D-Wave Quantum (QBTS) Stock Performance: Impact Of Kerrisdale Capital's Report

Table of Contents

Kerrisdale Capital's Short Thesis on D-Wave Quantum (QBTS): Key Arguments

Kerrisdale Capital's report presented a bearish outlook on D-Wave Quantum, raising several concerns about the company's financial health and the long-term viability of its technology. Their short thesis rested on three primary pillars: allegations of misleading financial statements, concerns about the commercial viability of D-Wave's technology, and valuation concerns.

Allegations of Misleading Financial Statements

Kerrisdale Capital's report leveled serious accusations regarding D-Wave's revenue recognition practices. They claimed that D-Wave's accounting methods inflated its reported revenue, potentially violating SEC regulations. Specific claims included allegations of:

- Overstatement of revenue from specific contracts: The report highlighted certain contracts, arguing that D-Wave recognized revenue prematurely, before fulfilling contractual obligations.

- Lack of transparency in revenue recognition policies: Kerrisdale criticized the lack of clarity in D-Wave's financial reporting, making it difficult for investors to accurately assess the company's true financial performance.

- Potential for material misstatements in financial filings: The report implied that these accounting irregularities could lead to material misstatements in D-Wave's SEC filings, a serious concern for investors.

While D-Wave has since responded to these allegations, the initial impact on investor confidence was significant. The validity of these claims remains a subject of ongoing debate and requires further investigation. Keywords: financial misreporting, accounting irregularities, revenue recognition, SEC filings, D-Wave financials.

Concerns Regarding the Commercial Viability of D-Wave's Technology

Beyond financial concerns, Kerrisdale also questioned the market demand and commercial viability of D-Wave's quantum annealing technology. Key arguments included:

- Limited market adoption: The report suggested that the adoption rate of D-Wave's technology has been slower than anticipated, casting doubt on its long-term market potential.

- Intense competition in the quantum computing space: Kerrisdale highlighted the increasing competition from other companies developing different quantum computing technologies, suggesting a challenging landscape for D-Wave.

- Scalability challenges: The report questioned the scalability of D-Wave's quantum annealing approach, suggesting that it might face limitations in solving complex real-world problems. Keywords: quantum annealing, market competition, technological viability, commercialization, scalability, quantum computing market.

Valuation Concerns and Overestimation of Future Potential

Kerrisdale Capital argued that D-Wave's stock was significantly overvalued, given its current financial performance and the uncertainties surrounding its future prospects. Their analysis included:

- High price-to-sales ratio: The report pointed to a high price-to-sales ratio, suggesting that the market was placing an overly optimistic valuation on D-Wave's future growth.

- Unrealistic growth projections: Kerrisdale challenged D-Wave's own projections for future revenue growth, arguing that they were overly ambitious and lacked sufficient supporting evidence.

- Significant downside risk: Based on their analysis, Kerrisdale predicted a significant decline in D-Wave's stock price. Keywords: stock valuation, market capitalization, price-to-sales ratio, future growth potential, overvalued, QBTS valuation.

Market Reaction to Kerrisdale Capital's Report on QBTS Stock

The release of Kerrisdale Capital's report had an immediate and substantial impact on D-Wave Quantum's stock price and overall investor sentiment.

Immediate Impact on QBTS Stock Price

Following the report's publication, QBTS stock experienced a sharp decline, reflecting the negative sentiment among investors. Trading volume also surged, indicating significant market activity driven by the report's revelations. Keywords: stock price drop, trading volume, market volatility, immediate market impact, QBTS stock price.

Investor Sentiment and Confidence

The report significantly eroded investor confidence in D-Wave Quantum. Analyst ratings and recommendations were revised downwards, reflecting the growing concerns about the company's financial health and future prospects. Keywords: investor sentiment, analyst ratings, buy/sell recommendations, market confidence, D-Wave investor relations.

Long-Term Implications for QBTS Stock

The long-term implications of Kerrisdale's report remain uncertain. While the immediate impact was negative, the future trajectory of QBTS stock will depend on several factors, including:

- D-Wave's response and actions: The company's ability to address the concerns raised in the report will play a crucial role in shaping investor sentiment.

- Technological advancements: Any significant breakthroughs in D-Wave's technology or increased market adoption could positively impact the stock price.

- Overall market conditions: The broader market environment will also influence the performance of QBTS stock. Keywords: long-term outlook, future price prediction, stock forecast, investment strategy, QBTS future.

Analyzing the Validity of Kerrisdale Capital's Claims and D-Wave's Response

A thorough assessment requires careful consideration of both Kerrisdale's claims and D-Wave's response, as well as independent analysis.

D-Wave's Rebuttal and Counterarguments

D-Wave issued a formal rebuttal to Kerrisdale's report, refuting several of the key allegations. The effectiveness of their response in mitigating the negative market impact remains a point of debate. Keywords: D-Wave response, rebuttal, counterarguments, damage control, D-Wave press release.

Independent Analysis and Expert Opinions

Independent analysts and experts have offered various perspectives on the matter. Some have supported Kerrisdale's concerns, while others have defended D-Wave's position. A comprehensive understanding requires careful evaluation of these diverse opinions and consideration of their potential biases. Keywords: independent analysis, expert opinion, unbiased assessment, credible sources, quantum computing experts.

