D-Wave Quantum (QBTS) Stock: Reasons Behind Monday's Significant Decrease

Table of Contents

Market Sentiment and Overall Tech Stock Performance

The decline in D-Wave Quantum (QBTS) stock wasn't occurring in a vacuum. Several broader market forces likely played a significant role.

Broad Market Downturn

- A general negative trend in the tech sector and broader market significantly impacted investor confidence.

- Rising interest rates, concerns about inflation, and geopolitical instability all contributed to a sell-off across various sectors.

- Negative news concerning major tech companies often creates a ripple effect, increasing risk aversion amongst investors.

Investor sentiment is crucial. When the overall market experiences a downturn, even companies with strong fundamentals can see their stock prices fall as investors opt for safer investments. This increased selling pressure disproportionately affects smaller-cap stocks like D-Wave Quantum (QBTS) stock.

Sector-Specific Concerns

- Advancements by competitors in the quantum computing space could trigger uncertainty regarding D-Wave Quantum's market share.

- Potential regulatory changes impacting the quantum computing industry could create hesitancy amongst investors.

- Concerns about the scalability and practical applications of quantum computing technology could also contribute to negative sentiment.

Negative news regarding competitors, or a slowdown in overall quantum computing investment, can significantly influence investor perception of D-Wave Quantum and impact D-Wave Quantum (QBTS) stock price.

Lack of Recent Positive Catalysts for D-Wave Quantum (QBTS) Stock

The absence of positive news or significant catalysts can create uncertainty and pressure on stock prices.

Absence of Major Announcements

- Investors often anticipate major product launches, partnerships, or breakthroughs from companies like D-Wave Quantum.

- The absence of such announcements can lead to a lack of positive momentum for the stock.

- Missed milestones or delays in anticipated projects can exacerbate investor concern and negatively impact D-Wave Quantum (QBTS) stock performance.

Without substantial positive news, investor confidence wanes, leading to selling pressure.

Financial Performance and Expectations

- Disappointing financial reports, lower-than-expected revenue, or increased expenses can negatively affect investor sentiment.

- Earnings calls that fail to address investor concerns can further contribute to a stock price decline.

- If revenue projections for the next quarter fall short of analyst estimates, this can also lead to a sell-off.

A discrepancy between actual and anticipated financial performance often results in a negative market reaction, directly impacting D-Wave Quantum (QBTS) stock.

