D-Wave Quantum (NYSE: QBTS): A Deep Dive Into Recent Stock Market Volatility

Table of Contents

Factors Contributing to D-Wave Quantum's Stock Volatility

Several interconnected factors contribute to the volatility observed in QBTS stock. These range from the inherent uncertainty of investing in a cutting-edge technology to broader macroeconomic conditions.

Technological Advancements and Market Expectations

D-Wave's progress in quantum annealing technology significantly impacts investor sentiment. Any breakthrough, announcement, or even perceived shortfall, can trigger substantial price swings.

- New algorithm releases and their market implications: The release of new algorithms demonstrating enhanced capabilities in solving complex problems directly influences investor confidence and market valuation. Successful demonstrations translate to higher stock prices, while setbacks can lead to declines.

- Partnership announcements and collaborations: Strategic partnerships with major corporations or research institutions can signal increased market adoption and credibility, boosting investor confidence and the QBTS stock price. Conversely, the lack of significant partnerships may negatively affect investor perception.

- Progress in scaling quantum processors: The ability to build larger, more powerful quantum processors is a key factor influencing investor sentiment. Announcements of advancements in this area typically generate positive market reactions.

Competitive Landscape and Market Share

The quantum computing industry is highly competitive, with several players vying for market dominance. D-Wave's position relative to competitors significantly impacts its stock price.

- Analysis of competitors' progress and funding: Competitors' advancements in different quantum computing approaches (e.g., gate-based quantum computing) and their access to funding influence D-Wave's perceived market share and future prospects.

- Discussion of D-Wave's unique advantages: D-Wave's focus on quantum annealing offers a unique approach with potential advantages in specific application areas. Highlighting these advantages is crucial in shaping investor perception and the QBTS stock valuation.

- Market share projections and their impact on stock price: Analyst projections regarding D-Wave's market share in the future significantly influence investor sentiment and stock price movements. Positive projections typically lead to price increases, while negative ones can cause declines.

Financial Performance and Investor Confidence

D-Wave's financial performance, revenue projections, and profitability directly influence investor confidence and QBTS stock price.

- Analysis of revenue streams and growth potential: The identification and development of reliable revenue streams and demonstrating significant growth potential are vital in attracting investors and supporting a higher stock valuation.

- Discussion of profitability and operational efficiency: Demonstrating a clear path towards profitability and operational efficiency is crucial for long-term investor confidence and sustainable stock price growth.

- Impact of financial forecasts on investor sentiment: Positive financial forecasts and guidance usually lead to increased investor confidence and higher QBTS stock prices, while negative projections can trigger sell-offs.

Analyzing the Impact of External Market Factors

External market forces play a significant role in shaping the QBTS stock price, independently of D-Wave's operational performance.

Macroeconomic Conditions and Investor Risk Appetite

Broader economic factors influence investor behavior towards high-growth technology stocks like QBTS.

- Rising interest rates can reduce investor appetite for riskier assets, potentially leading to lower QBTS stock prices.

- High inflation erodes purchasing power and may deter investment in growth stocks.

- Overall economic growth influences the investment climate, impacting the attractiveness of QBTS as an investment opportunity.

Sector-Specific Trends in Quantum Computing

Industry-wide trends and news within the quantum computing sector also impact investor sentiment towards QBTS.

- Major breakthroughs in competing technologies can shift investor focus and potentially negatively impact D-Wave's valuation.

- Government funding announcements or policy changes related to quantum computing can affect the overall sector outlook and, consequently, the QBTS stock price.

- Market hype and speculation surrounding quantum computing can create periods of both significant price increases and sharp corrections.

Global Market Sentiment and Geopolitical Factors

Global events and geopolitical uncertainty can significantly influence investor confidence and market volatility, impacting even seemingly unrelated sectors like quantum computing.

- Geopolitical instability can lead to risk aversion among investors, potentially affecting QBTS stock prices.

- Global market corrections can impact all asset classes, including QBTS, regardless of the company's specific performance.

Investment Strategies for Navigating QBTS Volatility

Investing in D-Wave Quantum requires a careful consideration of risk and a well-defined investment strategy.

Assessing Risk Tolerance and Investment Goals

Before investing in QBTS, investors should assess their risk tolerance and align their investment strategy with their long-term financial goals. Investing in QBTS is inherently risky due to the early stage of the quantum computing industry.

Diversification Strategies for Reducing Risk

Diversification is crucial to mitigate the risk associated with investing in a single high-growth stock like QBTS. Investors should spread their investments across different asset classes to reduce overall portfolio volatility.

Long-Term vs. Short-Term Investment Approaches

A long-term investment horizon is generally recommended for stocks like QBTS, given the potential for significant long-term growth in the quantum computing sector. Short-term trading based on short-term market fluctuations is generally riskier and less suitable for this type of investment.

