Decoding X's Finances: Impact Of The Recent Debt Sale On Musk's Company

Table of Contents

The Details of X's Recent Debt Sale

This section details the specifics of X's recent debt issuance, providing crucial context for understanding its potential implications.

Amount and Terms of X's Debt

While precise figures may not be publicly available immediately following a private debt sale, reports suggest X raised a substantial amount (insert estimated amount if available, otherwise use phrasing like "a significant sum" or "a substantial amount"). The terms of the debt likely include specific interest rates (insert estimated interest rate range if available, otherwise use phrasing like "market-rate interest" or "a competitive interest rate"), maturity dates (insert estimated maturity date or date range if available, otherwise use phrasing like "a multi-year maturity" or "various maturity dates"), and repayment schedules. The lenders involved are also important, but this information is often kept confidential in private debt transactions.

Reasons Behind the Debt Sale

Several factors could have prompted X's decision to issue debt. These include:

-

Funding Ongoing Operations and Improvements: X requires substantial resources to maintain its operations, including server infrastructure, employee salaries, and ongoing platform development. The debt sale could provide the necessary capital for these critical expenses.

-

Paying Down Existing Debt: X may have used a portion of the funds to refinance or pay down existing high-interest debt, thereby reducing its overall financial burden and improving its financial flexibility.

-

Financing Ambitious Expansion Plans: Musk's vision for X likely involves significant expansion plans, potentially including the integration of payment processing capabilities, enhanced subscription models, or other ambitious features. The debt could facilitate these expansions.

-

Supporting Other Musk-Related Ventures: Some speculation exists that the funds could indirectly support other Musk ventures, though direct connections remain largely unsubstantiated.

-

Specific examples of X's financial challenges pre-debt sale: (Insert verifiable examples if available, perhaps referencing news articles or financial reports. This section should provide context and show the need for the debt sale.)

-

Analysis of X's cash flow before and after the debt sale: (Insert analysis if data is publicly available. Use charts or graphs if possible for clearer visualization.)

-

Comparison of this debt sale to other financing rounds in X's history: (Insert comparison if data is available. Show how this debt sale compares in size and terms to previous funding rounds.)

Impact on X's Financial Health

The debt sale significantly impacts X's financial health, both positively and negatively.

Increased Debt Burden and X's Debt

The newly issued debt increases X's overall debt load. This elevates the risk profile for the company, as a larger debt burden necessitates consistent revenue generation to meet interest payments and eventual repayment obligations. Poor financial performance could potentially lead to default, a scenario that could have severe consequences.

Credit Rating Implications

A higher debt load may negatively affect X's credit rating. Credit rating agencies assess a company's financial health and creditworthiness. A downgrade in X's credit rating could make it more expensive to secure future funding, potentially hindering future growth and expansion plans. This would increase the cost of X's debt.

Interest Payments

The interest payments on the newly issued debt will directly impact X's profitability and cash flow. Substantial interest expenses reduce the amount of money available for reinvestment in the platform, expansion projects, or shareholder returns. This can limit growth and potentially affect the user experience.

- Discussion of debt-to-equity ratios: (Insert analysis if data is available. This is a key metric showing the financial leverage of the company.)

- Potential impact on stock price (if applicable): (Insert analysis if applicable. This would typically be relevant if X were a publicly traded company.)

- Analysis of X's profitability margins: (Insert analysis if data is available. This is a key metric for financial health.)

- Comparison to industry benchmarks: (Insert comparison if data is available. This provides context and helps to gauge X's financial performance relative to competitors.)

Implications for Musk's Overall Business Strategy

X's financial situation is intertwined with Musk's broader business empire.

Synergy with Other Ventures

The debt sale could influence Musk's strategies across his various companies. Potential synergies could exist between X and other ventures, such as Tesla or SpaceX, although the nature and extent of such synergy are often speculative. For instance, X could become a key platform for marketing Tesla products or promoting SpaceX initiatives. This integration is a key aspect to analyze for understanding the long-term implications.

Long-Term Vision for X

The debt sale may influence Musk's long-term vision for X's growth and development. The availability of capital could accelerate the development of new features or services, expanding the platform’s functionality and user base. Conversely, financial constraints might necessitate a more cautious approach to expansion, delaying the implementation of planned projects.

User Experience

While not directly related to Musk's broader business strategy, financial decisions can indirectly affect user experience. For example, if X experiences financial pressures, it might lead to service disruptions, reduced customer support, or adjustments to subscription pricing that could impact user satisfaction.

- Potential integration of X with other Musk companies: (Insert potential examples if any are discussed publicly.)

- Discussion of planned new features or services: (Insert discussion if any plans are publicly known.)

- Analysis of user growth and engagement trends: (Insert analysis if data is publicly available.)

