Definity's $3.3 Billion Acquisition Of Travelers Canada: A Closer Look

Table of Contents

Financial Aspects of the Acquisition

Deal Value and Financing

Definity's acquisition of Travelers Canada represents a significant investment, totaling $3.3 billion. The financing strategy likely involved a mix of debt and equity, though the exact breakdown remains undisclosed. This level of investment highlights Definity's commitment to expanding its presence in the Canadian market and its confidence in the long-term potential of the acquired business. Securing this financing underscores Definity's strong financial position and access to capital markets. The debt implications will need to be carefully monitored, assessing its impact on Definity's overall financial health and future investment capabilities.

Impact on Definity's Financial Statements

The acquisition will undoubtedly impact Definity's financial statements. While the immediate effect might show increased debt levels, the long-term benefits are expected to outweigh the initial costs. Synergies resulting from integrating Travelers Canada's operations into Definity's existing infrastructure should generate significant cost savings, potentially in areas like IT, administration, and claims processing. Increased revenue streams from the combined entity are also anticipated.

- Key financial ratios affected: Debt-to-equity ratio, return on assets (ROA), return on equity (ROE).

- Expected ROI for Definity: A detailed ROI projection will likely be unveiled in Definity's future financial reports, taking into account both tangible and intangible benefits.

- Potential impact on shareholder value: The acquisition is expected to positively impact shareholder value in the long term, though short-term volatility is possible. Successful integration and synergy realization are key to achieving this positive impact. Keywords: Financial impact, acquisition cost, debt financing, profitability, ROI, shareholder value, financial statements.

Market Impact and Competitive Landscape

Market Share Changes

The acquisition significantly alters the Canadian P&C (Property & Casualty) insurance market share distribution. Travelers Canada held a substantial market share before the acquisition, and its integration into Definity propels Definity to a more dominant position within the Canadian insurance sector. This consolidation could lead to increased market concentration.

Competitive Dynamics

This acquisition intensifies the competition among major players in the Canadian insurance sector. Other insurers will likely respond by adjusting their strategies, potentially leading to increased competition through innovative product offerings, more aggressive pricing, or further industry consolidation. The market will be closely watching how competitors respond to Definity’s strengthened position.

- Key competitors: Intact Financial Corporation, Manulife Financial, Sun Life Financial are key players to watch for their responses to this change in the competitive landscape.

- Predicted market reactions: Expect increased marketing efforts and potential price adjustments from competitors.

- Potential for increased premiums or improved services: The outcome is uncertain; increased market power could lead to either scenario, depending on Definity's pricing strategy and focus on operational efficiencies. Keywords: Market share, competition, Canadian P&C insurance, industry consolidation, competitive landscape.

Strategic Rationale and Future Plans

Definity's Growth Strategy

The acquisition aligns perfectly with Definity's broader growth strategy. It allows for significant market expansion within Canada, adding a substantial portfolio of customers and insurance products. Product diversification also benefits from this acquisition, potentially broadening Definity's service offerings and attracting a wider range of customers. Furthermore, the acquisition could provide access to Travelers Canada's technological advancements and expertise.

Integration Plans and Synergies

Definity's success will hinge on its ability to seamlessly integrate Travelers Canada into its existing operations. This integration will involve significant planning and execution, focusing on aligning systems, processes, and cultures. The expected synergies from this integration are considerable, promising improved operational efficiency and significant cost reduction.

- Expected timeline for integration: A detailed timeline is likely to be shared in official announcements. This would involve assessing the complexity of aligning technology, rebranding strategies, and the integration of different teams and operational processes.

- Potential job impacts: Job losses are a common concern in mergers and acquisitions, but Definity may aim to retain key talent to leverage existing expertise. A detailed communication strategy for employees will be crucial during the integration period.

- Plans for technological upgrades and operational efficiencies: This integration is expected to lead to significant improvements in technological infrastructure and optimize operational procedures for cost efficiencies. Keywords: Strategic goals, market expansion, integration, synergies, operational efficiency, growth strategy.