Conclusion

The volatility of D-Wave Quantum's (QBTS) stock price is driven by a complex interplay of factors, including technological advancements, competitive pressures, financial performance, and broader macroeconomic conditions. Understanding these factors is crucial for making informed investment decisions. While the long-term potential of the quantum computing industry is significant, investing in an early-stage company like D-Wave carries substantial risk. Conduct thorough research, consider your risk tolerance, and stay informed about the latest developments in the quantum computing industry and D-Wave's financial performance to navigate the volatility of D-Wave Quantum (QBTS) stock effectively.

Featured Posts

-

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025 -

Sinners Monte Carlo Training Weather Interrupts First Day

May 20, 2025

Sinners Monte Carlo Training Weather Interrupts First Day

May 20, 2025 -

Finding Your Path A Comprehensive Guide To Solo Travel

May 20, 2025

Finding Your Path A Comprehensive Guide To Solo Travel

May 20, 2025 -

Retired Four Star Admirals Corruption Conviction Details And Impact

May 20, 2025

Retired Four Star Admirals Corruption Conviction Details And Impact

May 20, 2025 -

Todays Nyt Mini Crossword March 15 Solutions

May 20, 2025

Todays Nyt Mini Crossword March 15 Solutions

May 20, 2025

Latest Posts

-

Wwe Talent Critiques Hinchcliffes Unsuccessful Appearance

May 20, 2025

Wwe Talent Critiques Hinchcliffes Unsuccessful Appearance

May 20, 2025 -

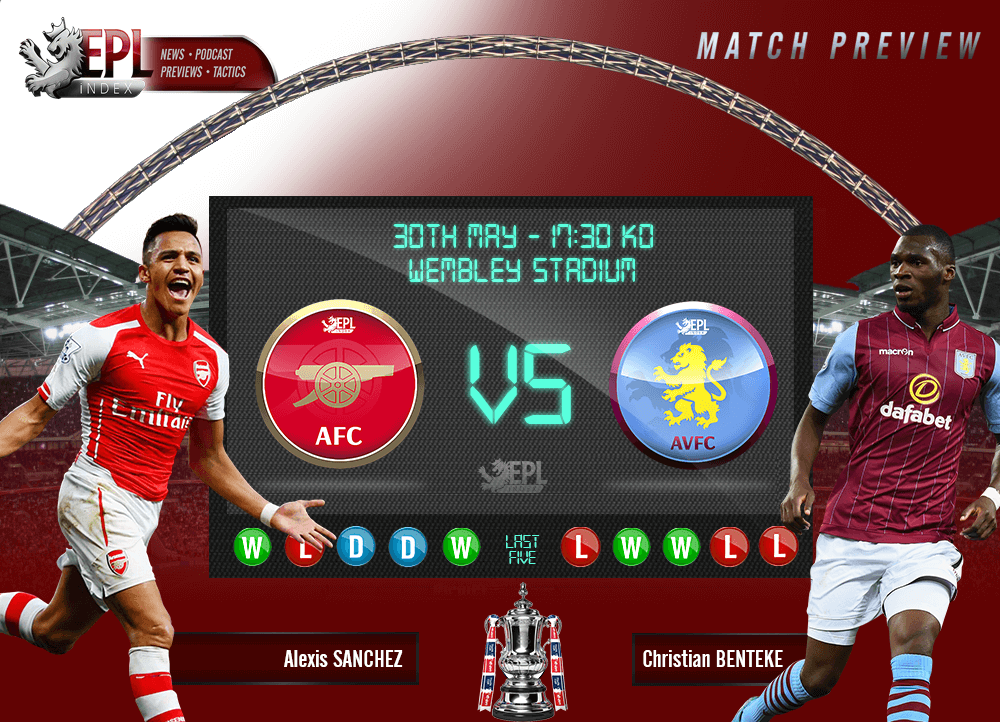

Aston Villa Ease Past Preston Rashfords Brace Fuels Fa Cup Triumph

May 20, 2025

Aston Villa Ease Past Preston Rashfords Brace Fuels Fa Cup Triumph

May 20, 2025 -

Rashford Scores Twice As Manchester United Defeat Aston Villa In Fa Cup

May 20, 2025

Rashford Scores Twice As Manchester United Defeat Aston Villa In Fa Cup

May 20, 2025 -

Rashfords First Aston Villa Goals Secure Fa Cup Win Over Preston

May 20, 2025

Rashfords First Aston Villa Goals Secure Fa Cup Win Over Preston

May 20, 2025 -

Rashfords Double Sends Preston Packing Aston Villa Fa Cup Victory

May 20, 2025

Rashfords Double Sends Preston Packing Aston Villa Fa Cup Victory

May 20, 2025