D-Wave Quantum (QBTS) Stock Performance: Analyzing Thursday's Dip

Table of Contents

Analyzing the Thursday Dip in QBTS Stock Price

Several factors likely contributed to Thursday's decline in D-Wave Quantum's stock price. A holistic analysis requires considering both broader market trends and company-specific news.

Market-Wide Factors

The overall market sentiment played a significant role. Thursday saw a general downturn in the tech sector, impacting many growth stocks, including QBTS. This broader market weakness likely exacerbated any company-specific concerns.

- NASDAQ and S&P 500 Performance: The NASDAQ Composite and the S&P 500 both experienced declines on Thursday, indicating a general negative market trend. Specific percentage drops for these indices on that day would provide further context (data needed here). This overall negative sentiment likely contributed to selling pressure across various sectors, including quantum computing stocks.

- Interest Rate Hikes: The ongoing discussion and potential for further interest rate hikes by central banks can create uncertainty in the market, leading investors to move towards safer investments and away from riskier growth stocks like QBTS.

Company-Specific News and Announcements

While no major negative news directly related to D-Wave Quantum was released on Thursday, the absence of positive catalysts in a generally negative market could have contributed to the price drop. Any news impacting investor sentiment should be considered.

- Lack of Positive News: The absence of significant positive announcements or partnerships could have left QBTS vulnerable to the broader market downturn. Investors often react negatively to a lack of positive news, especially in a volatile market environment.

- Analyst Ratings: Any changes in analyst ratings or price targets for QBTS around this time would significantly influence investor sentiment and trading activity.

Investor Sentiment and Trading Volume

Analyzing the trading volume on Thursday is essential for understanding investor behavior. High volume during a price drop suggests significant selling pressure, while low volume might indicate a lack of conviction in the sell-off.

- Trading Volume Data: Data on QBTS trading volume on Thursday is crucial. A high volume would suggest a large number of investors actively selling their shares, contributing to the price decline. Conversely, low volume might imply that the price drop was influenced more by algorithm-driven trading or a limited number of sellers.

- Profit-Taking: Some investors might have engaged in profit-taking after a period of QBTS stock price increases, contributing to the downward pressure.

Comparison to Competitor Performance

Comparing QBTS's performance to its competitors within the quantum computing sector provides valuable context. Did competitors experience similar dips, or did QBTS underperform?

- Competitor Stock Performance: Analyzing the performance of competitors like IBM (with its quantum computing initiatives) and IonQ on Thursday is crucial. If competitors experienced similar dips, it suggests that the decline was primarily market-driven. Conversely, if QBTS underperformed, company-specific factors might be at play.

- Market Share and Innovation: The relative performance might also reflect investor sentiment towards each company’s market share, technological advancements, and overall growth potential in the quantum computing landscape.

Long-Term Outlook for D-Wave Quantum (QBTS) Stock

Despite Thursday's dip, the long-term outlook for D-Wave Quantum requires a careful evaluation of several factors.

Fundamental Analysis

A thorough fundamental analysis is crucial to assess D-Wave Quantum’s long-term potential. This includes analyzing its financial health, technological advancements, and competitive landscape.

- Financial Metrics: Key financial metrics like revenue growth, earnings, and cash flow provide insights into the company's financial health. Strong fundamentals can suggest resilience against market volatility.

- Technological Advancements: D-Wave Quantum's progress in developing its quantum annealing technology and its ability to secure new clients are crucial factors affecting its long-term success.

Technical Analysis

Technical analysis can provide insights into potential support and resistance levels for QBTS stock. Studying historical price patterns can help predict future price movements.

- Support and Resistance Levels: Identifying key support and resistance levels on the QBTS stock chart helps determine potential price reversal points.

- Moving Averages: Analyzing moving averages can help gauge the overall trend and potential momentum changes in the QBTS stock price.

Risks and Opportunities

Investing in D-Wave Quantum (QBTS) involves both significant risks and opportunities.

- Risks: Competition from other quantum computing companies, technological hurdles in scaling quantum computing technology, and overall market volatility are all key risks.

- Opportunities: Strategic partnerships, government funding for quantum computing research, and potential breakthroughs in quantum annealing technology represent significant growth opportunities for D-Wave Quantum.

