De Minimis Tariffs On Chinese Goods: G-7's Ongoing Discussion

Table of Contents

- Defining "De Minimis" Tariffs and Their Impact

- What are De Minimis Tariffs?

- The Impact on E-commerce and Consumers

- Concerns Regarding Undermining Domestic Industries

- The G7's Stance and Diverging Interests

- Differing Perspectives Among G7 Members

- Negotiating a Balance: Trade vs. National Interests

- The Role of International Trade Organizations

- Future Implications and Potential Outcomes

- Potential Scenarios

- Long-term Economic Consequences

- Conclusion

Defining "De Minimis" Tariffs and Their Impact

What are De Minimis Tariffs?

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. Essentially, if the value of a shipment falls below this predetermined limit, no tariffs are levied. This threshold varies significantly across countries and is a key element in international trade policy.

- Definition of de minimis: A specific monetary value set by a government below which imported goods are exempt from tariffs.

- Historical context of tariff thresholds: De minimis levels have historically been lower, but the rise of e-commerce has pushed for adjustments.

- Variations between countries: The de minimis value differs substantially between nations, reflecting diverse economic priorities and trade agreements. For instance, some countries may have a lower threshold to support domestic businesses, while others may have a higher one to encourage online retail growth.

The Impact on E-commerce and Consumers

The de minimis level significantly impacts online shopping from China. A higher threshold generally leads to lower prices for consumers due to reduced import costs. This increased affordability can boost consumer spending and broaden product availability.

- Lower prices for consumers: Higher de minimis thresholds translate directly to lower costs for imported goods purchased online.

- Increased competition for domestic businesses: Lower import costs can intensify competition for domestic businesses, potentially impacting their market share and profitability.

- Potential for increased imports: A higher de minimis limit could lead to a surge in imports from China, impacting domestic industries' competitiveness.

- Impact on small businesses: Small businesses, particularly those in the retail sector, may face heightened competition from cheaper imports.

Concerns Regarding Undermining Domestic Industries

Raising the de minimis threshold significantly impacts domestic industries. Critics argue this undermines local businesses by enabling a flood of cheaper imports, potentially leading to job losses and economic hardship.

- Loss of jobs in domestic industries: Increased imports could lead to factory closures and unemployment in sectors competing with Chinese goods.

- Unfair competition: Subsidized or dumped goods from China could create an uneven playing field for domestic industries.

- Potential for dumping of cheap goods: A higher threshold might encourage the dumping of cheap goods below market value, further harming domestic producers.

- Need for protectionist measures: Proponents of lower thresholds argue for protectionist measures to safeguard domestic industries and jobs.

The G7's Stance and Diverging Interests

Differing Perspectives Among G7 Members

The G7 nations hold diverse viewpoints on de minimis tariffs for Chinese goods. While some advocate for higher thresholds to promote free trade and lower consumer prices, others prioritize protecting their domestic industries.

- Specific stances of individual G7 nations: The US, for example, has historically taken a more protectionist stance compared to some of its European counterparts.

- Rationale behind their positions: Each nation's position is influenced by factors like its domestic industrial structure, economic dependence on China, and political considerations.

- Impact of domestic political pressures: Internal political pressure from industries affected by imports plays a significant role in shaping each nation’s stance.

Negotiating a Balance: Trade vs. National Interests

Balancing the benefits of free trade with the need to protect national industries is a central challenge in the G7 negotiations. Finding a compromise that addresses both concerns is crucial for maintaining economic stability and international cooperation.

- Economic implications of different tariff levels: Each tariff level has distinct economic implications, affecting consumer prices, industry competitiveness, and government revenue.

- Potential compromises being considered: Negotiations likely involve exploring compromises, such as phased adjustments to the de minimis level or sector-specific exceptions.

- The role of lobbying groups: Lobbying groups representing various industries exert significant influence on the negotiations, advocating for their specific interests.

The Role of International Trade Organizations

International trade organizations, like the WTO, play a significant role by establishing rules and regulations for tariffs. Their involvement influences the scope of the G7's negotiations.

- WTO rules on tariffs: WTO agreements set constraints on tariff levels, preventing excessive protectionism.

- The influence of other international organizations: Other international bodies may also provide recommendations or guidance on the matter.

- Potential for legal challenges: Decisions made by the G7 could be subject to legal challenges if they violate existing international trade agreements.

Future Implications and Potential Outcomes

Potential Scenarios

Several potential outcomes are possible from the G7 negotiations:

-

Raising the de minimis level: This could lead to lower consumer prices but potentially harm domestic industries.

-

Lowering the de minimis level: This would offer greater protection for domestic producers, but could increase prices for consumers.

-

Maintaining the current de minimis level: This would represent a status quo approach but may not satisfy all stakeholders.

-

Impact of each scenario on consumers, businesses, and international relations: Each outcome carries different implications for these stakeholders.

Long-term Economic Consequences

The G7's decision on de minimis tariffs on Chinese goods will have long-term ramifications for global trade patterns.

- Shift in global supply chains: The decision could influence the location of production and the distribution of goods.

- Impact on economic growth: The choice will affect economic growth in both importing and exporting nations.

- Effects on consumer spending: Changes in prices will influence consumer spending patterns.

Conclusion

The ongoing G7 discussion regarding de minimis tariffs on Chinese goods is a complex issue with significant ramifications for global trade and economies. Balancing the desire for free trade with the need to protect domestic industries requires careful consideration. The outcome of these negotiations will shape the future of international commerce and impact both businesses and consumers worldwide. Stay informed about updates on de minimis tariffs on Chinese goods to understand their impact on your business and the broader economy. Understanding the nuances of these de minimis tariffs on Chinese goods will be critical for navigating the changing landscape of international trade.

April Nyc Concert Vybz Kartel To Headline Barclay Center

April Nyc Concert Vybz Kartel To Headline Barclay Center

Espn On The Bruins Key Moves And Their Impact On The Franchise

Espn On The Bruins Key Moves And Their Impact On The Franchise

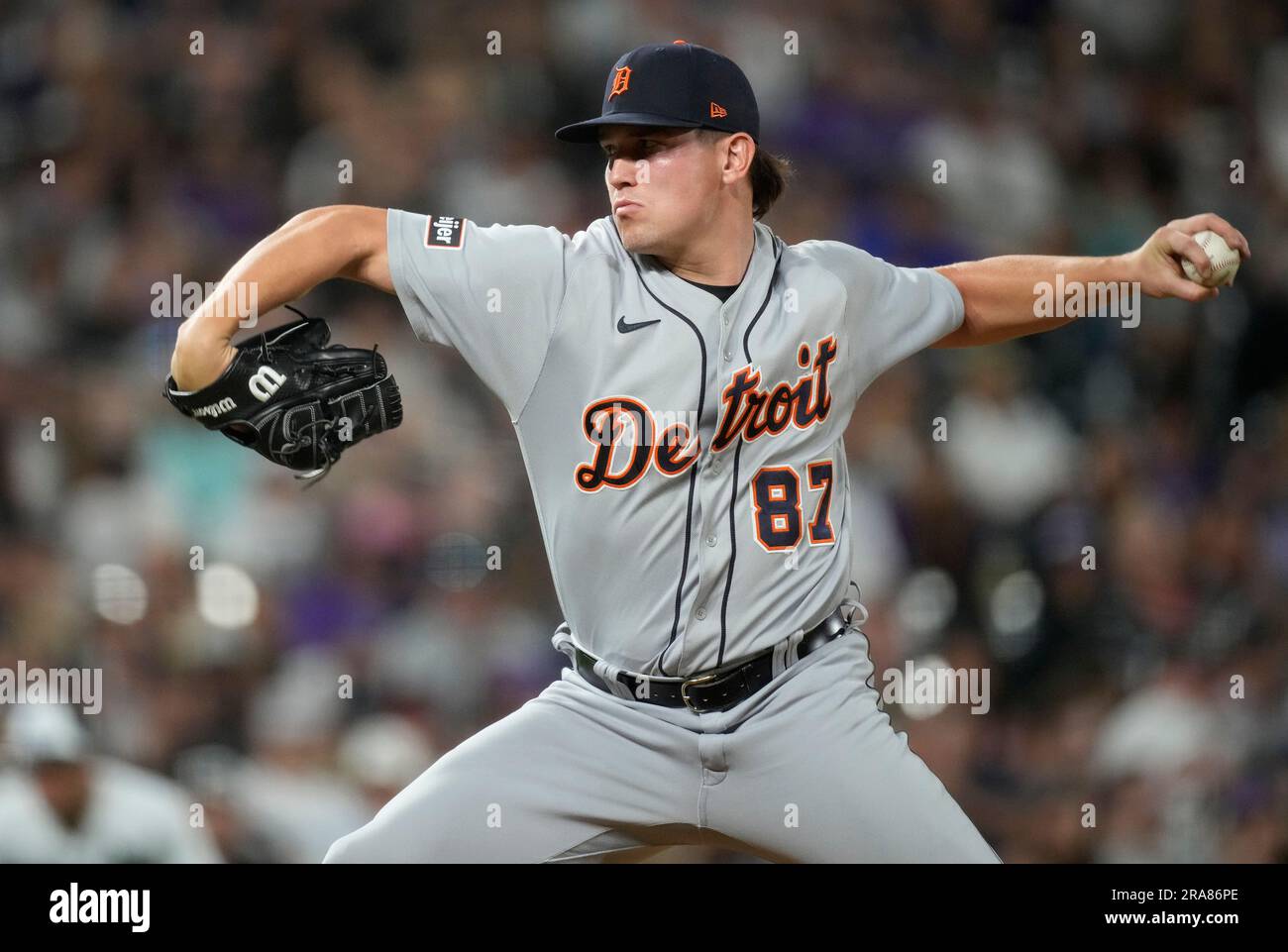

Colorado Rockies Vs Detroit Tigers 8 6 Upset

Colorado Rockies Vs Detroit Tigers 8 6 Upset

Unprecedented Participation 19 Indian Paddlers At Wtt Chennai

Unprecedented Participation 19 Indian Paddlers At Wtt Chennai

Los Memes Mas Chistosos Del Canada Vs Mexico En La Liga De Naciones Concacaf

Los Memes Mas Chistosos Del Canada Vs Mexico En La Liga De Naciones Concacaf