Conclusion

This article examined the impact of Kerrisdale Capital's report on D-Wave Quantum (QBTS) stock performance. We analyzed the key arguments presented in the short report, the market's reaction, and D-Wave's response. The situation highlights the volatility inherent in investing in early-stage technology companies, particularly within the rapidly evolving quantum computing sector.

Call to Action: Understanding the complexities surrounding D-Wave Quantum (QBTS) and its stock performance requires careful consideration of all available information. Continue your research on D-Wave Quantum stock, considering all perspectives, before making any investment decisions. Stay informed about future developments and further analysis of QBTS stock and the quantum computing market as a whole. Thorough due diligence is crucial when considering investing in D-Wave Quantum or any other quantum computing stock.

Featured Posts

-

Endgueltige Bauform Entscheidungen Der Architektin Vor Ort

May 20, 2025

Endgueltige Bauform Entscheidungen Der Architektin Vor Ort

May 20, 2025 -

Hmrc Letter Surge Guidance For Uk Taxpayers

May 20, 2025

Hmrc Letter Surge Guidance For Uk Taxpayers

May 20, 2025 -

Visita De Michael Schumacher A Su Nieta Vuelo Desde Mallorca A Suiza

May 20, 2025

Visita De Michael Schumacher A Su Nieta Vuelo Desde Mallorca A Suiza

May 20, 2025 -

New Light On Agatha Christie Private Correspondence Exposes Book Conflict

May 20, 2025

New Light On Agatha Christie Private Correspondence Exposes Book Conflict

May 20, 2025 -

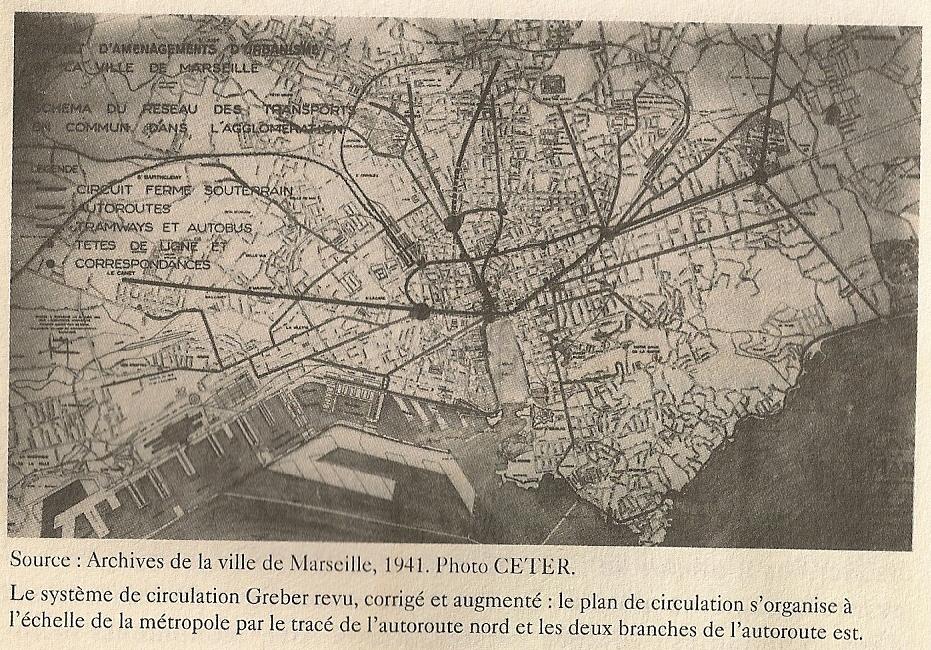

Cote D Ivoire Lancement Des Plans D Urbanisme De Detail Une Invitation Aux Maires

May 20, 2025

Cote D Ivoire Lancement Des Plans D Urbanisme De Detail Une Invitation Aux Maires

May 20, 2025

Latest Posts

-

Fa Cup Rashfords Two Goals Power Manchester United To Victory Over Aston Villa

May 20, 2025

Fa Cup Rashfords Two Goals Power Manchester United To Victory Over Aston Villa

May 20, 2025 -

Fa Cup Rashfords Two Goals Secure Manchester United Win Against Aston Villa

May 20, 2025

Fa Cup Rashfords Two Goals Secure Manchester United Win Against Aston Villa

May 20, 2025 -

Hinchcliffes Wwe Report Segment A Behind The Scenes Look At The Failure

May 20, 2025

Hinchcliffes Wwe Report Segment A Behind The Scenes Look At The Failure

May 20, 2025 -

Manchester United Cruise Past Aston Villa Rashfords Brace Secures Victory

May 20, 2025

Manchester United Cruise Past Aston Villa Rashfords Brace Secures Victory

May 20, 2025 -

Wwe Talent Critiques Hinchcliffes Unsuccessful Appearance

May 20, 2025

Wwe Talent Critiques Hinchcliffes Unsuccessful Appearance

May 20, 2025