David Gentile Sentenced: 7 Years For GPB Capital Fraud

Table of Contents

The GPB Capital Fraud Scheme

Understanding the Ponzi-like Scheme

GPB Capital, once a seemingly successful investment firm, orchestrated a complex Ponzi-like scheme that systematically defrauded investors. The scheme involved raising billions of dollars through the sale of private placement investments in purportedly high-yielding alternative assets. Instead of investing these funds as promised, Gentile and his co-conspirators misappropriated significant portions, using the money for personal enrichment and to pay off earlier investors—a classic hallmark of a Ponzi scheme. The fraudulent activities involved a web of deceptive practices, including misleading marketing materials, falsified financial statements, and concealed losses.

- Billions Raised: GPB Capital raised billions of dollars from unsuspecting investors through a network of brokers and financial advisors.

- Fraudulent Strategies: The firm employed various fraudulent strategies, including misrepresenting the performance of its investments and fabricating financial reports.

- Misrepresentations: Investors were consistently misled about the nature of the investments, their risks, and their actual performance. Projected returns were often vastly inflated.

- Assets Involved: The scheme involved investments in various assets, including automotive dealerships and healthcare companies, many of which were significantly overvalued or entirely fictitious.

David Gentile's Role in the Fraud

Gentile's Position and Responsibilities

David Gentile, as a key figure within GPB Capital, played a significant role in perpetrating the fraud. His precise responsibilities encompassed overseeing fundraising efforts, managing investments, and controlling the flow of funds within the firm. Evidence presented during the legal proceedings directly implicated him in orchestrating the deceptive practices and misappropriation of investor funds.

- Responsibilities: Gentile held a position of significant authority within GPB Capital, giving him direct control over key financial decisions.

- Capital Raising: He was actively involved in raising capital from investors, often making materially false and misleading statements about investment performance and risk.

- Trial Evidence: Evidence presented at trial included emails, financial records, and witness testimonies demonstrating his direct involvement in the fraudulent scheme.

- Guilty Plea: Gentile ultimately pleaded guilty to charges related to the GPB Capital fraud.

The 7-Year Sentence and its Implications

Legal Proceedings and Sentencing

Following a thorough investigation by federal authorities, David Gentile faced numerous charges, including securities fraud and conspiracy to commit wire fraud. After a period of legal proceedings, including a guilty plea, he received a seven-year prison sentence. The judge, in handing down the sentence, cited the severity of the fraud, the significant financial losses suffered by victims, and Gentile's central role in orchestrating the scheme.

- Charges: Gentile faced several serious charges related to securities fraud and wire fraud, reflecting the complexity and gravity of his crimes.

- Sentence Length: The seven-year prison sentence reflects the seriousness of the crime and serves as a deterrent to others contemplating similar actions.

- Restitution: While a seven-year sentence is significant, the possibility of restitution for the victims remains a crucial factor in the aftermath of this large-scale fraud.

- Legal Precedents: This case sets a significant legal precedent, potentially influencing future prosecutions of similar white-collar crimes and highlighting the potential penalties for such actions.

Impact on Investors and the Financial Industry

Losses Suffered by Investors

The GPB Capital fraud resulted in devastating financial losses for thousands of investors. The exact amount of losses remains substantial, with many individuals losing their life savings. This widespread financial damage has severely impacted investor confidence and trust in the financial industry.

- Number of Victims: Thousands of investors were affected by the GPB Capital fraud, highlighting the wide-reaching consequences of such schemes.

- Financial Losses: The financial losses suffered by investors totaled billions of dollars, representing a significant blow to their personal finances and retirement plans.

- Investor Confidence: The GPB Capital scandal has eroded investor trust in financial institutions and heightened concerns about the effectiveness of regulatory oversight.

- Regulatory Scrutiny: The case has led to increased regulatory scrutiny of private placement offerings and a renewed focus on protecting investors from fraudulent activities.

Conclusion

The David Gentile sentencing underscores the devastating impact of the GPB Capital fraud and the significant consequences faced by those involved in orchestrating such schemes. The seven-year sentence serves as a stark reminder of the legal repercussions of investment fraud and the potential for substantial penalties. The scale of the fraud, the substantial losses suffered by investors, and the legal ramifications of this case should serve as a powerful warning.

Call to Action: Learn more about protecting yourself from investment fraud and understanding the signs of a Ponzi scheme. Resources from the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) can provide valuable insights. The David Gentile sentencing serves as a stark reminder of the consequences of GPB Capital-type fraud.

Featured Posts

-

L Humour De Chantal Ladesou Analyse De Son Style Comique

May 11, 2025

L Humour De Chantal Ladesou Analyse De Son Style Comique

May 11, 2025 -

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television Production

May 11, 2025

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television Production

May 11, 2025 -

Selena Gomez And Benny Blancos Baby News Fact Or Fiction

May 11, 2025

Selena Gomez And Benny Blancos Baby News Fact Or Fiction

May 11, 2025 -

Le Refuge Parisien De Chantal Ladesou Ou Elle Retrouve Sa Belle Fille Et Ses Petits Enfants

May 11, 2025

Le Refuge Parisien De Chantal Ladesou Ou Elle Retrouve Sa Belle Fille Et Ses Petits Enfants

May 11, 2025 -

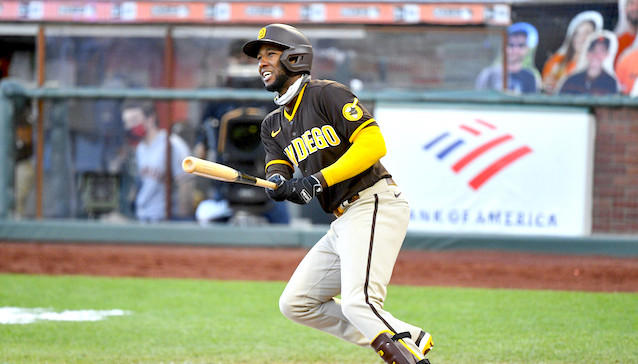

80 Game Ban For Jurickson Profar Mlbs Ped Policy In Action

May 11, 2025

80 Game Ban For Jurickson Profar Mlbs Ped Policy In Action

May 11, 2025