Conclusion

Thursday's dip in D-Wave Quantum (QBTS) stock price resulted from a combination of market-wide factors, such as the broader tech sector downturn, and potentially some company-specific considerations. While the short-term outlook might be uncertain, the long-term potential of D-Wave Quantum depends on its ability to navigate competitive pressures, secure funding, and continue to make technological advancements in the quantum computing field. Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, it's crucial to conduct thorough research, considering both the fundamental and technical aspects. Continue to follow future news and updates concerning D-Wave Quantum's stock performance and the quantum computing market to make informed investment choices. Understanding the complexities of investing in D-Wave Quantum (QBTS) is essential for successful participation in this rapidly evolving sector.

Featured Posts

-

Trans Australia Run Will The Record Be Broken

May 21, 2025

Trans Australia Run Will The Record Be Broken

May 21, 2025 -

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 21, 2025

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 21, 2025 -

Ftc To Challenge Microsoft Activision Deal Approval

May 21, 2025

Ftc To Challenge Microsoft Activision Deal Approval

May 21, 2025 -

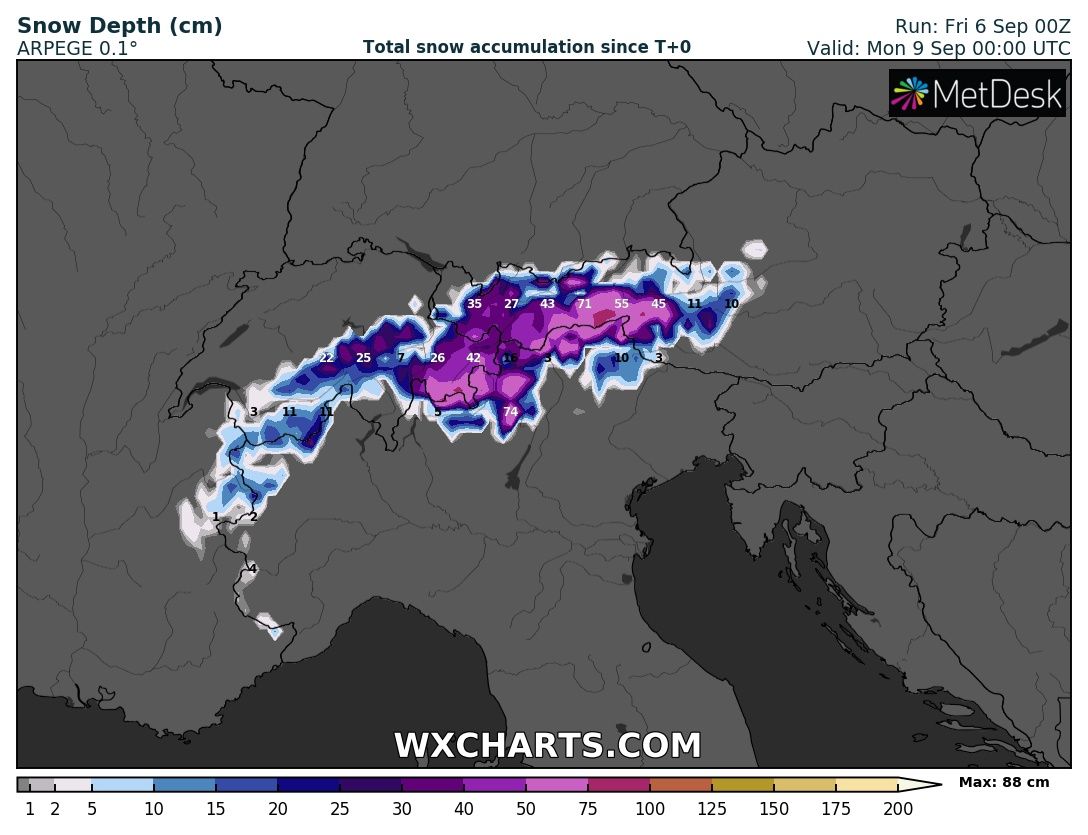

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025 -

Dexter Revival John Lithgow And Jimmy Smits Set For Return

May 21, 2025

Dexter Revival John Lithgow And Jimmy Smits Set For Return

May 21, 2025

Latest Posts

-

Michael Bays Outrun Video Game Adaptation Cast And Crew Details

May 22, 2025

Michael Bays Outrun Video Game Adaptation Cast And Crew Details

May 22, 2025 -

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 22, 2025

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 22, 2025 -

Sydney Sweeney Joins Michael Bays Outrun Film Project

May 22, 2025

Sydney Sweeney Joins Michael Bays Outrun Film Project

May 22, 2025 -

Barry Ward Interview The Irish Actor On Type Casting

May 22, 2025

Barry Ward Interview The Irish Actor On Type Casting

May 22, 2025 -

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025