D-Wave Quantum (QBTS): A Comprehensive Stock Investment Analysis

Table of Contents

- Understanding D-Wave Quantum's Technology and Market Position

- D-Wave's Quantum Annealing Approach

- The Current State of the Quantum Computing Market

- Financial Performance and Valuation of QBTS

- Analyzing D-Wave Quantum's Financials

- Valuation and Investment Considerations

- Risks and Potential Rewards of Investing in QBTS

- Identifying Key Risks

- Assessing Potential Returns

- Conclusion

Understanding D-Wave Quantum's Technology and Market Position

D-Wave's Quantum Annealing Approach

D-Wave Quantum employs a unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computers (used by companies like IBM and Google), which process information sequentially, D-Wave's machines leverage quantum effects to find the lowest energy state of a complex system, effectively solving optimization problems.

-

Specific applications of D-Wave's technology: D-Wave's quantum annealers are particularly well-suited for tackling complex optimization problems across various sectors, including:

- Logistics and supply chain optimization

- Financial modeling and risk management

- Materials science and drug discovery

- Artificial intelligence and machine learning

-

Comparison to competitors in the quantum computing space: While gate-based models are considered more versatile in the long term, D-Wave's annealing approach offers a current advantage in solving specific types of optimization problems, often outperforming classical algorithms. However, companies like IBM and Google are pursuing both gate-based and annealing approaches, making the competitive landscape dynamic.

-

Discussion of market share and potential for future market dominance: D-Wave holds a significant early-mover advantage in the commercial quantum computing market, having deployed numerous quantum annealers to clients globally. However, future market dominance depends on factors such as continued technological advancements, the ability to scale its systems, and the overall growth of the quantum computing market itself.

The Current State of the Quantum Computing Market

The quantum computing market is still in its nascent stages, but projections indicate explosive growth in the coming years. Market research firms predict substantial expansion, driven by increasing private and public investment, alongside growing recognition of quantum computing's potential to revolutionize various industries.

-

Key market drivers and growth projections: Government funding initiatives, increased private sector investment, and the growing need for solutions to complex computational problems are key market drivers. Market analysts forecast significant growth over the next decade, though precise figures vary depending on the source.

-

Potential future applications of quantum computing across various industries: Beyond the applications mentioned above, quantum computing holds immense potential in diverse fields:

- Healthcare: Drug discovery, personalized medicine, and genomics research.

- Finance: Portfolio optimization, fraud detection, and risk assessment.

- Energy: Materials discovery and optimization of energy systems.

-

Analysis of potential barriers to market entry and competition: High barriers to entry include the significant capital investment required for research and development, the highly specialized skills needed, and the intense competition from established tech giants. However, the potential rewards are equally substantial, encouraging further investment and innovation.

Financial Performance and Valuation of QBTS

Analyzing D-Wave Quantum's Financials

D-Wave Quantum, being a relatively young company in a rapidly evolving market, is currently not profitable. Analyzing its financial statements requires careful consideration of its stage of development and its long-term growth prospects rather than focusing solely on short-term profitability.

-

Key financial ratios and metrics: Key metrics to consider for QBTS include revenue growth, research and development spending, and its cash burn rate. A thorough analysis of these factors is crucial for a comprehensive understanding of the company's financial health.

-

Comparison to other publicly traded quantum computing companies: Direct comparisons to other publicly traded quantum computing companies are limited due to the relatively small number of publicly listed firms in this sector.

-

Assessment of the company’s debt load and financial stability: Assessing the company’s financial stability involves scrutinizing its debt levels, cash reserves, and overall funding strategy. The current debt load and its implications for future growth need to be considered.

Valuation and Investment Considerations

Valuing QBTS presents a unique challenge due to the high uncertainty inherent in the quantum computing market. Traditional valuation methods may not be fully applicable, making reliance on future growth projections a significant component of any assessment.

-

Potential upside and downside scenarios for QBTS stock price: The QBTS stock price is highly susceptible to changes in market sentiment, technological breakthroughs, and competitive landscape developments. Significant upside potential exists if D-Wave achieves market leadership, but equally significant downside risk is present.

-

Discussion of risk factors associated with investing in QBTS: Investing in QBTS involves significant risk due to:

- Technological obsolescence

- Intense competition

- Dependence on securing further funding rounds

-

Comparison of QBTS to other high-growth technology stocks: While QBTS shares some characteristics with other high-growth technology stocks, its position within a nascent market creates distinct risks and potential rewards that require separate consideration.

Risks and Potential Rewards of Investing in QBTS

Identifying Key Risks

Investing in D-Wave Quantum (QBTS) entails considerable risks, primarily stemming from the early stage of the quantum computing market and the company's position within it.

-

Technological risks: Competition from established tech giants and the possibility of technological obsolescence pose substantial threats. Rapid advancements in the field could render D-Wave's technology less competitive.

-

Financial risks: D-Wave's current lack of profitability, coupled with its high research and development expenditure, presents significant financial risks, including the potential need for further funding rounds which could dilute existing shareholder value.

-

Market risks: Overall market sentiment towards quantum computing and broader macroeconomic factors could influence QBTS's stock price regardless of the company's operational performance.

