D-Wave Quantum (QBTS) Stock Plunge: Understanding Thursday's Decline

Table of Contents

Analyzing the Immediate Triggers for the QBTS Stock Drop

Several factors likely contributed to the immediate drop in QBTS stock price on Thursday. Let's examine the most probable triggers.

Lack of Positive News or Earnings Announcements

The absence of positive catalysts played a significant role in the QBTS stock decline. Investors often react negatively when a company fails to deliver positive news or strong earnings announcements.

- No significant contract wins announced: A lack of substantial new contracts indicates potential challenges in securing business and revenue growth.

- Delayed product launches: Postponements of crucial product releases signal potential setbacks in development or market readiness, impacting investor confidence.

- Absence of positive financial reports: Without positive financial data, investors lack confidence in the company's short-term and long-term financial health.

This lack of positive news created uncertainty in the market, inviting selling pressure and contributing directly to the QBTS stock plunge. The absence of good news often amplifies any negative sentiment.

Broader Market Sentiment and Downturn

The overall market conditions on Thursday also likely contributed to the QBTS decline. A general market downturn can significantly impact even seemingly strong companies.

- General market trends: If the broader market experienced a downturn, QBTS would likely be affected, especially given its position as a relatively high-risk, growth stock.

- Technology sector performance: The technology sector often experiences amplified volatility. A poor performance in this sector would disproportionately affect QBTS.

- Investor sentiment shifts: Changes in investor sentiment, perhaps driven by macroeconomic factors or general risk aversion, could lead to widespread selling, including in the quantum computing sector.

Whether QBTS's decline mirrored broader market trends or was more severe is crucial to understanding the specific reasons behind the drop. A more significant decline than the overall market suggests investor-specific concerns about D-Wave Quantum.

Potential Impact of Analyst Ratings or Reports

Negative analyst reports or ratings can significantly impact a stock's price. The release of a negative report, or a change in rating, could have precipitated or exacerbated Thursday's decline.

- Mention specific analysts and their ratings, if available: Identifying specific analysts and their actions allows for a more detailed analysis of the impact. (Note: This section would need to be updated with specific information if available.)

- Discuss the impact of sell recommendations: Sell recommendations from influential analysts can trigger immediate selling pressure, as investors react to the perceived negative assessment.

Analyst opinions carry significant weight in shaping investor confidence and trading decisions. Negative sentiment, especially from reputable analysts, can amplify the effects of other negative factors.

Long-Term Factors Contributing to QBTS Stock Volatility

Beyond immediate triggers, several long-term factors contribute to the inherent volatility of QBTS stock.

The Inherent Risks of Investing in Quantum Computing Stocks

Investing in early-stage quantum technology companies like D-Wave Quantum carries significant risk.

- High risk, long-term investment horizon: Quantum computing is a nascent field, meaning substantial returns are likely years away, and the possibility of failure is substantial.

- Uncertain profitability: The path to profitability for quantum computing companies is unclear, making it a high-risk investment.

- Competition in the quantum computing field: The quantum computing sector is fiercely competitive, with established tech giants like IBM and Google investing heavily in the field.

These inherent risks make QBTS stock a volatile investment, susceptible to significant price swings based on even minor shifts in market sentiment or company performance.

Competition in the Quantum Computing Sector

The competitive landscape is a major factor influencing QBTS's market position and stock price.

- Mention key competitors (IBM, Google, etc.): The presence of major players like IBM and Google creates significant competitive pressure.

- Technological advancements by competitors: Faster development and deployment of superior quantum technologies by competitors can quickly render QBTS's technology less attractive.

- Market share implications: Loss of market share to competitors significantly impacts future revenue and profitability, leading to negative market reactions.

The competitive pressure and rapid technological advancements in the quantum computing sector create a dynamic and volatile environment, impacting investor confidence in QBTS.

Overall Financial Performance and Future Projections of D-Wave Quantum

The company's financial health and future projections play a crucial role in influencing investor sentiment and stock price.

- Key financial indicators: Metrics like revenue, expenses, profit margins, and debt levels provide insights into the company's financial stability.

- Profitability: The ability (or lack thereof) to generate profits is a critical factor affecting investor perception.

- Funding rounds: The need for additional funding suggests challenges in achieving self-sufficiency and can negatively impact stock price.

- Future growth estimations: Positive future projections can boost investor confidence, while negative projections can lead to a drop in stock prices.

Analyzing D-Wave Quantum's financial health, along with realistic assessments of future growth, is essential to understanding investor reaction to the company's performance.

Conclusion

The sharp decline in D-Wave Quantum (QBTS) stock on Thursday likely resulted from a combination of factors. These factors ranged from the absence of positive news and broader market trends to the inherent risks and competitive pressures within the quantum computing sector. Investors considering investing in D-Wave Quantum or other quantum computing stocks should carefully consider the risks involved. Understanding the complexities of the quantum computing market and the volatility inherent in QBTS stock is crucial for informed investment strategies. Continue monitoring the D-Wave Quantum (QBTS) situation for further updates and deeper analysis to navigate the fluctuating landscape of quantum computing stocks. Thorough due diligence is paramount before investing in this high-risk, high-reward sector.

