Determining Your Watch Budget: A Step-by-Step Guide

Table of Contents

Assessing Your Financial Situation

Before even considering specific watch models, it's essential to honestly assess your financial situation. Understanding your disposable income is key to determining a realistic watch budget.

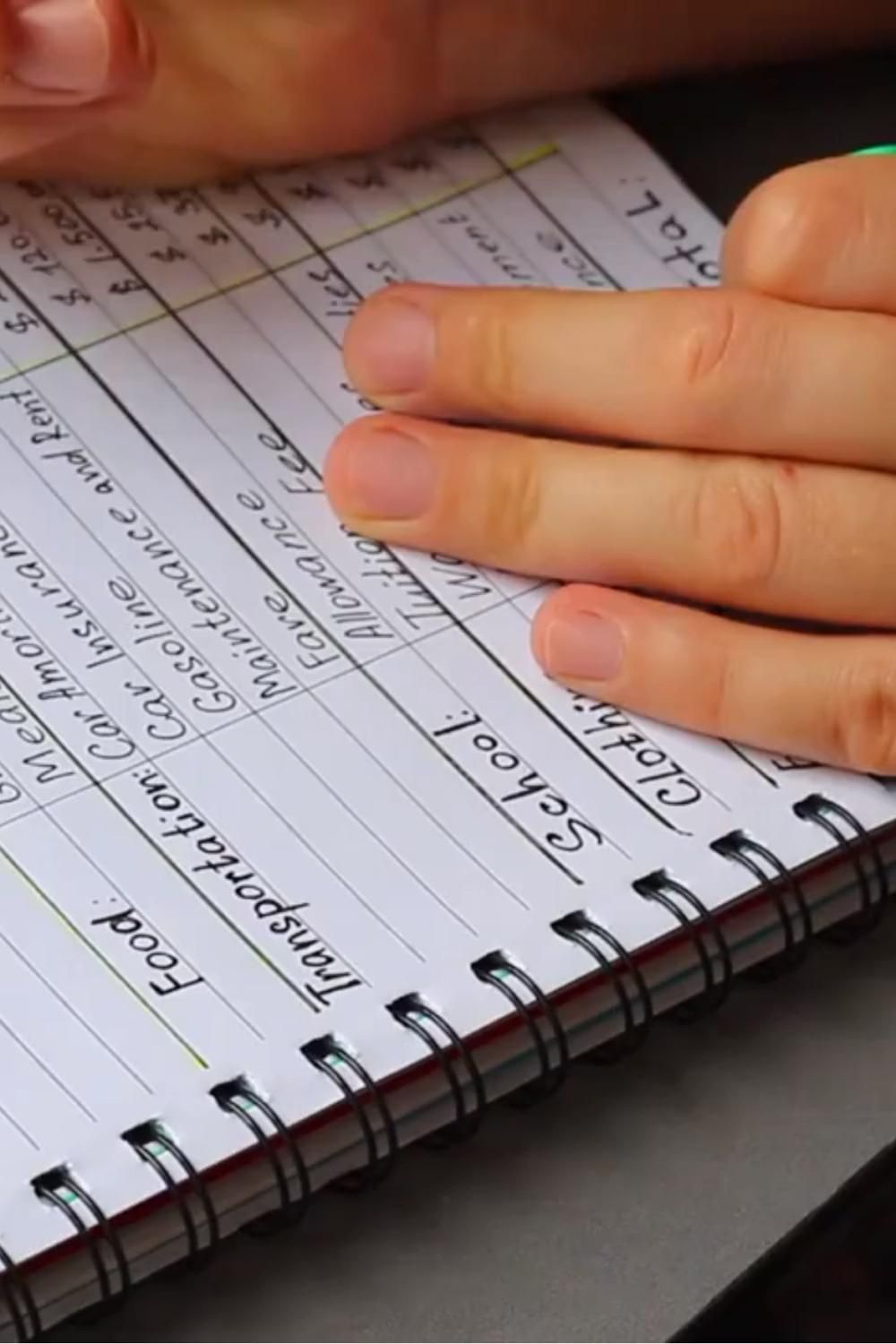

Current Income and Expenses

Analyze your monthly income and carefully list all your essential expenses. Honesty is paramount here; a realistic budget is built on accurate financial information.

- Rent or Mortgage: Your housing costs are likely your largest expense.

- Utilities: Include electricity, water, gas, and internet.

- Groceries and Food: Account for both daily meals and occasional dining out.

- Transportation: Factor in car payments, gas, insurance, or public transportation costs.

- Debt Payments: Include minimum payments on credit cards, loans, or other debts.

- Other Expenses: Consider health insurance, subscriptions, entertainment, and other regular spending.

By subtracting your total monthly expenses from your net income, you'll get a clearer picture of your disposable income – the money you have available after covering essential needs.

Existing Savings and Debt

Evaluate your current savings and outstanding debts. Understanding your readily available cash is critical.