Assessing Potential Returns

Despite the considerable risks, the potential rewards of investing in QBTS could be substantial if D-Wave successfully establishes itself as a leader in the quantum computing market.

-

Long-term growth prospects for D-Wave and the quantum computing market: The long-term growth potential for D-Wave and the quantum computing market is considerable, offering significant upside potential for investors willing to accept substantial risk.

-

Potential for disruptive innovation and market leadership: If D-Wave can successfully navigate the challenges and maintain a technological edge, its potential for disruptive innovation and market leadership is significant.

-

Factors influencing potential return on investment: Return on investment is influenced by technological advancements, market adoption, successful competition, and macroeconomic conditions.

Conclusion

Investing in D-Wave Quantum (QBTS) presents a unique opportunity to participate in the burgeoning field of quantum computing. However, the analysis highlights the substantial risks associated with this investment, primarily stemming from the company's stage of development, the nascent nature of the market, and intense competition. The potential for high returns exists, but only with the acceptance of considerable risk. A careful assessment of your risk tolerance and investment goals is crucial before considering a QBTS investment. Remember to always consult with a financial advisor before making any investment decisions. Thorough due diligence regarding QBTS stock price and the quantum computing sector is paramount before allocating capital to this unique investment opportunity.

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto Performances Et Conduite

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto Performances Et Conduite

Rashford Scores Twice As Manchester United Rout Aston Villa In Fa Cup

Rashford Scores Twice As Manchester United Rout Aston Villa In Fa Cup

Abn Amro Waarschuwt Voedingsindustrie Te Afhankelijk Van Goedkope Arbeidsmigranten

Abn Amro Waarschuwt Voedingsindustrie Te Afhankelijk Van Goedkope Arbeidsmigranten

Mas Alla Del Arandano El Mejor Aliado Para Una Vida Larga Y Saludable

Mas Alla Del Arandano El Mejor Aliado Para Una Vida Larga Y Saludable

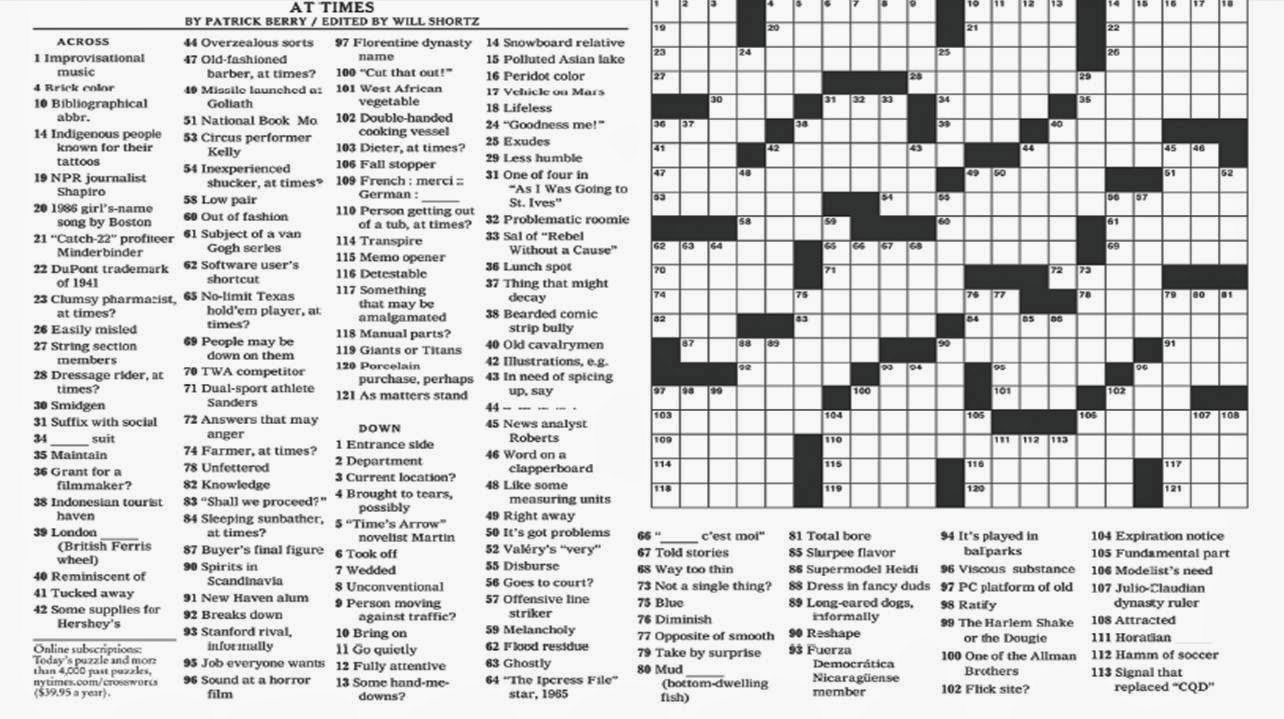

Nyt Mini Crossword Hints April 26th 2025

Nyt Mini Crossword Hints April 26th 2025