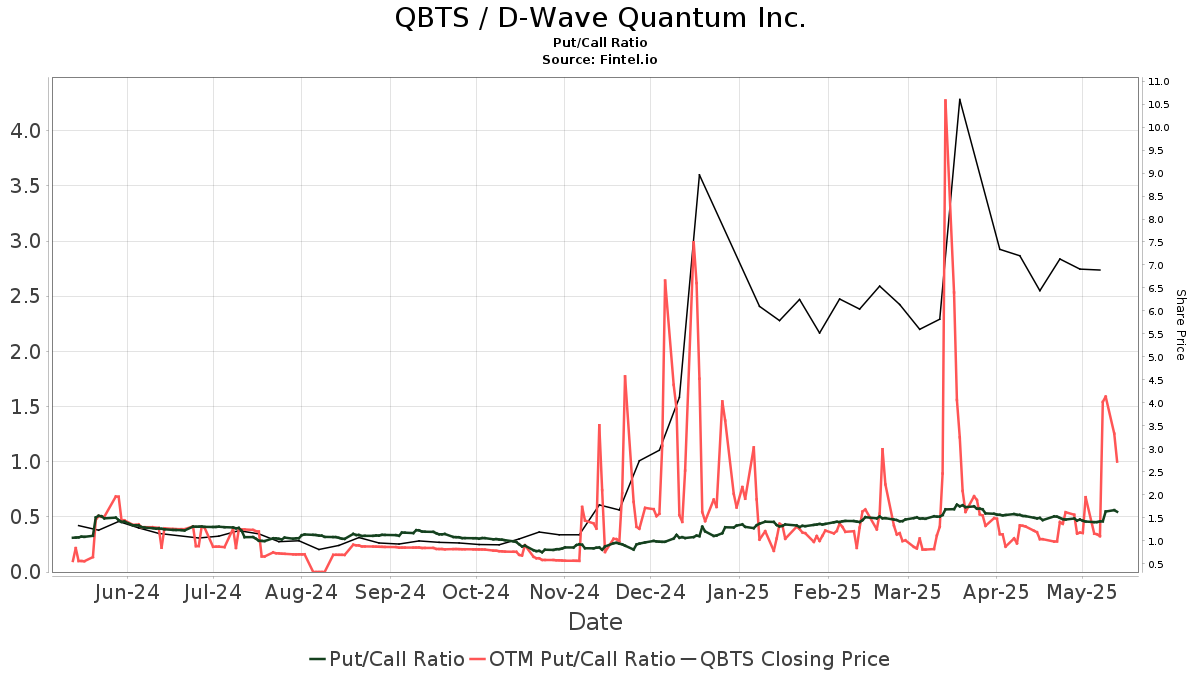

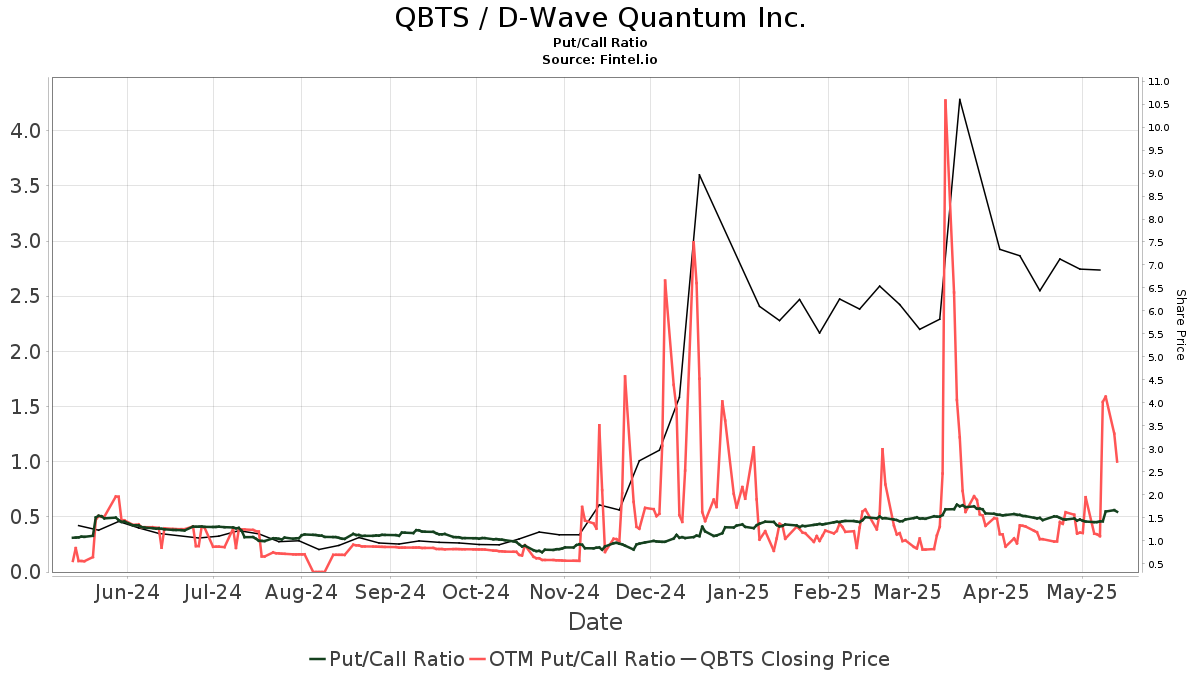

Technical Analysis of D-Wave Quantum (QBTS) Stock Chart

Technical analysis can provide insights into the reasons behind the price drop.

Identifying Technical Indicators

- A breakdown below key support levels can indicate significant selling pressure.

- Negative momentum indicators, like a bearish crossover of moving averages, can confirm a downtrend.

- High volume during the price drop strengthens the signal of increased selling pressure. (Include a hypothetical chart example if possible showing these indicators.)

These technical indicators suggest that underlying factors beyond just news headlines contributed to the decline in D-Wave Quantum (QBTS) stock.

Trading Volume and Volatility

- High trading volume during the price drop suggests a significant number of investors were actively selling their shares.

- Increased volatility signifies a heightened level of uncertainty and risk in the market.

- A combination of high volume and volatility often amplifies price movements, leading to sharper declines.

High trading volume coupled with increased volatility points to a rapid shift in investor sentiment and can significantly exacerbate the price drop in D-Wave Quantum (QBTS) stock.

Conclusion: Analyzing the Future of D-Wave Quantum (QBTS) Stock

The decline in D-Wave Quantum (QBTS) stock on Monday likely resulted from a combination of factors: a broader tech market downturn, a lack of recent positive catalysts for the company, and technical indicators confirming increased selling pressure. While the short-term outlook might appear uncertain, D-Wave Quantum operates in a promising sector with long-term growth potential. However, investors should proceed cautiously.

Stay informed about the evolving dynamics of D-Wave Quantum (QBTS) stock and the broader quantum computing market before making any investment decisions. Conduct thorough due diligence, monitor the company's performance, and consider consulting with a financial advisor before investing in D-Wave Quantum (QBTS) stock or any other high-risk technology stock.

Featured Posts

-

D Wave Quantum Qbts Stock Price Drop In 2025 Understanding The Decline

May 20, 2025

D Wave Quantum Qbts Stock Price Drop In 2025 Understanding The Decline

May 20, 2025 -

14 279 Voies Abidjan Mise A Jour Du Projet D Adressage

May 20, 2025

14 279 Voies Abidjan Mise A Jour Du Projet D Adressage

May 20, 2025 -

Manchester Uniteds Cunha Pursuit Accelerated Talks And Plan B Details

May 20, 2025

Manchester Uniteds Cunha Pursuit Accelerated Talks And Plan B Details

May 20, 2025 -

Dont Ignore Important Hmrc Letters For Uk Households

May 20, 2025

Dont Ignore Important Hmrc Letters For Uk Households

May 20, 2025 -

Kcrg Tv 9 To Broadcast 10 Minnesota Twins Games

May 20, 2025

Kcrg Tv 9 To Broadcast 10 Minnesota Twins Games

May 20, 2025

Latest Posts

-

I Tragodia Toy Baggeli Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025

I Tragodia Toy Baggeli Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025 -

Giakoymakis I Prosfora Apo Tin Los Antzeles

May 20, 2025

Giakoymakis I Prosfora Apo Tin Los Antzeles

May 20, 2025 -

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025 -

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Tis Anthropinis Aksias

May 20, 2025

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Tis Anthropinis Aksias

May 20, 2025