- Cash Savings: This is the most readily accessible money for a watch purchase.

- Investment Accounts: While you could potentially liquidate investments, remember this may have tax implications or impact your long-term financial goals.

- Retirement Funds: It's generally not advisable to use retirement funds for a watch purchase.

- Outstanding Debt: High levels of debt limit your ability to comfortably afford a new watch; prioritize debt reduction before making a significant purchase.

The amount of readily available cash and the impact of debt will significantly influence your watch budget.

Prioritizing Your Purchase

Consider where a new watch ranks among your other financial goals. A new watch might be a priority, but it's important to balance it against other important needs or wants.

- Travel: Are you saving for a vacation?

- Home Improvements: Do you need to repair or renovate your home?

- Emergency Fund: Do you have a sufficient emergency fund?

- Investment Goals: Are you saving for a down payment on a house or other investments?

Using a budgeting app or spreadsheet can help you visualize your finances and prioritize your spending. This will help you determine how much you can comfortably allocate to a watch purchase.

Defining Your Watch Preferences

Once you understand your financial capabilities, it’s time to define your desired watch. This will help you narrow down options and refine your budget.

Desired Style and Functionality

Identify the key features you want in your watch. Different styles and functionalities significantly impact price.

- Dress Watches: Elegant and classic, often more expensive due to intricate details.

- Sport Watches: Durable and functional, with features like chronographs and water resistance.

- Dive Watches: Built for underwater use, featuring high water resistance and often robust construction.

- Automatic Movement: More expensive than quartz movements due to their mechanical complexity.

- Chronograph: A complication that adds stopwatch functionality, increasing the price.

- Water Resistance: Higher water resistance ratings generally mean a more expensive watch.

Brand Preferences and Material Considerations

Research different watch brands and materials to understand their price points.

- Budget-Friendly Brands: Offer good value for money with reliable features. Examples include Seiko, Orient, and Tissot.

- Mid-Range Brands: Combine quality, style, and features at a moderate price point. Examples include Hamilton, Longines, and Tag Heuer.

- Luxury Brands: Represent high-end craftsmanship and often use precious materials. Examples include Rolex, Patek Philippe, and Audemars Piguet.

- Materials: Steel is common and relatively affordable, while titanium is lighter and more expensive. Gold and platinum significantly increase the price.

Long-Term Value and Resale Potential

Consider the watch's potential for future value. While most watches depreciate, certain models appreciate, especially vintage or collector's watches. Researching specific models before purchasing can provide insights into their potential resale value. This is a factor to consider, particularly if you anticipate reselling the watch in the future.

Setting a Realistic Budget Range

Now, combine your financial assessment with your watch preferences to establish a realistic budget.

Establishing Upper and Lower Limits

Define a comfortable spending range based on your previous assessments.

- Percentage of Disposable Income: Consider allocating a specific percentage (e.g., 10%) of your disposable income to the watch purchase.

- Savings Target: Set a savings goal and work towards it before making the purchase.

- Specific Amount: Determine a fixed amount you're comfortable spending and stick to it.

It’s crucial to stick to your pre-determined budget to avoid financial strain.

Contingency Planning

Account for unexpected costs such as repairs or servicing.

- Battery Replacement: Especially for quartz watches.

- Strap Repairs or Replacements: Straps can wear out over time.

- Service Intervals: Mechanical watches often require periodic servicing.

Saving a small percentage above your target purchase price for maintenance is advisable.

Financing Options (if applicable)

Explore responsible financing options only if absolutely necessary.

- Credit Cards: Use them sparingly and pay off the balance promptly to avoid high interest charges.

- Personal Loans: Offer potentially lower interest rates than credit cards but require careful consideration of repayment terms.

Avoid overextending yourself financially; responsible borrowing is key.

Conclusion

Determining your watch budget before making a purchase is essential to avoid financial strain and ensure a satisfying experience. This process involves three key steps: assessing your financial situation to understand your disposable income, defining your watch preferences to identify your ideal timepiece, and setting a realistic budget range, including contingency planning. Remember to prioritize responsible spending and avoid overextending your finances.

Ready to find the perfect timepiece? Use this step-by-step guide to effectively determine your watch budget and begin your watch-buying journey today!

