and IBM is a testament to the power of collaboration in driving digital transformation within the financial services industry. The integration of IBM's cutting-edge technologies has resulted in improved operational efficiency, enhanced customer experiences, and a more robust security infrastructure for Deutsche Bank. The future of this partnership looks bright, with potential collaborations exploring further advancements in AI, cloud computing, and other emerging technologies. The continued success of Deutsche Bank and IBM's digital innovation partnership is a powerful example of how collaboration can drive significant transformation and competitiveness in the financial sector. Learn more about the successful digital transformation strategies employed by Deutsche Bank and IBM, and explore how this partnership can inspire your own digital journey.

Featured Posts

-

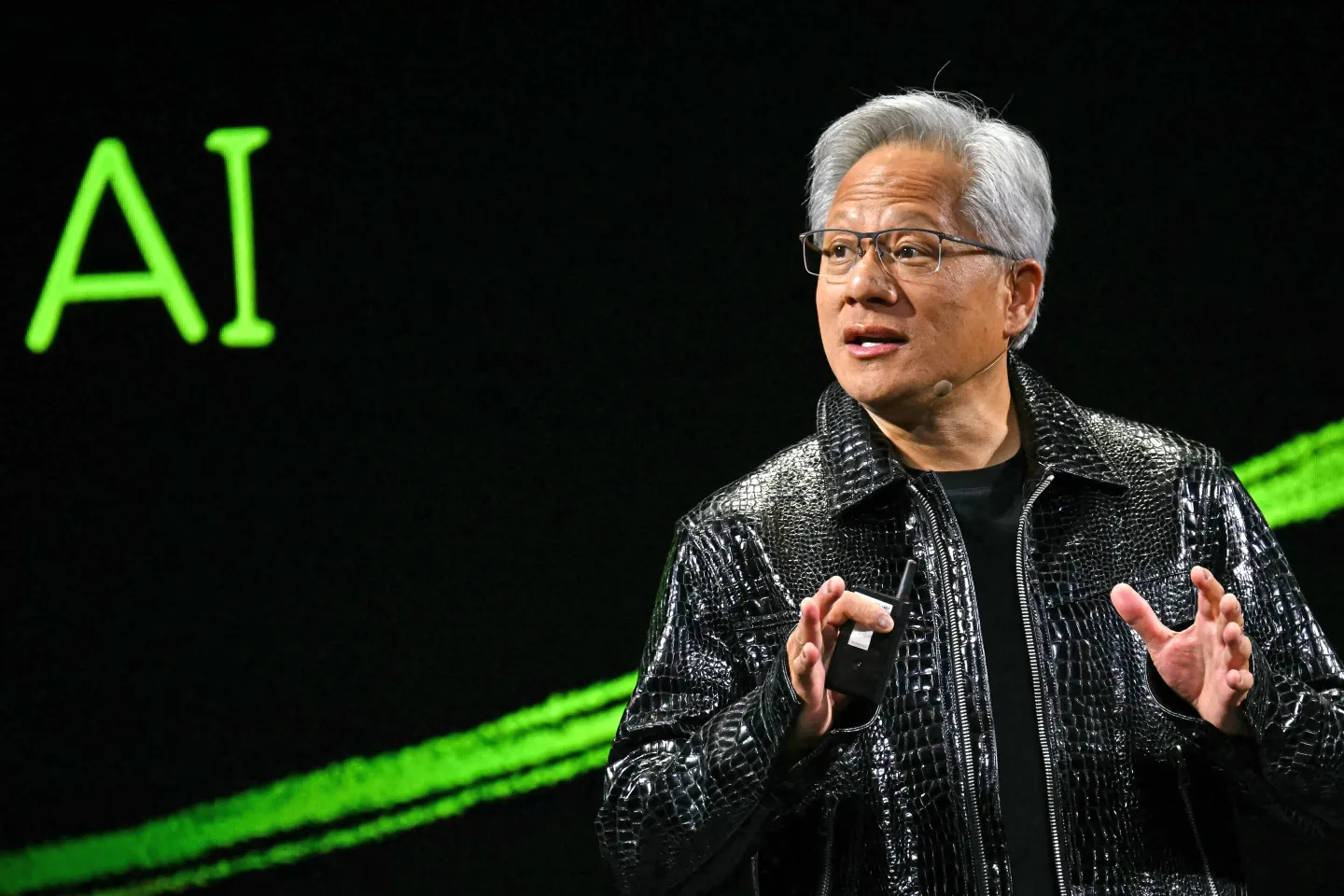

Chinas Ai Rise Nvidia Ceo Jensen Huang Sounds The Alarm

May 30, 2025

Chinas Ai Rise Nvidia Ceo Jensen Huang Sounds The Alarm

May 30, 2025 -

Jon Jones Vs Tom Aspinall Paddy Pimbletts Unexpected Heavyweight Title Fight Prediction

May 30, 2025

Jon Jones Vs Tom Aspinall Paddy Pimbletts Unexpected Heavyweight Title Fight Prediction

May 30, 2025 -

Perviy Vzglyad Gilermo Del Toro Pokazyvaet Treyler Frankenshteyna

May 30, 2025

Perviy Vzglyad Gilermo Del Toro Pokazyvaet Treyler Frankenshteyna

May 30, 2025 -

Kawasaki Ninja 650 Krt Edition 2025 Unveiling The New Model

May 30, 2025

Kawasaki Ninja 650 Krt Edition 2025 Unveiling The New Model

May 30, 2025 -

Gorillaz 25th Anniversary House Of Kong Exhibition Details

May 30, 2025

Gorillaz 25th Anniversary House Of Kong Exhibition Details

May 30, 2025