Regulatory Approvals and Legal Considerations

Regulatory Scrutiny

Securing regulatory approvals for this large-scale acquisition was crucial. Various regulatory bodies, including the Competition Bureau of Canada, would have scrutinized the deal to ensure it doesn't harm competition or consumers. The approval process likely involved detailed reviews of Definity's plans, addressing any potential antitrust concerns.

Antitrust Concerns

Given the size of the acquisition and its impact on market share, antitrust concerns were inevitable. Definity likely addressed these concerns by demonstrating the acquisition's pro-competitive aspects, possibly highlighting its plans to enhance services or lower premiums. The successful completion of the deal implies these concerns were adequately addressed to the satisfaction of regulators.

- Key regulatory bodies involved: Competition Bureau of Canada and potentially other provincial regulatory bodies.

- Timeline for approvals: The timeline would depend on the thoroughness of the regulatory review process and the information provided by Definity.

- Any conditions imposed: Regulatory approvals may have been subject to certain conditions to mitigate any potential negative impacts on competition. Keywords: Regulatory approval, antitrust, competition law, legal considerations.

Conclusion: Analyzing Definity’s $3.3 Billion Investment in the Future of Canadian Insurance

Definity's acquisition of Travelers Canada is a transformative event for the Canadian insurance landscape. The financial implications are significant, requiring careful management of debt and a focus on realizing projected synergies. The deal has changed the competitive dynamics, setting the stage for potential further consolidation or innovative responses from competitors. Definity's strategic goals of market expansion, product diversification, and enhanced technological capabilities are directly supported by this acquisition. The long-term success will depend on effective integration and the realization of anticipated cost savings and revenue growth. To stay informed about further developments in the Definity acquisition, Travelers Canada, and Canadian insurance market updates, subscribe to our newsletter or follow relevant news sources.

Featured Posts

-

Can Manila Bay Maintain Its Vibrancy

May 30, 2025

Can Manila Bay Maintain Its Vibrancy

May 30, 2025 -

Loeil De Philippe Caveriviere Replay Du Debat Avec Philippe Tabarot 24 Avril 2025

May 30, 2025

Loeil De Philippe Caveriviere Replay Du Debat Avec Philippe Tabarot 24 Avril 2025

May 30, 2025 -

France Et Le Vietnam Un Partenariat Renforce Pour La Mobilite Durable

May 30, 2025

France Et Le Vietnam Un Partenariat Renforce Pour La Mobilite Durable

May 30, 2025 -

Further Losses Predicted For Live Music Stocks On Friday

May 30, 2025

Further Losses Predicted For Live Music Stocks On Friday

May 30, 2025 -

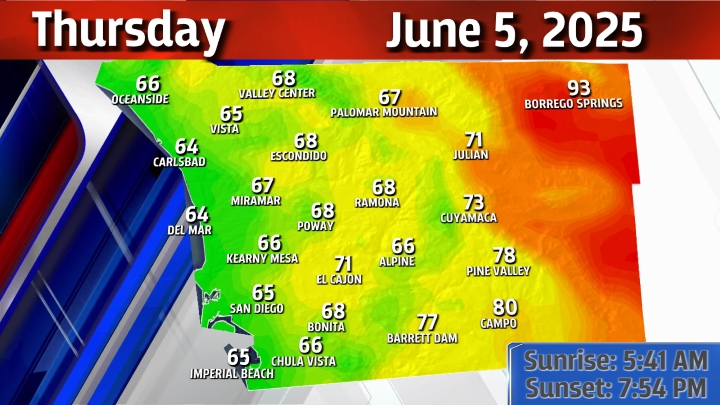

Four Days Of Warm Clear Weather Forecast For San Diego County

May 30, 2025

Four Days Of Warm Clear Weather Forecast For San Diego County

May 30, 2025