Featured Posts

-

Tramp I Svift Prichini Ta Naslidki Yikhnogo Konfliktu

May 27, 2025

Tramp I Svift Prichini Ta Naslidki Yikhnogo Konfliktu

May 27, 2025 -

Ukraina Na Puti V Nato Garantii I Perspektivy Ot Germanii

May 27, 2025

Ukraina Na Puti V Nato Garantii I Perspektivy Ot Germanii

May 27, 2025 -

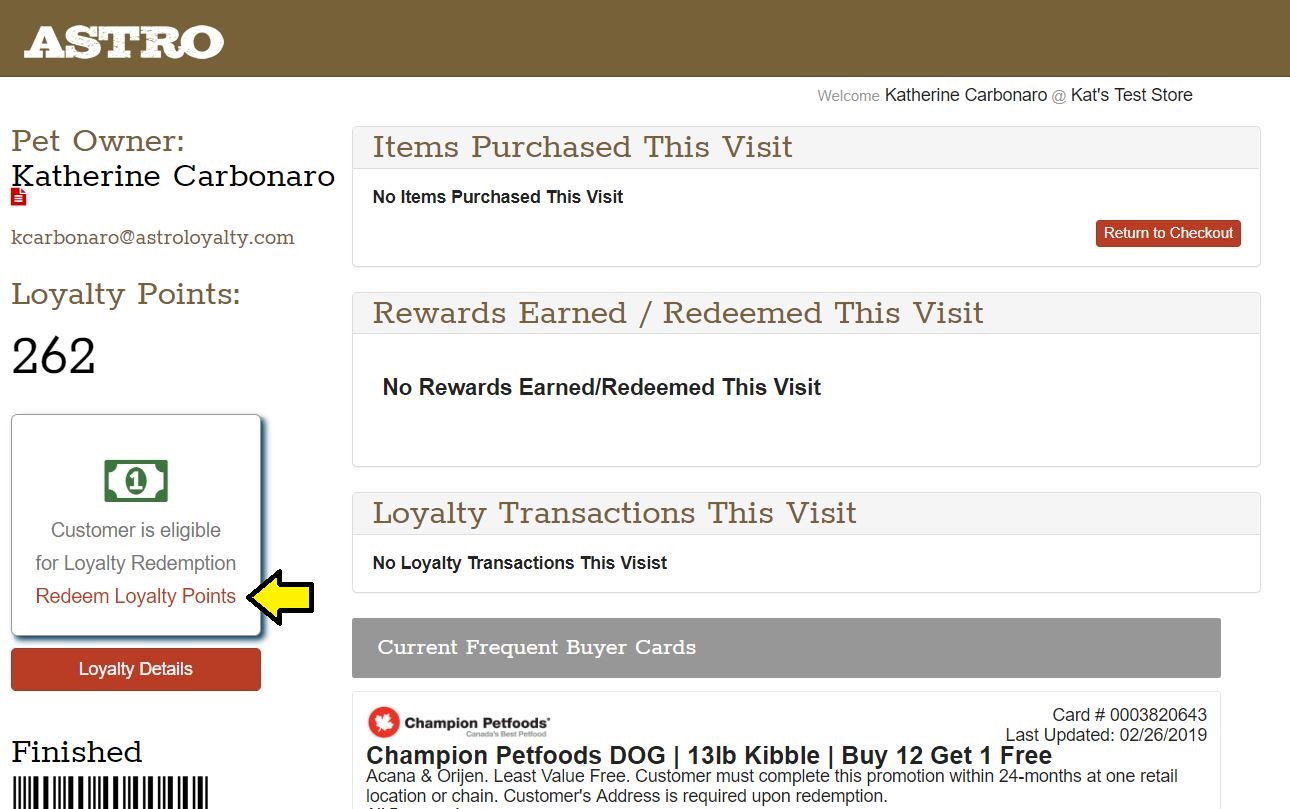

Maximize Your Travel Value Redeem Loyalty Points Now

May 27, 2025

Maximize Your Travel Value Redeem Loyalty Points Now

May 27, 2025 -

Ecb Nin Tarifelere Yoenelik Uyarisi Ne Anlama Geliyor

May 27, 2025

Ecb Nin Tarifelere Yoenelik Uyarisi Ne Anlama Geliyor

May 27, 2025 -

Almanacco Giornaliero Martedi 20 Maggio Accadde Oggi

May 27, 2025

Almanacco Giornaliero Martedi 20 Maggio Accadde Oggi

May 27, 2025

Latest Posts

-

Greve Sncf Analyse Des Arguments De Philippe Tabarot Sur Les Revendications

May 30, 2025

Greve Sncf Analyse Des Arguments De Philippe Tabarot Sur Les Revendications

May 30, 2025 -

Philippe Tabarot Critique La Greve A La Sncf Et Ses Revendications

May 30, 2025

Philippe Tabarot Critique La Greve A La Sncf Et Ses Revendications

May 30, 2025 -

Greve Sncf Le Ministre S Exprime La Pagaille Est Elle Inevitable

May 30, 2025

Greve Sncf Le Ministre S Exprime La Pagaille Est Elle Inevitable

May 30, 2025 -

Sncf Greve Reactions A La Contestation Des Revendications Syndicales

May 30, 2025

Sncf Greve Reactions A La Contestation Des Revendications Syndicales

May 30, 2025 -

Greve Sncf Philippe Tabarot Juge Les Revendications Illegitimes

May 30, 2025

Greve Sncf Philippe Tabarot Juge Les Revendications Illegitimes

May 30, 2025