Future Outlook and Predictions

Predicting X's future is challenging, but the debt sale provides important clues. Several scenarios are possible. A successful scenario involves X successfully leveraging the funds to expand its user base, increase revenue through subscriptions or advertising, and eventually reduce its debt burden. Conversely, an unsuccessful scenario might involve ongoing financial struggles, a potential credit rating downgrade, or even the need for further debt financing or restructuring. Expert opinions and industry analysis should be considered for a comprehensive assessment.

Conclusion

X's recent debt sale presents a complex financial picture. While it provides capital for operations and potential expansion, it also increases X's debt burden and carries the risk of impacting its credit rating and profitability. The long-term implications for X's financial health and Musk's overall strategy remain uncertain, requiring close monitoring of X's financial performance and future strategic moves. The impact of this debt on X's financial health, and the future of Musk's business ventures, demands continued observation.

Call to Action: Stay informed about the ongoing developments in X's financial landscape. Continue to follow our analysis of X's finances and Musk's business decisions for further insights into this evolving situation. For more detailed information on X's finances and its future, check back regularly for updates.

Featured Posts

-

Teens Rock Throwing Leads To Murder Conviction

Apr 29, 2025

Teens Rock Throwing Leads To Murder Conviction

Apr 29, 2025 -

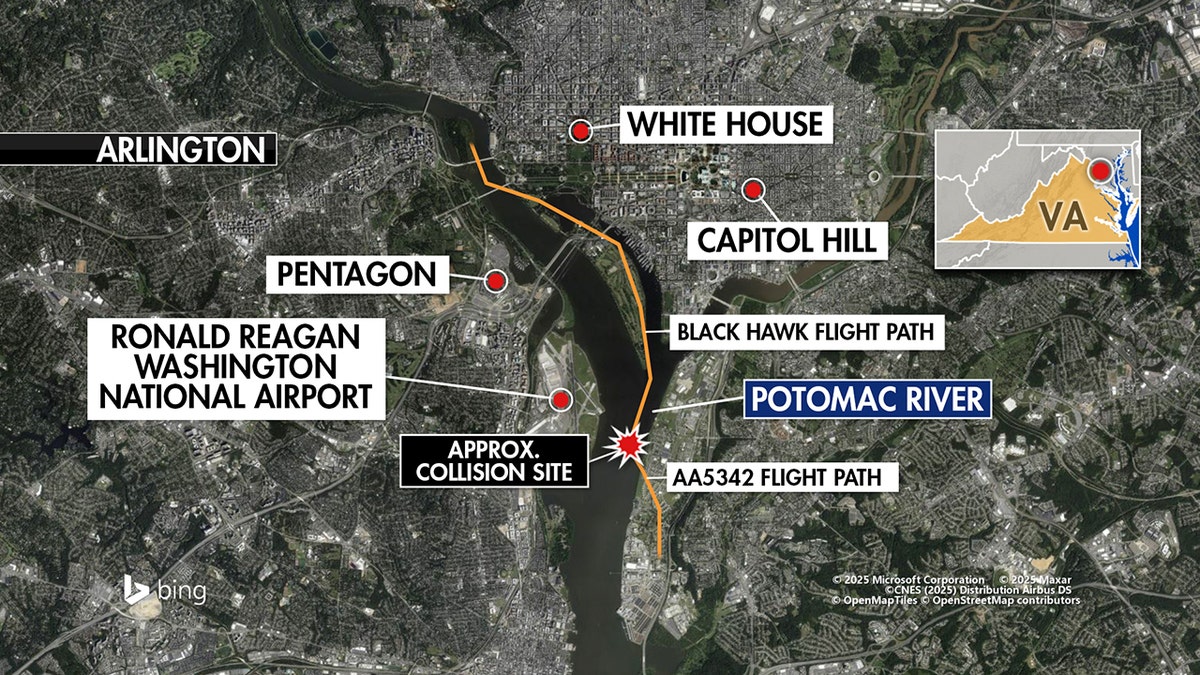

D C Blackhawk Passenger Jet Crash A New Report Reveals Disturbing Details

Apr 29, 2025

D C Blackhawk Passenger Jet Crash A New Report Reveals Disturbing Details

Apr 29, 2025 -

Trumps Decision On Roses Pardon

Apr 29, 2025

Trumps Decision On Roses Pardon

Apr 29, 2025 -

Hollywood Shutdown Writers And Actors On Strike Impacting Film And Tv

Apr 29, 2025

Hollywood Shutdown Writers And Actors On Strike Impacting Film And Tv

Apr 29, 2025 -

Analyzing The Economic Effects Of Trumps Tariffs On Goods From China

Apr 29, 2025

Analyzing The Economic Effects Of Trumps Tariffs On Goods From China

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni