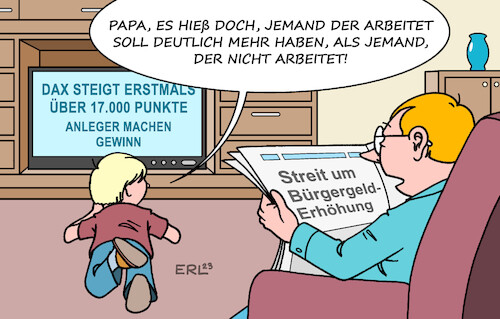

Dax Performance: The Impact Of German Politics And Economics

Table of Contents

The Influence of German Economic Indicators on Dax Performance

Several key economic indicators directly impact investor sentiment and, subsequently, DAX performance. Understanding these indicators is fundamental to forecasting market movements and making informed investment decisions. Key factors include GDP growth, inflation, unemployment rates, interest rates, and consumer and business confidence.

-

GDP Growth: Strong GDP growth signifies a healthy economy, typically boosting investor confidence and leading to increased DAX performance. Sustained economic expansion creates opportunities for businesses, driving stock prices higher.

-

Inflation: High inflation erodes purchasing power, impacting consumer spending and potentially leading to decreased DAX performance. Central banks often respond to high inflation with interest rate hikes, which can further impact market sentiment.

-

Unemployment: Low unemployment rates indicate a robust labor market, contributing to positive consumer spending and generally boosting the DAX. Conversely, high unemployment often signals economic weakness and can negatively affect the index.

-

Interest Rates: Interest rate changes implemented by the European Central Bank (ECB) directly impact borrowing costs for businesses and consumers. Interest rate hikes, while potentially curbing inflation, can also slow economic growth, negatively impacting DAX performance. Conversely, lower interest rates can stimulate borrowing and investment, potentially leading to a higher DAX.

-

Consumer and Business Confidence: Positive consumer and business confidence are strong indicators of future economic activity. High confidence levels typically translate to increased spending and investment, bolstering DAX performance.

Analyzing Key Economic Sectors and their Impact on the DAX

The German economy is diverse, with several key sectors significantly influencing the DAX. Analyzing the performance of these sectors provides a more granular understanding of overall market trends.

-

Automotive Industry: Germany is a global automotive powerhouse. The performance of companies like Volkswagen, BMW, and Daimler significantly impacts the DAX. Any disruption or downturn in the automotive sector will ripple through the index.

-

Manufacturing: Germany's strong manufacturing base contributes significantly to its overall economic output. Manufacturing output is a leading indicator of economic health, with strong production generally correlating to a higher DAX.

-

Technology Sector: The growing German technology sector presents significant growth potential. The success of German tech companies can boost the DAX, mirroring trends seen in other global tech markets.

-

Energy Sector: The energy sector's performance is becoming increasingly vital, influenced by global energy prices, energy transition policies, and geopolitical events. Stability and innovation in this sector can either support or hinder DAX performance.

-

Export Performance: Germany is a major exporter. Strong export performance indicates a healthy economy and global demand for German goods, generally positively correlating with DAX growth.

The Political Landscape and its Effect on Dax Performance

Political stability and government policies are paramount in influencing investor confidence and, consequently, DAX performance. Uncertainty in the political landscape can create market volatility.

-

Political Stability: A stable political environment fosters investor confidence, encouraging investment and generally supporting positive DAX performance. Political instability, on the other hand, creates uncertainty and can negatively impact the market.

-

Government Policies: Government policies, especially fiscal policy (taxation and government spending) and regulatory changes, significantly influence the business environment and therefore impact the DAX. For example, policies supporting renewable energy or promoting innovation can positively impact related sectors within the index.

-

Elections: Election cycles and potential policy shifts can introduce uncertainty into the market, leading to short-term market volatility. Investors often react to election results and potential changes in government priorities.

-

Regulatory Changes: New regulations in key sectors, such as environmental regulations or financial regulations, can impact specific DAX components and the overall index performance.

-

Geopolitical Risks: Geopolitical events impacting the European Union or the global economy – such as trade wars or geopolitical conflicts – can significantly affect investor sentiment and cause volatility in the DAX.

Understanding Market Volatility and Dax Performance

Market volatility is an inherent risk in any investment. Understanding the factors contributing to DAX volatility and employing strategies to manage this risk is essential.

-

Global Market Trends: Global market trends significantly impact the DAX. A downturn in global markets often leads to decreased DAX performance, while positive global trends can have a positive influence.

-

Unexpected Economic Events: Unexpected economic events, such as a sudden economic downturn or a major financial crisis, can cause sharp market corrections in the DAX.

-

Investor Sentiment: Investor sentiment plays a crucial role in short-term DAX fluctuations. Periods of high investor optimism lead to higher prices, while pessimism can trigger sell-offs.

-

Volatility Index (VIX): Monitoring the VIX, a measure of market volatility, can provide insights into potential market risk. A high VIX generally indicates heightened market uncertainty.

-

Diversification: Diversification strategies, such as investing in a range of assets beyond the DAX, can help manage risk and potentially improve overall investment performance.

Conclusion

DAX performance is inextricably linked to the health of the German economy and the stability of its political landscape. By carefully considering the interplay of economic indicators, government policies, and global market trends, investors can develop a more robust understanding of the DAX market. Monitoring key economic data, political developments, and market sentiment allows for better-informed decisions, potentially leading to improved DAX investment strategies. Stay updated on German politics and economics to optimize your understanding of DAX performance and make sound investment choices. Continued research into the factors influencing DAX performance is strongly recommended for a comprehensive view of this dynamic market.

Featured Posts

-

Your Guide To A Happy Day February 20 2025

Apr 27, 2025

Your Guide To A Happy Day February 20 2025

Apr 27, 2025 -

Dax Bundestag Elections And Business Indicators A Complex Interplay

Apr 27, 2025

Dax Bundestag Elections And Business Indicators A Complex Interplay

Apr 27, 2025 -

Alberto Ardila Olivares Garantia En El Logro De Tus Objetivos Profesionales

Apr 27, 2025

Alberto Ardila Olivares Garantia En El Logro De Tus Objetivos Profesionales

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Mc Cook Jewelers Second Chance Helping Nfl Players Rebuild Their Lives

Apr 27, 2025

Mc Cook Jewelers Second Chance Helping Nfl Players Rebuild Their Lives

Apr 27, 2025

Latest Posts

-

Trumps Actions At Pope Benedicts Funeral A Controversial Presence

Apr 27, 2025

Trumps Actions At Pope Benedicts Funeral A Controversial Presence

Apr 27, 2025 -

A Blend Of Politics And Faith Trumps Participation In Pope Benedicts Funeral

Apr 27, 2025

A Blend Of Politics And Faith Trumps Participation In Pope Benedicts Funeral

Apr 27, 2025 -

The Funeral Of Pope Benedict Xvi Trumps Attendance And Its Implications

Apr 27, 2025

The Funeral Of Pope Benedict Xvi Trumps Attendance And Its Implications

Apr 27, 2025 -

Trump And The Vatican Analyzing His Appearance At Pope Benedicts Funeral

Apr 27, 2025

Trump And The Vatican Analyzing His Appearance At Pope Benedicts Funeral

Apr 27, 2025 -

Politics And Ritual Clash Trumps Role At Pope Benedict Xvis Funeral Mass

Apr 27, 2025

Politics And Ritual Clash Trumps Role At Pope Benedict Xvis Funeral Mass

Apr 27, 2025