D-Wave Quantum (QBTS): Monday's Stock Decline Explained

Table of Contents

Market Sentiment and Overall Tech Stock Performance

Monday's downturn in D-Wave Quantum (QBTS) stock wasn't isolated. The broader tech sector experienced a period of weakness, impacting investor confidence across the board. Negative market sentiment, particularly surrounding growth stocks and emerging technologies like quantum computing, likely played a significant role. This general bearish trend likely exacerbated any company-specific issues affecting D-Wave.

- Major indices like the NASDAQ Composite and the S&P 500 experienced declines on Monday, indicating a widespread market correction.

- A comparison with other quantum computing company stocks reveals similar downward trends, suggesting a sector-wide impact rather than an issue solely affecting D-Wave Quantum (QBTS).

- Several market reports highlighted concerns about rising interest rates and potential economic slowdown, contributing to the overall negative investor sentiment.

D-Wave Quantum's (QBTS) Recent News and Announcements

While no overwhelmingly negative company-specific news directly preceded Monday's drop, the absence of positive catalysts might have contributed to the decline. The lack of significant new developments or announcements could have led investors to reassess their positions, especially in a volatile market environment. Analyzing the news flow around D-Wave Quantum (QBTS) is crucial for understanding investor behavior.

- There were no major press releases or earnings reports released immediately before Monday's decline.

- The absence of positive news, such as significant contract wins or technological breakthroughs, might have fueled selling pressure.

- Investor reaction to the lack of substantial new developments could have been amplified by the pre-existing negative market sentiment.

Competitor Activity and Industry Developments

The quantum computing industry is highly competitive, with several companies vying for market leadership. Developments from competitors, even if not directly impacting D-Wave's technology, can influence investor perception and market share expectations. Analyzing the competitive landscape is essential when evaluating D-Wave Quantum (QBTS).

- Competitors like IBM, Google, and IonQ continue to make advancements in their respective quantum computing technologies. Any significant breakthroughs by these rivals could indirectly put downward pressure on D-Wave's stock.

- While a direct comparison of technologies is complex, any perceived shift in market share or technological leadership can affect investor confidence in D-Wave.

- News regarding competitor funding rounds or partnerships could also influence investor sentiment towards D-Wave Quantum (QBTS).

Financial Factors and Analyst Ratings

D-Wave Quantum's (QBTS) recent financial performance and analyst ratings play a significant role in influencing investor decisions. Any negative revisions to financial projections or downgrades in analyst ratings can trigger selling pressure. Monitoring these metrics provides important context.

- Investors scrutinize key financial metrics like revenue, earnings, and debt levels. Any negative trends in these areas could contribute to stock price volatility.

- Changes in analyst ratings and price targets directly affect investor perception and trading decisions. A downward revision in price targets could amplify the negative market sentiment.

- Regular review of D-Wave's financial reports and analyst opinions offers valuable insights for informed investment decisions.

Conclusion: Investing in D-Wave Quantum (QBTS) After Monday's Dip

Monday's decline in D-Wave Quantum (QBTS) stock price can be attributed to a combination of factors: a broader negative market sentiment affecting the tech sector, a lack of positive company-specific news, competitive pressures within the quantum computing industry, and potentially underlying financial concerns. It's crucial for investors to understand that the quantum computing market is inherently volatile. While the technology holds immense long-term potential, short-term fluctuations are to be expected.

Before investing in D-Wave Quantum (QBTS) or any quantum computing stock, thorough research is essential. Carefully consider the market conditions, company-specific news, and competitive landscape. Monitor the stock's performance closely and stay informed about any relevant developments. Further reading on D-Wave Quantum (QBTS) and broader quantum computing investment strategies is highly recommended. The volatility of the quantum computing market necessitates a well-informed and cautious investment approach.

Featured Posts

-

Noumatrouff Mulhouse Un Avant Gout Du Hellfest

May 21, 2025

Noumatrouff Mulhouse Un Avant Gout Du Hellfest

May 21, 2025 -

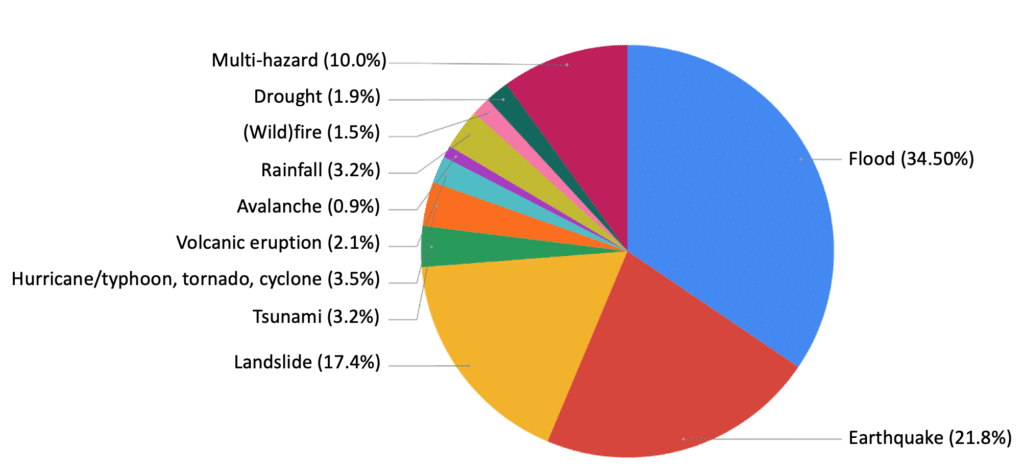

Natural Disaster Fears Manga Prediction And Tourism Impact

May 21, 2025

Natural Disaster Fears Manga Prediction And Tourism Impact

May 21, 2025 -

The Hunter Biden Recordings What They Say About Joe Bidens Mental Capacity

May 21, 2025

The Hunter Biden Recordings What They Say About Joe Bidens Mental Capacity

May 21, 2025 -

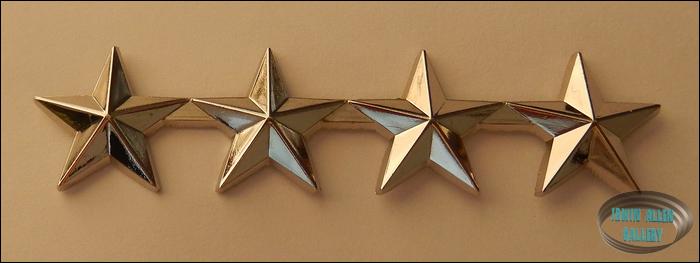

Us Four Star Admiral Sentenced The Full Story Of Corruption Charges

May 21, 2025

Us Four Star Admiral Sentenced The Full Story Of Corruption Charges

May 21, 2025 -

Vanja I Sime Neocekivana Kombinacija Odusevila Fanove Gospodina Savrsenog

May 21, 2025

Vanja I Sime Neocekivana Kombinacija Odusevila Fanove Gospodina Savrsenog

May 21, 2025

Latest Posts

-

Racist Tweets Lead To Jail Time For Tory Councillors Wife Southport Incident

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife Southport Incident

May 22, 2025 -

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025 -

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025 -

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025 -

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025