Featured Posts

-

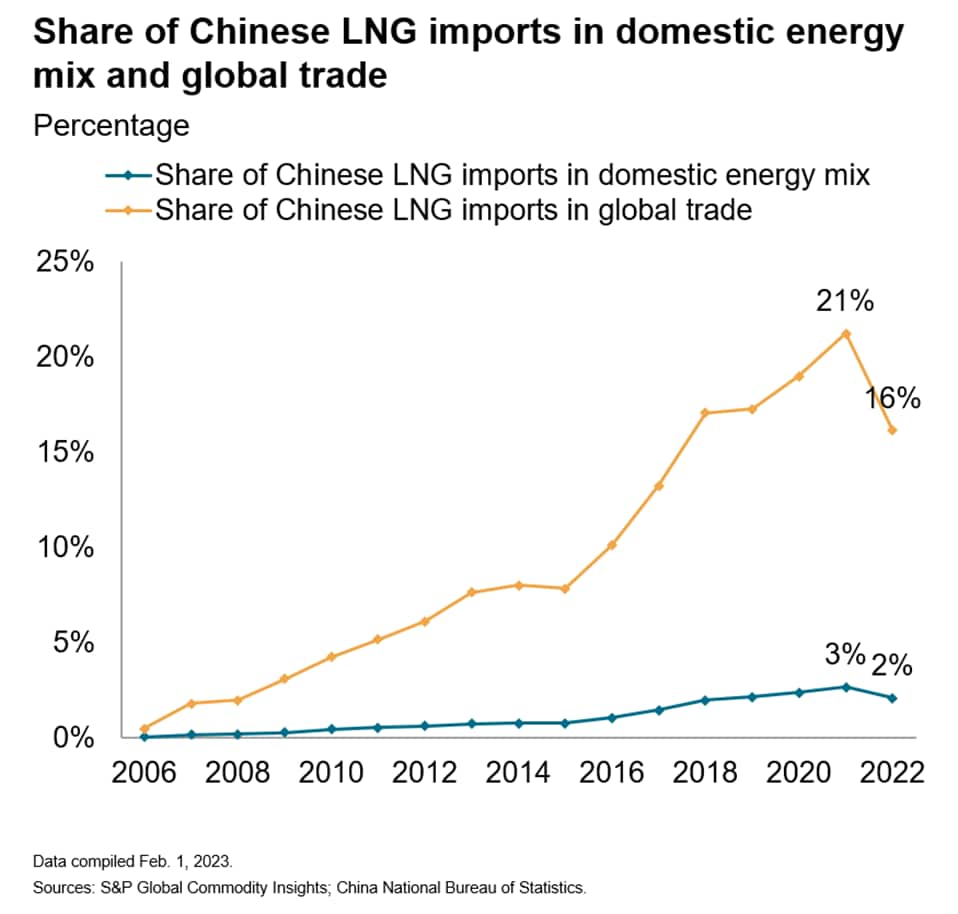

Increased Lng Demand In Taiwan The Post Nuclear Reality

May 20, 2025

Increased Lng Demand In Taiwan The Post Nuclear Reality

May 20, 2025 -

Man United Transfer Target Matheus Cunha Latest News And Concerns From Journalist

May 20, 2025

Man United Transfer Target Matheus Cunha Latest News And Concerns From Journalist

May 20, 2025 -

Understanding Lou Galas Rise To Fame In The Decameron

May 20, 2025

Understanding Lou Galas Rise To Fame In The Decameron

May 20, 2025 -

From Scatological Data To Engaging Podcast The Power Of Ai Digest

May 20, 2025

From Scatological Data To Engaging Podcast The Power Of Ai Digest

May 20, 2025 -

Valentinos Whimsical Ensemble On Suki Waterhouse A Grandma Chic Moment

May 20, 2025

Valentinos Whimsical Ensemble On Suki Waterhouse A Grandma Chic Moment

May 20, 2025

Latest Posts

-

Wwe Raw May 19th 2025 A Mixed Bag Of Matches And Moments

May 20, 2025

Wwe Raw May 19th 2025 A Mixed Bag Of Matches And Moments

May 20, 2025 -

Wwe Raw 5 19 2025 Recap Highlights And Lowlights

May 20, 2025

Wwe Raw 5 19 2025 Recap Highlights And Lowlights

May 20, 2025 -

Wwe Smack Down Rey Fenixs Debut And New Ring Name Confirmed

May 20, 2025

Wwe Smack Down Rey Fenixs Debut And New Ring Name Confirmed

May 20, 2025 -

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025 -

Wwe Tyler Bates Highly Anticipated Television Comeback

May 20, 2025

Wwe Tyler Bates Highly Anticipated Television Comeback

May 20, 2025